American wealth disparity has become a defining characteristic of the 21st-century economic landscape. While the United States is heralded as the richest nation globally, this wealth is not shared equally among its citizens. Recent statistics reveal that a staggering 40% of U.S. households enjoy a disposable income of at least $94,000, far surpassing households in the UK where only 10% experience similar financial freedom. Furthermore, the disparity in US household wealth continues to widen, with the top 10% enjoying more disposable income than the top 5% in Britain. This growing wealth inequality fosters not only economic challenges but also social divisions, making it crucial to explore the trends and implications of wealth distribution in the U.S.

In examining the economic divides within the nation, it becomes apparent that the financial landscape is becoming increasingly polarized. Terminology such as income inequality and economic stratification often emerge in discussions surrounding the pronounced disparity in wealth across American households. The stark differences highlight a reality where a small percentage of the population continues to amass significant fortunes, while a larger segment struggles with escalating living costs and limited financial resources. Additionally, as we delve into the complexities of disposable income trends, it becomes evident that the gulf between the affluent and less fortunate is not merely a number but a lived experience that shapes the social fabric of society. Understanding this dynamic is essential in addressing the core issues related to wealth inequality.

Understanding American Wealth Disparity

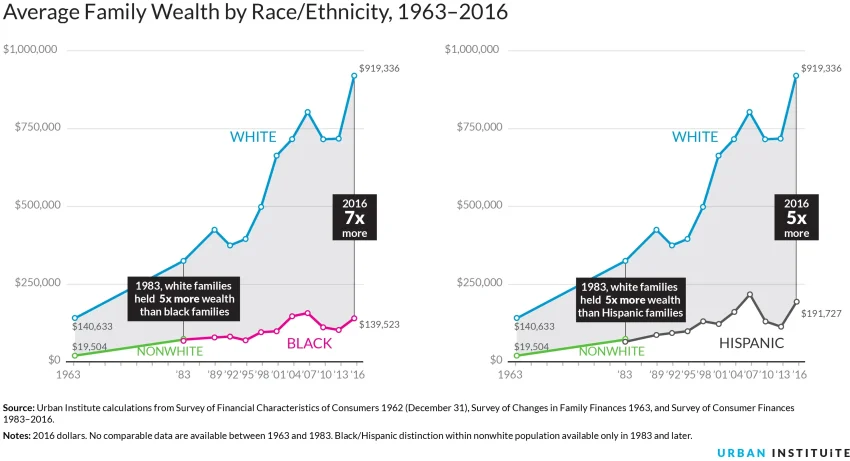

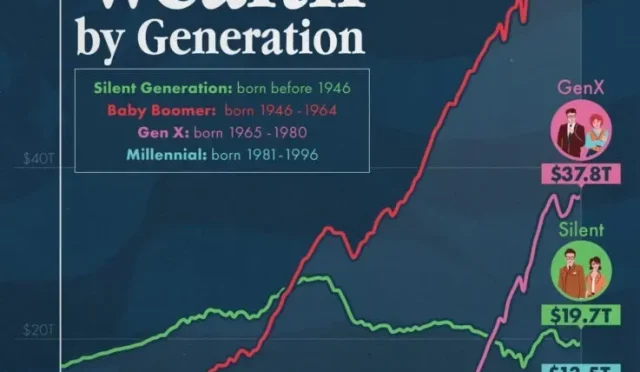

American wealth disparity has become a focal point for discussions surrounding economic inequalities in the nation. While the U.S. total household wealth is expected to approach $170 trillion by mid-2025, the distribution of this wealth is severely skewed. Those in the top 10% hold a staggering share of that wealth, creating a significant chasm between the rich and the poor. Reports show that the top 1% of earners have garnered the majority of wealth gains over the last four decades, with the top 10% beyond their reach, often fueling economic discontent among average citizens.

