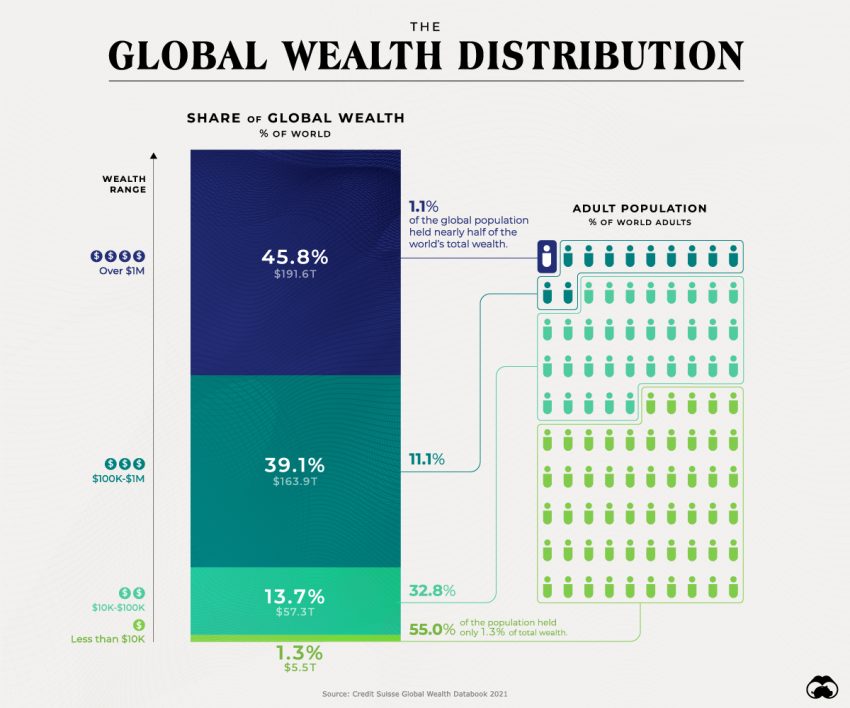

Global wealth distribution reveals a startling reality: just a tiny fraction of the global population holds the majority of the world’s wealth. Specifically, about 1.6% of adults possess nearly half of all wealth, illustrating significant wealth inequality on a global scale. The global wealth pyramid emphasizes this disparity, where 3.1 billion individuals collectively control a mere 12.7% of total assets. While the world saw an increase in personal wealth by 4.6% last year, the benefits largely accrued to the wealthiest, thereby exacerbating income inequality. This striking imbalance between a few billionaires and billions of struggling individuals calls for urgent discussions surrounding wealth distribution and its implications for society’s future.

The distribution of economic resources around the globe highlights critical disparities in how wealth is allocated among various populations. Often referred to as wealth inequality, this phenomenon is characterized by an overwhelming concentration of assets at the top of the global wealth pyramid, where a mere percentage of individuals command substantial fortunes. As we delve into the mechanics of this uneven wealth allocation, it is essential to recognize the impact of income disparity, which affects daily lives for billions of people worldwide. From the billionaires hoarding unimaginable wealth to the vast majority who strive for basic financial security, understanding these dynamics is crucial for addressing systemic financial challenges. By exploring the realities of wealth distribution, we can engage more meaningfully with the pressing issues of equity and social justice.

Understanding Global Wealth Distribution

Global wealth distribution refers to how wealth is shared among individuals across different demographics, regions, and socioeconomic brackets. The stark realities of this distribution reveal significant disparities, with just 1.6% of adults possessing nearly half of the world’s wealth. This concentration of wealth highlights not only economic inequalities but also social and political consequences that can arise from such disparities. As reported in recent studies, a large majority of the population, approximately 82%, shares only 12.7% of total wealth, showing stark evidence of income inequality.

The global wealth pyramid provides a structured view of this distribution, breaking down the population into tiers based on their net worth. The richest tier, which encompasses those with over one million dollars, holds an astounding $226 trillion, underscoring the vast decrease in wealth as one moves down the pyramid. For instance, the bottom tier, where individuals have less than $10,000, comprises about 1.55 billion adults who collectively own a mere 0.6% of global wealth. This significant skew towards the affluent underscores a troubling trend of wealth inequality that continues to challenge global development.

The Global Wealth Pyramid Explained

The global wealth pyramid illustrates the stratification of wealth distribution around the world, categorizing the population into specific wealth bands. At the top lies the elite 1.6% who are millionaires, with a substantial portion of their wealth concentrated among a small number of billionaires. According to recent data, there are 60 million people who fall into this upper echelon, commanding a staggering 48.1% of total global wealth. In stark contrast, those in lower wealth tiers, such as the 1.55 billion individuals with less than $10,000, account for a mere 0.6% of global wealth, emphasizing the extremes of wealth distribution.

