Climbing the Wealth Ladder: 3 Solutions to Succeed

Climbing the wealth ladder is a journey filled with opportunities and financial challenges, marking a pivotal aspect of personal finance management. As one navigates through this intricate process, understanding effective wealth management and implementing smart financial strategies can dramatically increase income and improve savings. According to financial experts, the key to success lies not just in reducing expenses, but in maximizing earning potential and adapting strategies as your wealth grows. By utilizing practical personal finance tips, you can pave the way to elevated spending freedoms at each wealth level. Embracing this dynamic approach allows you to take control of your financial future and steadily ascend the wealth ladder.

Embarking on the journey to financial independence often means exploring new avenues for wealth accumulation, commonly referred to as advancing up the financial hierarchy. This process involves an array of wealth-building strategies that aim to enhance earnings and bolster savings for a prosperous livelihood. As individuals strive to improve their financial standing, they must be prepared to adapt their approaches according to their evolving economic situation. By leveraging sound financial guidance and smart investment decisions, climbing the wealth ladder becomes a realistic goal. Ultimately, achieving sustainable wealth requires a blend of strategic planning, disciplined saving, and ongoing education in personal finance.

Understanding the Wealth Ladder

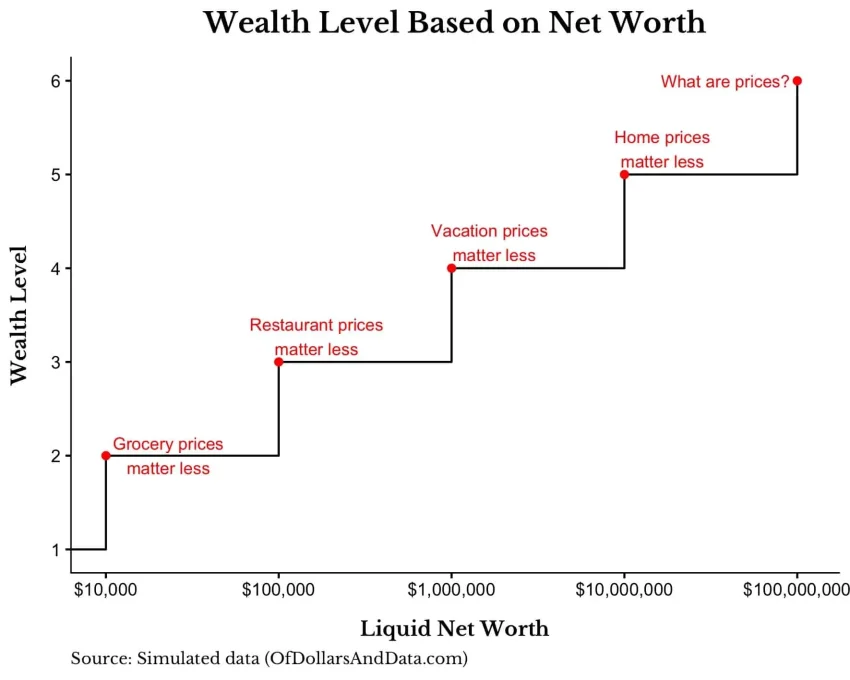

The wealth ladder is a conceptual tool that illustrates the various levels of financial success based on one’s net worth. Levels range from those with less than $10,000 in assets all the way up to those boasting over $100 million. Each rung on this ladder signifies not just a difference in wealth but also varying degrees of financial freedom and lifestyle choices. For individuals striving for improvement in personal finance, understanding where you stand on this ladder is crucial for shaping your financial strategies.

Recognizing your current position allows for tailored financial planning, encouraging better decisions that align with your goals. For instance, individuals in level one may focus on basic wealth management practices such as building an emergency fund or paying down debts, while those approaching higher levels might delve into investment strategies or complex financial instruments. By strategizing your climb up the wealth ladder, you effectively lay the groundwork for consistent, long-term growth.

Three Essential Strategies for Climbing the Wealth Ladder

Climbing the wealth ladder requires a multi-faceted approach that goes beyond mere saving. One of the most impactful strategies is to increase your income. According to financial expert Nick Maggiulli, elevating your income should take precedence over solely cutting expenses. While creating a budget and monitoring savings are vital in personal finance management, they may not suffice when aiming for significant wealth growth. By strategically finding ways to boost your income—be it through side hustles, investment avenues, or career advancements—you exponentially increase your potential for wealth accumulation.

