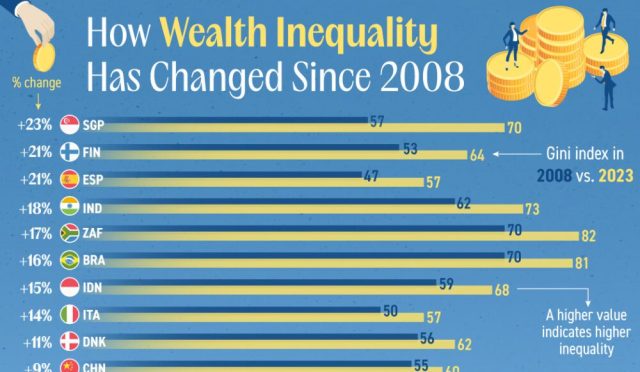

Wealth inequality continues to be a pressing issue in the modern economy, even amid the optimism surrounding booming stock and housing markets. While reports indicate that the stock market is reaching unprecedented heights, the reality remains that this prosperity is disproportionately benefiting the affluent. Statistics reveal that the top 10% of wealth holders control a staggering 87% of the stock market, while the bottom 50% barely owns 1%. At the same time, the housing market is experiencing rising home equity, yet many individuals, especially young investors, are finding it increasingly difficult to afford property due to soaring prices and high mortgage rates. In this landscape, understanding the dynamics of financial assets and investment accounts becomes vital as the financial gap continues to widen, sparking discussions on how we can create a more equitable economic future.

The disparity in wealth distribution remains a major challenge facing society today, marked by a significant chasm between the rich and poor. Despite the economic growth reflected in both the stock market and real estate sectors, a large portion of the population grapples with limited access to financial resources and building wealth. Many individuals, particularly among younger generations, are turning their attention towards diversifying their investment portfolios, entering markets previously dominated by more affluent counterparts. This evolving approach to investing, coupled with rising interest in various financial instruments, highlights an emerging trend that offers hope amid the ongoing challenges posed by an inequitable economy. As more people begin to engage with their financial futures, the potential for a shift in the wealth landscape is gradually becoming palpable.