This pyramid not only highlights the enormity of wealth held by the rich but also sheds light on the challenges faced by the lower tiers. The data reveals that despite a global growth in personal wealth, the benefits have not been equitably shared. For instance, while the upper-middle tier of those with $100,000 to $1 million holds substantial wealth, they still represent only a fraction of the overall population. This structured understanding of wealth allows researchers and policymakers to address wealth inequality, strategizing for more inclusive economic reforms.

Income Inequality Around the World

Income inequality is a pervasive issue impacting societies globally, manifesting through disparities in wages, job opportunities, and access to resources. In many countries, the wealth gap has widened, leading to social unrest and calls for reform. The data indicates that while wealth increased globally by 4.6% in 2024, it did not translate into equitable income growth for the broader population. This persistent income inequality creates barriers for those at the lower end of the wealth spectrum, perpetuating the cycle of poverty and limiting social mobility.

The implications of income inequality extend beyond economics; they affect health, education, and overall life satisfaction. Countries with high levels of income inequality often struggle with social cohesion and face heightened tensions between different economic classes. Fostering awareness and implementing targeted policies aimed at raising income levels for lower tiers is crucial for creating an equitable society. This includes investments in education, healthcare, and job training programs to empower the economically disadvantaged.

Wealth Inequality and Its Impact

Wealth inequality reflects the uneven distribution of assets among individuals and has profound implications for social and economic stability. The statistics show that the wealthiest 1.6% of the population controls almost 48% of global wealth, leading to a situation where a small elite holds disproportionate power and influence. This concentration can stifle economic growth, as it tends to inhibit consumer spending from the wider population, which is crucial for economic vitality.

Moreover, wealth inequality erodes trust in institutions and can contribute to political polarization. Many people feel disenfranchised by a system that appears rigged in favor of the wealthy. Addressing wealth inequality requires a multifaceted approach, incorporating taxation reforms, improving access to education and healthcare, and promoting fair wages in the labor market. Only through these comprehensive strategies can societies hope to reduce wealth inequality and create a more equitable future.

The Role of Billionaires in Wealth Distribution

Billionaires play a notable role in global wealth distribution, often symbolizing extreme wealth inequality. The report outlines that there are 2,891 billionaires worldwide, controlling more than $15.6 trillion in wealth. These individuals not only demonstrate the vast accumulation of resources but also raise questions about the ethical responsibilities of the ultra-wealthy in addressing societal challenges. With such immense financial power, billionaires have the potential to impact policies, economies, and social initiatives significantly.

However, the existence of such wealth concentration among a select few can incite debates about effective wealth redistribution. There are growing calls for billionaires to contribute more significantly to the welfare of society, particularly through philanthropy and responsible business practices. Balancing wealth creation with social accountability is essential to address the systemic issues tied to wealth inequality and promote a sustainable economic environment for all.

Future Trends in Global Wealth Distribution

Looking ahead, the trends in global wealth distribution indicate a continued focus on addressing income and wealth disparities. With the rise of technology and innovation, new economic opportunities are emerging that can potentially alter the current dynamics of wealth distribution. These shifts may empower more individuals in lower economic tiers, providing access to resources that were previously out of reach. However, it is crucial that these changes are accompanied by policies aimed specifically at reducing inequality.

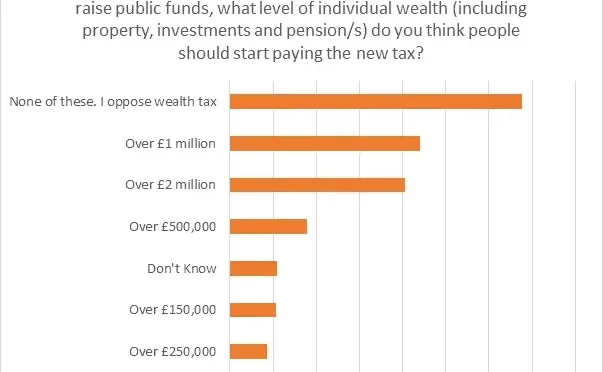

A critical aspect of this future trend is the ongoing conversation around taxation and wealth redistribution. Governments worldwide are increasingly considering policies that tax the wealthier segments of the population to fund social programs aimed at uplifting those in lower tiers of the wealth pyramid. As society becomes more aware of the implications of extreme wealth inequality, public pressure for systemic change is likely to grow, influencing future legislative actions and shaping how wealth is distributed globally.

Global Wealth and Economic Growth

Understanding global wealth in the context of economic growth is vital for policymakers and economists alike. While the numbers indicate a general increase in wealth, the uneven distribution depicts a challenging reality. The richest individuals are enjoying the benefits of economic expansion at a rate far greater than the average person. This phenomenon raises questions about the sustainability of such growth when base economic rights and opportunities for the lower tiers remain stagnant.

Therefore, fostering inclusive economic growth that benefits all segments of society is essential. Initiatives that focus on improving education, investing in job creation, and ensuring fair wages will contribute to a healthier economy. Economies thrive when wealth is more evenly distributed, as this promotes spending, stimulates demand, and ultimately leads to more robust and equitable economic growth.