Moreover, a focus on income growth can complement other financial strategies, such as improving savings rates and diversifying income streams. Think about leveraging your skills or pursuing education and certifications that lead to higher-paying roles. The concept is simple: the more you earn, the more you can save and invest, which in turn supports your journey up the wealth ladder.

Improving Your Financial Health Through Lifestyle Changes

Maintaining a healthy lifestyle can have profound effects on your financial longevity, which Maggiulli emphasizes through his suggestion to exercise more. By enhancing personal health, individuals can potentially extend their working years, allowing for more opportunities to save and invest. This dual approach not only accommodates a longer lifespan but also helps mitigate future healthcare costs that might otherwise deplete your wealth.

Additionally, engaging in physical activity can boost mental clarity, endurance, and productivity—all vital components for professional success. As you enhance your health, you are simultaneously setting yourself up for increased job performance, which can inevitably lead to promotions or new job opportunities. In this way, making lifestyle changes can directly enhance your capacity to climb the wealth ladder.

The Role of Ego in Wealth Accumulation

Letting go of ego is another critical aspect of climbing the wealth ladder that Maggiulli highlights. Overemphasis on status and consumerism can result in wasteful spending behaviors, which ultimately stunt financial growth. Individuals often feel pressured to maintain a lifestyle beyond their means, which can lead to feelings of inadequacy and increased financial stress. Recognizing when your ego influences spending choices is essential to shifting towards a more productive mindset that prioritizes saving and investing.

By rethinking your financial priorities and making conscious spending decisions, you can transform your financial habits into ones that promote wealth accumulation. Focusing on assets rather than appearances not only enhances savings rates but also positions you for better opportunities to invest your wealth as you climb higher up the ladder.

Adopting Effective Financial Strategies

A successful climb up the wealth ladder is rooted in effective financial strategies. Implementing a robust wealth management plan tailored to your unique situation can help you navigate the complexities of personal finance effectively. Whether you’re just starting to accumulate wealth or aiming to preserve what you have, working with a financial advisor to establish clear goals can make a significant difference in your journey. Strategies may include debt management, investment planning, and retirement savings.

Moreover, regularly reviewing and adapting your financial strategies in response to changes in your income or expenses is crucial. As the economy fluctuates and personal circumstances evolve, having a flexible financial strategy ensures you can capture opportunities for growth while minimizing potential setbacks.

The Importance of Budgeting and Savings

Budgeting remains a cornerstone of effective personal finance management and is particularly vital for those aspiring to move up the wealth ladder. A well-structured budget allows for accurate tracking of income and expenses, which can uncover areas where you can save more. This improved awareness can lead to smarter spending decisions and, ultimately, higher savings rates—critical components for accumulating wealth over time.

Additionally, setting up automated savings can further enhance your budgeting efforts. By consistently contributing a portion of your income to savings accounts or investment portfolios, you make wealth building a priority, regardless of your everyday spending urges. Over time, these small but consistent savings can compound into significant wealth, thereby aiding your journey up the wealth ladder.

Investing Wisely for Future Growth

Investing is one of the key methods for climbing the wealth ladder, as it allows your money to work for you. Transitioning from simply saving to investing can greatly enhance your potential returns and growth. To adopt effective financial strategies, understanding different investment vehicles—such as stocks, bonds, and real estate—is essential. Each option comes with varying levels of risk and reward, so conducting thorough research or consulting with a financial professional can provide clarity and confidence in your investment decisions.

Furthermore, diversification of your investment portfolio minimizes risk while maximizing the potential for returns. Spreading your investments across different asset classes can protect your wealth during economic downturns and position you favorably when market conditions improve. By committing to a disciplined investment approach, you set the stage for long-term growth, which is vital for climbing the wealth ladder.

Cultivating a Wealth Mindset

Cultivating a wealth mindset is essential for those serious about climbing the wealth ladder. This mentality goes beyond mere financial success; it encompasses a holistic view of personal development and self-improvement. Individuals with a wealth mindset tend to view challenges as opportunities for growth, often seeking out new learning experiences or networking opportunities that can aid in their financial journey. This perspective shift opens doors to creative solutions to financial obstacles and encourages proactive behavior in wealth management.

