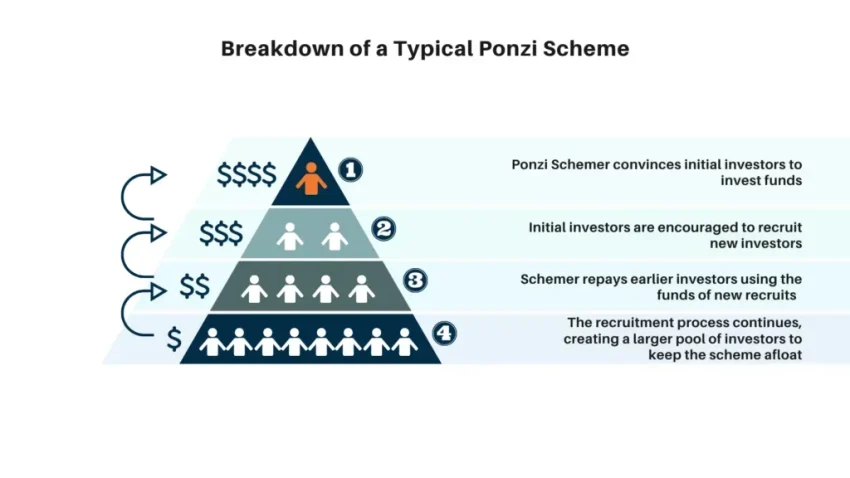

Ponzi scheme investment fraud has a long history of promising spectacular gains while seeding payments with funds from new investors, a tactic that collapses when the influx of fresh money slows and trust evaporates, and a recurring pattern of cycles that leaves investor trust damaged long after the initial hype. In recent years, high-profile cases have shown how promoters deploy polished marketing, celebrity endorsements, social proof, and guaranteed returns to attract unsuspecting individuals across communities and generations worldwide today. These schemes often intertwine money laundering networks and opaque corporate structures that hide who profits, how profits are generated, and how losses are shifted onto later participants or external investors, turning seemingly legitimate ventures into traps. Strong regulatory oversight, independent audits, and thorough due diligence are essential to prevent these frauds from spreading, and consumer protection agencies stress verifying licensing, registrations, and track records before wiring funds or transferring digital assets, especially in fast-moving markets where digital assets blur lines. Understanding the signs helps readers protect their cryptocurrency investments and avoid becoming another statistic in investment fraud prosecutions by staying skeptical of guaranteed yields, complex tiered plans, and unsolicited outreach that promises rapid wealth, with long-term implications for retirement plans, savings, and families.

From a different angle, this pattern is a fraudulent investment program built on illusion rather than real performance. LSI-oriented descriptions include pyramid-like schemes, unregistered offerings, fake profits tied to digital assets, and get-rich-quick promises that encourage reinvestment. By mapping these terms to consumer protection and regulatory frameworks, readers can cross-check licenses, track records, and disclosures before committing funds. Ultimately, awareness and due diligence serve as safeguards against risky ventures that masquerade as fintech opportunities but lack legitimate economics.

The Goddess of Wealth Case: Zhimin Qian and a Global Ponzi Scheme

After a seven-year investigation, Zhimin Qian, known in media as the ‘Goddess of Wealth,’ was convicted in the United Kingdom on money laundering charges tied to a colossal Ponzi scheme. From 2014 to 2017, she allegedly siphoned roughly $6.7 billion from more than 128,000 Chinese investors who believed they were backing a cutting-edge fintech company. The operation marketed cryptocurrency investments and other products, but investigators found no legitimate business operations behind the glossy promotional materials.

Qian’s approach blended tech mystique with aggressive sales pitches designed to appeal to professionals—and even members of the judiciary. Her company, Tianjin Lantian Gerui Electronic Technology Co., presented itself as a leading fintech enterprise, yet the business model remained opaque and the promised returns of up to 300% lacked verifiable support. This case illustrates the classic warning signs of investment fraud when high-tech branding masks a fund-raising scheme reliant on new money from later investors.