Addressing Wealth Disparities Globally

Tackling global wealth disparities requires a concerted effort involving governments, non-profits, and the private sector. Collaborative initiatives can foster dialogue and seek sustainable solutions that aim to close the wealth gap, ensuring that equitable distribution becomes a priority worldwide. Many organizations are now focusing on creating programs that aid in empowering lower-income communities through education, healthcare, and entrepreneurship.

In addition, advocating for progressive tax policies can significantly contribute to addressing these disparities. By ensuring that those with higher incomes contribute a fair share, governments can fund social programs designed to uplift disadvantaged sectors of society. Creating a culture of social responsibility among the wealthy will be crucial to bridging the wealth gap and promoting a more equitable global economy.

The Importance of Wealth Education

Wealth education plays an essential role in addressing the knowledge gap that often perpetuates financial inequality. Many individuals in lower wealth tiers lack access to financial literacy training, which is crucial for making informed decisions about savings, investments, and wealth accumulation. Providing wealth education to underserved populations can empower them to build assets and improve their financial future.

Moreover, integrating financial education into school curriculums can help equip future generations with the necessary tools to navigate the economic landscape. Emphasis on critical life skills, such as budgeting, investing wisely, and understanding credit, can significantly impact individuals’ ability to break free from the cycle of poverty and contribute to a more balanced economic reality.

Frequently Asked Questions

What does the global wealth distribution look like?

The global wealth distribution reveals significant inequality, with just 1.6% of adults holding nearly 48% of total wealth. Meanwhile, 82% of the adult population possesses only 12.7% of global wealth, illustrating a stark division in wealth distribution worldwide.

How does income inequality affect global wealth distribution?

Income inequality contributes heavily to global wealth distribution disparities, as a small percentage of individuals accrue significant wealth while the majority struggle with minimal assets. This economic divide, reflected in the global wealth pyramid, highlights the challenges faced by billions in lower wealth tiers.

What is the global wealth pyramid and its importance?

The global wealth pyramid is a visual representation that categorizes the adult population into wealth tiers. It is important as it illustrates the concentration of wealth among billionaires and the stark contrast with those holding little to no wealth, emphasizing the need for addressing wealth inequality.

How many billionaires are there in the global wealth distribution?

As of now, there are approximately 2,891 billionaires worldwide within the global wealth distribution. Collectively, they hold over $15.6 trillion, highlighting the significant concentration of wealth among this elite group.

What percentage of global wealth do billionaires control?

Billionaires control a substantial share of global wealth, amounting to approximately 33% when considering only their collective assets among the wealth distribution tiers. This concentration underscores the stark wealth inequality prevalent in today’s economy.

What are the implications of wealth inequality on global economies?

Wealth inequality has profound implications on global economies, impacting social stability, economic growth, and access to resources. As wealth becomes increasingly concentrated among the top tiers of the global wealth pyramid, societal challenges such as poverty and social unrest may intensify.

How does the wealth distribution report influence policy decisions?

Wealth distribution reports provide critical data that can influence policy decisions aimed at reducing income inequality. By highlighting disparities, policymakers can create targeted initiatives to redistribute wealth and foster equitable economic growth.

How did global wealth change in the recent year?

In 2024, global personal wealth saw a growth of 4.6%, but this growth was not evenly distributed, with wealth concentration remaining a significant issue in the overall global wealth distribution.

What strategies can be employed to address wealth inequality?

Strategies to address wealth inequality include implementing progressive taxation, increasing access to education and job opportunities, and promoting policies that enhance economic mobility for lower income tiers in the global wealth pyramid.

What is the economic outlook given the current state of wealth distribution?

The economic outlook remains uncertain due to the stark wealth distribution disparities. While overall wealth may be growing, the concentration at the top indicates persistent challenges to equity and long-term economic stability.

| Wealth Band (USD) | Number of Adults | % of Adults | Total Wealth (USD) | % of Wealth |

|---|---|---|---|---|

| > $1 million | 60 million | 1.6% | $226.47 trillion | 48.1% |

| $100k – $1 million | 628 million | 16.4% | $184.51 trillion | 39.2% |

| $10k – $100k | 1.57 billion | 41.3% | $56.82 trillion | 12.1% |

| <$10k | 1.55 billion | 40.7% | $2.71 trillion | 0.6% |

| **Total** | **3.80 billion** | **100.0%** | **$470.51 trillion** | **100.0%** |

Summary

Global wealth distribution continues to showcase stark disparities, with just 1.6% of adults holding nearly half of the world’s wealth. The insights derived from this distribution reveal the prominence of an elite tier within the global wealth pyramid, significantly skewing wealth across different tiers. The remaining 82% of the adult population collectively possess only 12.7% of total wealth, accentuating widespread economic inequality. The findings illustrate the urgent need to address wealth distribution imbalances to foster a more equitable global economy.