Wealth Tax Canada: Funding Military Spending by Mark Carney

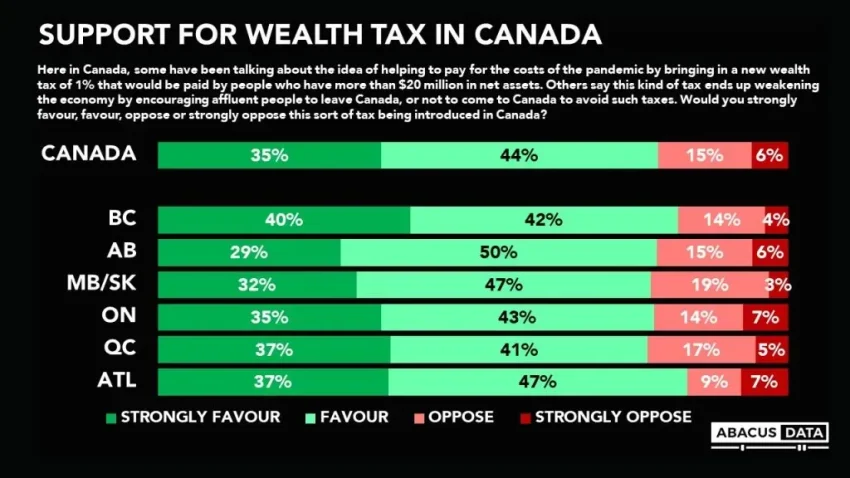

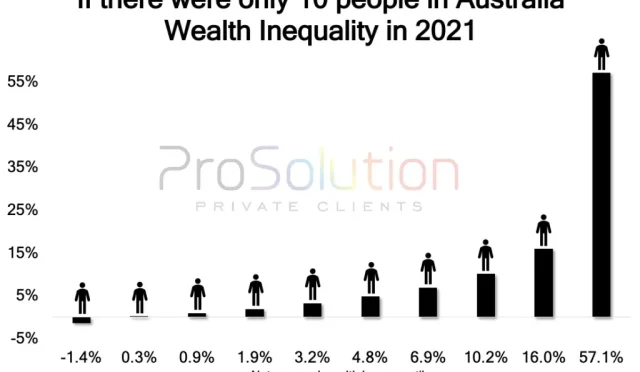

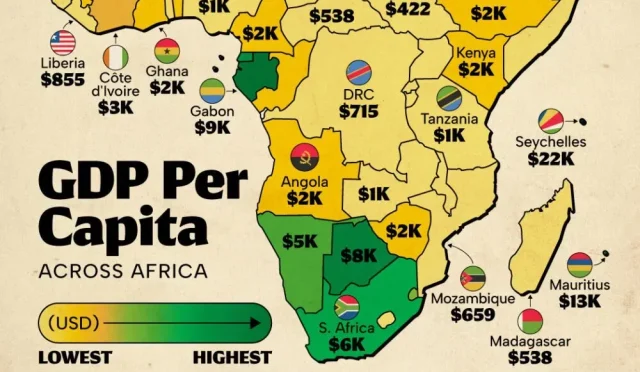

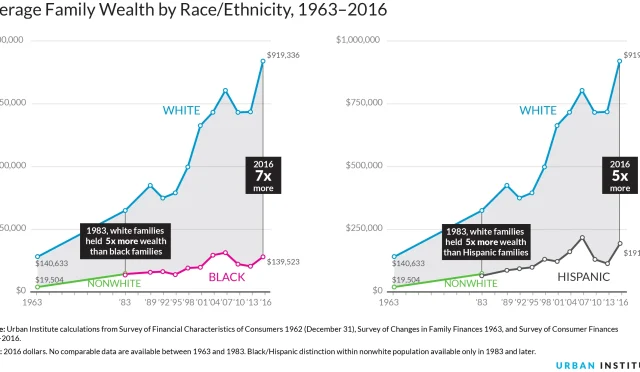

Wealth Tax Canada has emerged as a contentious topic amidst discussions surrounding national military spending, which has been ramped up under Prime Minister Mark Carney’s proposal to allocate five percent of GDP to defense. As the conversation intensifies regarding the funding of military expenses, many Canadians are advocating for a tax increase on the wealthy, rather than adding to the national debt. With rising wealth inequality in Canada, the need for equitable taxation has never been more pressing, especially as the budget allocates significant funds towards military enhancement. Public opinion polls suggest a strong preference for tax reforms that target affluent citizens, facilitating a funding mechanism that aligns with social priorities. The discussion about wealth tax is crucial not only for equitable financial responsibility but also for ensuring that essential services remain intact in the face of mounting military expenditures.