Understanding Wealth Inequality in Today’s Economy

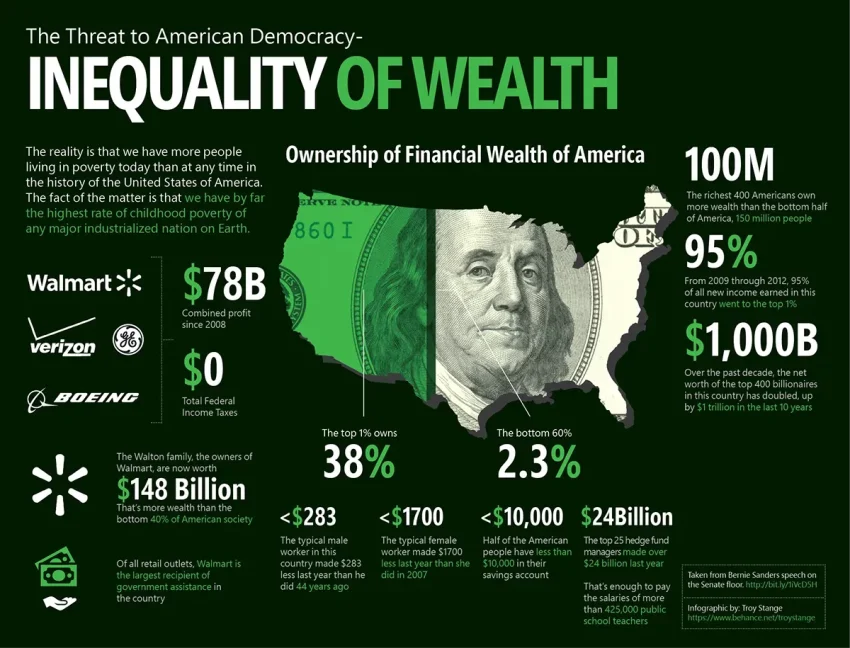

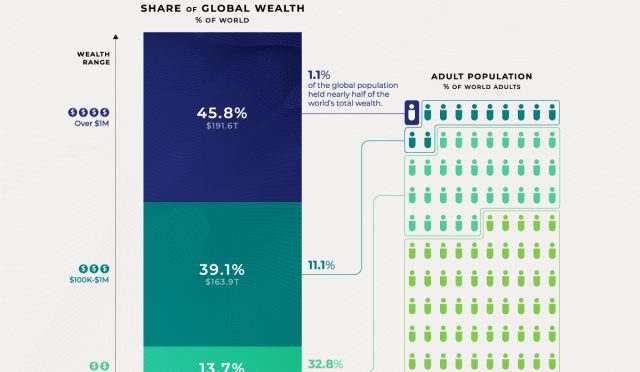

Wealth inequality remains one of the most pressing issues in today’s economy, starkly represented by the distribution of financial assets across different income levels. The statistics are astonishing: the top 1% of earners own half of all stocks, while a mere 1% of stock ownership is held by the bottom 50%. This extreme disparity not only highlights how wealth accumulates among the affluent but also showcases the barriers that prevent low-income households from accessing and benefiting from investment opportunities in the stock market.

Moreover, the consequences of wealth inequality extend beyond merely financial metrics; they affect social mobility and economic stability. When a small percentage of the population controls a vast majority of the nation’s wealth, the majority are left with limited resources to invest in financial assets like stocks or real estate. This ongoing trend stifles the growth and potential of young investors who, despite their increasing participation in the stock market, often face systemic barriers that make wealth accumulation challenging.

The Stock Market: A Key Tool for Wealth Building

The stock market is often referred to as a wealth-building machine, and for good reason. It offers individuals the opportunity to grow their financial assets significantly over time through investments. Recent data indicates a concerning yet encouraging trend amongst young investors; while the housing market poses challenges due to rising prices, the stock market has seen an influx of new participants eager to cultivate their personal wealth. Nearly half of Robinhood’s customer base comprises first-time investors, and this trend reflects a growing understanding of the importance of stock investments in securing financial futures.

Additionally, the performance of the stock market in recent years has outpaced other asset classes, including real estate, making it a more attractive option for wealth accumulation. The fact that the stock market has more than doubled the returns of the housing market throughout the 2020s showcases its potential. By harnessing the power of investment accounts, young and underserved populations are transforming their financial landscapes, indicating a shift in mindset toward investment and financial independence.

Challenges in the Housing Market Affecting Investment Strategies

The current housing market presents significant challenges, especially for first-time homebuyers. Rising home prices and mortgage rates have made homeownership increasingly unattainable for many young Americans. With homeownership rates for Gen Z plummeting to just 16%, the focus is shifting away from purchasing homes and toward investing in financial assets. As potential buyers are priced out of the housing market, a surprising outcome is the uplift in stock market investments among younger generations, which have been spurred by the need to put savings to work in earning environments.

Consequently, many young investors are redirecting funds that would typically be reserved for down payments towards stock purchases, recognizing that investing in financial markets often yields higher returns than real estate. This recalibration not only highlights adaptive financial strategies among young investors but also sheds light on the necessity of creating more accessible pathways for financial literacy and investment opportunities, especially for those who have been historically marginalized within the market.

How Young Investors are Reshaping Financial Markets

Young investors are dramatically reshaping financial markets, particularly through technological advancements that facilitate easier access to investment accounts. Firms like Robinhood are pivotal in attracting a demographic that is not only tech-savvy but also eager to invest early in their financial journeys. Reports show that investment accounts among young adults have skyrocketed, increasing from 6% in 2015 to an impressive 37% in 2024. This sixfold growth indicates a significant shift toward early financial participation.