One of the reasons for this disparity can be traced to the escalating cost of living in prosperous areas. States like California and New York have exorbitant housing and living costs, which, despite high incomes, leave many feeling financially strained. Furthermore, housing prices have surged dramatically, making it increasingly difficult for individuals and families to achieve home ownership—a crucial determinant of wealth in America. As the rich continue to accumulate wealth through investments, those without financial investments are left struggling to keep up with inflation, further exacerbating the feelings of economic exclusion experienced by many.

Wealth in America Compared to the UK

A stark comparison between wealth in America and the UK highlights the substantial differences in disposable income trends. Recent data indicate that 40% of U.S. households enjoy a disposable income of at least $94,000, compared to just 10% of UK households reaching the same threshold. This disparity is indicative of broader economic trends, underscoring America’s unique position in terms of household wealth. The top earners in America not only outperform their UK counterparts but also have experienced significant gains in real disposable income, particularly following the Great Financial Crisis.

However, while the quantitative measures of wealth showcase America’s affluence, they also mask the qualitative experiences of its citizens. Many individuals feel impoverished despite high earnings, primarily due to the high living expenses which consume a considerable part of their disposable income. Thus, while wealth figures suggest prosperity, the reality for many Americans points to increasing economic strain, which is often less visible in countries like the UK.

The Impact of Inflation on Household Wealth

Inflation plays a challenging role in shaping the economic realities of American families. Recent years have witnessed skyrocketing housing and vehicle prices, with costs about 22% higher than pre-pandemic levels. This inflationary pressure is particularly burdensome for those who did not own property before these price surges, as they now face significantly higher costs without corresponding increases in wages. While the average wage has kept pace with inflation, disparities still exist, leaving some households feeling economically squeezed despite the overall wealth in America continuing to rise.

Furthermore, the category of financial assets remains predominantly in the hands of wealthier individuals, providing them with a safety net that is absent for many lower-income families. Those without investments or property find themselves in a precarious position, barely covering basic expenses while the wealthy continue to enjoy and expand their financial portfolios. In this context, inflation exacerbates the wealth gap, rendering financial security elusive for a substantial portion of the population.

Expectations and Lifestyle Inflation

The concept of lifestyle inflation presents additional challenges for many Americans navigating their financial landscape. As individuals earn more, they often feel justified in spending more, leading to a relentless cycle of wanting bigger homes, luxury vehicles, and extravagant vacations. The pressure to maintain or exceed one’s perceived status in society becomes overwhelming, as many people equate their self-worth with their financial success. However, this mindset often leads to unsustainable financial habits that contribute to feelings of inadequacy when incomes do not rise in tandem with expectations.

This expectation disconnect can create a sense of financial failure. For example, even those in the upper echelons of income may find themselves aspiring for an ever-elusive higher status, driven by societal benchmarks set through social media and personal comparisons. This incessant comparison further heightens the feeling that they fall short, despite their relatively affluent position. It becomes clear that accumulation of wealth is not the sole determinant of happiness or satisfaction; rather, balanced living and realistic financial planning are essential.

Social Media and Financial Comparison

In the modern age, social media plays a significant role in exacerbating feelings of inadequacy regarding wealth and success. Platforms inundate users with curated images that showcase luxurious lifestyles, dramatically influencing perceptions of wealth and personal worth. This constant comparison can lead many to feel discontent with their financial status, irrespective of their actual economic circumstances. The impression created by influencers and peers can distort reality, making individuals forget that everyone has unique financial paths and challenges.

The challenge becomes navigating personal finance amid the noise of external expectations. Continually comparing oneself to others often leads to a relentless cycle of wanting more and feeling less satisfied. This trend is particularly troubling when considering that many individuals experiencing financial difficulties are working diligently to improve their situations. The pressure to showcase success on social media can lead to financial strain, as individuals prioritize appearance over sound financial management, creating a deeper divide between how wealth is perceived versus how it is lived.