In Canada, the debate surrounding a tax on wealth has gained heightened visibility as military budget allocations increase. This shift in focus towards defense spending underlines the urgent necessity to tackle national issues like wealth disparity and funding mechanisms for various expenditures. The call for implementing a wealth tax resonates with many citizens who feel that a tax increase on the affluent could offer a viable solution to finance essential services while addressing growing inequality. As military budgets expand, it becomes ever more essential to explore alternative revenue streams, particularly those that ensure that the burden is fairly shared among citizens. Engaging in this conversation not only promotes a fair financial landscape but also encourages a reevaluation of national priorities in light of pressing social needs.

How a Wealth Tax Can Fund Military Spending in Canada

A wealth tax in Canada could effectively provide the necessary funding for the significant increase in military spending proposed by Mark Carney. With military expenditures set to reach unprecedented levels, estimated at five percent of the national GDP, the government will need to explore alternative revenue sources beyond traditional tax frameworks. By imposing a wealth tax on the ultra-wealthy, who have seen their net worth soar, Canada can generate substantial funds—potentially amounting to billions annually, as estimates suggest. This approach not only aims to finance military spending but also addresses mounting concerns over wealth inequality in the country.

Moreover, the implementation of a wealth tax aligns with the growing global movement towards equitable taxation systems, where the wealthiest contribute their fair share. The NDP’s proposal could see approximately $23 billion generated per year, helping to offset cuts to social programs that many Canadians depend on. The wealth tax could also serve as a counterbalance against the widening gap between the affluent and those struggling, especially in the face of economic uncertainties. As Canada looks to redefine its budget objectives, utilizing a wealth tax could pave the way for sustainable military funding while promoting social equity.

Impact of Increased Military Spending on Social Programs

The decision to increase military spending to five percent of GDP raises concerns regarding the potential consequences for vital social programs in Canada. With an annual military budget projected to swell from $41 billion to a staggering $150 billion, the allocation of funds has many questioning whether this emphasis on defense compromises essential services. Canadians value their social safety nets, including healthcare and education, and any diversion of funds could jeopardize these critical areas, exacerbating existing wealth inequalities.

Critics argue that prioritizing military expenditure over social spending reveals a misguided approach to national welfare. While proponents may suggest that increased security is necessary, it is vital to consider the immediate needs of Canadians who rely on public services. Rather than justifying a military spending spree, the focus should shift towards maintaining and improving social programs that enhance the well-being of all Canadians. Individuals and families could face direct consequences if program cuts occur to fund a more contentious military agenda.

Public Opinion on Military Spending and Taxation

Public sentiment around Mark Carney’s proposal to escalate military spending reflects a complicated landscape in Canada. Recent polls indicate that a significant portion of Canadians would prefer to increase national debt rather than impose higher taxes to finance this spending. However, this mentality may overlook the essential dialogue surrounding acceptable funding mechanisms and priorities. Canadians deserve to engage in discussions that explore alternative solutions instead of settling for superficial financial strategies.

It’s evident from the polls that the business community’s push for increased spending is not necessarily representative of the broader public. Many Canadians are understandably wary of how the proposed expenditures will affect their everyday lives—particularly when facing existing affordability crises. Therefore, a concerted effort to gauge public unambiguity regarding military spending levels and the methods to fund them, especially concerning wealth taxes, is paramount to build trust in governmental decisions.

The Role of Business Media in Military Spending Debate

The business media’s enthusiastic support for increased military spending has significant implications for public discourse in Canada. Often, the narratives presented prioritize the perspectives of business commentators and financial interests, with less focus on the societal outcome of such military investments. As these commentators weigh in on funding strategies—like raising GST or cutting social programs—their emphasis tends to detract from the crucial perspective of ordinary Canadians who would bear the brunt of such decisions.

