Gender Wealth Gap: Exploring Stock Market Disparities

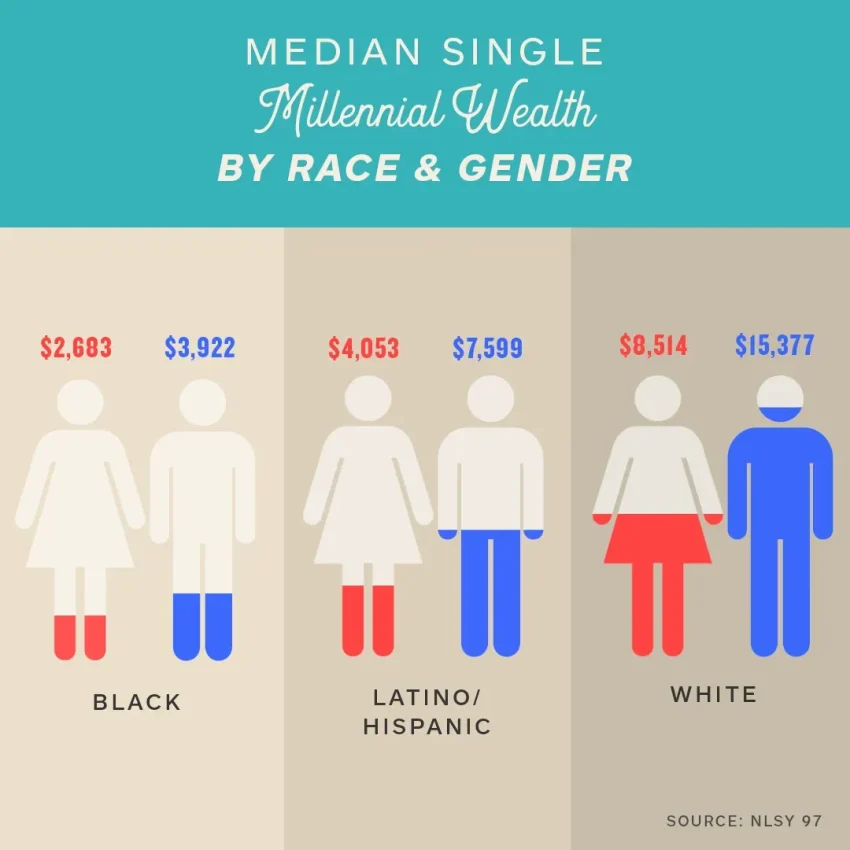

The gender wealth gap is a persistent issue that reflects the disparities in financial resources between men and women. In recent years, it has become evident that differences in investment strategies and attitudes toward risk play a crucial role in this gap. For instance, men often outperform women in stock market performance due to their higher rates of market participation and aggressive investment choices. Conversely, women tend to favor safer, more conservative approaches, which can hinder their overall wealth accumulation. Understanding these dynamics is vital for addressing financial literacy and promoting equitable investment practices that empower all individuals, regardless of gender.

The disparity in financial assets between men and women, often referred to as the wealth gap by gender, highlights significant inequalities in economic empowerment. This phenomenon can be largely traced to varied approaches to investment and financial strategy, where traditionally, men engage more actively in high-risk markets compared to their female counterparts. The distinction in wealth creation methods showcases how differing risk tolerances and levels of financial insight affect overall asset accumulation. Understanding these nuances is crucial in crafting targeted educational initiatives that foster financial literacy and encourage more women to break into the investing sphere. By broadening access to investment knowledge and resources, we can work towards bridging this chasm and enabling a more equitable financial landscape.

Understanding the Gender Wealth Gap in Investment Strategies

The gender wealth gap remains a pressing issue in today’s financial landscape, significantly impacting women’s ability to accumulate and grow wealth through investments. Despite achieving higher levels of education and professionalism, women are frequently subjected to more conservative investment strategies compared to their male counterparts. This disparity is rooted in various factors, including societal expectations and varying risk tolerances between genders. As financial literacy becomes increasingly crucial for wealth accumulation, addressing these differences is essential.

Historically, men have tended to engage more aggressively in the stock market, leading to greater wealth accumulation through high-risk investments. This contrasts sharply with women’s approaches, which often lean towards safer investment avenues like savings accounts or bonds. It’s important to analyze how these investment behaviors stem from cultural norms, which can discourage risk-taking among women. By understanding these factors, we can develop targeted strategies to promote equitable participation in the stock market.

The Impact of Stock Market Performance on Wealth Accumulation

Stock market performance plays a pivotal role in shaping wealth accumulation, particularly for those actively engaged in trading and investments. During bull markets, substantial gains can be realized by those who invest wisely, often resulting in a significant increase in net worth. However, the benefit of these market conditions is not uniformly experienced, as women are less likely to participate in stock market activities. Consequently, when markets flourish, the wealth gap widens, emphasizing the importance of engaging women in these financial opportunities.

