Trump tax policies philanthropy is becoming a hot topic as President Trump’s recent legislation could significantly reshape the landscape of charitable giving in America. While mega-donors like MacKenzie Scott and Melinda French Gates have been shaking up philanthropy with their generous contributions, the new tax policies threaten to curtail such billionaire donations. Starting in 2026, the tax benefits for the wealthy will be limited, potentially reducing charitable contributions by billions of dollars. This shift raises critical questions about the long-term philanthropic impact and the future roles of wealthy donors in addressing societal needs. As the philanthropic sector braces for the implications of these changes, the effects on charitable giving may underscore the importance of understanding philanthropy tax implications among affluent charities and donors alike.

The recent developments surrounding Trump’s tax reforms have brought philanthropy to the forefront of public discourse. High-profile figures in charitable giving, notably billionaires who massively influence the sector, may find their contributions curtailed due to the new tax structure. With changes that restrict how much wealthy individuals can deduct, we could see a decline in the scale of their donations, drawing concern about the overall charitable giving impact. Organizations that rely heavily on these generous donations are now faced with the daunting prospect of seeking alternative funding sources. Understanding how affluent donors perceive their role in philanthropy amidst these tax implications is essential in navigating this evolving landscape.

The Impact of Trump’s Tax Policies on Philanthropy

President Trump’s new tax reforms, dubbed the “One Big Beautiful Bill,” have raised significant concerns among philanthropic organizations regarding their long-term viability. As of 2026, these changes will retract tax benefits from wealthy philanthropists, potentially resulting in a staggering reduction of $4.1 to $6.1 billion in charitable contributions. This decline underscores how crucial tax incentives have been in motivating donations from high-net-worth individuals, whose financial capabilities far exceed those of middle-class donors.

The new limitations on tax deductions also mean that many wealthy Americans might reconsider their philanthropic giving strategies. With the effective deduction rate dropping from 37% to 35% and added restrictions for itemizers, it is clear that Trump’s tax policies could fundamentally alter the landscape of charitable giving in America. Many nonprofit organizations depend heavily on the generosity of the rich, which raises the question: how will charities adapt to a future where their major benefactors might be less inclined to contribute?

Billionaire Donations vs. Middle-Class Contributions

The recent tax changes could exacerbate the existing disparities between billionaire donations and contributions from middle-class individuals. While figures like MacKenzie Scott continue to demonstrate the power of mega-donations, the average American hardly matches this level of giving. With the cost of living rising, fewer middle-class families are in a position to make significant donations, which could create an inhospitable environment for smaller charities that rely on a broader base of support.

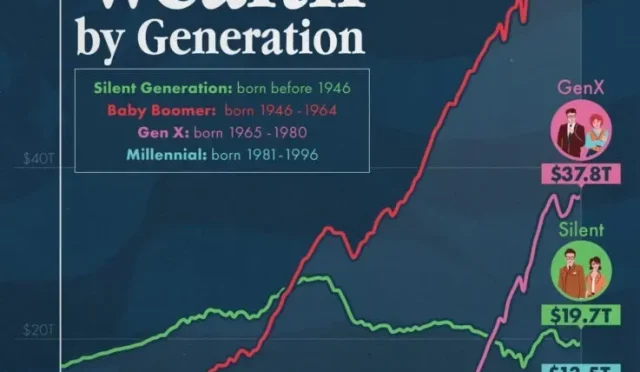

The data is telling: from 2000 to 2020, the number of Americans making donations shrank from 66.2% to 45.8%, indicating a worrying trend towards a reliance on fewer, wealthier donors. This compounding effect highlights a worrying disconnect in philanthropic giving—a gap that the average household simply cannot bridge given today’s economic realities. As a result, smaller organizations that rely on a pool of diverse donors might find themselves struggling to sustain operations moving forward.

Charitable Giving and Its Economic Implications

Charitable giving is not only a measure of individual generosity; it also plays a pivotal role in economic dynamics. Trump’s tax reform could undermine this philanthropy by causing a reduction in total contributions, which can impact funding for vital programs like education, health, and social services. When billionaires cut back their donations due to unfriendly tax breaks, it creates a domino effect that could lead to resource shortages for many organizations that operate on tight budgets.

Moreover, less philanthropic activity can hinder economic growth and social welfare initiatives. Each dollar given to charity fuels programs that benefit the community, and any drop in donations translates to fewer resources for essential services. As nonprofit sectors already indicate a decline in donor numbers, the need for strategic fundraising and broader access to giving incentives for the middle class become increasingly relevant. This dynamic warrants serious consideration from policymakers who seek to promote a healthy philanthropic ecosystem.

