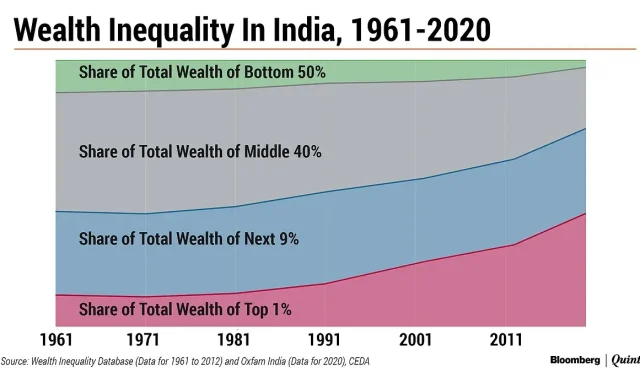

The Zucman Tax, an ambitious proposal for a wealth tax in France, has ignited fierce discussions about tax policy and wealth inequality. Named after renowned economist Gabriel Zucman, this initiative targets the ultra-wealthy, requiring households with assets exceeding €100 million to contribute at least 2% of their wealth annually. Proponents argue that this measure is crucial for addressing France’s mounting debt crisis and achieving tax equity, while critics warn it may lead to tax flight and hinder business investments. As the French budget debate heats up, understanding the implications of the Zucman Tax becomes essential for gauging its potential impact on the nation’s economy. With wealth inequality reaching unprecedented levels, the proposal reflects a critical moment in France’s fiscal policy landscape and its quest for a fairer tax system.

The proposed wealth tax, often referred to as the Zucman Tax, reflects a significant shift in how France might approach fiscal responsibility and social equity. This initiative aims not only to reshape financial contributions from its wealthiest citizens but also to redefine the narrative surrounding the nation’s budget priorities. In the broader context of economic policy, discussions surrounding assets taxation and the fight against financial disparity are becoming increasingly prominent. As the debate intensifies, alternative views and critiques emerge, raising questions about the sustainability of using high-net-worth individuals as a fiscal solution. Ultimately, the Zucman Tax is more than just a policy proposal; it’s a reflection of France’s ongoing struggle with wealth distribution and economic justice.

Understanding the Zucman Tax Proposal

The Zucman Tax, named after its creator Gabriel Zucman, is a groundbreaking proposal aimed at addressing wealth inequality in France. This tax targets households with a net worth exceeding €100 million, mandating them to contribute at least 2% of their total wealth annually. The objective is to ensure that the ultra-wealthy pay a fair share toward the nation’s budget, particularly in times of economic struggle. By focusing on high-net-worth individuals, the Zucman Tax seeks to alleviate the financial burden on the middle and lower classes while fostering a sense of tax equity.

Historically, tax policy in France has often sparked intense debates, particularly around wealth taxes. The Zucman Tax differs significantly from previous wealth tax initiatives like the ISF and IFI, as it includes a broader tax base encompassing all types of assets, not just real estate. This approach may provide a more accurate reflection of an individual’s true wealth and capacity to contribute to the state budget. As France prepares for a critical budget debate, understanding the implications of the Zucman Tax becomes essential.

Frequently Asked Questions

What is the Zucman Tax and how does it address wealth inequality in France?

The Zucman Tax is a proposed wealth tax in France, aimed at households with net assets exceeding €100 million. It requires these ultra-wealthy individuals to contribute at least 2% of their wealth annually, which aims to address wealth inequality and financial fairness. By targeting the wealthiest, the Zucman Tax seeks to generate revenue for public services and address France’s growing wealth gap, where the richest have seen their fortunes increase significantly over recent decades.

How does the Zucman Tax differ from France’s existing wealth taxes?

The Zucman Tax differs from existing wealth taxes like the Impôt sur la Fortune Immobilière (IFI) and the previous Impôt de Solidarité sur la Fortune (ISF) in several key ways: it targets all types of assets rather than just real estate, mandates a higher flat rate of 2% without a cap, and applies to a higher threshold of net worth (€100 million), limiting its impact to about 1,800 households compared to hundreds of thousands under previous systems.

Who supports the Zucman Tax and what are the main arguments against it?

Support for the Zucman Tax largely comes from left-wing political parties who see it as a necessary step towards tax equity and addressing wealth inequality. Opponents, including centrist and right-wing parties, argue that it could deter investment in France and lead to tax flight, arguing it could undermine the economy by discouraging entrepreneurial risk-taking and capital retention.

What potential revenue could the Zucman Tax generate for the French budget?

Estimates of potential revenue from the Zucman Tax vary significantly. Optimistic projections suggest it could generate between €20 billion to €25 billion annually for the French budget. However, conservative estimates account for tax flight risks and suggest it may only yield around €5 billion, reflecting concerns that high taxes could drive the wealthy out of the country.

Is the Zucman Tax constitutional in France?

The constitutionality of the Zucman Tax is still debated, as opponents argue it might be considered ‘confiscatory.’ However, supporters assert that as it only affects households with net worths above €100 million, it cannot be deemed confiscatory. Ultimately, its constitutionality will be determined by the Constitutional Council if it is included in a budget bill.

What impact would the Zucman Tax have on the overall tax policy in France?

The implementation of the Zucman Tax would signify a shift in France’s tax policy towards increased financial contributions from the ultra-wealthy, potentially reshaping the country’s approach to wealth inequality and public finance. It reflects a broader recognition of the need for fairer tax structures and could initiate further debates on taxation and social equity in France.

| Key Question | Summary |

|---|---|

| What is the Zucman Tax? | A proposed wealth tax targeting households with net worth exceeding €100 million, requiring them to pay at least 2% of their wealth in taxes. |

| What are the primary differences with existing taxes? | It applies to all assets, has a higher tax rate (2%), and limits its scope to around 1,800 ultra-wealthy households, unlike former taxes that targeted a broader base. |

| Who supports/opposes it? | Support primarily from left-wing parties; opposition from the centrist bloc and right due to concerns about investment attractiveness. |

| Potential revenue impact | Estimates vary, with potential to generate €20-25 billion, but contested figures suggest it may yield only about €5 billion due to tax flight risks. |

| Is it constitutional? | Its constitutionality is in question, pending evaluation by the Constitutional Council. |

Summary

The Zucman Tax represents a critical step towards addressing wealth inequality in France by targeting the ultra-wealthy. As the debate unfolds around its implementation and potential economic impact, understanding the various positions and implications of the Zucman Tax will be essential for informed discussions on the future of taxation and fiscal policy in France.