Bank of America wealth management stands at the forefront of the banking industry’s approach to personal finance, especially for affluent clients looking to secure and grow their financial legacies. With a firm commitment to a robust wealth management strategy, the bank is not only expanding its services but also streamlining operations to ensure investment growth that surpasses market expectations. In a landscape marked by fierce banking sector competition, Bank of America aims to capitalize on the impending wealth transfer from Baby Boomers to their heirs, potentially reshaping the financial services domain. The institution is strategically positioning itself to capture a significant portion of the estimated $84 trillion to $124 trillion at stake, responding to the evolving needs of high-net-worth individuals. By integrating advanced digital solutions and personalized services, Bank of America wealth management is setting new standards in client engagement and asset management.

In the realm of financial advisory and investment guidance, the prominence of Bank of America’s wealth management division highlights its dedication to serving high-net-worth individuals and families. As the competition among banking institutions intensifies, particularly for the young affluent demographic, the bank’s innovative wealth management approaches promise to deliver tailored investment strategies that resonate with clients’ values and financial aspirations. The anticipated generational wealth transition presents a unique opportunity for financial entities to enhance their offerings and secure meaningful client relationships. Bank of America’s proactive stance in integrating cutting-edge technology into its advisory services stands out, ensuring it meets the diverse needs of today’s wealth holders. With capitalized efforts toward personalized financial management, the institution is well-prepared to navigate the intricacies of wealth transfer and investment growth.

Strategic Investments in Wealth Management by Bank of America

Bank of America is significantly advancing its position in the wealth management sector, setting ambitious targets for growth and expanding its services tailored to affluent clients. During its inaugural investment day in Boston, executives detailed a robust strategy aimed at achieving a net new asset growth rate of 4% to 5% in the Merrill Wealth Management division over the next few years. This strategic focus not only highlights the bank’s dedication to investment growth but also illustrates a commitment to meeting the evolving needs of its high-net-worth clientele.

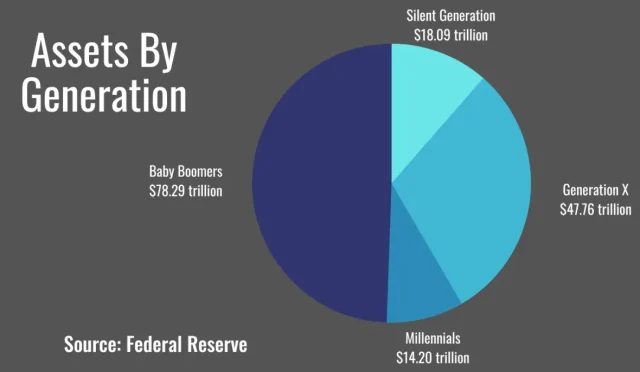

The drive towards enhanced wealth management services is part of a broader initiative to compete against rivals in the banking sector while capitalizing on the impending wealth transfer anticipated within the next few decades. With an estimated $84 trillion to $124 trillion expected to change hands from Baby Boomers to their heirs, Bank of America is positioning itself as a leader in facilitating this transition. The bank’s strategic investments reflect a deep understanding of the market opportunities within the affluent demographic, reinforcing its aim to deliver superior financial solutions.

Navigating The Great Wealth Transfer: Opportunities Ahead

As the U.S. prepares for what is being dubbed “The Great Wealth Transfer,” the potential for wealth management firms to capitalize on this generational shift is monumental. Bank of America, with over 20 million millionaires in the U.S. alone, recognizes the opportunity to cater to affluent clients who will soon be inheriting vast fortunes. This transformative moment in financial services underscores the need for personalized strategies that address the unique challenges and aspirations of high-net-worth individuals.

Furthermore, the expected wealth transfer will not only impact asset management strategies but also change the dynamics of family wealth and philanthropy. Bank of America is keen to engage heirs and charities with values-based investing options that resonate with their ideals, thereby securing a broader client base that values ethical and responsible investing. This focus aligns with the bank’s larger goal to establish long-lasting relationships with new generations of wealth holders.

Competing for New Clients: Millennials and Generation Z

To remain competitive in the fast-evolving banking landscape, Bank of America is actively enhancing its wealth management services aimed at attracting Millennials and Generation Z. These younger generations are not just looking for traditional banking solutions; they desire integrated services that align with their values and are enriched by advanced digital technologies. Understanding this shift, Bank of America is poised to implement innovative strategies to capture this market segment effectively.

Moreover, the integration of technology into wealth management practice—like utilizing AI in client-advisor matching—demonstrates the bank’s commitment to modernizing its advisory processes. By catering to the preferences of younger clients who expect seamless digital experiences, Bank of America is not only expanding its service offerings but also ensuring that it remains relevant in a competitive landscape. This dual focus on technology and tailored services positions the bank as a forward-thinking entity in the wealth management sphere.