Money Laundering Unpacked: From Bitcoin Conversions to Real Estate

Money laundering played a central role in the prosecution, showing how illegally gained funds were funneled through cryptocurrency channels, converted into Bitcoin, and moved through real estate and other assets to obscure their origins. By layering transactions and asset purchases, the perpetrators created the appearance of legitimate wealth while hiding the illicit source.

The case underscores the evolving methods criminals use to launder proceeds from investment fraud, leveraging crypto liquidity and cross-border transfers to complicate enforcement. It also highlights why regulatory oversight and robust anti-money-laundering controls are essential to interrupt schemes early and prevent the transfer of stolen funds across jurisdictions.

Ponzi Scheme Investment Fraud: Mechanics Behind a $6.7 Billion Operation

The scheme operated on a familiar Ponzi model: early investors were paid with funds from new participants, creating the illusion of profitability and legitimacy. The operation marketed cryptocurrency investments and other products, but regulators found no sustainable business activity behind the promised profits. The growth depended on a continuous influx of new money to sustain payouts to earlier shareholders.

Marketing materials celebrated high yields while the underlying cash flows were non-existent. The absence of verifiable financial statements, independent audits, or registration with a financial regulator allowed investment fraud to flourish. The scale—tens of billions and thousands of victims—offers a stark reminder of the importance of due diligence and independent verification in any high-return opportunity.

Cryptocurrency Investments as a Front: Promises vs. Real Profits

Qian’s operation positioned cryptocurrency investments as a cutting-edge path to wealth, aligning with the late-2010s fintech and blockchain push. Yet the enterprise maintained no transparent linkage between its claimed crypto strategies and actual profits. Returns reportedly tied to crypto activities often came from new capital inflows rather than genuine trading or project success.

The crypto veneer served to attract tech-savvy investors who believed in digital assets and rapid gains. In reality, the scheme exploited that enthusiasm, using crypto assets to mask fund movements and launder money as the operation expanded. The result was a complex, high-risk investment fraud that preyed on trust in digital finance without real underlying performance.

Targeted Victimology: Reaching Professionals, Judiciary, and Retail Investors

Investigators highlighted how Qian targeted a broad spectrum of victims, from business professionals to members of the Chinese judiciary. Promotional materials projected a credible, globally oriented fintech operation designed to appeal to high-net-worth individuals and influential professionals seeking sophisticated investments. This broad outreach helped the scheme attract substantial sums from diverse sources.

This pattern reflects a known scam playbook: messaging tailored to perceived sophistication while ignoring licensing, regulatory oversight, and the true business model. Victims often overlook fundamental due diligence when confronted with polished materials and testimonials. The case underscores the need for independent verification before committing funds to any investment.

Regulatory Oversight and False Endorsements: The Diaoyutai State Guesthouse Tactics

A striking element of the Qian case was the deliberate attempt to lend legitimacy through curated events at prestigious venues. By hosting investor meetings at the Diaoyutai State Guesthouse in Beijing, the perpetrators sought to simulate government endorsement and regulatory approval, despite the absence of real oversight. These tactics show how fraudsters leverage perceived authority to lower investor skepticism.

Without verifiable licenses or regulatory registration, promotional materials and staged endorsements collapse under scrutiny. This episode highlights why regulatory oversight—transparent licensing, independent audits, and public disclosures—is essential to defend against investment fraud. Appearances of legitimacy can be as dangerous as actual deceit when due diligence is bypassed.

China’s 2017 Crypto Crackdown: Crypto Regulation Driving Exits

China’s 2017 crackdown on cryptocurrencies, including the banning of Initial Coin Offerings (ICOs) and the closing of domestic trading platforms, created a regulatory backdrop that exposed many scams exploiting digital-asset hype. Qian capitalized on the evolving crypto landscape while evading clear regulatory boundaries, marketing intangible crypto investments to a broad audience without real backing.

