A wealth tax would reshape the discourse around France tax policy and the broader economic outlook. Supporters argue that even a modest levy on fortunes could help close the fiscal gap while sparing middle earners. The fiscal deficit France faces has widened, pressuring policymakers to balance spending and revenue. Economists in the taxation of fortunes debate say a wealth levy could alter savings, investment, and inequality in nuanced ways. In this evolving economic policy debate, the case for or against a wealth tax remains a live, consequential question.

Beyond the blunt label, a wealth levy is described in different terms, including a fortune tax or an asset-based charge, reflecting LSI-inspired connections among related ideas. Proponents argue that such a levy on large fortunes could add resilience to public finances while aligning with French tax reform goals. Opponents warn about unintended economic distortions and leakage, noting that wealth-based charges are only one piece of the broader fiscal policy debate. As public discussion shifts, policymakers are weighing how revenue from capital assets could fund services without stifling growth.

Wealth Tax and the French Economic Argument

The piece argues from a stance of caution on wealth taxation, framing it as not a viable pillar of France tax policy. In the broader economic policy debate, even sophisticated defenses for taxing fortunes are presented as insufficient to justify the potential harms to growth and entrepreneurship.

Proponents like Gabriel Zucman have urged an annual levy on fortunes above certain thresholds, but the article contends that such arguments miss the mark. Within discussions of taxation of fortunes, the consequences for investment, capital allocation, and long-run fiscal sustainability are central, and the author remains skeptical about the net benefit of a wealth tax in the French context.

France’s Fiscal Deficit and the Revenue Challenge

France is described as facing a large fiscal gap this year, with a deficit of about €160 billion, exceeding 5% of GDP. This fiscal deficit France situation is the backdrop for policy decisions and it intensifies the pressure on tax policy to deliver credible revenue without derailing growth.

The deficit narrative elevates the urgency of reform, but the article cautions against quick fixes that hinge solely on wealth taxation or punitive measures on top earners. Instead, it frames the revenue challenge as part of a complex fiscal puzzle that must balance equity with economic vitality in the broader France tax policy discourse.

Tax Policy and the Economic Policy Debate in France

Tax policy is central to the ongoing economic policy debate in France, where reforms are evaluated through their impact on growth, investment, and public services. The discussion intersects with questions about how best to allocate resources and how to design incentives that support productive activity.

Within this debate, opinions diverge across left-leaning economists, centrists, and other stakeholders about the appropriate mix of taxation and spending. The article emphasizes that any reform must be grounded in careful analysis rather than bold slogans, especially when considering the macroeconomic consequences of major structural changes.

Taxation of Fortunes: France’s Contemporary and Historical Context

Taxation of fortunes has long been a contentious element of France’s fiscal framework, with advocates arguing for wealth taxes as a tool for equity. The piece, however, questions whether this approach aligns with current economic realities and whether it would deliver the intended public benefits without compromising competitiveness.

Historical and contemporary considerations of the taxation of fortunes suggest that revenue potential may be limited by behavioral responses and capital flight. In the context of French tax reform, the article argues for a cautious appraisal of wealth-based levies as a solution to the fiscal deficit France challenge.

French Tax Reform: What Works and What Doesn’t

French tax reform debates center on balancing fairness and efficiency, and on whether new levies would deliver meaningful revenue without deterring investment. The discussion is anchored in the realities of the French economy and how reforms would affect growth trajectories.

The article stresses that reform ideas must be evaluated against practical outcomes, including the health of capital markets and the country’s overall investment climate. In the language of France tax policy, this means weighing the short-term political appeal of a wealth tax against long-term macroeconomic goals.

Wealth Tax Revenue: Reality Check in the Policy Arena

A recurring question is how much revenue a wealth tax could actually raise, given exemptions, loopholes, and behavioral changes. The content urges a realism-based assessment within the French tax reform agenda, rather than rosy projections that ignore operational challenges.

From the perspective of the wider economic policy debate, revenue estimates tied to wealth taxation must be scrutinized alongside other instruments, including broader tax reform, to ensure that fiscal objectives are attainable without compromising growth or innovation in France.

Investor Confidence and France’s Fiscal Trajectory

Investors in French government bonds respond to how the deficit and tax policy evolve, with nervousness about the sustainability of public finances. This market signal underscores the importance of credible policy paths in the France tax policy framework.