Furthermore, the active engagement of young investors in the stock market is essential for mitigating wealth inequality over the long term. As these individuals build their investment portfolios, they pave the way for future financial opportunities that can break the cycle of poverty and promote economic growth. The trend signifies not only a burgeoning financial awareness but also a proactive approach to wealth-building among younger demographics—one that transcends the traditional barriers imposed by high housing costs.

The Interplay Between Real Estate and Stock Investments

There is an intricate interplay between the real estate and stock markets that influences wealth accumulation strategies. Despite homes being seen as a traditional investment, the volatility and high costs associated with real estate are prompting many to consider stocks as a more flexible investment option. With rental prices surging, young adults are opting to rent rather than buy, investing their savings in the stock market instead. This reflective strategy demonstrates a shift in perception and offers the potential for enhanced financial growth.

Moreover, the stock market’s performance has often surpassed that of real estate, making it an increasingly attractive venue for investors, particularly amid economic uncertainties. Individuals who might have once invested in housing due to societal expectations are now recognizing the stock market’s superiority in terms of liquidity and potential returns, especially in a climate where housing prices are outstripping wages. This pivot represents a modern day evolution in wealth accumulation tactics, emphasizing the importance of diverse investment strategies.

Investment Accounts: Opening Doors for the Underrepresented

Investment accounts are increasingly becoming gateways to wealth-building for underrepresented groups. With more low-income households engaging in the stock market, barriers to financial participation are slowly being dismantled. Data shows that nearly a third of Chase customers moving funds to investment accounts belong to below-median income brackets, marking a significant increase from previous years. This trend signals a growing trend of financial empowerment among communities that have historically faced capital access challenges.

Moreover, the surge in investment accounts illustrates a crucial shift in how financial assets are viewed across various demographics. As more individuals, particularly young people, embrace the concept of wealth-building through stocks rather than being confined by the constraints of homeownership, the landscape of investments evolves. This is driving a more inclusive financial ecosystem where diverse populations can participate and benefit from stock ownership, fostering a more equitable economic environment.

The Role of Financial Literacy in Wealth Accumulation

Financial literacy is a vital component of navigating the complexities of wealth accumulation, especially in the realm of investment strategies. Many young investors are benefitting from increased access to information and resources that help them make informed decisions about entering the stock market. The explosion of online platforms has made learning about investments more accessible, equipping individuals with the necessary tools to understand market dynamics, financial assets, and risk management.

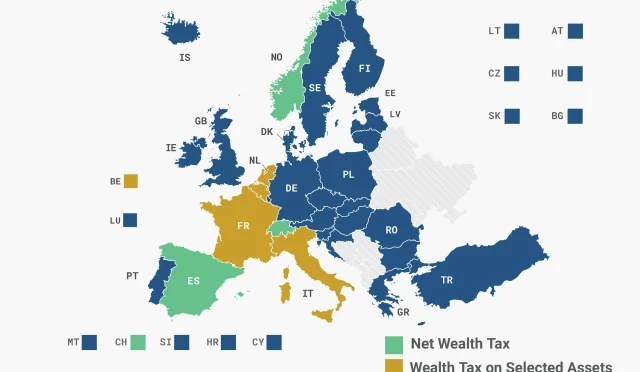

However, it is imperative to continue promoting financial education initiatives to ensure that everyone can take advantage of available investment opportunities. The potential for wealth accumulation through financial assets can be transformative, but individuals must be prepared to engage thoughtfully with their investment accounts. By empowering more people through comprehensive financial literacy programs, society can work towards alleviating wealth inequality and, subsequently, bolster overall economic growth.

Celebrating Positive Developments in Wealth-Building Opportunities

Despite the persistent challenges in wealth inequality and high housing costs, recent developments in the financial landscape are worth celebrating. The increasing participation of low-income households and young investors in owning financial assets indicates a hopeful shift toward more inclusive wealth-building opportunities. As more individuals recognize the value of participating in the stock market, the potential for creating generational wealth rises, facilitating greater economic equity.