Moreover, the performance of the stock market is influenced by various external factors, including economic policies and global events. When market conditions are favorable, those who have established portfolios can see exponential growth in their investments. Men’s tendency to embrace higher risk levels allows them to capitalize on these fluctuating market conditions effectively. On the other hand, women’s typically conservative approach may lead to missed opportunities for wealth growth. Therefore, encouraging women to adopt more active investment strategies during opportune market conditions could help mitigate the disparity.

Encouraging Women to Invest: Bridging Financial Disparities

Addressing the gender wealth gap requires a proactive approach to encouraging more women to invest in the stock market. One of the key solutions lies in enhancing financial literacy among women, providing them with the knowledge necessary to make informed investment decisions. Workshops, seminars, and online resources dedicated to stock market basics and investment strategies can empower women to take control of their finances. Increased financial education can significantly shift the perception of investing from being intimidating to accessible.

Furthermore, financial institutions play a crucial role in creating inclusive environments that foster women’s participation in investing. By recognizing the unique challenges women face and providing targeted resources—such as mentorship programs and tailored investment advice—these institutions can help bridge the gap. Understanding the importance of these initiatives is vital as they serve to not only boost women’s confidence in investing but also to cultivate a more equitable financial future.

The Role of Financial Literacy in Wealth Accumulation

Financial literacy is fundamental in today’s economy, impacting individuals’ abilities to accumulate wealth and make sound investment choices. While studies suggest that both genders exhibit similar knowledge regarding basic financial concepts, the application of this knowledge diverges significantly between men and women. Men often exhibit stronger engagement in advanced investment strategies and stock market activities, leading to enhanced wealth accumulation, particularly during bullish periods. Thus, enhancing financial literacy specifically aimed at women holds the potential to close this gap.

Incorporating comprehensive financial education into school curricula can pave the way for future generations to enter the market with confidence. Teaching young women about investment strategies and the importance of the stock market is crucial for fostering a culture of financial empowerment. By equipping women with the necessary tools and knowledge, we can encourage them to actively participate in investing, thus increasing their long-term wealth accumulation opportunities.

Investment Strategies: Men vs. Women

Investment strategies differ considerably between men and women, often reflecting broader behavioral economic trends in risk perception and financial decision-making. Men are generally more likely to engage in high-risk investments, betting on potentially high returns through aggressive stock market trading. This tendency contributes to their ability to accumulate wealth at a faster rate than women, who typically prefer more conservative and lower-risk options. Understanding the psychological factors behind these strategies can help demystify investment behaviors.

Acknowledging these differences is essential for fostering a more inclusive approach to investing. Financial advisors should strive to tailor their strategies to accommodate women’s investment preferences, focusing on education and the benefits of diversifying portfolios. By providing resources that cater to women’s unique perspectives on risk and investment, we can promote equality in wealth accumulation and bridge the gender wealth gap effectively.

Promoting Diverse Investment Strategies Among Individuals

Encouraging a diversification of investment strategies is crucial for all individuals seeking to enhance their wealth accumulation. Individuals often gravitate towards familiar asset classes, which may limit their growth potential. Women, in particular, can benefit from exploring various investment vehicles, such as mutual funds and ETFs, which provide exposure to a wider array of equities with potentially more balanced risk. By advocating for a broader range of investment strategies, we can encourage both men and women to optimize their portfolios.

Moreover, promoting awareness around the benefits of diversification is essential in today’s volatile market environment. Knowledge of various investment strategies empowers individuals to make confident choices rather than relying solely on traditional methods. As women become more informed about the numerous opportunities available to them in the stock market, they are likely to become more engaged, ultimately leading to better financial outcomes.

Breaking Barriers: Enhancing Women’s Participation in Financial Markets

Breaking down the barriers that prevent women from participating in financial markets is critical to achieving gender equity in wealth accumulation. Historical societal norms and lack of representation in financial sectors have often discouraged women from engaging with investment opportunities. Companies and organizations need to prioritize initiatives that foster inclusivity, such as mentorship programs and community engagement, aimed at increasing women’s confidence in their investment abilities.

Additionally, creating awareness about the importance of women’s presence in financial markets can empower more individuals to contribute to the conversation surrounding gender wealth disparities. By highlighting successful female investors and sharing their stories, we can inspire a future generation to view investing as an attainable goal, regardless of gender. Thus, fostering an environment of support and motivation can lead to greater participation from women in financial markets.

