Wealth migration has become a focal point of discussion among economists and policymakers, particularly in the wake of high-profile relocations like that of billionaire Lakshmi Mittal. His move from the UK underscores a significant trend where high-net-worth individuals are increasingly seeking jurisdictions with more favorable tax climates. Concerns over UK inheritance tax, which can reach up to 40% on global assets, are pushing affluent residents to reevaluate their residency amidst daunting European tax challenges. This capital flight indicates a growing wealth tax exodus that is reshaping both domestic and international economic landscapes. As countries strive to balance fiscal needs with attractiveness for the rich, understanding the nuances of wealth migration is more critical than ever.

The phenomenon of affluent individuals relocating to avoid high taxation is often referred to as capital flight or the mobility of wealth. As financial pressures increase, many super-rich citizens are contemplating their tax obligations, particularly in regions enforcing stringent wealth taxes. This ongoing trend of relocating to tax-friendly locales such as Switzerland or Dubai highlights the underlying dynamics of wealth distribution and the potential exodus from areas with burdensome fiscal policies. The debate surrounding inheritance tax and its implications for high-net-worth individuals has never been more pertinent, as governments grapple with the challenge of maintaining revenue without incentivizing migration. Exploring these concepts reveals deeper insights into global economic strategies and the implications for wealth management today.

Understanding Wealth Migration: A Global Perspective

Wealth migration has become a central theme in discussions surrounding global taxation, particularly as high-net-worth individuals search for more favorable fiscal environments. Lakshmi Mittal’s move is emblematic of a larger trend where affluent individuals and families evaluate their residency based on tax policies that may seem punitive or overly burdensome. This phenomenon, often referred to as capital flight, is not unique to the UK; wealthy individuals are increasingly relocating to jurisdictions like Switzerland or Dubai, which offer tax benefits that enhance their wealth preservation strategies.

The implications of wealth migration extend beyond mere fiscal considerations; they reflect the broader concerns of inequality and economic stability within Europe. As European governments grapple with rising debts and the challenge of equitable wealth distribution, the exodus of high-net-worth individuals poses a dual threat: a reduction in tax revenue and the potential erosion of the domestic economic base. Countries like Norway have experienced tangible impacts from wealth taxes, where significant numbers of affluent residents have relocated after tax hikes, illustrating the delicate balance that governments must strike.

The Impact of UK Inheritance Tax on High-Net-Worth Individuals

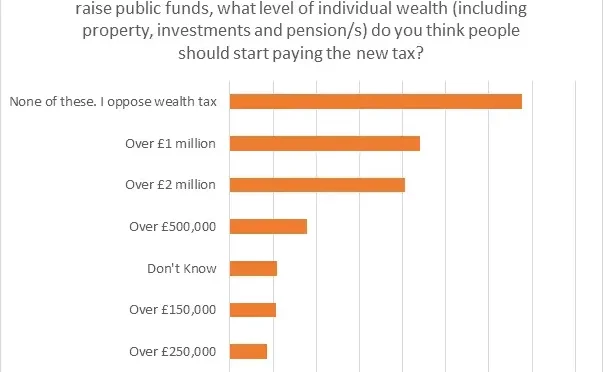

UK inheritance tax is often cited as a primary motivator for the migration of wealthy individuals, highlighting the dissatisfaction with a system that imposes taxes on global assets at rates up to 40%. This approach is particularly disconcerting for high-net-worth individuals who seek to maintain their wealth across generations without the impending threat of substantial tax liabilities. The recent trends in wealth migration, driven by such taxes, underscore a critical issue: as tax policies become increasingly complex and burdensome, affluent individuals are incentivized to leave, taking their capital with them.

The situation is compounded by the fact that wealth migration represents both a tactical response to unfavorable tax regimes and an emotional decision influenced by the perceived social climate of a country. As seen with Mittal, high-net-worth individuals are not only making financial calculations but contemplating their legacy in regions that appear more welcoming. This flight of wealth raises difficult questions for policymakers in the UK — how to revise tax systems to achieve fiscal objectives without driving affluent taxpayers overseas.

