Wealth inequality in America has reached alarming levels, particularly as the wealthiest Americans have seen their fortunes skyrocket, benefitting profoundly from corporate tax cuts introduced during the Trump administration. With a staggering $700 billion increase among the ten richest individuals since Trump took office, many critics blame such policies for exacerbating the divide between the ultra-wealthy and the average citizen. Reports from Oxfam highlight how these billionaire tax policies have facilitated one of the largest upward wealth transfers in decades, effectively leaving low-income households struggling to make ends meet. As taxes for the richest continue to plummet, the burden seems to shift toward the nation’s most vulnerable, with alarming implications for socio-economic equity. An urgent discourse emerges around the necessity for reform to address and mitigate the stark wealth disparity that characterizes contemporary America.

The growing divide between the affluent and the impoverished in the United States has become a pressing concern, particularly involving discussions around economic disparity and resource distribution. In recent years, the financial gains of the richest individuals have raised eyebrows and fostered a sense of urgency to address inequitable fiscal policies. Many observers note that the significant tax breaks offered to high earners under political administrations have contributed to a stark disparity in wealth. Analysts and advocates alike are calling for reforms to ensure a more balanced economic landscape, where the affluent contribute their fair share and resources are fairly allocated to support those in need. As awareness of these issues grows, it becomes increasingly important to confront the systemic barriers that perpetuate economic injustice.

Understanding Wealth Inequality in America

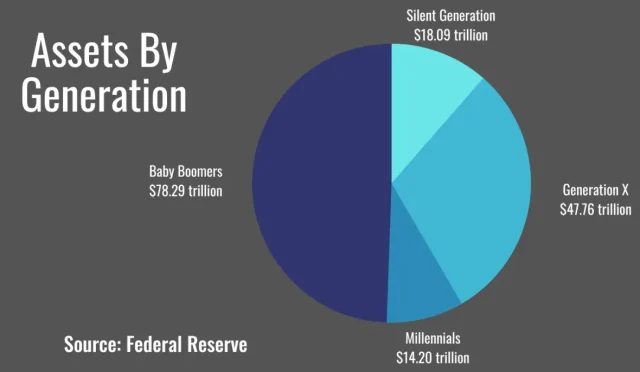

Wealth inequality in America has become an increasingly pressing issue, with the latest statistics revealing a widening gap between the richest individuals and the average citizen. Recent reports indicate that the ten wealthiest Americans have collectively seen their fortunes surge by a staggering $700 billion since the start of Donald Trump’s term. This highlights a critical concern: while the wealthiest individuals enjoy unprecedented financial growth, millions of Americans struggle to make ends meet, with more than 40 percent of the population living below double the federal poverty line.

The increasing disparity fueled by billionaire tax policies and corporate tax cuts has prompted calls for reform. Senator Elizabeth Warren has been vocal about the need for a wealth tax, arguing that the current tax system disproportionately benefits the ultra-rich while leaving low-income families to bear an unfair burden. According to her, the wealth amassed by the top 1 percent has grown at an alarming rate, illustrating a systemic issue that requires immediate attention to ensure a more equitable society.

The Impact of Corporate Tax Cuts on Wealth Distribution

Corporate tax cuts have been touted as a means to stimulate economic growth; however, evidence suggests they have exacerbated wealth inequality in America. The Big, Beautiful Bill, signed into law by the Trump administration, slashed corporate tax rates significantly, allowing billionaires and large corporations to amass even greater wealth. This policy has raised concerns among economists and social advocates who argue that the benefits of such cuts have not trickled down to the working-class families who need them the most.

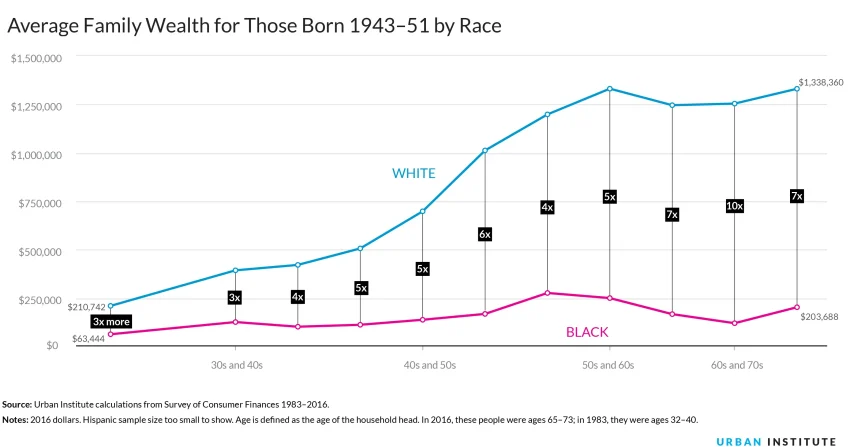

Instead of strengthening the economy for all, these tax reductions have led to an increase in financial resources for the wealthiest individuals while igniting backlash against rising taxes for lower-income households. The disparity is further emphasized by the Oxfam report that indicates the richest in America have gained nearly 987 times more wealth than those at the bottom of the economic spectrum. This trend not only threatens economic diversity but also raises urgent questions about the sustainability of such income distribution in the long run.

