Racial Wealth Gap: Impact of the ‘Big, Beautiful Bill’

The racial wealth gap in the United States represents a profound and systemic economic disparity that continues to impact millions of families, particularly within communities of color. Despite attempts to stimulate economic growth, recent legislation aims to reduce tax burdens for affluent families while inadvertently exacerbating the challenges faced by low-income families. This growing wealth inequality is not merely an economic issue; it reflects decades of policy decisions that have favored the wealthy, leaving marginalized groups to struggle with financial insecurity and limited opportunities. With the wealth gap widening further, the ramifications of these tax cuts are becoming increasingly evident, restricting access to essential resources like education, health care, and stable housing. As the nation confronts these issues, understanding the intricacies of such laws is critical to fostering a more equitable economy for future generations.

Economic inequality, particularly along racial lines, is a pressing issue that highlights the stark contrast between wealth accumulation in different communities. This financial chasm not only underscores the reality of resource distribution but also reflects historical inequities that have shaped present-day realities. Recent policy changes, often masked as beneficial reforms, tend to favor higher-income households while disproportionately straining low-income families, particularly those from racial and ethnic minority backgrounds. The legislative developments aiming to alleviate burdens on the wealthy frequently overlook the fundamental needs of those struggling for financial stability. Ultimately, fostering a healthier economic landscape necessitates a comprehensive approach that genuinely addresses the imbalances in wealth and opportunity across all communities.

Understanding the Racial Wealth Gap

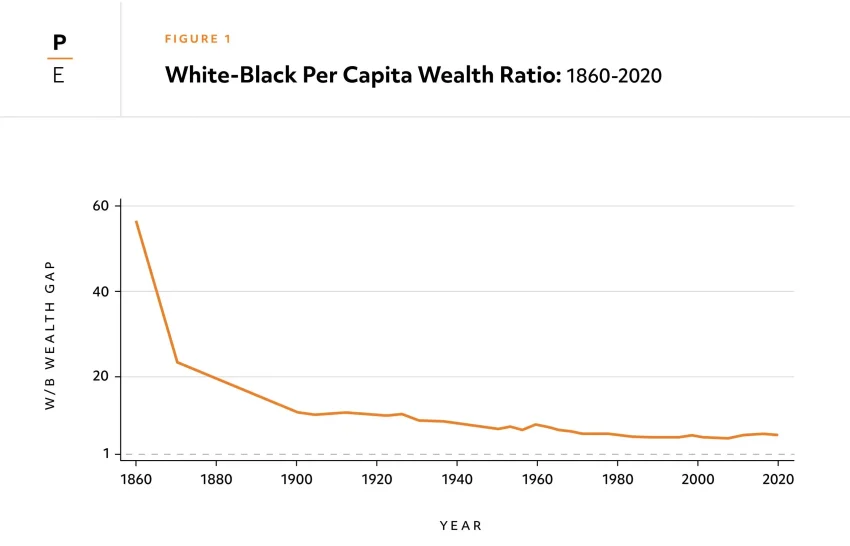

The racial wealth gap in the United States is an enduring issue that reflects deep-rooted economic disparities between white Americans and racial minorities, particularly Black families. Recent studies have shown that the median wealth of white families is significantly higher than that of Black families, often exceeding $250,000. This wealth inequality can be traced back to historical injustices such as discriminatory practices in housing, employment, and banking. As policies continue to perpetuate these inequalities, the racial wealth gap becomes a crucial metric for understanding broader economic disparities in American society.

When examining the impacts of newly enacted legislation, such as the ‘big, beautiful bill’, it’s essential to consider how these laws might exacerbate existing economic disparities. Studies from institutions like the Congressional Budget Office have revealed that tax cuts primarily benefit wealthier households while leaving low-income families behind. This is particularly troubling as the wealth disparities not only hinder economic mobility but also contribute to systemic issues like access to healthcare and education, further entrenching the racial wealth gap.

Economic Disparity and Its Impact on Low-Income Families

Economic disparity is a significant contributor to the struggles faced by low-income families in America. Policies like the recent tax cuts aim to stimulate economic growth, but in reality, they often result in a transfer of wealth from the poor to the rich. For example, the U.S. tax code provides substantial benefits to wealthy families while offering minimal relief to those earning less. This disconnect crucially influences low-income families’ ability to achieve financial stability and build a secure future, perpetuating cycles of poverty and increasing reliance on government assistance.

Low-income families, often composed of racial and ethnic minorities, find it increasingly difficult to meet their basic needs amidst these economic disparities. Legislation that appears to support these families often includes cuts to essential services such as Medicaid and food assistance programs. With the costs transferred to the most vulnerable populations, these families are left with fewer resources to afford necessities, resulting in heightened financial insecurity and reducing their overall quality of life.

The Long-Term Consequences of Tax Cuts

Tax cuts, particularly those benefiting the wealthy, have long-term consequences on wealth distribution and economic inequality. The permanent extension of individual tax cuts from bills like the ‘big, beautiful bill’ decreases federal revenue while disproportionately benefiting affluent families. Critics argue that this policy not only fails to address wealth inequality but actively works to widen the gap by favoring those already at the top of the economic ladder. As the concentration of wealth becomes more extreme, economic mobility for the lower classes diminishes, resulting in a society where the rich get richer, and the poor struggle to survive.