Challenges of European Tax Policies for High-Net-Worth Individuals

Across Europe, the challenge of taxation on the wealthy is characterized by an evolving landscape marked by policy changes aimed at addressing economic disparities. Yet, attempts to levy harsher taxes have often led to the unintended consequence of capital flight. The responses from wealthy individuals to increase wealth taxes create a ripple effect, as evidenced by past taxes in countries like France and Norway, which have provoked notable exoduses of affluent residents. These migrations serve as cautionary tales for governments contemplating similar measures.

The EU’s experience illustrates a complex interplay between the need for generating revenue and the desire to retain high-net-worth individuals. If tax policies are perceived as excessively punitive, they can diminish the appeal of a country as a residence for wealth creation and investment. This reality leaves European nations in a precarious position; while the imperative to address fiscal challenges is clear, the risk of wealth tax exodus grows with each policy that appears to threaten the financial security of wealthy individuals.

Capital Flight: The Growing Trend Among Affluent Individuals

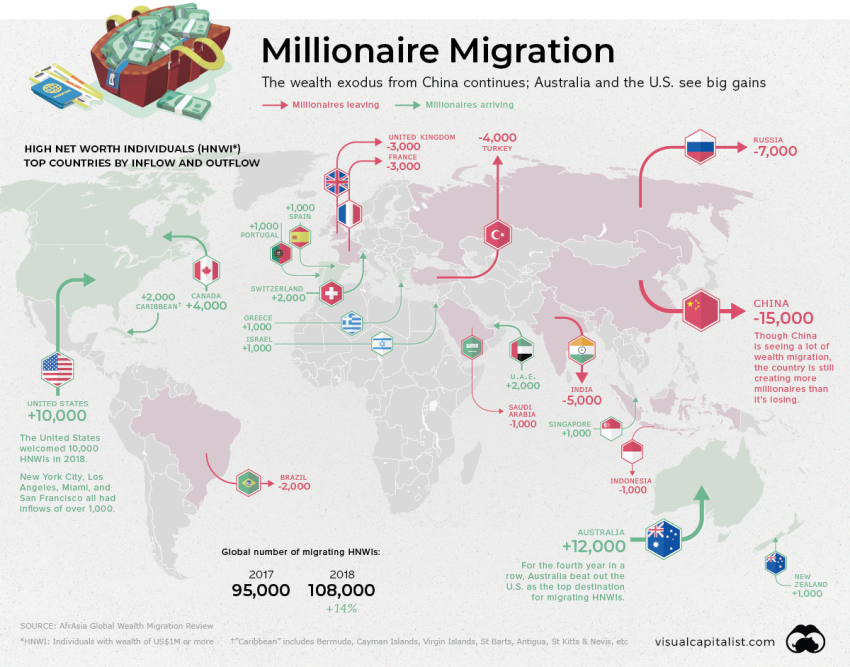

The term capital flight refers to the large-scale exit of financial capital from one country to another, often spurred by economic uncertainty or unfavorable tax legislation. Recent statistics indicate an alarming trend where thousands of wealthy individuals are leaving the UK in light of intensified tax measures under the prospective Labour government. With numbers expected to reach 16,500 departures, it becomes clear that the wealthy are actively seeking better environments for their assets, further emphasizing the importance of capital stability and growth.

As rich individuals opt to relocate to nations that afford them greater tax advantages, the ramifications reach beyond personal finances. The departure of such capital can exacerbate existing inequalities and fiscal deficits within the home country. Policymakers must confront the sobering reality that while higher taxes might be levied in the name of social equity, they can simultaneously catalyze significant capital flight, thereby undermining the intended benefits of those fiscal policies.

Reassessing Wealth Tax Strategies in Europe

European governments are reevaluating their strategies regarding wealth taxation amid concerns that these taxes may deter high-net-worth individuals from remaining within their borders. Historical backlash, like that witnessed in Norway following increased taxes, serves as a powerful warning against creating an overly aggressive tax environment. Rather than delivering the promised increase in funding for social programs, these measures could provoke an exodus of wealthy individuals, leading to reduced tax revenues.

