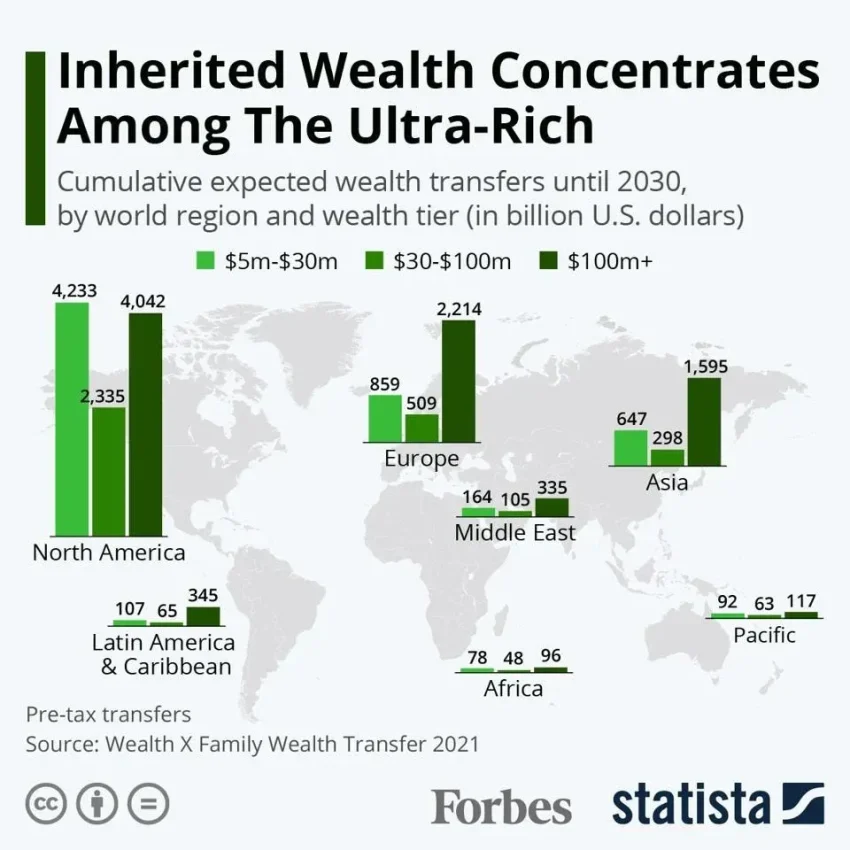

Inherited wealth is poised to play a significant role in shaping economic landscapes globally, with more than $70 trillion (£53 trillion) expected to be transferred across generations in the coming decade. This staggering figure is not merely a relay of fortunes; it represents a catalyst for rising wealth inequality and has prompted urgent calls for G20 intervention. Economists, including Nobel laureate Joseph Stiglitz, warn that such concentrated inheritance trends will exacerbate global inequality, threatening democratic structures and stifling societal progress. The continuing disparities highlighted in the latest reports underline the imperative for robust economic policies to address these chasms effectively. As the world grapples with these challenges, the discussion around inherited wealth becomes increasingly pivotal in the fight against the widening divide between the rich and the poor.

When examining the dynamics of wealth transmission, the phenomenon of generational wealth transfer can be seen as a pivotal factor in perpetuating economic disparities. The concentration of assets among a small elite continues to reshape the financial terrain, leading to alarming patterns of global inequality that demand immediate attention. Social theorists and policymakers alike recognize the urgent need for intervention as highlighted by leading economists, including Joseph Stiglitz. By redefining our approach toward economic policies, particularly those governing inheritance, we can pave the way for a fairer distribution of resources. Addressing these critical issues will not only combat the cycle of wealth accumulation among the few but also ensure a more equitable socio-economic environment for all.

The Disparity of Inherited Wealth

Inheriting wealth can create substantial disparities in economic opportunity, leading to a widening wealth gap that affects both social structures and individual aspirations. With over $70 trillion projected to be inherited globally in the next decade, this transfer of wealth is likely to entrench elite status, perpetuating cycles of privilege for a select few while limiting access for those less fortunate. The implications of such inherited wealth exacerbate existing wealth inequality, where the wealthy continue to accumulate resources and opportunities while the lower segments of society struggle to gain a foothold.

Moreover, the generational transfer of wealth often comes without the necessary responsibilities or investment in community enrichment, leading to increased global inequality. Without stringent policies to address this issue, such as inheritance taxes or equitable wealth distribution frameworks, the society’s stratification will only intensify. Addressing the issue of inherited wealth is thus essential for fostering inclusivity and promoting social mobility, ensuring that future generations have fair chances to succeed.