The crackdown also forced fund flows and organizers to relocate across borders, underscoring the need for robust regulatory oversight and international cooperation in supervisory capacity. For investors, the episode reinforces the importance of understanding regulatory context, as changes can dramatically alter the risk profile of so-called crypto investments.

Cross-Border Escape: UK Conviction, Fake Passport, and Asset Laundering

Following China’s regulatory shifts, Qian moved to the United Kingdom, attempting to distance the scheme from its origins. Investigations revealed the use of a phony St Kitts and Nevis passport to facilitate transfers and the persistence of illicit activity abroad. The UK case demonstrates the global reach of sophisticated money laundering tied to investment fraud.

Asset movement, including real estate and other high-value acquisitions, furthered the laundering process and obscured the scheme’s proceeds. The international dimension highlights the challenges regulators face in tracing funds across borders and the necessity of cross-border information sharing to disrupt Ponzi structures at their source. It also shows why investors should seek jurisdictions with strong regulatory oversight and transparent disclosures.

Red Flags in Investment Scams: No Licenses, No Clear Business Model, Extraordinary Returns

A core red flag in this case was the absence of legitimate licensing or registration with a financial authority. The company promised guaranteed profits of up to 300%—a promise that should have triggered immediate skepticism and rigorous due diligence. Investigators found no verifiable business model or independent audits to ground profitability claims in real economics.

Investors should beware of marketing that emphasizes secrecy, technical jargon, or exclusive access to proprietary strategies. The combination of unregistered status, extraordinary yields, and a lack of regulatory oversight is a classic setup for investment fraud. The Zhimin Qian case reinforces the importance of licensing verification and independent validation before committing funds.

Lessons for Investors and Regulators: Strengthening Oversight to Prevent Investment Fraud

For investors, the Qian case underscores the importance of researching the company, its leadership, licenses, and the credibility of its cryptocurrency-investment claims. Before committing funds, verify regulatory registrations and request independent audits. The broader takeaway is that robust regulatory oversight and cooperative enforcement are essential to stopping investment fraud before it expands.

Regulators and policymakers can draw from this case to strengthen cross-border cooperation, tighten anti-money-laundering controls, and improve transparency around fintech ventures. By enhancing supervision, registration, and disclosure requirements for crypto-related products, authorities can disrupt Ponzi schemes and protect the public from investment fraud while preserving legitimate innovation.

Frequently Asked Questions

What is Ponzi scheme investment fraud and how does it work?

Ponzi scheme investment fraud is a scam where returns to early investors are paid from new investors’ money rather than from legitimate profits. Operators promise high, guaranteed returns to attract more funds and use new investments to pay earlier participants. When recruitment slows or regulators intervene, the scheme collapses and most investors lose money.

What are common red flags of Ponzi scheme investment fraud?

Red flags include guaranteed or consistently high returns with little risk, aggressive recruitment, and investments that are poorly documented or unregistered. The operation may lack transparent business activity and regulatory oversight, and it may push crypto or offshore accounts to evade scrutiny.

How is money laundering connected to Ponzi scheme investment fraud?

Money laundering is often used to disguise the origin of funds in a Ponzi scheme. Proceeds may be routed through real estate, shell companies, offshore accounts, or cryptocurrency transactions to conceal the fraud and complicate enforcement.

Do cryptocurrency investments play a role in Ponzi scheme investment fraud?

Yes. Some Ponzi schemes use cryptocurrency investments to attract victims or to move funds across borders. Crypto can complicate traceability and enable rapid transfers, which scammers exploit to avoid detection.

What is regulatory oversight and why is it important for preventing Ponzi scheme investment fraud?

Regulatory oversight involves financial authorities licensing and supervising investment products, enforcing disclosures, and prosecuting wrongdoing. It helps deter Ponzi schemes and provides channels to report suspicious activity. Always verify that an offering is registered and transparent.