The dilemma for European policymakers is profound: how do they implement necessary fiscal reforms while ensuring that wealthy individuals see value in staying? A balanced approach that considers both the revenue needs of the government and the concerns of affluent citizens can guide a more stable tax strategy. Creating an environment that fosters wealth creation while allowing for fair taxation might mitigate the risks of wealth migration and capital flight that countries currently face.

The Role of Global Tax Competition in Wealth Relocation

Global tax competition is an important factor in wealth relocation, as countries jockey to attract affluent individuals with favorable tax regimes. The decisions made by high-net-worth individuals often reflect their assessment of international tax environments, where factors like capital gains tax rates and inheritance taxes play crucial roles. Countries such as Switzerland and Dubai are actively promoting policies that encourage the relocation of wealth and the establishment of residences for wealthy individuals, creating a competitive landscape that pressures European nations to reconsider their tax strategies.

The interplay between global tax policies underscores the need for careful consideration by governments. As they craft laws intended to address wealth inequality, they must also be mindful of the competitive nature of tax systems worldwide. The risk of losing wealthy individuals to more favorable jurisdictions could diminish the overall tax base, challenging the sustainability of social programs and potentially widening the economic divide that policy aims to remedy.

Social Implications of Wealth Migration in Europe

The social implications of wealth migration in Europe extend beyond mere economic statistics; they encompass the changing landscape of community and engagement among affluent individuals. As high-net-worth individuals exit jurisdictions perceived as hostile to their financial interests, the social fabric of those regions can begin to fray. The departure of these individuals not only reduces tax revenues but may also impact local businesses and philanthropic efforts that rely on the support of the wealthy.

This migration trend leads to bigger questions about social equity and the responsibilities of the wealthy. With significant capital flows redirected into other economies, the communities they leave behind face challenges in terms of resources and investment. The conversation around wealth taxation must therefore evolve to consider not only fiscal outcomes but also the broader social responsibilities that high-net-worth individuals hold in their communities. Acknowledging this dynamic can help create a more holistic approach to tax policy that considers both financial and societal impacts.

Historical Context: Wealth Taxes and Their Consequences

Examining the historical context of wealth taxes unveils a narrative characterized by both intention and consequence. Various European countries have instituted wealth taxes with the hope of redistributing wealth and addressing income inequality. However, as shown by past experiences in countries like Norway and France, these taxes can provoke immediate wealth migration instead of the desired revenue influx. The historical trends highlight the need for caution when considering new wealth tax implementations.

Economists and policymakers are increasingly recognizing that while wealth taxes may be a tool for fiscal reform, their effectiveness often hinges on implementing complementary policies that encourage economic retention rather than flight. Striking the right balance becomes essential; fostering an environment that encourages the wealthy to invest in society while ensuring fairness in taxation may ultimately lead to more sustainable economic health.

Future Directions for Tax Policy and Wealth Retention

As nations globally navigate complex economic realities, the future of tax policy will require innovative solutions that address both the need for revenue and the importance of capital retention. The growing trend of wealth migration should prompt European governments to reconsider not just tax rates but also the myriad factors that influence high-net-worth individuals’ decisions. Strategies that combine competitive tax rates with robust social programs may prove most effective in retaining affluent residents.

Looking ahead, the integration of technology and enhanced data analytics into tax policy could lead to more informed decision-making. By analyzing the behaviors and responses of high-net-worth individuals to previous tax changes, policymakers can craft legislation that minimizes capital flight. In creating an engaging dialogue with the affluent community regarding taxation, governments may foster a sense of partnership that reinforces the social contract while still ensuring that fiscal needs are met.

Frequently Asked Questions

What is wealth migration and how does it impact high-net-worth individuals?