Moreover, these positive trends suggest that while systemic issues remain, there is also significant momentum toward democratizing access to investment opportunities. The rise in investment accounts, diversification of assets owned by historically marginalized groups, and the overarching vision of financial empowerment reflect a collective shift toward better financial futures. Embracing these developments can lead to more robust and resilient economic communities, supporting a fairer distribution of wealth.

Frequently Asked Questions

How does wealth inequality affect access to the stock market?

Wealth inequality significantly impacts access to the stock market, as the wealthiest individuals own a disproportionate share of financial assets. In the U.S., the top 10% controls 87% of the stock market, which leaves the bottom 50% with only 1%. However, initiatives like investment platforms have started to democratize access, allowing more individuals, particularly those from lower-income brackets, to participate in investment accounts.

What role does the housing market play in perpetuating wealth inequality?

The housing market contributes to wealth inequality by setting high prices and mortgage rates that make homeownership unattainable for many. The current statistics show that young investors, particularly Gen Z, are struggling with a homeownership rate of just 16%. While wealthier households benefit from rising home values, many lower-income individuals find themselves increasingly priced out.

Are young investors contributing to reducing wealth inequality through stock market participation?

Yes, young investors are playing a pivotal role in reducing wealth inequality as more of them open investment accounts. Reports indicate a sixfold increase in investment activity among 25-year-olds since 2015, suggesting that newer generations are prioritizing stock market investments over traditional homeownership as a way to build wealth.

How can financial assets in investment accounts combat wealth inequality?

Financial assets held in investment accounts can combat wealth inequality by providing a pathway for lower-income individuals to accumulate wealth. With programs targeting younger demographics, more people are entering the stock market, which historically has been a significant wealth-building tool, aiding in bridging the wealth gap.

What are the implications of high housing prices on young investors in the stock market?

High housing prices have led young investors to divert funds typically reserved for down payments into the stock market. This shift has resulted in increased participation in investing, allowing young individuals to potentially achieve greater returns than they would receive from real estate investments, which has previously been a major barrier to wealth accumulation.

Is the rise of investment accounts a solution to wealth inequality?

The rise of investment accounts is a promising solution to wealth inequality. Greater access to these accounts enables individuals from diverse income levels to engage in wealth-building activities in the stock market, promoting financial literacy and investment among those who previously had limited access to such opportunities.

How do stock market dynamics influence wealth inequality trends?

Stock market dynamics often exacerbate wealth inequality, as affluent individuals benefit more from market gains. However, recent trends show an increase in participation from lower-income households, suggesting a potential shift as these families engage more with financial markets, which could help mitigate long-standing disparities.

Can the stock market remain a viable option for wealth building amid wealth inequality?

Despite wealth inequality, the stock market remains a viable option for wealth building. With educational resources and increasing access to investment accounts for young investors, there is potential for a broader demographic to partake and benefit from market growth, contributing to a more equitable financial landscape.

| Key Point | Details |

|---|---|

| Wealth Inequality in Stock Ownership | Top 10% own 87% of the stock market; top 1% own 50%; bottom 50% owns just 1%. |

| Homeownership and Housing Market | Home prices are high; Gen Z homeownership rate is only 16%; first-time buyer rates are at an all-time low. |

| Investment Accounts Growth | 54% of Americans earning $30,000-$80,000 have taxable investment accounts, indicating rising participation in the market. |

| Young Investors | 37% of 25-year-olds are using investment accounts in 2024, a significant increase from previous years, indicating a shift towards stock investments. |

| Investing vs. Home Buying | Investing in stocks has outperformed real estate returns during the 2020s, leading young people to prioritize stock investments over home buying. |

Summary

Wealth inequality continues to be a pressing issue in society today. Despite the stock market thriving and achieving all-time highs, the disproportionate ownership of wealth remains concerning, with the top 10% of earners controlling the vast majority of stocks. However, recent data shows a positive trend, as more middle and lower-income individuals are entering the investment realm, with a significant increase in young investors actively participating in the stock market. This shift suggests a growing recognition of the stock market as a viable wealth-building avenue. While challenges like high housing costs persist, these developments indicate that there is potential for greater wealth distribution in the future.