The American stock market is navigating a landscape marked by volatility and opportunity, as it remains tantalizingly close to all-time highs amid renewed trade tensions. In recent months, stock market trends have been significantly influenced by excitement surrounding artificial intelligence investments, reminiscent of the tech boom that preceded the dotcom crash in 2000. While many investors are buoyed by the potential for innovation and growth, there is a growing concern about potential market correction risks that could disrupt this upward momentum. The current atmosphere leads to valid comparisons with historical market downturns, emphasizing the need for caution. As the world monitors developments in trade discussions, the future trajectory of the American stock market remains a focal point for investors and analysts alike.

The trading landscape in the United States reflects a complex interplay of economic factors and fluctuating investor sentiment, particularly as the nation confronts challenges in international commerce. The dynamics of equities, commodities, and indices are not only shaped by local conditions but also deeply intertwined with global trade relations. Investors are increasingly attentive to technologies, specifically artificial intelligence advancements, drawing parallels to earlier market phenomena that highlight financial risks, such as those seen during the tech bubble burst. As cautious optimism prevails, observers note the comparison to historical parallels and the potential for significant corrections. Consequently, navigating this intricate environment calls for keen awareness of the emerging tendencies and their implications for future market performances.

Recent Trends in the American Stock Market

The American stock market has seen significant fluctuations in recent months, primarily influenced by external factors such as renewed trade tensions and technological advancements. With stocks soaring to near all-time highs, investors are closely monitoring how geopolitical events might affect market trends. The interplay between international trade policies and stock performance underscores the volatility that can stem from uncertainty in global markets.

Moreover, while the market appears resilient thanks to a surge in sectors driven by artificial intelligence investment, experts caution that these gains could be misleading. The enthusiasm surrounding AI has prompted a massive influx of capital into technology stocks, reminiscent of the speculative bubbles seen during the dotcom boom. Yet, this exuberance raises questions about sustainability, calling for vigilant analysis of market correction risks.

Understanding Trade Tensions and Their Impact on Investment

Trade tensions have become a significant factor influencing the American stock market dynamics. Recent disputes between major economies can create ripples of uncertainty that directly impact investor confidence and market stability. As companies navigate tariffs and trade barriers, their stock prices often reflect these challenges, resulting in a mixed outlook across different sectors. These developments remind investors to factor in the global economic landscape when assessing portfolio risks.

In light of these trade complexities, strategic investment approaches are crucial. Investors are urged to diversify their holdings and consider sectors that may benefit from short-term volatility. Additionally, monitoring the shifting narratives around trade agreements can unveil potential market opportunities, supporting informed decision-making that aligns with long-term growth objectives.

Artificial Intelligence: A Double-Edged Sword for Investors

The surge in artificial intelligence investment has captivated market participants, leading many to believe that we’re witnessing the dawn of a new technological era. Companies that harness AI technology are experiencing remarkable growth, fueling a bullish sentiment that resonates through the stock market. However, this enthusiasm should be tempered with caution as investors assess the long-term viability of these innovations.

While the excitement surrounding AI draws parallels to the speculative spirit that catalyzed the dotcom crash, the underlying differences in technology and application warrant analysis. Unlike the early 2000s, AI possesses practical applications across various industries, potentially leading to sustainable financial returns. Yet, the risk of significant market correction remains a reality, emphasizing the need for due diligence amidst the hype.

Market Correction Risks: Lessons from the Past

As history has proven, market corrections are an inherent part of investing and can arise swiftly and unexpectedly. Given the current landscape, many investors wonder if the stock market is heading for a downturn similar to the dotcom crash. The factors driving the market today, such as booming technology stocks powered by AI, may not insulate it from future declines. Understanding the signs and implications of a potential correction is paramount for prudent investing.

Investors today can glean valuable lessons from the dotcom era, particularly in terms of market exuberance and overvaluation. During the late 1990s, many investors disregarded basic principles of valuation, chasing market trends that ultimately led to massive losses. In contrast, maintaining a disciplined investment strategy rooted in fundamentals can protect against the risks posed by an impending correction, helping investors weather the storm when it arises.

Comparing Today’s Market to the Dotcom Crash

The current stock market landscape has drawn inevitable comparisons to the dotcom crash, prompting discussions about what lessons can be learned. Both eras are characterized by rapid technological advancements and increased investor interest in tech stocks. However, it’s vital to recognize the distinguishing factors impacting today’s market, including improved regulatory environments and a more mature technological foundation that underpins current trends.

Despite these differences, the potential for a market correction looms large on the horizon. With many stocks trading at historically high multiples, analysts warn that a significant pullback could unfold if growth expectations falter. Investors must remain vigilant and informed, balancing their excitement for innovation with an awareness of the cyclical nature of markets.

Geopolitical Factors and Their Effects on Stock Performance

Geopolitical factors significantly influence stock performance in the American stock market, often creating waves of uncertainty. Trade negotiations, political unrest, and other global events can alter investor sentiment dramatically, leading to fluctuations in stock prices. Traders are tasked with continuously assessing these external pressures, incorporating geopolitical analysis into their investment strategies to mitigate risks and capitalize on opportunities.

Furthermore, the interconnectedness of today’s global economy means that localized tensions can have far-reaching implications for U.S. companies and, by extension, their stock prices. Investors should stay informed about international developments and consider geopolitical risks alongside financial metrics, ensuring they are well-prepared to navigate sudden market shifts.

