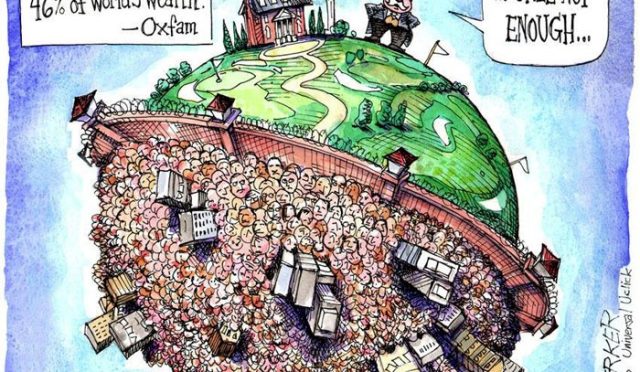

The debate surrounding **wealth tax** in the U.S. has gained significant traction in recent years, fueled by calls from politicians and economists advocating for a more equitable taxation system. A wealth tax, levied on the value of an individual’s assets, could generate substantial revenue while targeting the financial elite, raising questions about its viability and fairness. Supporters highlight potential benefits, such as reducing income inequality and funding essential public services, while critics point to constitutional hurdles that complicate its implementation. The **wealth tax debate** sheds light on the broader implications for the U.S. economy, especially regarding the need for reform in a system heavily reliant on income tax. As discussions persist about the potential **wealth tax in the U.S.**, understanding both the **pros and cons** of this approach is crucial for determining its future efficacy.

The concept of taxing individuals based on their amassed fortune, often referred to as asset taxation or property taxation, continues to be a focal point in discussions about fiscal reform in America. This approach not only emphasizes the financial resources of the wealthy but also proposes a mechanism for redistributing wealth more fairly within society. Advocates argue that such a system could alleviate the growing disparity between the rich and the poor, while detractors argue about the logistical and constitutional challenges involved in assessing and taxing individual assets. By exploring the implications of this taxation model, policymakers can better navigate the **wealth tax debate** and its potential impact on various sectors, including how it aligns with existing tax structures.

Understanding Wealth Tax in the U.S.

Wealth tax, defined as a tax imposed on the net wealth of individuals, has been a topic of heated debate in the U.S. political landscape. Unlike income tax, which is levied on earnings, a wealth tax targets the total value of an individual’s assets, including properties, stocks, and other valuable possessions. Discussions about implementing a wealth tax have gained traction in recent years, especially with prominent political figures advocating for it as a means to address economic inequality. The potential revenue generated from a wealth tax could not only fund social programs but also contribute to reducing the federal deficit.

However, the U.S. Constitution imposes substantial restrictions on the ability to implement a wealth tax, primarily due to the requirement that direct taxes be apportioned among states based on population. This means that any federal attempt to levy a wealth tax would have to align with the distribution of the population across the states, complicating what could otherwise be a straightforward taxation process. The reality is, while many citizens and politicians see the merit of a wealth tax in combating inequality, the constitutional legalities present a significant barrier.

Pros and Cons of Wealth Tax

The proponents of a wealth tax argue that it would be an effective tool for reducing income inequality and generating additional revenue for essential public services. By targeting the ultra-wealthy—those with assets exceeding $50 million—advocates like Elizabeth Warren believe that a wealth tax could help fund education, healthcare, and infrastructure projects that benefit the broader society. Moreover, it could discourage the hoarding of wealth, encouraging wealthy individuals to invest in productive economic activities rather than simply holding onto cash or appreciating assets.

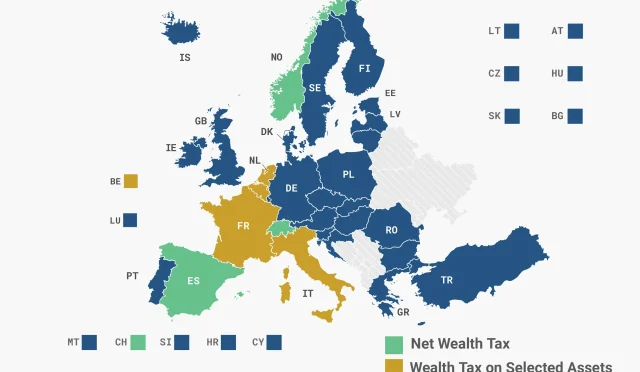

On the other hand, critics highlight several significant drawbacks associated with wealth taxes. First, there is the question of valuation, as accurately appraising assets such as fine art, investments, and personal property can prove exceedingly challenging. Additionally, there are concerns over tax evasion; historically, many wealthy individuals have sought to relocate to jurisdictions with more favorable tax policies, reducing the expected revenue from a wealth tax. The recent European experience is often cited, where many countries that once had wealth taxes have since abolished them due to evasion and administrative difficulties.