Wealth migration refers to the movement of affluent individuals relocating from one country to another primarily due to financial incentives, often driven by tax policies. High-net-worth individuals frequently consider jurisdictions with more favorable tax regimes, such as Switzerland or Dubai, particularly when faced with punitive taxes like the UK’s inheritance tax, which can reach 40% on global assets.

How does UK inheritance tax influence capital flight among wealthy individuals?

The UK’s inheritance tax, considered among the most punitive in Europe, imposes high rates on global assets, motivating capital flight. Wealthy residents view these taxes as a significant financial burden, prompting many to seek relocation to countries with no inheritance taxes, essentially engaging in wealth migration.

What role does capital flight play in the European tax challenges faced by governments?

Capital flight highlights the adverse effects of regulatory and tax pressures on wealthy individuals. As European governments, facing rising inequality and fiscal deficits, consider harsher taxes on wealth, many high-net-worth individuals may migrate to low-tax jurisdictions, thereby complicating the financial landscape and undermining expected tax revenue.

What are the implications of wealth tax exodus for European economies?

Wealth tax exodus can lead to diminished economic diversity and increased fiscal shortfalls for European economies. Countries like Norway have seen significant declines in their affluent populations following tax increases. This migration emphasizes the delicate balance governments must maintain between imposing taxes for revenue and encouraging capital retention.

How have high-net-worth individuals reacted to new tax measures in countries like the UK?

High-net-worth individuals have exhibited strong responses to new tax measures in the UK, often choosing to relocate to more favorable tax environments, such as the UAE or other low-tax countries. This reaction is evident in the estimated 16,500 wealthy individuals who plan to leave the UK following recent tax reforms, showcasing the trends in wealth migration.

Why are countries like France hesitant to implement stricter wealth taxes?

Countries like France hesitate to impose stricter wealth taxes due to fears of prompting a mass exodus of affluent residents. This concern is rooted in historical evidence that suggests heavy taxation drives high-net-worth individuals away, resulting in capital flight and reduced fiscal income, complicating efforts to address economic inequality.

What trends in wealth migration should European governments monitor?

European governments should closely monitor trends in wealth migration resulting from punitive tax policies. The phenomenon of wealthy individuals relocating to jurisdictions with lower taxes, such as the UAE and Switzerland, underscores the need for balanced tax strategies that do not inadvertently encourage capital flight while also addressing fiscal challenges.

How does the wealth migration of individuals like Lakshmi Mittal reflect broader economic patterns?

Lakshmi Mittal’s relocation from the UK to lower-tax jurisdictions highlights a significant pattern in wealth migration among high-net-worth individuals reacting to punitive tax policies. Such moves signify a broader economic trend where excessive taxation may drive affluent residents away instead of achieving the intended redistribution of wealth.

| Key Point | Details |

|---|---|

| Billionaire Departures | Many wealthy individuals, including Lakshmi Mittal, are relocating due to punitive tax systems. |

| Tax Policies | The UK has an inheritance tax of up to 40% on global assets, prompting high-net-worth individuals to leave for tax-friendly jurisdictions. |

| Wealth Migration Trends | Approximately 16,500 wealthy individuals are expected to leave the UK, with countries like UAE and US seeing an influx of these migrants. |

| Government Responses | European governments are grappling with rising fiscal deficits and considering tighter wealth taxes, although these can lead to capital flight. |

| Historical Evidence | Countries like Norway and France experienced significant backlash and exodus of wealthy residents after attempting to raise wealth taxes. |

| Future Challenges | The challenge for European governments is to balance necessary taxation for fiscal revenue while making their countries attractive to wealthy individuals. |

Summary

Wealth migration is increasingly becoming a reality for many high-net-worth individuals, driven by punitive tax policies in regions like the UK. Lakshmi Mittal’s recent move demonstrates how excessive taxation can lead to a significant exodus of billionaires, posing a challenge for governments in Europe. As they seek to generate revenue through wealth taxes, they must consider the potential consequences on capital flight and re-evaluate their fiscal strategies to avoid losing affluent residents to more tax-friendly jurisdictions.