The Importance of Advisor Development and Recruitment

Recognizing that human capital is key to success, Bank of America is heavily investing in the development and recruitment of its advisor workforce. With approximately 15,000 advisors, the focus on training ensures that new hires are equipped with foundational skills and advanced knowledge necessary to serve affluent clients effectively. This comprehensive development program indicates the bank’s belief in fostering talent within the organization, which is vital for sustainable growth in wealth management.

Additionally, the emphasis on recruitment highlights the bank’s ambition to strengthen its position in the competitive wealth management market. As banks across the sector vie for top talent, attracting skilled advisors becomes crucial for fostering relationships with high-net-worth clients. The investment in training and recruitment not only supports organic growth but also enhances the overall competency of the advisor team, making it more adept at navigating the complexities of wealth management.

Utilizing Technology to Enhance Wealth Management Services

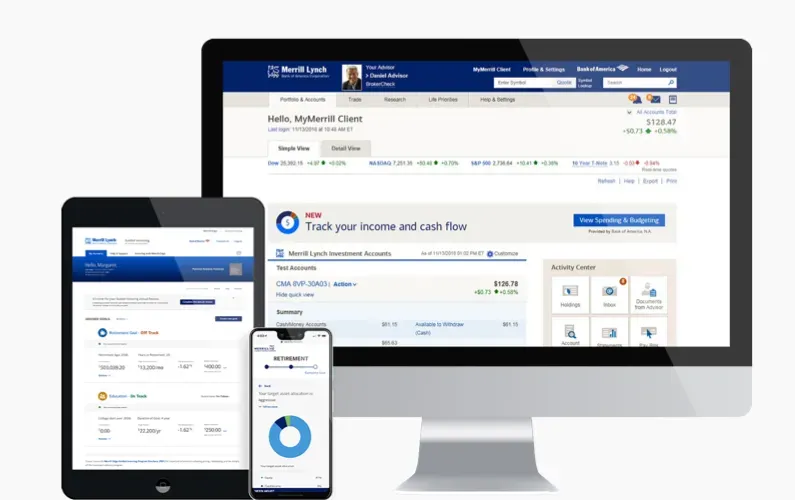

In today’s technologically driven world, Bank of America is leveraging advanced tools such as AI to refine its wealth management services. By implementing programs like Merrill’s Advisor Match, the bank aims to optimize the client and advisor pairing process, ensuring enhanced satisfaction and better outcomes for clients. This not only exemplifies the bank’s commitment to innovation but also demonstrates a strategic approach to connecting with affluent clients who seek tailored financial solutions.

Furthermore, the application of technology streamlines the onboarding process for new advisors, allowing them to focus more on client development and less on administrative tasks. As advisors use AI to accelerate relationship building, they can devote their energy to cultivating a solid clientele base. Bank of America’s commitment to integrating technology into its wealth management strategy not only sets it apart from competitors but also enhances the overall client experience.

Enhancing Client Experience Through Personalized Services

Client experience is paramount in the wealth management sector, especially when targeting affluent clients. Bank of America understands the critical importance of personalization in meeting the unique needs of its high-net-worth clientele. Through extensive training and a deep understanding of client preferences, advisors are equipped to offer tailored financial solutions that align with individual goals, enhancing client satisfaction and loyalty.

Additionally, the bank’s focus on building enduring relationships through improved service delivery is designed to attract and retain clients amidst fierce competition. By prioritizing client engagement and feedback, Bank of America is adapting its wealth management strategies to address the specific desires of its clients, potentially enhancing client retention and attracting new affluent clientele looking for bespoke financial advice.

Positioning for Growth in a Competitive Industry

As Bank of America navigates the intricate landscape of wealth management, its robust approach towards competition is pivotal. The bank is not only looking to secure veteran advisors but is also actively pursuing fresh talent to foster innovation and expand its service capabilities. This dual strategy helps Bank of America position itself as a leader in the industry, capable of compellingly engaging both traditional affluent clients and those from newer, younger demographics.

Moreover, the bank’s commitment to maintaining a strong market presence—holding a 14% share in the ultra-high-net-worth market—is indicative of its stability and ambition to scale. By continuously refining its wealth management offerings to appeal to the evolving tastes of clients, Bank of America ensures that it remains a compelling choice amidst increasing competition, laying the groundwork for sustained growth in the coming years.

Optimizing Financial Solutions for Ultra-High-Net-Worth Families

In recognizing the unique financial needs of ultra-high-net-worth families, Bank of America is strategically optimizing its wealth management solutions to address complex family dynamics and the intricacies of wealth transfer. This segment requires bespoke services that consider both wealth management strategies and legacy planning. By tailoring solutions that incorporate values-based investing alongside traditional investment growth, Bank of America stands out as a preferred partner for affluent families.

