Investing for children is a powerful strategy that can lay the foundation for a secure financial future. By introducing concepts such as a Roth IRA for kids early on, parents can instill valuable financial education and promote a sense of responsibility. Teaching kids about money through practical investments not only enhances their wealth management skills but also fosters independence as they learn to make informed decisions. With parental guidance in investment, children can explore their interests in stocks and savings, developing a positive attitude towards wealth. Ultimately, the goal is to equip the younger generation with essential tools and knowledge to navigate their financial journey successfully.

Teaching kids about financial literacy and investment is essential for fostering a generation that understands the value of money management. Parents can introduce their children to the world of finance through hands-on experiences, such as managing a brokerage account or participating in discussions about wealth strategies. By encouraging children to save and invest from a young age, they gain insights into compounding interest and long-term planning. Furthermore, empowering kids with the knowledge of various investment vehicles, like a Roth IRA, prepares them for responsible financial decisions as they transition into adulthood. This proactive approach not only nurtures their financial acumen but also helps instill core values that guide them throughout their lives.

The Importance of Financial Education for Kids

Financial education is the cornerstone of teaching kids about money management. As the saying goes, knowledge is power; without understanding, wealth can become a burden rather than a tool. By providing your children with a strong foundation in financial literacy, you equip them with the skills to make wise investment choices in the future. Parents can start by introducing simple concepts such as saving, spending, and investing. Letting children know the importance of compound interest through tools like a Roth IRA for kids can foster an appreciation for how money works over time.

Additionally, discussing topics such as budgeting, saving for goals, and the importance of charitable contributions can build a well-rounded understanding of financial responsibility. Engaging children in conversations about money can demystify complex topics, making them approachable and manageable. Financial education doesn’t just happen in a classroom—it’s a day-to-day conversation that parents can nurture at home, ensuring their kids grow up confident in their financial decision-making abilities.

Investing for Children: Building Wealth Early On

Investing for children is not just about setting aside money; it’s about creating a mindset of growth and responsibility. Starting investment accounts like Roth IRAs teaches children the value of investing early and highlights the potential for their funds to grow over time. This proactive approach to wealth management means that your kids learn to see money not just as currency, but as a valuable asset that can work for them. By allowing them to participate in decisions regarding their investments, you also empower them to take responsibility for their financial future.

Moreover, exposing children to the world of investing at a young age opens doors to practical lessons that surpass academic knowledge. As they watch their investments grow, discussions about risk, diversification, and market trends become real and pertinent. Guiding children through the process of selecting stocks or understanding index funds can inspire a lifelong interest in financial literacy and independence, ultimately positioning them for future success in their financial pursuits.

Parental Guidance in Wealth Management

Parental guidance is essential when it comes to teaching children about wealth management. As they grow older and begin to navigate their own finances, your role transitions from direct supervision to serving as a mentor. By gradually increasing the complexity of financial discussions and allowing your children to make independent choices within a structured environment, you prepare them for real-world challenges. It’s vital to impart the core values of responsibility and ethical decision-making, ensuring they understand that financial freedom comes with accountability.

Encouraging children to ask questions and consider various investment options will help foster a mindset of critical thinking. Parents can share personal stories of financial successes and mistakes, providing a real-world context that brings lessons to life. This guidance can help children view money as a versatile tool that can offer opportunities, but also requires careful management and respect.

Teaching Kids About Money: Core Values and Principles

Teaching kids about money goes beyond just the mechanics of saving or investing; it also involves instilling core values that will guide their financial decisions throughout their lives. Emphasizing the importance of hard work, perseverance, and ethical financial behavior will lead to responsible future habits. These values act as a compass, guiding children not only in their financial endeavors but also in their personal development as respectful and resourceful individuals.

Moreover, incorporating conversations about philanthropy can teach children that wealth is not solely about accumulation—it’s also about giving back. Involving them in charitable donations can foster empathy and remind them how their financial choices can impact their communities positively. Creating a balance between personal aspirations and social responsibilities will shape their perspectives on wealth and success.