What should I do if I suspect Ponzi scheme investment fraud?

Stop investing immediately and preserve all documents. Report your concerns to the appropriate regulator or authorities and seek legal counsel. Do not provide more money or personal information until the investment is fully verified.

Can legitimate investments turn into Ponzi schemes or be masqueraded as one?

While rare, some schemes can appear legitimate and be misused as Ponzi schemes. Conduct due diligence by checking licenses, track records, audited financials, and whether profits come from real business activity rather than new investor inflows.

What happened in the Zhimin Qian case and what does it illustrate about Ponzi scheme investment fraud?

In the United Kingdom, Zhimin Qian was convicted on money laundering charges tied to a large Ponzi scheme investment fraud involving cryptocurrency investments. She used glossy marketing and public events to recruit victims, stored funds in crypto, and operated without regulatory oversight. The case highlights red flags such as guaranteed profits, lack of registration, and crypto-enabled money movement.

How do Ponzi schemes recruit new investors?

They rely on persuasive marketing, testimonials, and referrals, often promising guaranteed profits and fast returns. Such tactics target professionals and use glossy materials to create an impression of legitimacy, while funding payments to earlier investors with new entrants.

What are the consequences for Ponzi scheme investment fraud perpetrators?

Perpetrators face criminal charges such as fraud and money laundering, potential prison time, asset forfeiture, and civil penalties. Victims may receive restitution where possible, but recovery is often challenging.

How can I verify a cryptocurrency investment or other offering for legitimacy and regulatory oversight?

Check if the investment is registered with the relevant regulator and whether the firm holds proper licensing. Review disclosures, audited financials, and ensure returns are backed by real business activity. Be wary of guaranteed profits, opaque models, or pressure to invest quickly via crypto.

What is the best way to report Ponzi scheme investment fraud?

Report suspicions to the appropriate financial regulator, consumer protection agency, or law enforcement in your country, and provide documentation such as marketing materials and payment records. Early reporting helps regulators shut down schemes and protect others.

| Key Point | Details |

|---|---|

| Case Overview | Zhimin Qian was convicted in the UK of money laundering tied to a massive Ponzi scheme that defrauded more than 128,000 people in China, stealing about $6.7 billion (2014–2017). |

| Company & Promises | Tianjin Lantian Gerui Electronic Technology Co. was marketed as a leading fintech business offering cryptocurrency investments and other products, promising returns up to 300% but with no legitimate operations. |

| Ponzi Mechanism | Early investors were paid with funds from later investors; the scheme operated as a classic Ponzi with no real profits or underlying business activity. |

| Marketing Tactics | Promotional materials targeted professionals (and even members of the Chinese judiciary), claiming safety and guaranteed high yields, and highlighting non-existent projects and partnerships. |

| Perceived Legitimacy | Glossy materials and high-profile events were used to create a sense of legitimacy, including hosting investor events at the Diaoyutai State Guesthouse in Beijing. |

| Regulatory Trigger & Relocation | China’s 2017 cryptocurrency regulations (ICO ban and closing of domestic trading platforms) preceded Qian’s departure to the UK using a phony St Kitts and Nevis passport, with funds moved to Bitcoin. |

| Laundering Attempts | Illegally gained funds were laundered through real estate and other asset purchases. |

| Regulatory Notables & Status | Qian had no verified financial or technological qualifications and was not registered with a financial regulatory body (CSRC); she is awaiting sentencing. |

| Lessons & Takeaways | This case underscores the importance of researching the investment, the company, and the people running it; avoid investments you do not fully understand. |

Summary

Conclusion: Ponzi scheme investment fraud is a global concern for investors seeking high returns. The Zhimin Qian case demonstrates how promoters can present a fraudulent operation as a fintech venture, lure a broad audience including professionals and officials, and move funds across borders while promising unrealistically high gains. This underscores the need for thorough due diligence, regulatory verification, and skepticism toward guaranteed profits when evaluating investment opportunities.