Moreover, the reduction in funding for essential public services has knock-on effects that extend beyond immediate financial concerns. With less money allocated to healthcare, education, and welfare programs, low-income families face increased challenges that hinder their ability to improve their financial circumstances. Over time, this creates a self-perpetuating cycle of poverty where economic barriers become even more pronounced, ultimately contradicting the very intentions behind such tax legislation.

The Illusion of Support for Low-Income Families

Policies framed as helping low-income families often mask their true nature of exacerbating wealth inequality. For instance, the so-called ‘baby bonus,’ or Trump Accounts, are presented as innovative solutions for wealth building but effectively serve to benefit wealthier families who can afford to contribute more. While the program may seem beneficial at a glance, its design fails to address the fundamental barriers low-income families face, such as inadequate income and savings potential. This illusion of support merely distracts from the reality that these measures often favor those already economically secure.

This facade of assistance is repeated in various forms through the bill, where tax credits and subsidies are allocated in ways that leave the most vulnerable behind. With wealthy families being able to fully capitalize on these credits, low-income families are left without vital financial support. Many low-income families either do not qualify for these credits or receive significantly lesser benefits, deepening the divide between classes. Ultimately, this reflects a systemic issue in policy-making, where disconnection from the actual needs of economically disadvantaged populations persists.

Impact on Healthcare Accessibility for Low-Income Communities

The intersection of economics and healthcare is critical when discussing financial security for low-income families. With recent legislation tightening Medicaid eligibility through new requirements, millions of low-income individuals risk losing healthcare access, exacerbating existing health disparities. This shift compromises the very foundation of healthcare accessibility, putting more pressure on already strained public health systems. Without proper healthcare, low-income communities face increased risks of chronic diseases and preventable health issues, which can lead to further economic hardships.

Moreover, the potential reduction in federal spending on healthcare subsidies, alongside cuts to essential programs like Medicaid, not only harms low-income families but also has broader implications for public health outcomes. The need for reliable and accessible healthcare is paramount for financial stability; when families face medical bankruptcies due to inability to pay for services, they are thrown deeper into poverty. Therefore, policies that target essential healthcare support are crucial for the economic health of families navigating the very real challenges of inequality and systemic injustice.

The Role of Tax Policy in Wealth Inequality

Tax policy plays a critical role in shaping wealth inequality in the United States. Legislation like the ‘big, beautiful bill’ reveals the intricate ways that tax cuts for the wealthy can drastically influence economic outcomes for low-income families. By providing tax breaks that primarily benefit high-income individuals, these policies contribute to a widening wealth gap and reinforce economic disparities based on race. An increasing concentration of wealth at the top inevitably diminishes the financial stability of families struggling to make ends meet, reflecting a profound disconnect in fiscal priorities.

As researchers continue to uncover the relationship between tax policy and wealth disparity, it is essential to advocate for reforms that promote equity. Policies that shift the burden away from low-income earners and invest in essential services can help mitigate these disparities and enhance financial security for all Americans, particularly for those disadvantaged by systemic inequities. A re-examination of tax legislation is crucial to create a more fair and just economic landscape that offers support to those who need it most.

Addressing the Structural Barriers to Economic Mobility

For many low-income families, structural barriers to economic mobility are deeply entrenched in policies and practices that perpetuate wealth inequality. These barriers include lack of access to quality education, affordable housing, and stable employment. Each of these elements plays a significant role in determining an individual’s or family’s ability to improve their financial situation over time. Without targeted interventions that address these structural challenges, low-income families face an uphill battle in achieving economic mobility.

Programs that aim to enhance access to education and training, provide low-income housing, and create job opportunities are essential for breaking the cycle of poverty. These initiatives must be supported by comprehensive financial policies that prioritize equitable resource distribution and support for marginalized communities. Addressing these structural barriers requires sustained political will and community investment to ensure that all families have a fair chance at financial security and upward mobility.

The Importance of Advocacy and Reform for Low-Income Families

Advocacy for low-income families is critical in the current political landscape, particularly in light of legislation that seems to favor wealthier Americans. Community organizing and grassroots movements play a crucial role in drawing attention to issues of wealth inequality and financial security. By mobilizing voices affected by these policies, advocates can pressure lawmakers to prioritize the needs of low-income families and implement reforms that genuinely address disparities.

Additionally, reforming government programs that serve low-income families is vital for ensuring their effectiveness and accessibility. This includes reassessing eligibility requirements for programs like Medicaid and SNAP, which have been tightened in recent legislation. Advocating for equitable policies can help shift the narrative around poverty and wealth, making it clear that systemic change is necessary for fostering a more just economy that uplifts all Americans, regardless of their socio-economic background.