Moreover, a wealth mindset encourages gratitude and mindfulness towards financial matters, allowing individuals to appreciate what they have while working towards future goals. By fostering this attitude, you not only position yourself for financial success but also inspire those around you to adopt similar practices, creating a supportive community focused on wealth building.

Seeking Professional Financial Advice

As you navigate the complexities of climbing the wealth ladder, seeking professional financial advice can provide invaluable insights and guidance. Financial advisors can offer tailored strategies that align with your specific goals and circumstances. Their expertise can demystify the realm of wealth management, allowing you to make informed decisions and avoid common pitfalls.

Additionally, engaging with a financial advisor can bring accountability to your financial actions. Knowing someone is tracking your progress can motivate you to adhere to your plans and adapt as necessary. Whether you need help with investment decisions, tax planning, or retirement strategies, professional advice can significantly enhance your financial outcomes as you climb the wealth ladder.

Frequently Asked Questions

What strategies can help me with climbing the wealth ladder?

To effectively climb the wealth ladder, three essential strategies are recommended: first, focus on increasing your income rather than merely cutting expenses. This can be achieved through career advancement, side hustles, or investments. Second, consider improving your health through exercise, which can extend your working life, allowing you to earn more over the years. Lastly, let go of ego-driven spending, as it often leads to financial strain. By embracing these financial strategies, you can enhance your wealth management.

What does it mean to improve savings while climbing the wealth ladder?

Improving savings is crucial for climbing the wealth ladder. As you progress to higher levels of wealth, the 0.01 percent rule can guide your daily spending decisions based on your net worth. Implementing effective personal finance tips, such as automating savings and setting clear financial goals, can significantly enhance your saving capacity. This disciplined approach not only safeguards your wealth but also prepares you for opportunities to invest and grow your financial portfolio.

How can I effectively increase income to climb the wealth ladder?

To increase your income and climb the wealth ladder, consider diversifying your income streams. This could include seeking promotions or raises in your current job, acquiring new skills to boost your employability, or starting a side business. Each of these financial strategies focuses on maximizing your earning potential, which is more impactful than just cutting costs, as highlighted by experts in wealth management.

Why is it important to let go of ego when climbing the wealth ladder?

Letting go of ego is vital for successfully climbing the wealth ladder because it allows you to make more rational financial decisions. Excessive ego can lead to lifestyle inflation, where you spend on luxury items that exceed your income level, ultimately hindering your savings and wealth accumulation. By adopting a mindset focused on long-term financial goals rather than immediate gratification, you can maintain a healthier savings rate and enhance your wealth management.

What financial tips can help in climbing the wealth ladder during uncertain times?

During uncertain times, focus on building a robust financial foundation as you climb the wealth ladder. Start by ensuring you have an emergency fund that covers 3-6 months of expenses, which provides security. Next, prioritize paying off high-interest debts to improve your savings potential. Finally, stay informed and adaptable in your financial strategies, such as investing wisely and seeking advice from wealth management professionals to navigate economic fluctuations.

How does financial discipline relate to climbing the wealth ladder?

Financial discipline is crucial for climbing the wealth ladder because it involves consistently making choices that align with your long-term financial goals. This includes budgeting effectively, prioritizing savings, and making informed investment decisions. By adhering to such personal finance tips and demonstrating restraint in spending, you enhance your ability to accumulate wealth and reach higher levels within the wealth ladder.

| Key Solutions | Description |

|---|---|

| 1. Increase Your Income | Focus on boosting your income over cutting expenses to build wealth more effectively. |

| 2. Exercise More | Invest in your health to extend your working years and enhance earning potential. |

| 3. Let Go of Your Ego | Avoid lifestyle inflation and unnecessary spending that can hinder wealth accumulation. |

Summary

Climbing the wealth ladder requires strategic thinking and adaptability, akin to playing chess, as you navigate your financial journey. By focusing on increasing income, prioritizing health through regular exercise, and managing ego-driven spending, individuals can significantly enhance their financial positions. These solutions not only promote wealth accumulation but also encourage a sustainable lifestyle that supports long-term financial health.

#WealthBuilding #FinancialSuccess #MoneyManagement #GrowYourWealth #SuccessStrategies