The Psychological Aspect of Wealth Accumulation

Wealth accumulation in America often leads to a paradoxical situation where even those with substantial incomes do not feel rich. This feeling stems from the relentless pursuit of more—whether that’s monetary wealth or status symbols driven by societal expectations. Studies show that individuals in the top income brackets frequently desire to ascend to even higher positions, leading to a sense of perpetual dissatisfaction. This phenomenon illustrates that, in many cases, the journey to accumulate wealth does not guarantee fulfillment; instead, it can lead to an endless cycle of wanting.

The pressure that comes with wealth can also create mental health challenges. High earners may grapple with anxiety and a sense of isolation, as the expectations placed upon them can weigh heavily. The growing awareness of wealth disparity in America further complicates this psychological aspect, as individuals feel guilty about their financial situations in light of societal struggles. Understanding that wealth is not merely a measure of status, but also requires emotional and social intelligence, can help individuals reshape their relationship with money and find greater satisfaction in their lives.

Living Costs Versus High Earnings

While America is often portrayed as a land of opportunity with high earning potential, the reality of living costs complicates this narrative. High wages in states with high costs of living can render individuals feeling cash-strapped despite earning six figures. The value of high household income can be significantly diminished by the exorbitant costs of housing, transport, and healthcare. The data shows that, while nominal earnings have increased, the purchasing power of those earnings has not kept pace with rising living costs, leading to increased financial pressure on many families.

Moreover, many Americans continue to find themselves in a predicament where their economic reality does not align with their income levels. Situations like rent increases, health emergencies, or student debt can rapidly erode financial stability for many, regardless of substantial earnings. Thus, it’s critical to evaluate financial health beyond just income figures; understanding disposable income relative to living expenses provides a clearer picture of financial stress experienced by households across America.

Wealth Distribution Impacted by Policy

Policies and regulations play a significant role in shaping wealth distribution in the United States. Tax policies favoring high earners have often contributed to widening the wealth gap. While the rich continue to benefit from tax breaks and favorable investment opportunities, lower-income families find themselves shouldering a disproportionate share of taxes and lacking access to wealth-building opportunities. These structural inequalities have led to a concentration of wealth among the top earners, illustrating that public policy directly influences economic landscapes.

Additionally, social safety net programs remain underfunded or poorly targeted, which further exacerbates wealth disparities. Many low-income families struggle to access essential services that foster economic mobility, such as education and healthcare. The government’s role in addressing these disparities cannot be understated, as equitable distribution and support for disadvantaged communities can pave the way for a more balanced wealth landscape in America, ultimately promoting a healthier society as a whole.

Strategies for Building Wealth in America

Building wealth in America requires more than just high earnings; it necessitates strategic financial planning and investment. Individuals should focus on saving a percentage of their income consistently while prioritizing investments in vehicles that can appreciate over time, such as stocks, bonds, and real estate. Financial literacy plays a crucial role in navigating investment landscapes and understanding the complexities of asset management. By setting realistic financial goals and adhering to disciplined savings routines, individuals can gradually accumulate wealth.

In addition, leveraging employer-sponsored retirement plans and taking advantage of tax-advantaged accounts can accelerate savings growth. Education about personal finance can empower individuals to make informed decisions regarding spending and investing. Furthermore, creating an emergency fund and avoiding debt accumulation are pivotal strategies for enhancing financial security. With informed planning, individuals can harness their high earnings to build substantial wealth, rather than perpetually striving to keep up with inflation and rising costs.

Frequently Asked Questions

What is the current state of American wealth disparity?

American wealth disparity remains significant, with the top 10% of earners controlling a disproportionate share of national wealth. By 2025, U.S. household wealth is projected to reach nearly $170 trillion. However, there is a stark contrast in disposable incomes, with many in the upper echelons feeling unsatisfied despite their wealth due to rising living costs and inflation.

How does wealth distribution in the US compare to the UK?

Wealth distribution in the US is markedly more favorable than in the UK. For instance, 40% of U.S. households have disposable income exceeding $94,000, compared to only 10% in the UK. Additionally, the financial landscape for the top 10% in the US has improved significantly, while the top 10% in the UK has seen real stagnation since the Great Financial Crisis.