Policy choices that seem punitive toward wealth or that promise quick revenue can have unintended consequences on capital markets. The discourse around economic policy debate must account for investor sentiment when evaluating whether a wealth tax or alternative reforms will stabilize deficits without chilling investment.

Economists in the Tax Debate: Zucman and Critics

Gabriel Zucman and other economists have framed wealth taxes as a tool for more progressive taxation, a position that sits at the heart of the modern economic policy debate. The article acknowledges the prominence of such views within the broader discussion of French tax reform.

However, the piece challenges the ultimate effectiveness of these proposals, suggesting that the arguments for taxing fortunes, while sophisticated, may not translate into the desired fiscal or growth outcomes in France. This tension is a core feature of the ongoing France tax policy conversation.

Left, Center, and Right: The Political Spectrum in Taxation

The political spectrum in France frames taxation as a lever for equity and opportunity, with left-leaning economists often advocating wealth taxes and centrists urging measured reforms. The economic policy debate reflects these diverse viewpoints and the struggle to find a durable consensus.

The article emphasizes that the political allure of wealth taxation must be weighed against practical implications for competitiveness and growth. In shaping public policy, the balance between fairness and efficiency remains central to the French tax reform discussion.

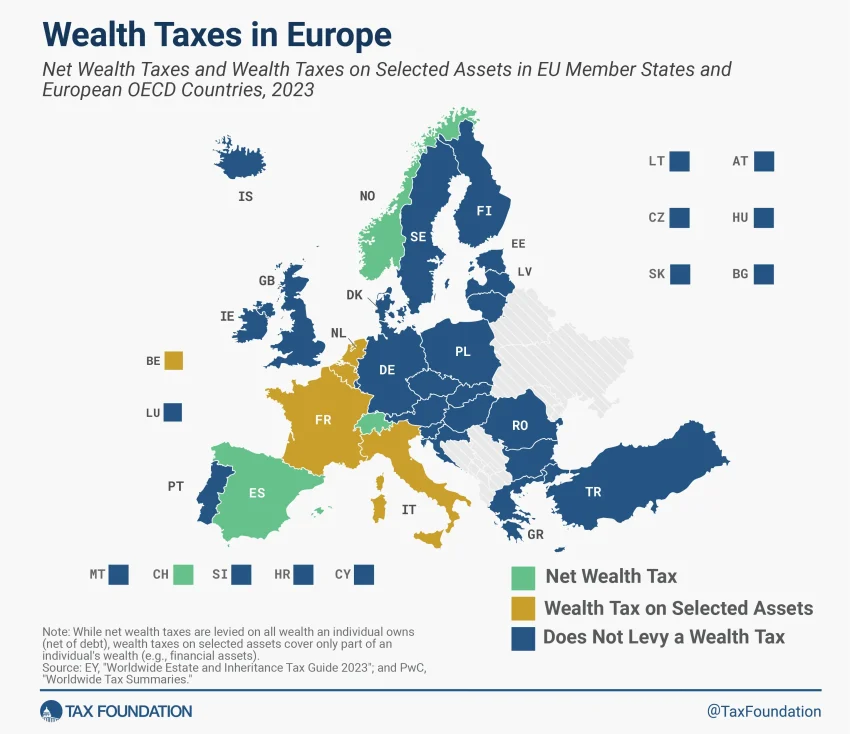

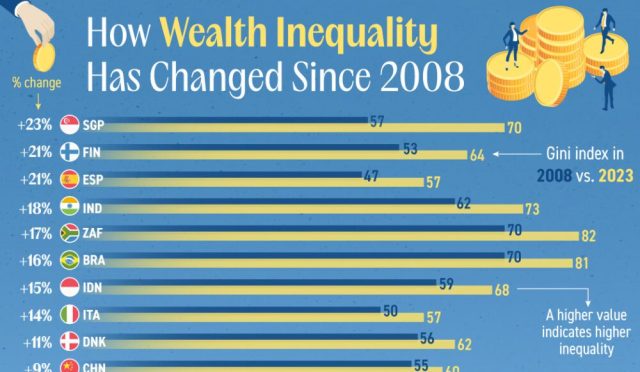

Global Perspectives on Taxation of Fortunes and Fiscal Policy

As France contemplates its own fiscal path, comparisons with other economies’ approaches to the taxation of fortunes inform the discussion. Global experience can illuminate both potential benefits and risks of wealth-based levies within a modern tax system.