The Urgency for G20 Intervention

The G20’s role has never been more critical in addressing the looming crisis of wealth inequality exacerbated by inherited wealth. With economists like Joseph Stiglitz emphasizing that over 80% of the world’s nations are witnessing increased inequality, the G20 must rise to the occasion. The evidence suggests that countries with high inequality face greater risks of democratic decline, presenting an urgent call for the G20 to establish a sustainable monitoring group akin to the UN Intergovernmental Panel on Climate Change. This panel could not only track wealth transition trends but also propose actionable policies tailored to mitigate the impacts of growing economic disparity.

Furthermore, the anticipated G20 intervention serves as a beacon of hope for equitable economic policies that could reverse the trends outlined in current analyses. With campaigners advocating for a high-level panel to monitor inequality, the G20 may indeed pioneer initiatives that prioritize systemic changes over mere surface-level adjustments. This proactive approach could ultimately reshape how wealth is distributed and inherited, promoting a fairer and more just global economic landscape.

Joseph Stiglitz’s Insights on Economic Policies

Prominent economist Joseph Stiglitz argues that effective economic policies are essential in combating the entrenched inequality that results from inherited wealth. His work underscores the need for systemic change through innovative approaches to taxation, particularly inheritance taxes, which have the potential to mitigate the impacts of wealth concentration. By advocating for a permanent G20 panel to scrutinize and assess policies aimed at inequality, Stiglitz emphasizes the importance of informed governance and international cooperation in tackling this global issue.

Stiglitz’s insights reveal that without proactive economic policies, the wealthiest segments of society will continue to accumulate capital, resulting in a society where the rich get richer, exacerbating the plight of the poor. His call to action for the G20 highlights the necessity for collaborative efforts among nations to share best practices and foster policies that promote equitable wealth distribution, thereby creating a more balanced and inclusive global economy.

Global Inequality: A Cause for Alarm

The increasing global inequality, particularly the concentration of wealth among a small elite, is alarming. According to studies, the richest 1% captured a staggering 41% of all new wealth generated from 2000 to 2024. This trend not only highlights the disproportionate distribution of resources but also raises concerns about social stability and economic growth. Economists warn that as wealth continues to be passed down, it could undermine efforts intended to promote social mobility and equitable opportunities for all.

Global inequality impacts various aspects of societal function, leading to disenfranchisement and growing discontent amongst the less privileged. The evidence suggests that nations with stark wealth disparity are at a significantly higher risk of facing democratic declines, as the social contract between the wealthy and the poor deteriorates. Thus, it is imperative for global leaders, particularly within the G20, to convene and devise strategies that address the root causes of this inequality in order to sustain democratic integrity and social cohesion.

The Role of Economic Policies in Mitigating Inequality

Effective economic policies play a vital role in redressing inequality by ensuring fair taxation, equitable representation, and access to opportunities. Governments can implement measures such as progressive taxation systems that target the ultra-wealthy to help redistribute wealth more equitably. The findings of the recent report underscore the necessity of adopting comprehensive fiscal policies aimed at addressing the inherent imbalance caused by inherited wealth.

In addition to taxation, economic policies should focus on enhancing social safety nets and investing in public services that benefit the wider population. By prioritizing education, healthcare, and infrastructure development, nations can empower their citizens, fostering a climate where social mobility is achievable. Addressing economic disparities through coherent economic policies not only supports the development of a fairer society but also strengthens democratic foundations that can withstand the pressures of inequality.

The Impact of Inherited Wealth on Social Mobility

Inherited wealth significantly impacts social mobility, often creating barriers that hinder equal opportunity for the less affluent. The transfer of wealth from one generation to the next can result in a lack of motivation for individuals to pursue education or career advancement, as the safety net of inherited wealth provides a cushion. This phenomenon contributes to the overarching issue of inequality, hindering a society where all individuals have the chance to thrive based on merit rather than familial connections.

The report highlights that without systematic interventions, the consequences of inherited wealth will continue to span generations, resulting in a society markedly divided along economic lines. A focused approach on social policies that increase access to education, job training, and equitable financial resources is essential to countering the effects of inherited wealth and promoting social mobility. By dismantling these barriers, societies can cultivate environments where achievements are based on individual capabilities, contributing to a more balanced economic landscape.

Responses to Wealth Inequality Crisis

The response to the burgeoning wealth inequality crisis is multi-faceted, requiring a collaborative approach among nations and communities. Efforts towards reforming economic systems must include a deep understanding of the factors contributing to wealth accumulation and distribution. Strategies such as enforcing equitable taxation policies, regulating monopolies, and promoting social entrepreneurship can help level the economic playing field, addressing the symptoms of wealth inequality.

In addition, grassroots movements and civil society organizations play a critical role in advocating for change. These organizations often raise awareness about the repercussions of inherited wealth, pushing for political action that addresses systemic inequalities. By fostering dialogue among citizens, policymakers, and economists, a clearer path toward sustainable solutions can be developed, touching on critical issues of wealth redistribution and equitable access to resources.