What factors contribute to growing wealth inequality in America?

Several factors contribute to the growing wealth disparity in America, including rising living costs, inflation, and the concentration of wealth among the richest individuals. Housing costs have surged, leading many to feel financially strained despite increases in household income.

Why do many Americans feel financially insecure despite high average incomes?

Many Americans feel financially insecure due in part to high living expenses in affluent areas, which can negate the benefits of high incomes. Furthermore, lifestyle inflation and rising consumer expectations can lead to feelings of falling behind, even among those earning significantly higher than average.

How does disposable income trends affect wealth disparity in the US?

Disposable income trends indicate that while average incomes have increased, the wealth gap has widened as the top earners gain more. The disparity in disposable income is stark, with the top 10% in America earning substantially more than their global counterparts, which exacerbates feelings of inequality.

What impact does cost of living have on perceptions of wealth in America?

The cost of living significantly influences perceptions of wealth in America. High costs in regions like California and New York may lead high-income earners to feel less wealthy due to the diminishing power of their income. This disconnect illustrates how geographical factors play a critical role in the experience of wealth disparity.

How has the American wealth comparison to global standards been affected over recent decades?

The American wealth comparison to global standards has shifted favorably for the top 10% amidst growing global inequality. Despite high overall wealth levels, the wealth distribution shows that most of the gains in recent decades have accrued to the top 1%, influencing international perceptions of wealth.

What is the significance of lifestyle inflation in relation to American wealth disparity?

Lifestyle inflation can exacerbate feelings of inadequacy among American households, even those with high incomes. As personal expectations for spending rise, many individuals may struggle to maintain financial stability, contributing to their perception of wealth disparity despite their earnings.

What role does inflation play in the ongoing wealth distribution issues in the US?

Inflation has played a critical role in wealth distribution issues in the US, with costs for essentials like housing and vehicles rising dramatically. While overall wages have kept pace with inflation, the disparities in asset ownership mean that many still feel economically pressured, leading to a deeper understanding of wealth disparity.

How do social media influences contribute to the perception of wealth disparity in America?

Social media can amplify feelings of inadequacy and wealth disparity as individuals showcase affluent lifestyles, leading many to compare themselves unfavorably against others. This dynamic can cause even relatively wealthy individuals to feel dissatisfied with their financial standing.

| Key Points | Statistics/Insights |

|---|---|

| America’s Wealth Status | By mid-2025, total household wealth in the U.S. is expected to approach $170 trillion. |

| Comparison with Britain | 40% of U.S. households earn over $94,000 post-tax, vs. 10% in the UK with similar disposable income. |

| Top Earners | Top 10% in U.S. earn over $205,000 in disposable income, higher than the top 10% in the UK. |

| Wealth Growth | Since the Great Financial Crisis, disposable income for America’s top 10% has grown by nearly 30%. |

| Living Costs | High living costs in states like California and New York often offset high income levels. |

| Inflation Impact | The rising cost of living, especially housing, has outpaced wage growth for many. |

| Societal Pressure | Social media exacerbates feelings of inadequacy and comparison among individuals regarding wealth. |

| Wealth Concentration | The top 10% hold a larger share of wealth, largely benefiting the top 1% and 0.1%. |

| Conclusion on Desire | Aiming for more wealth can lead to dissatisfaction regardless of current income. |

Summary

American wealth disparity is a pressing issue, showcasing a significant divide between the rich and the poor within one of the world’s richest nations. Despite immense growth in wealth, with estimates suggesting total household wealth nearing $170 trillion by mid-2025, the prosperity is not uniformly felt among all citizens. High living costs, inflation, and societal pressures contribute to a growing sense of discontent, even among high earners. As wealth becomes increasingly concentrated in the hands of a few, the aspirations of those striving to reach the upper echelons often lead to feelings of inadequacy and dissatisfaction. Recognizing and addressing these disparities is essential to fostering a more equitable economic environment.