The Wealth Tax Debate in America

The discussion surrounding a wealth tax in the United States illustrates deep divisions in societal perspectives on wealth and taxation. Advocates argue that implementing a wealth tax is a moral imperative in a democracy, as it seeks to distribute the financial responsibilities more equitably among the wealthiest citizens, who have accumulated vast fortunes often without paying proportional taxes. Discussions have intensified, particularly during electoral cycles, prompting many to reevaluate what a fair tax system should look like in an era of growing economic disparity.

Yet, the counterarguments remain potent, often focusing on the Constitution’s constraints on wealth taxation and the complexities associated with its implementation. Critics like Janet Holtzblatt bring attention to the challenges experiences of other nations have faced in managing wealth taxes, emphasizing that the administrative difficulties could overshadow potential benefits. As the wealth tax debate continues, it raises fundamental questions about fairness, economic policy, and how best to address the critical issues of wealth inequality in the 21st century.

Wealth Tax Implications for Individuals

The implications of a wealth tax for individuals could be profound, particularly for those whose wealth is tied up in assets rather than income. By taxing individuals on their net worth rather than their earnings, a wealth tax could dramatically alter financial strategies employed by high-net-worth individuals. It places a premium on liquidating assets to avoid paying taxes on inflated property values, leading individuals to consider complex financial maneuvers to mitigate their tax liability.

Moreover, a wealth tax could encourage more philanthropic efforts as individuals search for ways to reduce their taxable wealth. By donating to charities, directly impacting social causes and community initiatives, wealthy individuals might offset their taxable amounts while also contributing positively to societal welfare. However, the complexities of such tax planning further underline the need for clarity in how a wealth tax would be implemented and administered to avoid misinterpretations and mistakes.

Challenges in Implementing a Wealth Tax

Implementing a wealth tax in the U.S. poses significant challenges, not least of which is the valuation of varied assets. Unlike salary and wages, which are relatively straightforward to assess, determining the market value of assets such as luxury items, real estate, and intangible investments requires thorough appraisals and constant monitoring. The administrative burden on tax authorities could be immense, particularly in light of past budget cuts to the IRS, which has already faced scrutiny over its capacity to efficiently manage existing tax systems.

Furthermore, historical evidence from European countries that have attempted wealth taxes brings an added layer of caution. Many of these nations abandoned their wealth taxes due in large part to rampant tax evasion and significant revenue losses. The lessons learned from these precedents may make policymakers wary of introducing similar structures in the U.S., given the potential complications and negative ramifications for government revenue.

Potential Revenue from a Wealth Tax

If successfully implemented, a wealth tax in the U.S. could lead to a substantial influx of revenue. Estimates suggest that a tax on the wealthiest households could generate billions in funds, which could be allocated to various public services, including education, healthcare, and infrastructure. By targeting the ultra-wealthy, advocates believe a wealth tax could not only help reduce the deficit but also foster a more equitable society by redistributing wealth to those in need.

Nevertheless, the real challenge for policymakers lies in designing a wealth tax that is both fair and efficient. Various proposals suggest differing rates and exemptions, which complicate the matter further. Ultimately, while the potential revenue from a wealth tax appears promising, the implementation challenges and historical contexts surrounding wealth taxation in the U.S. cannot be understated, requiring rigorous analysis and thoughtful consideration before any effective policies could be established.

Administrative Challenges of Wealth Tax

The administrative challenges associated with a wealth tax are perhaps the most daunting aspect. Evaluating the intricate assets of high-net-worth individuals requires a robust framework capable of handling numerous valuations, making it a labor-intensive process. This demand for precise appraisals further complicates the already intricate tax landscape and places pressure on resources that may be limited, particularly given the IRS’s current staffing and budget constraints.

Moreover, the administrative burden is not solely about valuation; it extends to the enforcement of the tax. Ensuring compliance among millionaires and billionaires who may have greater means to evade taxes poses a political and fiscal dilemma. Historical examples from countries with wealth taxes show that without stringent oversight and active enforcement measures, substantial revenue intended from wealth taxes could evaporate, leading to further skepticism regarding their efficacy as a reliable revenue source.