Exploring the Role of Billionaires in Political Influence

Billionaires have increasingly played a pivotal role in shaping political landscapes in America, particularly during the Trump administration. With a network of mega-corporations funding significant initiatives, the political influence wielded by the wealthiest individuals is profound. During Trump’s inauguration, prominent billionaires like Elon Musk and Jeff Bezos were in attendance, signaling a merging of wealth and influence that raises ethical questions about governance and representation.

Abby Maxman, President of Oxfam America, emphasizes that this new American oligarchy threatens democratic processes, as the interests of billionaires often overshadow those of average citizens. The correlation between corporate funding and political power could lead to policies that favor the rich, perpetuating a cycle where wealth concentration undermines the democratic ideals of equality and opportunity for all.

The Social Implications of Growing Wealth Disparities

The social ramifications of wealth inequality in America extend far beyond economics. As billionaires continue to accumulate vast fortunes, the struggles of low-income households become more pronounced. Families find it increasingly difficult to afford basic necessities like housing, healthcare, and education. This creates a cycle of poverty that affects not only individuals but entire communities, leading to strained social systems and increased public discontent.

As highlighted in the Oxfam report, the consequences of this growing divide perpetuate a sense of hopelessness among lower-income populations. The increasing visibility of the wealth gap has led to heightened awareness and activism; however, meaningful change necessitates comprehensive policy reforms aimed at wealth redistribution and closing the gap. Addressing these issues is crucial to fostering a more inclusive future and preventing societal unrest.

The Consequences of Billionaire Tax Policies

Billionaire tax policies under the Trump administration have prompted sharp criticism, reflecting broader concerns regarding fiscal fairness. With tax cuts favoring individuals with substantial resources, numerous advocates argue that these policies benefit a select few at the expense of the general population. The result is a tax system that, according to some experts, needs to be unrigged to ensure that the wealthiest contribute a fair share to the economy.

Detractors of these policies argue that wealth concentration has detrimental effects on economic mobility and innovation. When tax policies disproportionately favor billionaires, it stifles competition and opportunities for small businesses and emerging entrepreneurs. A more equitable tax system must be enforced to ensure that wealth generated within the economy is reflected back into public services and social infrastructure.

Evaluating Economic Growth Versus Income Inequality

While proponents of the corporate tax cuts argue they are essential for economic growth, the resulting income inequality raises alarm bells among economists. Reports indicate that while the economy continues its ascent, the benefits are not being shared equally among all Americans. The stark contrast between the fortunes of billionaires and the struggles of everyday citizens poses an ongoing question: can sustainable economic growth be achieved without addressing income inequality?

Senator Warren’s critique highlights the necessity for a thorough evaluation of support structures that simultaneously encourage entrepreneurial ventures while distributing wealth more evenly. Economic policies should reflect not just raw growth metrics but also the well-being of the entire population, as true progress should encompass inclusive opportunities for all, thereby fostering long-term stability in the nation’s economic landscape.

The Future of Wealth in America

Looking towards the future, the question of wealth distribution in America cannot be overlooked. The shift toward a more equitable future necessitates comprehensive reforms, including readdressing tax codes and engaging in dialogue about wealth redistribution. As public concern over wealth inequality grows, policymakers must grapple with the challenges of implementing effective solutions that address systemic issues and provide relief for lower-income households.

Additionally, there is increasing recognition that investing in public services and community support systems is essential for sustainable wealth creation. This shift in mindset encourages a collective approach towards building a fairer economy, where the contributions of all citizens are valued, and opportunities for upward mobility are accessible to everyone. Such changes may lead to a reshaped economic landscape, promoting both equity and prosperity.

The Role of Public Awareness and Advocacy

Public awareness about wealth inequality and its consequences is crucial to stimulating change. With reports like that from Oxfam America shedding light on the disparities faced by low-income families, advocacy efforts are growing as citizens demand government accountability. Grassroots movements are increasingly essential in pressing for policy reforms aimed at addressing the systemic issues that underpin wealth inequality.

As more individuals become informed about the impact of current billionaire tax policies, there is a growing chorus advocating for a more equitable tax system. Initiatives promoting wealth taxes and corporate accountability seek to create a balance between growth and fairness, advocating for changes that prioritize the needs of the many over the interests of the few.