Further to this, the bank’s commitment to philanthropy and social impact investing resonates with ultra-high-net-worth clients who prioritize leaving a positive legacy. As such, Bank of America is adeptly positioning itself to support wealthy families in both amassing wealth and ensuring that their financial legacies align with their values, thus enhancing its service appeal within this lucrative market.

The Future of Wealth Management: Embracing Change and Innovation

The future of wealth management is poised for dynamic change, driven by shifting client expectations and rapid technological advancements. Bank of America embraces this change by fostering a culture of innovation—integrating cutting-edge technologies, such as AI and data analytics, to enhance decision-making and client interactions. This strategic embrace of innovation not only elevates the bank’s advisory services but also sets a standard for excellence in the wealth management industry.

Moreover, as client demographics evolve, so too will their expectations regarding financial services. Bank of America recognizes the importance of adapting its wealth management strategies to stay ahead of industry trends and client preferences. By continuously investing in technology and enhancing advisor capabilities, the bank ensures a competitive edge that is positioned to respond effectively to emerging trends in the marketplace.

Frequently Asked Questions

What is Bank of America’s wealth management strategy for affluent clients?

Bank of America’s wealth management strategy focuses on catering to affluent clients by enhancing personalized services and investment growth opportunities. The bank aims to achieve a net new asset growth rate of 4% to 5% over the next three to five years in its Merrill Wealth Management segment, indicating a strong commitment to serving this demographic.

How does Bank of America plan to compete in the wealth management sector?

Bank of America is investing heavily in its wealth management division to stay competitive against other major banks like JPMorgan Chase and Citigroup. By expanding its advisor workforce and utilizing advanced technologies like AI for client-advisor matching, the bank aims to attract more affluent clients and optimize client relationships, thereby enhancing investment growth.

What is ‘The Great Wealth Transfer’ and how does it affect Bank of America wealth management?

‘The Great Wealth Transfer’ refers to the estimated $84 trillion to $124 trillion of wealth expected to shift from Baby Boomers to their heirs and charities by the mid-2040s. Bank of America is strategically positioning its wealth management services to capture this opportunity by focusing on affluent clients, particularly through values-based investing and innovative financial solutions.

How does Bank of America enhance the investment growth prospects for ultra-high-net-worth clients?

Bank of America enhances investment growth for ultra-high-net-worth clients by leveraging its national footprint, with a 14% market share in this sector. The bank combines institutional investment strength with personalized service, helping clients to effectively transfer wealth and achieve their financial goals.

What recruitment strategies does Bank of America implement in its wealth management division?

Bank of America employs robust recruitment strategies to grow its wealth management division, notably through a comprehensive advisor development program. This program helps new hires transition from basic skills to advanced roles, ensuring that the bank maintains strong client relationships and supports investment growth in the competitive banking sector.

How does Bank of America’s wealth management services address the needs of younger clients?

Bank of America’s wealth management services are increasingly tailored to meet the needs of younger clients, including Millennials and Generation Z. The bank focuses on integrating advanced digital solutions and values-based investing options, which resonate with these emerging affluent demographics.

What role does technology play in Bank of America’s wealth management services?

Technology plays a crucial role in enhancing Bank of America’s wealth management services. The use of AI, particularly through tools like the Advisor Match program, allows for efficient client-advisor matching, streamlining the process of establishing strong relationships that are essential for investment growth.

| Key Area | Details |

|---|---|

| Investment Focus | Significant investment in wealth management to target affluent clients. |

| Inaugural Investment Day | Held on November 5, 2021, in Boston, first since 2011. |

| Growth Targets | Targeting 4-5% net new asset growth at Merrill Wealth Management over the next 3-5 years. |

| Revenue vs. Expenses | Aiming for revenue growth nearly double that of expenses, with a return on allocated capital target of 30%. |

| U.S. Wealth Market Potential | U.S. has over 20 million millionaires, presenting a strong opportunity for wealth management. |

| The Great Wealth Transfer | Projected transfer of $84 trillion to $124 trillion from Baby Boomers to heirs and charities by mid-2040s. |

| Market Share | 14% market share in ultra-high-net-worth sector. |

| Advisor Workforce Expansion | Investing in the recruitment of advisors, totaling around 15,000 in the team. |

| Technological Advancements | Utilizing AI, such as the Advisor Match program, for talent acquisition and client relationships. |

| Return on Tangible Common Equity | Medium-term ROTCE target raised to 16%-18% over the next 3-5 years. |

Summary

Bank of America wealth management is poised for substantial growth as it strategically invests in its wealth and investment management division. The bank has recognized the immense potential within the U.S. market, particularly in the face of the upcoming Great Wealth Transfer. With ambitious targets set for growth in the affluent client segment and a clear focus on expanding its advisor workforce through innovative technology and training programs, Bank of America aims to solidify its position as a leader in wealth management. Their commitment to enhancing client relationships and service delivery is expected to yield significant returns, further reinforcing their strategy in the competitive landscape of wealth management.