The Role of Technology in Driving Market Growth

Technology continues to play a critical role in driving growth within the American stock market, particularly through advancements that have redefined entire industries. As companies invest heavily in innovative solutions, the sector is poised for further expansion, attracting a wide array of investors eager to capitalize on emerging trends. This past year has witnessed an accelerated adoption of tech solutions, making it a focal point in investment decisions.

However, the rapid pace of innovation also raises questions about sustainability and long-term viability. Investors must evaluate the companies behind these technologies, assessing their fundamentals and market positioning. Staying up-to-date with technological developments, regulatory changes, and competitive landscapes is crucial for navigating this dynamic sector effectively.

Preparing for Potential Market Downturns

As the American stock market experiences growth, the possibility of a downturn remains a relevant concern for investors. Effective preparation involves diversifying investment portfolios to hedge against risks associated with market corrections. By spreading investments across various asset classes, sectors, and geographies, investors can potentially mitigate losses in the event of a downturn.

In addition, staying informed and maintaining a disciplined approach to investing can enhance financial resilience. Regularly reviewing and adjusting investment strategies in response to market indicators—such as interest rates, economic data releases, and global events—can provide investors with the agility needed to respond to changing circumstances and protect their capital.

The Importance of Data-Driven Investment Strategies

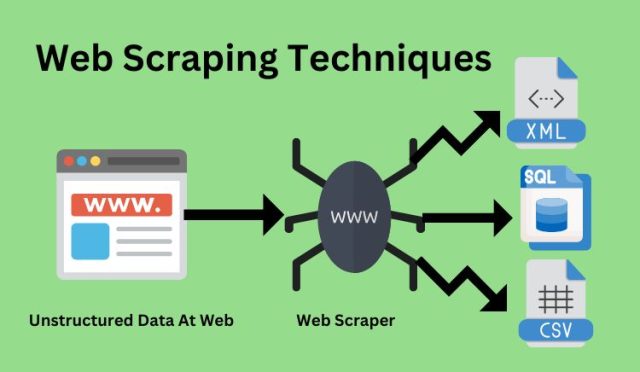

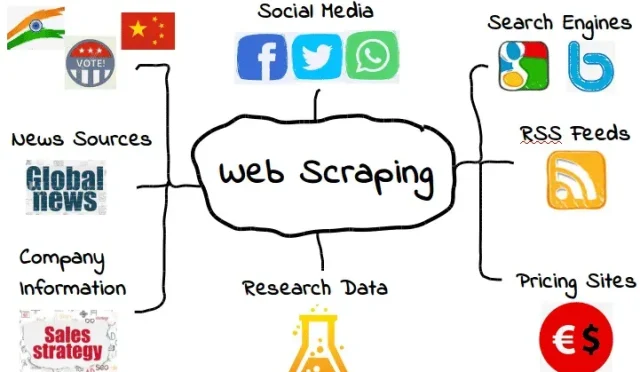

In the current investment landscape, data-driven strategies play a crucial role in identifying opportunities and informing decisions. Investors increasingly rely on analytics and technology to gain insights into market trends, making informed trades based on empirical data rather than emotions. This approach can enhance timing and positioning within the American stock market, particularly in volatile periods.

Additionally, leveraging data effectively allows investors to benchmark performance against market indices, evaluate risk factors, and develop tailored strategies that align with their financial goals. As information technology continues to evolve, the capacity for data analysis in investment decisions will only grow, empowering investors to navigate complexities with greater confidence.

Frequently Asked Questions

What are the current trends in the American stock market regarding trade tensions?

The American stock market is experiencing fluctuations primarily due to renewed trade tensions. These tensions can cause uncertainty among investors, impacting stock prices and market stability as traders react to news regarding tariffs and international relations.

How is artificial intelligence investment influencing the American stock market?

Investment in artificial intelligence is significantly influencing the American stock market, driving excitement and growth in tech stocks. This surge mirrors the enthusiasm of the late 1990s when tech advancements sparked immense market interest, highlighting both opportunities and risks for investors.

What are the risks of a market correction in the American stock market?

The American stock market faces notable market correction risks, particularly as current valuation levels are elevated. Investors are concerned that the ongoing rally, fueled by significant technological innovation, may lead to a correction reminiscent of previous market downturns.

How does the dotcom crash comparison relate to today’s American stock market?

Comparisons to the dotcom crash of 2000 are prevalent in discussions about today’s American stock market, especially with the high levels of investment in technology and artificial intelligence. Many investors worry that the current market exuberance could lead to a similar crash if valuations do not reflect sustainable growth.

What impact could a market correction have on the American stock market?

A market correction in the American stock market could have severe consequences, potentially leading to substantial losses for investors and widespread economic implications. The current market dynamics suggest that such a correction could be more extensive and far-reaching than those experienced in past decades.

| Key Point | Details |

|---|---|

| Market Fluctuations | The American stock market has seen fluctuations recently due to renewed trade tensions. |

| Market Highs | Despite fluctuations, the market remains close to its all-time high. |

| Artificial Intelligence Excitement | The rise in the market is largely influenced by excitement surrounding artificial intelligence. |

| Comparison to the Late 1990s | Analysts draw parallels between current market enthusiasm and the lead-up to the dotcom crash. |

| Investor Concerns | Investors are worried the current rally may lead to another market correction. |

| Potential Impact of a Crash | A future crash could have severe and globally extensive consequences compared to the dotcom crash. |

Summary

The American stock market is navigating through uncertain waters amid recent fluctuations driven by renewed trade tensions. Although it remains close to its all-time high, investors are increasingly wary of the excitement surrounding artificial intelligence, reminiscent of the late 1990s bubble. The potential for a significant market correction raises valid concerns among investors, who fear that any downturn could have more severe global repercussions than past crashes.