Evaluating the Financial Security Implications of Current Legislation

The implications of current legislation such as the ‘big, beautiful bill’ significantly impact the financial security of low-income families. With concerted efforts to reduce funding for essential services, the law has introduced measures that will inevitably leave many families struggling to meet their basic needs. Evaluating the long-term effects of such policies is crucial for understanding their broader implications on social well-being and economic stability. Without access to necessary health care, food assistance, and other support systems, low-income families face increased vulnerability.

Understanding the financial climate created by these policies provides a framework for advocating for better alternatives. By exploring the implications of ongoing legislative changes, it becomes possible to identify the gaps and advocate for solutions that prioritize the needs of economically disadvantaged populations. Financial security for low-income families must be a central focus in policy discussions, highlighting the urgent need for reforms that genuinely uplift rather than burden these communities.

Frequently Asked Questions

How does the ‘big, beautiful bill’ impact the racial wealth gap?

The ‘big, beautiful bill’ exacerbates the racial wealth gap by implementing tax cuts that disproportionately benefit wealthy families while imposing costs on low- and middle-income Americans, including racial and ethnic minorities. This law extends existing tax benefits that have historically widened economic disparities, leaving low-income families struggling to afford essentials.

What role do tax cuts play in increasing wealth inequality among racial groups?

Tax cuts under the ‘big, beautiful bill’ favor affluent families, which increases wealth inequality across racial groups. While the bill may seem supportive of low-income families, its structure primarily benefits the wealthy, further contributing to the economic disparity seen between Black and white Americans.

In what ways does the legislation affect low-income families and the racial wealth gap?

The legislation negatively affects low-income families by cutting programs like Medicaid and food assistance, directly impacting their financial security. This undermines their ability to build wealth and exacerbates the racial wealth gap where low-income families, often from marginalized racial backgrounds, face greater barriers to economic stability.

How do changes to the child tax credit influence racial wealth inequality?

The changes to the child tax credit tighten eligibility requirements, disproportionately affecting low-income families, especially those from Black and Latino communities. As a result, many families, including U.S. citizen children in mixed-status households, lose access to critical financial support, thereby deepening the racial wealth gap.

What implications does the ‘big, beautiful bill’ have for economic disparity in America?

The ‘big, beautiful bill’ reinforces economic disparity in America by prioritizing tax breaks for the wealthy while slashing resources for essential services. This approach exacerbates the racial wealth gap, as minorities and low-income families are disproportionately affected by reduced access to health care and nutrition programs.

Why are ‘Trump Accounts’ considered regressive in terms of wealth-building?

‘Trump Accounts’ are considered regressive because, although they offer a government contribution for children’s savings, the real benefits accrue to wealthier families who can afford to contribute significantly more. This structure fails to address the financial challenges faced by low-income families, widening the racial wealth gap instead of closing it.

How does Medicaid reform under the new law affect the racial wealth gap?

The Medicaid reforms under the new law threaten to strip coverage from low-income families, which often includes a disproportionate number of racial minorities. The introduction of work requirements and changes to eligibility will likely lead to more individuals losing vital health coverage, further widening the racial wealth gap.

What are the long-term effects of tax cuts on racial wealth inequality?

The long-term effects of tax cuts, as evidenced by the 2025 bill, include a growing racial wealth gap, as persistent tax benefits for the rich lead to more unequal wealth accumulation. This trend undermines the financial security of low-income families, particularly among racial minorities, by limiting their economic opportunities.

How can fiscal policy effectively address the racial wealth gap?

Effective fiscal policy should prioritize investments in programs that support low- and middle-income families, providing assistance that directly addresses the historical disadvantages faced by racial minorities. Instead of continuing regressive tax policies, implementing equitable financial measures can help close the racial wealth gap.

| Key Point | Details |

|---|---|

| Title of Law | ‘Big, Beautiful Bill’ |

| Author | Beverly Moran, Vanderbilt University |

| Date Published | July 18, 2025 |

| Impact on Racial Wealth Gap | The law exacerbates wealth inequalities, particularly affecting poor families and racial/ethnic minorities. |

| Tax Cuts | Broad tax cuts favor wealthy families while low-income families face increased costs and reduced support. |

| Health Care Impact | Changes to Medicaid will restrict coverage for low-income individuals. |

| Child Tax Credit | Increased eligibility limits benefit wealthy families more while excluding many low-income families and children. |

| Community Engagement Requirements | New requirements for Medicaid eligibility may lead to loss of coverage. |

| Misleading Programs | Programs like ‘Trump Accounts’ falsely promise to help low-income families but disproportionately aid the wealthy. |

Summary

The racial wealth gap is a critical issue that has been exacerbated by recent legislative changes. The ‘big, beautiful bill’ enacted in 2025 is designed under the guise of economic growth but instead serves to widen existing disparities in wealth between racial and socioeconomic groups. By providing significant tax breaks for wealthier families while introducing stringent limitations on essential social services, the law fundamentally undermines the economic stability of low-income populations, particularly among racial and ethnic minorities. This approach reinforces systemic inequities instead of addressing the urgent need to close the wealth gap, highlighting the necessity for more inclusive fiscal policies.

#RacialWealthGap #EconomicJustice #BigBeautifulBill #WealthInequality #PolicyImpact