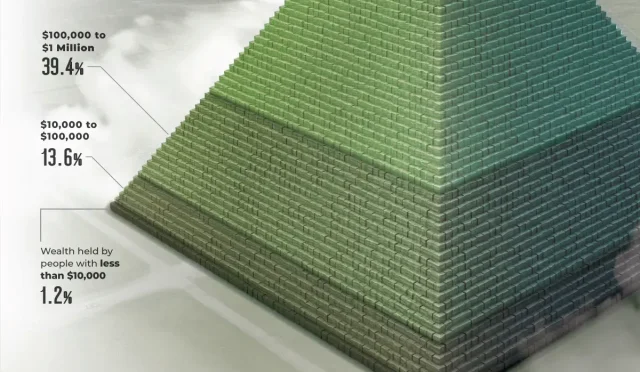

Real estate inheritance is a critical topic for families looking to preserve wealth across generations. As the baby boomer generation prepares to pass down nearly $25 trillion in real estate, understanding the complexities of transferring property to children has never been more important. This transition isn’t just about the financial implications; family feuds over inheritance can arise, driven by differing opinions on property usage and maintenance costs. With careful planning—like setting up trusts and understanding real estate tax implications—wealth transfer real estate can be managed effectively. Ensuring your offspring receive their rightful assets while minimizing disputes will help maintain family harmony and secure their financial future.

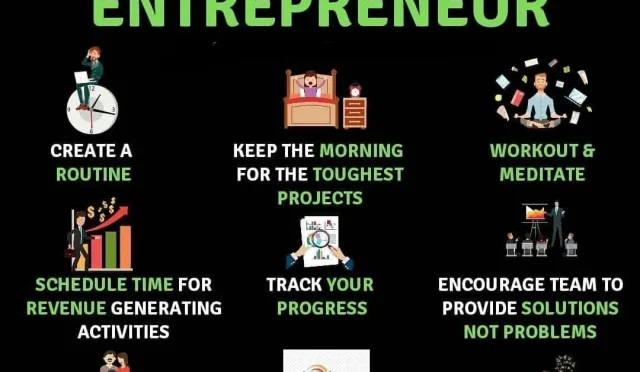

Inheriting property, a crucial aspect of wealth transfer, presents unique challenges that families must navigate. The process of passing down assets, particularly real estate for kids, can ignite tensions among siblings, often leading to disagreements over usage and upkeep responsibilities. To ensure a smoother transition of these valuable assets, it’s imperative to address possible family feuds over inheritance in advance. Utilizing legal mechanisms like trusts not only aids in mitigating the real estate tax implications but also fosters open communication within families about expectations and responsibilities. As families face the impending great wealth transfer, embracing strategic planning will be vital in preserving familial relationships and financial legacies.

Understanding Real Estate Inheritance for Future Generations

Inheriting real estate is a significant aspect of wealth transfer, especially for families with considerable assets. As older generations pass down their properties, it is crucial to understand the implications, both financial and emotional, tied to these inheritances. Real estate for kids can mean a potential windfall, but it can also lead to family feuds if not handled correctly. It’s vital to communicate openly about expectations and responsibilities, paving the way for smoother transactions and maintaining family harmony.

The complexity of transferring assets like vacation homes or investment properties necessitates thoughtful planning. Wealth transfer real estate involves not just the physical property but also the memories and relationships tied to it. Consequently, incorporating strategies to minimize conflicts—such as clear outlines on usage, financial responsibilities, and legal protections—can help in easing the transition and preventing disputes among heirs.

Frequently Asked Questions

What are the tax implications of passing down real estate to children?

Passing down real estate can result in significant tax implications for your heirs. If you transfer property while you’re still alive, your children will inherit your cost basis, leading to potential capital gains taxes if they sell the property later. To minimize these taxes, it’s advisable to pass down real estate through a will or a trust, allowing heirs to benefit from a step-up in basis at death.

How can families avoid disputes over inherited real estate?

Family feuds over inherited real estate can be avoided by establishing clear guidelines on usage, upkeep responsibilities, and financial obligations. Creating an operating agreement within a limited liability company (LLC) that holds the property can help manage these aspects and ensure all heirs understand their rights and responsibilities.

Is it advisable to gift real estate to children while still alive?

Gifting real estate to your children during your lifetime can have negative tax implications, as they would assume your cost basis for tax purposes. Instead, it is often more beneficial to pass down real estate through your will or a trust, allowing heirs to receive a step-up in basis that can lessen their capital gains tax burden.

What should be included in an operating agreement for inherited real estate?

An operating agreement for inherited real estate should outline usage rules, financial responsibilities, and procedures for resolving disputes. This may include provisions for how often each heir can use the property, how to manage costs associated with maintenance, and what happens should any heir wish to sell or buy out another’s interest.

How can parents ensure fair treatment among siblings when inheriting real estate?

To ensure fair treatment, parents should establish a trust that sets aside liquid assets for property upkeep and insurance, thereby reducing financial burden complaints among siblings. Additionally, clear communication about expectations and potential buyout provisions within the family should be maintained to address changing dynamics and interests.

What measures can protect inherited real estate from lawsuits?

Using a limited liability company (LLC) to hold inherited real estate can protect the property from lawsuits and creditors. This structure ensures that heirs are not personally liable for property-related legal issues, while also allowing for ease in transferring ownership interests and potentially minimizing transfer taxes.

What are some effective strategies for passing down family vacation homes?

To effectively pass down vacation homes and minimize potential conflicts, parents should draft clear estate plans that include guidelines for usage, maintenance costs, and distribution of profits or responsibilities. Consider setting up a trust that maintains family control over the property and outlines specific use agreements to prevent disputes among siblings.

| Key Point | Details |

|---|---|

| Trillion-Dollar Ownership | Baby boomers and the silent generation own nearly $25 trillion in real estate. |

| Potential Conflicts | Inheriting real estate can lead to family disputes over costs, rights, and upkeep. |

| Legal Strategies | Wealth advisors provide strategies to pass down real estate smoothly, minimizing taxes and disputes. |

| Trusts and LLCs | Using trusts and LLCs can help shield heirs from lawsuits and simplify transfer of ownership. |

| Usage Guidelines | Setting clear usage rules in operating agreements can prevent sibling disagreements over property use. |

| Financial Preparations | It’s essential to set aside funds for maintenance and insurance to avoid financial burdens on heirs. |

| Cash Out Provisions | Planning for potential desires to sell can ease future disputes among heirs. |

Summary

Real estate inheritance is a complex topic that can lead to significant family dynamics and financial implications. As we approach a significant wealth transfer, understanding how to manage real estate inheritances is crucial for ensuring harmony among heirs while maintaining the value of the property. By implementing effective strategies, such as creating trusts and clear usage guidelines, families can protect their legacies and mitigate potential disputes. Recognizing these key points can help wealthy parents and their heirs navigate the emotional and financial intricacies of real estate inheritance.