Assessing the Economic Policies of the Trump Administration

The economic policies of the Trump administration have been a focal point in the discussion of wealth inequality in America. By instituting significant corporate tax cuts and supporting billionaire tax policies, the administration has been accused of favoring the wealthiest Americans, resulting in increased financial strain on low-income households. Critics argue that these decisions have driven a wedge further between the affluent and the economically disadvantaged.

Furthermore, the lasting effects of such policies continue to reverberate through the economy, raising important questions about the future of capitalism in America. A critical assessment of these practices is necessary to evaluate their sustainability and the overall impact on economic health, potentially paving the way for reforms that prioritize equitable growth.

Frequently Asked Questions

How has wealth inequality in America been affected by the Trump administration?

Wealth inequality in America has been exacerbated by the Trump administration, particularly through corporate tax cuts and billionaire tax policies that have disproportionately benefited the wealthiest Americans. Reports indicate that these actions have facilitated a significant upward transfer of wealth, making the divide between the rich and the poor even wider.

What does the Oxfam report say about wealth inequality in America?

The Oxfam report highlights alarming statistics about wealth inequality in America, noting that the fortunes of the wealthiest Americans have soared while the conditions for low-income families have worsened. It claims that one of the largest transfers of wealth upwards in decades has occurred, significantly benefiting billionaires at the expense of those in the lower income brackets.

How did corporate tax cuts impact wealth distribution in America?

Corporate tax cuts enacted during the Trump administration have had a profound impact on wealth distribution in America, primarily benefiting the wealthiest Americans and corporations. These cuts reduced taxes for billionaires while increasing the tax burden on lower-income households, further perpetuating wealth inequality.

What has been the financial trend for billionaires during the Trump administration?

During the Trump administration, the financial trend for billionaires has been overwhelmingly positive, with reports showing a substantial increase in their wealth. For instance, one report indicated that U.S. billionaires gained $698 billion over just one year, highlighting the stark contrast in economic experiences between the ultra-wealthy and the rest of the population.

How do billionaire tax policies contribute to wealth inequality in America?

Billionaire tax policies contribute to wealth inequality in America by allowing the wealthiest individuals to pay significantly lower taxes compared to average workers. These policies, often implemented under the Trump administration, lead to substantial wealth accumulation among billionaires while leaving a majority of the population struggling with stagnant wages and rising costs of living.

What role did Senator Elizabeth Warren play in addressing wealth inequality in America?

Senator Elizabeth Warren has been a vocal advocate for addressing wealth inequality in America. She has proposed a wealth tax targeting the wealthiest Americans and emphasized the need for systemic reforms, including breaking up large corporations and unrigging the tax code, to ensure fairer distribution of wealth and support for working families.

What challenges do low-income families face amidst growing wealth inequality in America?

Amidst growing wealth inequality in America, low-income families face numerous challenges including struggles to afford basic necessities such as housing, healthcare, and groceries. Over 40 percent of the population lives on less than twice the federal poverty line, highlighting the stark economic divide that has worsened as the wealthiest Americans continue to amass unimaginable fortunes.

What evidence supports the claim of an ‘American oligarchy’ in relation to wealth inequality?

Evidence supporting the claim of an ‘American oligarchy’ in the context of wealth inequality includes reports of rampant wealth accumulation among billionaires and mega-corporations, which have thrived under favorable policies enacted during the Trump administration. Frequent mentions of the substantial profits made by billionaire CEOs and the disparities in wealth compared to ordinary workers underline this claim.

| Key Points |

|---|

| The ten wealthiest Americans increased their wealth by $700 billion since January 2023. |

| Trump’s administration’s tax policy, particularly the Big, Beautiful Bill, reduced corporate taxes and taxes for billionaires. |

| In contrast, taxes on low-income households are expected to increase, exacerbating wealth inequality. |

| The wealthiest 1% gained significantly more wealth than the poorest 20% over the past year, by a factor of 987 times. |

| 40% of the U.S. population is classified as low-income, struggling to meet basic needs. |

| Senator Elizabeth Warren and Oxfam America highlight the growing chasm between the wealthy and the poor, referring to it as the new American oligarchy. |

| Billionaires have profited significantly during Trump’s presidency, with claims of the Trump family making $3.4 billion from various ventures. |

Summary

Wealth inequality in America has become a pressing issue as the richest individuals manage to amass incredible fortunes while the majority of the population struggles financially. The alarming rise of the wealth of the top ten billionaires by $700 billion, driven by tax policies favoring the wealthy, reflects a system that increasingly prioritizes wealth accumulation at the top. With substantial gains for the ultra-rich resulting in significant losses for low-income households, it is clear that wealth inequality is not just a societal issue, but an economic threat that undermines the very fabric of American democracy.