This dynamic creates a need for alternative voices within the media, ones that question the prioritization of defense spending at the potential expense of social welfare. In emphasizing austerity or cuts to essential services, the discourse risks normalizing the idea that military spending is sacrosanct, diverting attention from alternative funding sources, such as a wealth tax. It’s vital for public media to foster a more inclusive discourse, ensuring all views, including those advocating for social welfare and equitable taxation, are represented.

Challenges and Misconceptions Surrounding Wealth Tax Implementation

The discourse around implementing a wealth tax in Canada is fraught with misconceptions, particularly regarding capital flight and the feasibility of such a tax structure. Critics often claim that imposing higher taxes on the rich will lead to an outflux of wealthy individuals seeking more favorable tax jurisdictions. However, the reality is more nuanced. While there are concerns about potential capital flight, it’s essential to understand that transferring wealth out of Canada comes with significant tax liabilities that can deter many from leaving.

Additionally, the argument that wealthy individuals would simply relocate ignores the fundamental economic ties that keep them anchored in Canada. Many high-net-worth individuals benefit from established businesses and assets within the country, which makes the prospect of leaving less appealing. Therefore, understanding the intricacies of wealth tax dynamics is vital to lay claims based on fear rather than fact. Policymakers need to address the myths surrounding this tax directly in order to clarify the broader benefits it could bring to Canadian society.

Alternatives to Military Spending in the Canada Budget

While military spending increases are presented as essential for national security, exploring alternatives within the Canada budget can yield substantial benefits without compromising public welfare. Prioritizing investment in social programs, infrastructure, education, and healthcare can offer a more balanced growth approach for the nation. Redirecting funds from military ambitions into these sectors can boost long-term economic stability and bolster Canadian living standards.

Moreover, innovative policies could emerge from re-examining the allocation of resources. Prioritizing technology, green initiatives, and workforce development can create a robust economy that doesn’t solely rely on military expenditures for growth and stability. By engaging in dialogues about investment in social infrastructures instead of militaristic expansion, Canada can ensure its long-term future is not only secure but equitable and prosperous for all its citizens.

Tax Increase on the Wealthy: Addressing Canada Wealth Inequality

The discussion surrounding tax increases on the wealthy in Canada is intrinsically linked to the growing issue of wealth inequality. Addressing this imbalance is crucial for ensuring a more just society, especially as military spending takes precedence over other national priorities. By imposing a tax increase on the wealthiest Canadians, the government can directly tackle wealth disparities, funding essential programs that benefit the majority while still catering to national security needs.

Such a tax would not only provide necessary resources to fund military expenditures but also alleviate some of the financial burdens facing average Canadians. Enacting a tax increase on the wealthy emphasizes the principle of equitable contribution, encouraging a society where the affluent play their part in supporting communal needs. In doing so, Canada can set a precedent for wealth distribution that prioritizes equal opportunity and access to resources for everyone.

Defining Shared Sacrifice in Military Financing

The concept of shared sacrifice emerges as a poignant theme in the context of funding military expenditures in Canada. At its core, shared sacrifice denotes that all economic segments of society should contribute equitably to national objectives, especially during times of proposed military escalation. However, this notion is challenged when the affluent are often insulated from economic hardships that others face, creating a scenario where the ‘sacrifice’ largely falls on the middle and working classes.

It becomes vital for policymakers and the public to engage in conversations prioritizing the definition of shared sacrifice, scrutinizing who is affected by military spending decisions. Engaging in open discussions helps to formulate policies that ensure those who are capable of contributing more—like the wealthy—take on their fair share of the burden. By addressing these disparities head-on, Canadians can promote a more equitable approach to national defense financing that does not solely rely on the sacrifices of the less wealthy.

The Future of Canada’s Military Budget: Balancing Needs and Resources

Looking towards the future of Canada’s military budget, the challenge lies in effectively balancing national security needs with resource allocation that supports all facets of society. As debates intensify over Mark Carney’s proposed military spending increase, discussions must pivot towards sustainable financing strategies that reflect both defense imperatives and social welfare. Engaging in dialogues about innovative funding sources—such as wealth taxes—can create a framework where military needs are met without sacrificing essential services.