The Role of Investment Accounts for Children

Investment accounts play a crucial role in establishing a healthy financial future for children. Introducing them to accounts like Roth IRAs early on provides tangible learning experiences about investments and the benefits of saving for the long term. These accounts not only offer tax advantages but also help children comprehend the significance of planning ahead for their financial goals.

It’s important that parents actively involve their children in understanding how these accounts work. Teaching them about contributions, earnings, and the impact of long-term investment can demystify the process and instill confidence. By doing so, children can build a sense of ownership over their financial futures, making smarter choices as they progress through adolescence into adulthood.

Family Discussions: Creating a Culture of Financial Awareness

Creating a culture of financial awareness within the family allows children to learn about money management in a supportive environment. Regular discussions about household budgets, savings goals, and investment strategies can demystify financial topics and reduce anxiety surrounding money matters. When families make financial topics a part of everyday conversations, children grow up comfortable discussing their finances and seeking guidance when needed.

Building this culture requires intentional effort from parents. They must model good financial habits, share their experiences, and encourage children to participate in discussions. Family outings or activities that revolve around financial literacy—like visiting shareholder meetings—can turn learning into engaging experiences, further reinforcing these valuable lessons.

Generational Wealth: Planning for the Future

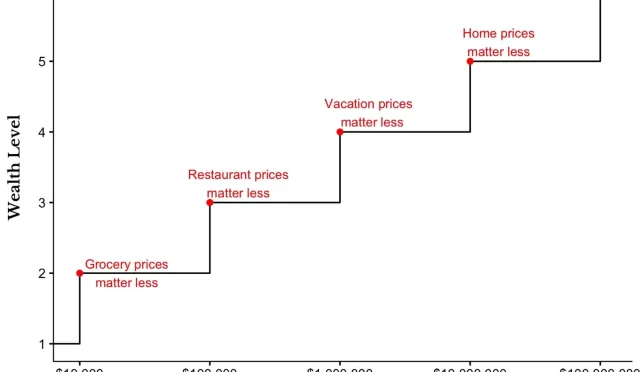

Generational wealth is an important aspect of financial planning that many parents aspire to achieve. It’s about creating a lasting legacy that equips children not only with financial resources but also with the knowledge to manage those resources wisely. Establishing robust financial habits early encourages a positive relationship with money as children grow. Understanding the principles of saving, investing, and responsible spending is essential in ensuring the wealth is maintained and expanded over generations.

To successfully transfer generational wealth, parents must have open dialogues about financial expectations and teachings. Sharing personal success stories and lessons learned can empower children to think strategically about their financial futures. Developing an explicit plan that encompasses values, goals, and management strategies can facilitate a smooth transition of wealth to the next generation.

The Impact of Experience on Financial Learning

Experiential learning plays a significant role in teaching children about money. Allowing children to engage directly with their investments—whether through family discussions, hands-on activities, or even paid work—creates practical learning opportunities. Integrating financial discussions into everyday life enables children to see the tangible consequences of their choices. For instance, a trip to a shareholders’ meeting can cultivate a deeper understanding of how businesses operate and the significance of their investments.

By making financial learning experiential and tailored to each child’s interests, parents can enhance understanding and retention. Activities that combine fun and education, such as budgeting for a family trip or planning a charitable event, can also illuminate the real-world implications of financial decision-making.

The Journey of Financial Literacy: Ongoing Education

Financial literacy is not a destination but an ongoing journey for both parents and children. As markets change and new financial products emerge, staying updated is crucial. Parents must commit themselves to continuous education by exploring financial resources, attending seminars, and engaging with other financially literate families. This personal growth will not only benefit their financial literacy but will enhance their ability to guide their children effectively on this journey.

To reinforce a legacy of learning, parents can introduce their children to similar resources—books, podcasts, or investment clubs suitable for their age. Encouraging them to seek out knowledge independently results in a proactive approach that positions them for success, ensuring that financial literacy remains a vital part of their lives.

Frequently Asked Questions

What are the benefits of starting investing for children early?