The broader economic policy debate benefits from looking at international examples, ensuring that France’s reform agenda remains realistic and aligned with global best practices for sustainable public finances and economic growth.

Avoiding Oversimplification: Nuance in Tax Policy Proposals

The article cautions against oversimplified solutions to a complex deficit challenge, reminding readers that wealth taxation is not a guaranteed fix. Effective policy design requires careful modeling, stakeholder engagement, and attention to long-run outcomes in the France tax policy landscape.

A nuanced approach to tax reform, considering revenue potential, behavioral response, and macroeconomic impact, is essential within the broader economic policy debate. The goal is to craft reforms that stabilize the fiscal path without sacrificing investment and innovation in France.

Conclusion: Rethinking Wealth Tax within France’s Fiscal Challenge

The overarching message is a call for caution about wealth taxes in the context of France’s sizable fiscal deficit and growth considerations. The conclusion ties together the themes of France tax policy, French tax reform, fiscal deficit France, taxation of fortunes, and the ongoing economic policy debate.

Ultimately, the article argues for policy paths that prioritize sustainable public finances and economic resilience, rather than relying on wealth-based levies as a quick fix. The discussion remains anchored in the broader frame of the economic policy debate and the practical realities facing France today.

Frequently Asked Questions

What is wealth tax and how does it fit into France tax policy?

Wealth tax is a levy on an individual’s net worth. In France, the policy has evolved, with reforms shifting focus from broad wealth taxation to targeting specific assets, reflecting ongoing discussions within France tax policy and the taxation of fortunes. The topic remains central to debates on fairness and growth.

What changes did the French tax reform bring to taxation of fortunes?

The 2018 French tax reform replaced the traditional wealth tax with a real estate wealth tax (IFI), narrowing the base to real estate assets above certain thresholds. This French tax reform is a key example of how taxation of fortunes is adjusted in response to policy goals and economic considerations within the broader economic policy debate.

How could a wealth tax affect the fiscal deficit France?

A wealth tax could raise revenue to help address the fiscal deficit France, but its actual impact depends on the rate, exemptions, asset values, and how individuals respond (e.g., relocation or asset shifting). In practice, revenue may be limited by design and behavior, making it a contentious tool in the fiscal planning process.

What is taxation of fortunes and why is it a topic in the economic policy debate?

Taxation of fortunes refers to taxes on an individual’s net wealth. Proponents argue it promotes equity and funds public services, while opponents worry about reduced investment and capital flight. As a result, taxation of fortunes sits at the heart of the economic policy debate, influencing France tax policy and international comparisons.

What are the common arguments for and against wealth tax in the economic policy debate?

Proponents say wealth tax enhances fairness and aligns contributions with ability to pay, potentially funding essential public goods. Opponents contend it can deter investment, complicate compliance, and prompt tax avoidance. These opposing views fuel the economic policy debate about the best balance between equity and growth.

How does the wealth tax concept fit into France’s broader tax policy compared with other countries?

France’s approach to wealth taxation has evolved and is often compared with international practices. Some countries apply broader net wealth taxes, while others focus on specific assets. The comparison informs ongoing discussions within France tax policy and the broader economic policy debate about optimal tax design and revenue generation.

| Key Point | Rationale | Evidence / Notes |

|---|---|---|

| Don’t tax wealth (main thesis) | The base argument presented is that wealth should not be taxed. | “Don’t tax wealth.” The text argues that even sophisticated arguments in favor are not convincing. |

| Context: France’s fiscal hole | The setting for the policy debate is a large national deficit and pressure to close the gap. | France faces a deficit of €160bn this year; investors are nervous; policymakers seek to close the gap. |

| Advocates’ stance on wealth tax | A subset of economists believes wealth tax could be part of the solution. | Left-leaning economists and some centrists push for wealth taxation; Gabriel Zucman proposed a 2% annual levy on fortunes > €100m. |

| Quality of arguments | Even when arguments are more nuanced, the author argues they are still wrongheaded. | The text notes subtiler arguments but maintains the overall critique against wealth tax. |

Summary

Wealth tax remains a controversial policy, and this conclusion argues against it. The base content argues that the case for taxing wealth is not compelling, even when arguments are framed with greater nuance. It situates the debate in France’s large deficit context, notes that some economists advocate for wealth taxes (e.g., a 2% levy on fortunes above €100 million), but maintains that the overall position is that wealth tax is not the right solution.