Moreover, striking this balance is more than just a fiscal strategy; it embodies Canada’s commitment to equity and fairness. As the government grapples with the implications of increased military expenditures, it must consider the voices of those affected most directly—average working Canadians. A thoughtful approach that weighs military priorities against social responsibilities is essential to foster community trust and ensure that national objectives are in tandem with democratic accountability.

Frequently Asked Questions

What is the proposed wealth tax in Canada that could fund military spending?

The wealth tax in Canada is a financial measure proposed to tax the ultra-wealthy, particularly those with net worth exceeding $25 million. This tax aims to generate substantial revenue, which could potentially cover a significant portion of the increased military spending proposed by Prime Minister Mark Carney, escalating to 5% of GDP.

How will a wealth tax help address Canada wealth inequality?

Implementing a wealth tax can help mitigate Canada wealth inequality by redistributing funds from the richest segments of society to support public services and military funding. This can ensure that the burden of increased military expenditure is shared more equitably, relieving pressure from the middle class and lower-income Canadians.

Why do some Canadians oppose increasing military spending funded by a tax increase on wealthy individuals?

Many Canadians are concerned that increasing military spending primarily benefits the defense sector at the expense of essential social programs. Opponents argue that relying on tax increases on the wealthy would redirect funds from crucial social safety nets, further exacerbating issues related to Canada wealth inequality.

Are there alternative funding methods for the military budget aside from a wealth tax in Canada?

Yes, alternatives to a wealth tax include increasing the Goods and Services Tax (GST) or growing public debt. However, these methods could disproportionately impact the middle class and working Canadians, raising concerns about their fairness in funding military expenses.

What are the potential economic impacts of Mark Carney’s military spending plan in Canada?

Mark Carney’s military spending plan could significantly boost Canada’s defense capabilities, but concerns about its funding methods, such as potential tax increases on wealthy individuals or the middle class, could lead to negative ramifications for social programs and increase public dissent over wealth distribution.

Who would be primarily responsible for paying the proposed wealth tax in Canada?

The proposed wealth tax would primarily target Canada’s ultra-wealthy individuals and families, particularly those with net worth exceeding $25 million, to ensure they contribute fairly to funding national military expenditures without overburdening average Canadians.

What challenges might arise from implementing a wealth tax to support military spending in Canada?

Challenges include opposition from affluent Canadians fearing capital flight, concerns about adequate enforcement of the tax, and the potential for political backlash from those who argue it could harm economic growth. This makes the discussion around wealth tax a contentious topic in Canadian politics.

How might the wealth tax affect military spending priorities in Canada?

A wealth tax could provide a significant revenue stream for military spending, allowing Canada to escalate military expenditures without compromising funding for social programs. However, it could also raise questions about prioritizing military needs over other national issues, such as healthcare and education.

| Key Points | Details |

|---|---|

| Increased Military Spending | Mark Carney proposes to raise military spending to 5% of Canada’s GDP, equating to $150 billion annually. |

| Public Opinion | Recent polls show Canadians prefer increasing national debt over raising taxes to fund military spending. |

| Wealth Tax Debate | Many commentators suggest funding through higher taxes on the middle class rather than targeting the wealthy. |

| Statistics on Wealthy Canadians | Around 20,000 families in Canada have wealth exceeding $25 million, indicating a potential source for revenue through a wealth tax. |

| Challenges of Taxing the Wealthy | Increasing taxes on the wealthy may not generate significant revenue due to potential tax evasion and capital flight. |

| Political Proposals | Wealth tax proposals are supported by multiple political parties in Canada, indicating bipartisan interest. |

Summary

Wealth tax Canada has emerged as a crucial topic in the context of funding increased military spending proposed by Mark Carney. As discussions unfold, the need for a wealth tax becomes evident, especially as it aligns with public sentiment favoring equitable financial contribution from the affluent. With the potential to generate billions in revenue, a wealth tax not only addresses military funding but also alleviates growing concerns over income inequality in Canada. The debate continues, demanding clarity on priorities as the nation faces significant financial decisions.

#CanadaWealthTax #MilitaryFunding #CarneyDefensePlan #TaxJustice #FiscalStrategy