Changing Dynamics in Wealthy Donor Philanthropy

The world of wealthy donor philanthropy is shifting, especially with the emergence of new billionaires who are redefining traditional charitable giving. Figures such as MacKenzie Scott have shown a willingness to distribute wealth in unprecedented amounts, making large-scale donations to numerous causes without extensive restrictions. However, Trump’s tax policies could dissuade such generosity among high-net-worth individuals who may feel less incentivized to give due to diminished tax benefits.

Many billionaires, despite their ethical motivations to give, are also strategic in their approach. Tax policies create a framework for philanthropy, and with those frameworks becoming less favorable under current regulations, there is a tangible risk of decreased financial support for critical social initiatives. Should the trend continue without adjustments to the tax code, the landscape could reflect fewer ‘high impact’ donations that have historically characterized philanthropic culture.

The Role of Charitable Contributions in Democracy

Philanthropy has long been a cornerstone of democratic society, working to address disparities and support unrepresented communities. However, with the looming threat of reduced billionaire contributions stemming from tax policy changes, there’s a potential gap that can undermine democratic principles. Charitable organizations play a crucial role in advocating for social issues that may not receive adequate governmental support; hence, their sustainability is paramount for a functioning democracy.

The essence of a robust democracy relies heavily on a vibrant nonprofit sector, which thrives on both large donations and grassroots support. By restricting tax benefits initially aimed at encouraging charitable giving, we risk sidelining vital voices and initiatives that propel democratic ideals. The consequences of reduced funding would likely disadvantage those already marginalized, ultimately challenging the very fabric of democratic governance.

MacKenzie Scott’s Philanthropic Footprint

MacKenzie Scott has emerged as an influential figure in philanthropy, making headlines with her unprecedented $19.25 billion in charitable donations since 2020. Her approach, which focuses on unrestricted donations to organizations that drive social change, stands in sharp contrast to traditional philanthropy; she exemplifies a model that prioritizes the needs of recipients over the control often exerted by donors. This strategy not only fosters innovation but has also raised important discussions regarding the future of giving amid restrictive tax policies.

Scott’s generosity provides a compelling case for the significant impact single philanthropists can have on social causes. However, if Trump’s tax reforms lead to reduced giving among other billionaires, Scott’s model could become an exception rather than a standard. Her work raises vital questions about the sustainability of charitable contributions if the tax environment becomes less favorable for wealthy donors. It remains essential to glean lessons from her philanthropic approach and advocate for tax incentives that can keep this model thriving.

The Future of Charitable Giving: A Call for Change

The future of charitable giving seems uncertain in the wake of changing tax policies. Philanthropy’s power hinges not only on the benevolence of wealthy donors but equally on the systemic structures that encourage giving. Advocates suggest that innovative solutions, including creating sustainable tax incentives or expanding benefits for middle-class supporters, are essential for maintaining robust charitable contributions across all income levels. As it stands, Trump’s policies could disfavor both large and small donations alike, potentially leading to a weakened philanthropic landscape.

For the charitable sector to thrive, it will need to adapt to the evolving economic environment. This could mean prioritizing grassroots fundraising initiatives alongside major gifts to engage more individuals in the charitable process. By fostering inclusive philanthropic practices and advocating for policies that support diversified giving, the sector can work towards a future where all donors feel empowered to contribute, regardless of their net worth. It’s a delicate balance—ensuring that philanthropy remains a powerful force for good.

The Giving Pledge and Its Broader Implications

The Giving Pledge is an extraordinary initiative that encourages billionaires to commit to donating at least half of their fortunes during their lifetimes. Spearheaded by the likes of Warren Buffett and Bill Gates, this movement has amassed pledges totaling more than $600 billion across its signatories. However, the effectiveness of the Giving Pledge in the context of changing tax frameworks raises questions about its potential impact on the philanthropic landscape—especially if signatories feel less motivated to give due to tax implications introduced by recent policies.

While many of the signatories have noble intentions, following through with actual donations remains a challenge. With Trump’s tightened tax rules, the momentum for fulfilling these pledges could stall, dissuading some billionaires from engaging with charitable organizations. As policymakers assess the ramifications of current legislation on philanthropy, recognizing and reinforcing incentives for major donors will be critical to ensure that the commitments made under the Giving Pledge translate into tangible benefits for communities and causes in need.

