Wealth tax is rapidly becoming a focal point of economic discussions, particularly in the United States, as lawmakers propose measures like the Billionaires Income Tax Act. This initiative aims to tackle the growing divide in income inequality and create a framework for shared prosperity by targeting the ultra-wealthy, ensuring they contribute fairly to the economy. With nearly 38 million Americans facing poverty, the push for a wealth tax not only seeks to fund essential programs but also embodies a broader vision of financial success that benefits all citizens. By implementing such tax measures, we can explore innovative solutions like universal basic income, which promise to uplift those struggling while aligning the nation more closely with democratic ideals. When we question how much is enough wealth, we open the door to rethinking our priorities in favor of a more equitable society.

When we discuss taxes on accumulated wealth, we’re referring to a strategy that challenges the conventional definitions of success and fairness in our economic system. Terms like asset taxation or rich tax reflect concerns about the concentration of financial power among a select few. This dialogue often highlights proposals aimed at breaking down barriers created by vast fortunes, promoting funding for public goods that contribute to the overall well-being of society. Alternative funding mechanisms, such as cash transfers through universal basic income, serve as a powerful reminder that financial security should not be an exclusive privilege of the wealthy. By exploring different facets of wealth taxation, we address the pressing issues tied to financial equity and the necessity for systemic reform.

Defining Financial Success in Modern America

In America, the concept of financial success remains nebulous. We often celebrate the journeys of billionaires, equating wealth with achievement while neglecting important questions about sufficiency. Approximately one-third of the American populace struggles to navigate financial emergencies, as nearly 38 million citizens live below the poverty line. This stark inequality undermines societal progress and raises critical concerns about our values as a nation. When wealth distribution flows into the hands of a few, our democracy is jeopardized, and opportunities for innovation and growth are thwarted.

Setting new standards for what constitutes ‘enough’ wealth could transform our understanding of success. If we view financial success not as limitless accumulation but as a means to secure comfort and community stability, we can recalibrate our aspirations. For instance, establishing a threshold of $30 million can help delineate between a richly fulfilled life and an obsession with wealth that can lead to undue power over political and economic systems. Reassessing wealth in this manner encourages a healthier narrative around financial success, prioritizing collective well-being over personal profit.

The Imlications of Income Inequality

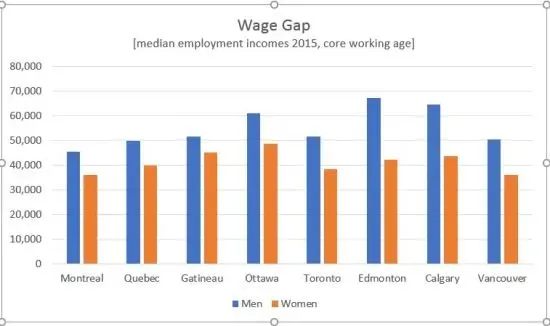

Income inequality remains a pervasive issue that fuels social discord and economic instability. The disproportionate wealth accumulation among ultra-rich individuals stands in stark contrast to the realities faced by low-income households, where financial security is often out of reach. As the wealth of the top 1% expands, the resources available to the general public diminish, harming social cohesion. Studies indicate that when wealth becomes overly concentrated, it leads to decreased investments in innovation, healthcare, and education—key drivers for social mobility and national success.

Moreover, income disparity negatively impacts cognitive function and mental health, particularly among those who struggle to meet their basic needs. Researchers have found that the stress associated with financial hardship diminishes cognitive capacity, reducing the ability to concentrate and innovate. Addressing income inequality through policies like the Billionaires Income Tax Act could alleviate some of these burdens, creating an environment where more people can think long-term and contribute meaningfully to society.

Frequently Asked Questions

What is the purpose of the Billionaires Income Tax Act?

The Billionaires Income Tax Act aims to require ultra-wealthy individuals to pay taxes annually on realized gains, rather than deferring them indefinitely. This proposal is intended to address income inequality and ensure that those with extreme wealth contribute their fair share to society.

How could a wealth tax help reduce income inequality in America?

A wealth tax, specifically one targeting households with assets above $30 million, could significantly reduce income inequality by redistributing excessive wealth to fund public initiatives, such as education and healthcare, promoting shared prosperity across all income levels.

What is the relationship between wealth tax and universal basic income (UBI)?

A wealth tax could provide the necessary funding for a universal basic income, allowing for financial stability and security for all citizens. By taxing wealth above a certain threshold, the government can ensure that everyone has access to basic needs and opportunities.

How might implementing a wealth tax influence financial success for average Americans?

Implementing a wealth tax can help redefine financial success by redirecting funds to support community programs and services, thus enhancing economic opportunities for average Americans. This proactive approach helps alleviate poverty and fosters an environment where everyone can strive for their own version of financial success.

What evidence supports the implementation of a wealth tax in the U.S.?

Evidence from successful pilots of programs like universal basic income indicates that cash transfers contribute to better mental health, reduced stress, and increased economic stability for families. Coupling this with a wealth tax on excessive accumulation can create a sustainable safety net that benefits society as a whole.

How does the current wealth distribution affect democracy and economic growth?

The current concentration of wealth among a small percentage of individuals can destabilize democracy and hinder economic growth. By taxing excessive wealth, we can prevent undue influence on political processes and encourage investments that benefit broader society, fostering a healthier democratic system.

What impact could a 50% wealth tax have on billionaires and the economy?

A 50% wealth tax on assets exceeding $30 million is designed not to punish entrepreneurship but to ensure that wealth contributes to the common good. This approach could raise substantial revenue, approximately $557 billion over ten years, which could then be redirected to benefit all, promoting shared prosperity.

Can a wealth tax lead to a better quality of life for everyday Americans?

Yes, a wealth tax can lead to improved quality of life for everyday Americans by funding essential public services and social safety nets, thereby providing greater financial security, access to resources, and opportunities for growth.

What are potential criticisms of a wealth tax?

Critics of a wealth tax often argue that it may disincentivize investments or harm economic growth. However, advocates argue that a structured wealth tax can stimulate broader economic benefits by reallocating resources towards community development and reducing economic disparities.

In what ways can a wealth tax contribute to shared prosperity?

A wealth tax can facilitate shared prosperity by leveling the playing field, allowing resources to be redistributed toward initiatives that uplift underserved communities, enhance educational opportunities, and support social services, ultimately leading to a more equitable society.

| Key Points |

|---|

| Financial success is ambiguously defined in America, leading to wealth concentration among a few individuals. |

| About a third of Americans cannot cover a $500 emergency, highlighting financial insecurity. |

| The wealthy disproportionately influence democracy and media, raising concerns about power imbalances. |

| The Billionaires Income Tax Act proposes taxing billionaires annually on realized gains to reduce wealth inequality. |

| Defining a wealth threshold, such as $30 million, promotes equitable distribution without stifling ambition. |

| A proposed simple wealth tax of 50% on wealth over $30 million could fund social programs and basic income. |

| Universal Basic Income (UBI) could be funded by taxing wealth and ensures dignity and opportunity for all. |

| Studies show UBI improves stability and doesn’t disincentivize work, promoting economic growth. |

Summary

Wealth tax plays a crucial role in addressing the stark income inequality prevalent in America today. By redefining what constitutes financial success and instituting a wealth tax, we can work towards shared prosperity for all citizens. This tax implementation can help fund initiatives like Universal Basic Income, ensuring that everyone enjoys basic security and opportunity, ultimately fostering a healthier, more equitable society.