Investing for children early allows them to benefit from compound interest, teaching important financial lessons while they grow. By using tools like Roth IRAs, children can learn the value of saving and making informed investment decisions, setting the stage for responsible wealth management in the future.

How can parents effectively teach kids about money management?

Parents can teach kids about money management by involving them in family financial discussions, explaining investment choices, and using real-life examples. Activities such as having children manage a small budget or invest in a Roth IRA help them understand the basics of finance and instill good habits early on.

What investment accounts are best for children?

Roth IRAs are an excellent option for investing for children, as they grow tax-free and can teach kids about long-term savings and the importance of starting early. Additionally, custodial brokerage accounts can also be set up to allow children to manage investments with parental guidance.

Why is financial education essential for children?

Financial education is essential for children as it equips them with the knowledge to make informed decisions about money and investments, fostering capable future adults. Understanding wealth management, saving, and investment options helps them view money as a tool rather than a hindrance.

How can parents incorporate wealth management discussions with their kids?

Parents can incorporate wealth management discussions by regularly engaging children in conversations about their investments, asking them about their goals, and discussing the results of different financial choices. This gradual inclusion fosters understanding and ownership of their financial future.

What role does parental guidance play in teaching kids about investing?

Parental guidance plays a crucial role in teaching kids about investing, as parents can offer practical insights, tailor lessons to their children’s understanding levels, and help them navigate the complexities of financial decisions. This guidance ensures that children develop healthy money management habits.

What are some common mistakes parents make when investing for their children?

Common mistakes include not providing sufficient financial education, failing to involve children in investment decisions, and being unclear about the purpose of the investment accounts. It’s important for parents to educate their children about their options and the implications of different investment strategies.

How can parents encourage responsible investing in their children?

Parents can encourage responsible investing by involving their children in discussions about investment strategies, allowing them to make age-appropriate financial decisions, and teaching them about risk management and diversification, thus preparing them for financial independence and informed choices in the future.

What should parents consider before opening a Roth IRA for their child?

Before opening a Roth IRA for their child, parents should consider the child’s income sources, the contribution limits, and the long-term benefits of tax-free growth. They should also educate their child on how to manage the account once they reach adulthood to ensure they make informed decisions.

How can family trips enhance financial literacy for children?

Family trips can enhance financial literacy by providing an engaging environment for discussions about money management, investments, and financial values. Tailoring experiences to each child’s interests can help them relate better to financial concepts while fostering strong family bonds centered around learning.

| Key Points | Details |

|---|---|

| Introduction to Investing for Children | Daniel Ramsey, a successful entrepreneur, started investing in his children’s futures from birth. |

| Financial Education is Key | Teaching children about financial concepts using tools like Roth IRAs can promote understanding of compound interest. |

| Involvement in Investment Decisions | Children are involved in discussions and decision-making regarding their investments, fostering responsibility. |

| Investment Strategies | The children save one-third for savings, one-third for spending, and one-third for charitable causes. |

| Parental Guidance | Parents should guide their children through financial management to prepare them for adulthood. |

| Importance of Values | It’s crucial to instill core values along with financial education to develop responsible individuals. |

| Generational Wealth | Wealth education ensures a smooth transition and appreciation of family assets for future generations. |

| Conclusion | Investing for children is not just about financial preparation, but also instilling core values and knowledge. Daniel Ramsey’s approach, starting investments early while involving his children in decision-making, illustrates the positive impact of financial literacy. Parents are encouraged to engage actively with their children’s financial education, ensuring they appreciate both the value of money and the importance of responsible management. This comprehensive strategy prepares children for a successful financial future. |

Summary

Investing for children is essential for their future financial health. By starting early, as Daniel Ramsey did for his three children, parents can teach their kids the importance of money management and instill values that will guide them throughout their lives. Encouraging involvement in investment choices and providing a solid financial education will not only prepare children for responsible wealth management but will also lay the foundation for independent and successful adults.

#InvestingForChildren #FinancialLiteracy #WealthBuilding #MoneyTips #ParentingGuide