Exploring Philanthropy Tax Implications Moving Forward

The impending changes to tax policies concerning philanthropy pose significant challenges to the landscape of charitable giving. As the effective tax benefits for wealthy donors decrease, understanding the implications of these adjustments becomes paramount. Navigating the complexities of tax implications will require nonprofits and stakeholders to rethink fundraising strategies in order to maintain sources of income vital to their missions.

Looking forward, it may be necessary to advocate for policy revisions that promote favorable tax conditions for charitable organizations, especially in light of the wealth inequality becoming increasingly apparent. Emphasizing the importance of philanthropy tax implications could sway policymakers to consider reforms, promoting an environment conducive to more generous donations, thereby enhancing the impact of philanthropy in addressing pressing societal issues. A coordinated push by the nonprofit sector could bolster these discussions, emphasizing that tax incentives play a critical role in fostering a vibrant charitable ecosystem.

Frequently Asked Questions

How will Trump’s tax policies affect billionaire donations to charity?

Trump’s tax policies, particularly through the ‘One Big Beautiful Bill’, are expected to reduce billionaire donations by over $4 billion due to reduced tax benefits for wealthy donors. The effective tax benefit for charitable donations will drop from 37% to 35%, resulting in fewer contributions from major philanthropists.

What are the philanthropy tax implications of Trump’s new tax law?

Under Trump’s new tax law, philanthropy tax implications include limiting tax deductions for high earners. Billionaires will face a lower effective tax benefit for charitable giving, which is projected to decrease overall donations to charitable causes significantly.

How does Trump’s tax policy impact middle-class donors compared to billionaires?

While Trump’s tax policy offers some benefits for middle-class donors, such as allowing up to $1,000 in cash deductions, it cannot match the scale of giving seen from billionaires like MacKenzie Scott, whose mega-donations heavily influence charitable funding.

What is the projected impact of Trump tax policies on charitable giving?

It is estimated that Trump’s tax policies could lead to a reduction of charitable donations by between $4.1 billion and $6.1 billion. This decline is influenced by weaker tax incentives for wealthy donors, significantly impacting nonprofit organizations relying on these large gifts.

How do wealthy donors like MacKenzie Scott influence philanthropy in light of Trump’s tax reforms?

Wealthy donors such as MacKenzie Scott have a profound impact on philanthropy, contributing billions to causes, but under Trump’s tax reforms, the incentive for them to donate may diminish, thereby affecting the overall landscape of charitable giving.

What role does the Giving Pledge play in billionaire philanthropy amid Trump’s tax policies?

The Giving Pledge encourages billionaires to commit to giving away a majority of their fortunes, but with Trump’s tax policies reducing incentives for large donations, participation and the actual financial impact of this pledge may be compromised.

Can middle-class taxpayers benefit from the charitable giving changes in Trump’s policies?

Yes, middle-class taxpayers can benefit from tax deductions for charitable contributions, but the overall impact will likely be minimal compared to the significant cuts in donations from wealthy individuals due to reduced tax incentives in Trump’s tax policies.

What challenges do nonprofits face due to Trump’s tax policies on philanthropy?

Nonprofits are facing challenges due to prospective reductions in donations from wealthy individuals influenced by Trump’s tax policies, as their reliance on large contributions will likely lead to a significant funding gap in the sector.

| Key Point | Details |

|---|---|

| Impact of Trump’s Tax Policies | The new tax policies will reduce wealthy donors’ tax benefits from 37% to 35%, potentially cutting philanthropy by over $4 billion. |

| Limitations on Deductions | The legislation restricts itemizers, allowing deductions only for donations exceeding 0.5% of adjusted gross income. |

| Philanthropic Consequences | Experts estimate a potential reduction in donations from $4.1 billion to $6.1 billion, negatively impacting charitable organizations. |

| Billionaire Donors | Members of the Giving Pledge, like MacKenzie Scott and Melinda French Gates, have made significant donations, but new policies may deter future contributions. |

| Middle-Class Contributions | While middle-class taxpayers can deduct up to $1,000 in cash donations, their impact is minimal compared to billionaires, with overall donor numbers declining. |

| Long-term Trends | The donation rate among Americans has decreased from 66.2% to 45.8% over two decades, highlighting a growing reliance on wealthy philanthropists. |

Summary

Trump tax policies philanthropy is significantly affected by the new legislation enacted in 2026, which limits tax incentives for wealthy donors. This change could lead to a substantial decrease in charitable contributions from the richest Americans, amounting to billions in potential losses for various philanthropic endeavors, particularly as middle-class donors struggle to match the giving power of billionaires. The long-term implications suggest a growing disparity in charitable giving, where increasing donor amounts from wealthy individuals outpace the diminishing number of average donors, ultimately straining the nonprofit sector.