The Future of Investing: Gender Perspectives

As we look towards the future of investing, understanding gender perspectives is crucial for achieving a more balanced financial landscape. The evolving dynamics of investing may present unique opportunities for women to engage more actively in the stock market, particularly as the importance of financial literacy continues to be underscored. The emergence of technology-driven investment platforms and resources, such as mobile apps, can also facilitate easier access for women to manage their portfolios, thereby diminishing the perceived barriers to entry.

Further, acknowledging the benefits of differing perspectives can enrich the investment community. As more women share their insights and approaches to investing, the industry is likely to integrate varied strategies that reflect a more comprehensive understanding of risk and wealth accumulation. Encouraging dialogue and sharing results among men and women can foster a rich cross-pollination of investment ideas that cater to diverse risk appetites and return expectations.

Investing as a Pathway to Financial Independence

Investing wisely can serve as a critical pathway to financial independence, particularly for women. By actively managing their investments and understanding market dynamics, women can build significant wealth over time. Financial independence is not simply about being able to pay the bills; it’s about creating a foundation that allows individuals to pursue personal goals, from education to retirement. For women, gaining financial autonomy through investing can ultimately change their economic status and their families’ circumstances.

Promoting the idea of investment as a means of achieving financial independence can introduce women to the broader possibilities of wealth accumulation. By setting clear financial goals and employing suitable investment strategies, women can leverage their resources to secure a more stable financial future. Through education and support networks, women can learn that investing isn’t just for the wealthy; it’s a critical step toward preserving and growing their wealth.

Frequently Asked Questions

What is the gender wealth gap and how does it relate to stock market performance?

The gender wealth gap refers to the disparity in wealth accumulation between men and women, often exacerbated by differences in stock market engagement and investment strategies. Men typically have higher stock market participation, which leads to greater capital appreciation during favorable market conditions, thereby widening the wealth gap.

How do investment strategies impact the gender wealth gap?

Investment strategies significantly impact the gender wealth gap as men generally adopt more aggressive investment strategies compared to women. This difference in approach often results in higher returns for men, contributing to their increased wealth accumulation and further widening the gender wealth gap.

Why are men more likely to invest in the stock market than women?

Men are statistically more likely to invest in the stock market than women due to factors such as higher risk tolerance, peer influence, and traditional gender norms that encourage aggressive financial behavior. This leads to greater participation in wealth-building activities, perpetuating the gender wealth gap.

What role does financial literacy play in the gender wealth gap?

While research suggests that men and women possess similar levels of financial literacy, the application of this knowledge differs. Men engage more actively in stock market investments, while women may opt for conservative saving strategies, which can hinder their wealth accumulation and contribute to the gender wealth gap.

How can women improve their investment strategies to close the gender wealth gap?

Women can improve their investment strategies by seeking financial education, embracing stock market participation, and exploring diverse investment options. By understanding the long-term benefits of equities and adopting more aggressive investment approaches, women can work towards closing the gender wealth gap.

What is the impact of economic conditions on the gender wealth gap?

Economic conditions, particularly during bull markets, have a profound impact on the gender wealth gap. When stock markets perform well, those already investing reap significant rewards. As men tend to engage more in these markets, they benefit disproportionately from economic upswings, further widening the wealth gap with women.

What steps can be taken to promote women’s participation in the stock market to reduce the gender wealth gap?

To promote women’s participation in the stock market and reduce the gender wealth gap, it is essential to provide accessible financial education, create supportive investment communities, and advocate for policies that encourage equity in financial markets. Breaking down barriers and offering resources will empower women to invest more actively.

| Key Points | Details |

|---|---|

| Gender Wealth Gap | Financial disparities between men and women are largely influenced by differences in investment behaviors. |

| Stock Market Participation | Men are more likely to invest in the stock market than women, affecting overall wealth accumulation. |

| Investment Strategies | Men tend to employ aggressive investment strategies leading to higher returns, while women often opt for conservative options. |

| Impact of Bull Markets | Strong stock market performance disproportionately benefits those who are invested, typically men, thus exacerbating the wealth gap. |

| Educational Initiatives | Encouraging women’s participation in the stock market through education and resources is essential to bridge the gender wealth gap. |

| Long-term Benefits | Promoting diverse investment strategies among women can lead to substantial long-term financial gains. |

Summary

The gender wealth gap is significantly influenced by differing investment behaviors and stock market participation between men and women. As financial disparities become more pronounced, understanding these dynamics is crucial for fostering a more equitable financial landscape. Increased female engagement in stock markets through education and accessible resources will be vital in bridging this wealth gap, paving the way towards a balanced financial future that benefits everyone.

#FinanceNews #GenderWealthGap #StockMarketDisparities #EconomicEquality #InvestmentTrends