The Psychological Effects of Wealth Inequality

The psychological consequences of wealth inequality are profound and can lead to feelings of inadequacy, frustration, and disenchantment among those affected by economic disparities. Studies indicate that individuals from lower socio-economic backgrounds often experience marginalization, which can negatively impact their mental health and overall well-being. The perception of a rigid social structure, where mobility appears unattainable due to inherited wealth among the elite, fosters disillusionment and societal divisions.

In response, it is essential to cultivate narratives that emphasize inclusivity and shared prosperity, thereby reshaping societal perceptions of wealth and success. Initiatives that highlight stories of success achieved through hard work and innovation can inspire hope in marginalized communities. By fostering environments that celebrate diverse achievements, societies can mitigate the negative psychological effects associated with wealth inequality and encourage collective actions towards a more equitable future.

Conclusion: A Call to Action against Inequality

In conclusion, the growing trends of inherited wealth and the corresponding rise in wealth inequality present significant challenges that require urgent, coordinated action. The recommendations from experts like Joseph Stiglitz for establishing a permanent G20 panel to monitor inequality signify a necessary step toward addressing these issues on a global scale. Countries must seek not only to understand their own economic environments but also to collaborate and learn from each other’s successes and failures in combating inequality.

The collective action of the G20 can drive the development of effective economic policies that address the root causes of inequality, ensuring that wealth is not merely transferred but rather equitably distributed. As nations come together to shape a more just economic landscape, the hope for a future where opportunities are accessible to all, regardless of background, remains a strong motivator for continued advocacy and reform.

Frequently Asked Questions

How does inherited wealth contribute to global wealth inequality?

Inherited wealth significantly exacerbates global wealth inequality, as the vast majority of wealth is passed down across generations. Studies suggest that from 2000 to 2024, the wealthiest 1% will capture 41% of all new wealth, leaving only 1% for the bottom half of the population. This trend highlights how inherited wealth perpetuates the economic divide, making it harder for those without legacy wealth to achieve social mobility.

What role does the G20 play in addressing inherited wealth and inequality?

The G20 is crucial in addressing inherited wealth and global inequality, as it consists of major economies that can implement policies to mitigate these issues. A recent report calls for the G20 to establish a permanent monitoring panel to assess trends in inequality, including the impact of inherited wealth on social structures and democratic institutions.

Who is Joseph Stiglitz and how does he connect to the issue of inherited wealth?

Joseph Stiglitz is a Nobel Prize-winning economist who emphasizes the dangers of inherited wealth in exacerbating inequality. He leads a panel advocating for G20 intervention to monitor economic policies related to wealth distribution, suggesting that without addressing inherited wealth, global inequality will continue to rise, threatening democratic processes.

What implications does inherited wealth have for democracy and social equity?

Inherited wealth can lead to significant democratic decline, as higher inequality levels correlate with diminished democratic institutions. Countries with high inherited wealth and wealth inequality are often seven times more likely to experience democratic backsliding, indicating that addressing inherited wealth is essential for fostering social equity and robust governance.

How do economic policies affect inherited wealth and global inequality?

Economic policies directly influence the distribution of inherited wealth and the resulting global inequality. The lack of effective inheritance taxes allows wealth to accumulate within elite families, perpetuating a cycle that disadvantages lower-income groups. Policymakers, particularly within the G20, must explore solutions to curb the growing trend of inherited wealth that undermines economic fairness.

What actions are being proposed to manage the impacts of inherited wealth on society?

To manage inherited wealth’s impact, various proposals recommend establishing dedicated monitoring bodies to track wealth inequality trends. The G20 is being urged to adopt such measures, focusing on implementing policies that could limit the concentration of wealth, thereby enhancing social mobility and addressing the adverse consequences of inherited wealth.

| Key Point | Details |

|---|---|

| Inherited Wealth Projection | Over $70 trillion is expected to be inherited globally in the next decade. |

| Impact on Inequality | Increased inherited wealth is likely to exacerbate global inequality, particularly between the rich and the poor. |

| Need for Intervention | Economists urge G20 intervention to monitor and address rising inequality. |

| Global Trends | Increased inequality reported in over 80% of countries, with significant implications for democracy. |

| Consequences of Inequality | Countries with high inequality face greater risks of democratic decline. |

| The Role of G20 | The G20 aims to create a framework for monitoring and addressing global wealth disparities. |

| Economic Efficiency | Compounded wealth and lack of inheritance taxes lead to reduced social mobility. |

Summary

Inherited wealth has become a pressing issue as over $70 trillion is projected to be passed down through generations worldwide, leading to an increase in inequality. The need for proactive measures by global leaders, especially within the G20, is crucial in monitoring this trend and fostering equality. Without intervention, the consequences of inherited wealth could undermine democratic institutions and social structures, making it imperative for nations to collaborate on effective policies to address these growing disparities.