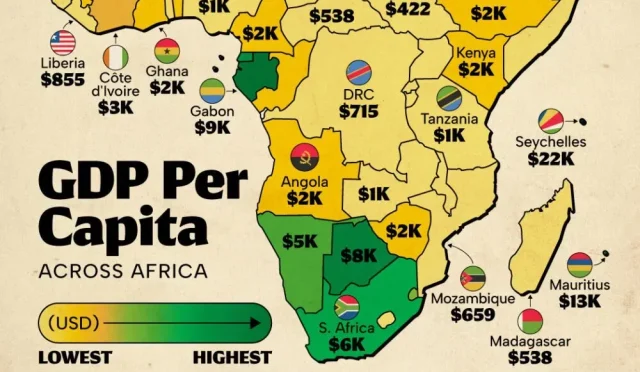

Global Perspectives on Wealth Tax

Globally, the concept of a wealth tax has seen varied implementations and outcomes, providing valuable lessons for the U.S. One notable case is France, which had a wealth tax in place for decades before abolishing it due to widespread tax evasion and adverse effects on wealthy individuals relocating to more tax-friendly nations. Such experiences underscore the necessity for a comprehensive, sustainable approach when considering a wealth tax in the U.S., drawing on international precedents while tailoring policies to address domestic concerns.

In contrast, some countries still maintain a wealth tax successfully; Norway, for instance, has managed to balance wealth taxation while retaining a broad tax base. This demonstrates that with the right policies, transparency measures, and administrative support, a wealth tax could be effectively integrated into the U.S. tax system, shaping how citizens perceive wealth and equity within the socio-economic framework.

The Future of Wealth Tax in the U.S.

Looking towards the future, the wealth tax will likely continue to be a contentious issue in American politics. As economic disparities become more pronounced, the call for more progressive taxation policies may intensify, prompting renewed discussions surrounding wealth taxes. To navigate these challenges, policymakers will need to explore feasible solutions that align constitutional constraints with the demands of equality and revenue generation.

Additionally, public opinion will play a crucial role in shaping the future of wealth tax discussions. As voters become increasingly aware of wealth inequality and its implications for economic mobility, there may be a greater appetite for comprehensive reforms that encompass wealth taxes, making it essential for politicians to consider both the legal implications and public sentiment as they advocate for or against such measures.

Frequently Asked Questions

Why doesn’t the U.S. have a wealth tax?

The U.S. lacks a wealth tax primarily due to constitutional constraints, which require that any direct tax be proportionally distributed among states. This limitation complicates the implementation of a federal wealth tax, despite growing support for the idea as a way to tap into the wealth of the richest Americans.

What are the wealth tax pros and cons?

The pros of a wealth tax include generating significant revenue from the wealthy and potentially reducing income inequality. However, the cons involve administrative challenges, constitutional hurdles, and the risk of tax evasion, as seen in other countries that have implemented wealth taxes.

What are the implications of a wealth tax in the U.S.?

The implications of a wealth tax in the U.S. include potential legal battles to amend the Constitution, complex asset evaluations, and the enforcement difficulties that could arise. This raises questions about the tax’s impact on wealth concentration and the economy overall.

How does the wealth tax debate unfold among U.S. politicians?

The wealth tax debate attracts attention from various U.S. politicians, with advocates like Bernie Sanders and Elizabeth Warren arguing for its necessity to curb wealth inequality. They propose taxing households with substantial assets, yet face opposition regarding its feasibility and constitutional viability.

What challenges does the U.S. face in implementing a wealth tax?

The U.S. faces several challenges in implementing a wealth tax, including constitutional restrictions, administrative complexities, the need for accurate asset valuation, and resistance from wealthy individuals who may relocate to escape taxation.

| Key Point | Details |

|---|---|

| Wealth Tax Potential | Could generate significant revenue, though minimally affects most. |

| Constitutional Barriers | The Constitution prohibits direct taxes without apportionment, complicating implementation. |

| Challenges in Administration | Valuing diverse assets (e.g., real estate, art) complicates tax collection. |

| Historical Context | Southern states’ interests during the Constitutional Convention led to restrictions on wealth taxes. |

| Current Tax System | The U.S. primarily relies on income tax for federal revenue, with states able to levy wealth taxes. |

| Political Advocacy | Figures like Bernie Sanders and Elizabeth Warren support implementing a wealth tax. |

| Administrative Complexities | Challenges similar to those faced in European nations that have tried wealth taxes. |

Summary

Wealth tax remains a contentious issue in the United States due to constitutional prohibitions and administrative complexities. While advocates suggest a wealth tax could provide necessary revenue from the ultra-wealthy, implementing such a tax faces significant hurdles, including the need for constitutional amendments and addressing the complexities of asset valuation. The debate continues, reflecting the nation’s struggle with equitable taxation.

#WealthTax #USEconomy #TaxPolicy #EconomicDebate #FinanceInsights