Elon Musk’s staggering wealth, now estimated at a jaw-dropping $749 billion, positions him as one of the richest individuals in the world, outpacing the total value of India’s four largest companies combined. This remarkable net worth is largely attributed to significant gains from his ventures, particularly the Tesla compensation package that was recently reinstated by a court ruling. With the reinstatement of stock options worth $139 billion, Musk’s billionaire ranking has surged to new heights, ensuring his dominance at the top of global wealth charts. Moreover, the soaring valuation of SpaceX and continued investor confidence in Tesla further amplify his financial prowess. Such astronomical wealth raises intriguing questions about the underlying factors that propel Musk’s success in the technology and aerospace sectors.

The wealth amassed by Elon Musk is emblematic of a new era of billionaires who are reshaping industries and economies around the globe. His financial journey reflects not only the remarkable success of companies like Tesla and SpaceX but also the profound implications of innovative compensation structures in corporate America. Alternative metrics, such as his ranking among world billionaires and the valuation of associated businesses, underscore the transformative impact of his entrepreneurial ventures. By examining the dynamics of Musk’s financial ascent, especially in relation to the valuations of comparable global corporations, we gain insight into the broader narratives of wealth creation in today’s market.

The Unprecedented Rise of Elon Musk’s Wealth

Elon Musk’s net worth has reached staggering heights, currently sitting at approximately $749 billion. This remarkable wealth positions him ahead of the combined market valuations of India’s four largest companies, which include Reliance, HDFC Bank, Bharti Airtel, and Tata Consultancy Services. The surprising jump in Musk’s wealth was primarily influenced by a pivotal Delaware Supreme Court ruling that reinstated a massive Tesla compensation package previously deemed invalid. This legal decision not only restored his financial status but also underscored the potential volatility and significance of corporate governance decisions in shaping billionaire fortunes.

His wealth trajectory showcases an extraordinary journey fueled by various strategic ventures, particularly with Tesla and SpaceX. The reinstatement of his $139 billion Tesla stock options, part of a 2018 pay package, was crucial in reinvigorating his financial standing. Investors are keenly watching how this decision will impact Tesla’s stock prices and overall market dynamics, considering Musk’s ambitious plans to innovate within the realms of electric vehicles and space technology.

Insights into Musk’s Tesla Compensation Package

The Tesla compensation package that significantly influenced Elon Musk’s wealth is arguably one of the most substantial in corporate history. Initially valued at $56 billion, the package was designed to reward Musk based on Tesla’s performance metrics, linking his financial success directly to the company’s growth. The recent restoration of the options by the Delaware Supreme Court illustrates the complexities and implications that arise in executive compensation, especially for high-profile figures like Musk. This ruling not only reinstated significant value to Musk’s stock options but also sparked discussions surrounding the adequacy and fairness of such large compensation structures within the corporate landscape.

As Tesla continues to push boundaries in electric vehicle development and artificial intelligence, the implications of Musk’s compensation become even more profound. Shareholders have shown strong support for his leadership and vision, as demonstrated in November 2025 when they approved a groundbreaking $1 trillion compensation framework. This monumental package reflects not just an investment in Musk’s leadership but also signifies a belief in Tesla’s potential to dominate the future automotive and AI industries.

Musk’s Adventures in Aerospace with SpaceX

SpaceX stands as a testament to Elon Musk’s visionary approach to aerospace and technology. Founded in 2002, SpaceX has transformed the space industry, focusing on reducing costs and enabling more frequent space travel. With a valuation rumored to reach heights akin to those of leading tech companies, SpaceX’s ongoing projects and ambitions, including a potential public listing, contribute significantly to Musk’s wealth and reputation as a trailblazer in multiple fields. The rocket manufacturer not only aims to revolutionize space travel but also has significant ties to national and international space missions, leveraging partnerships with government agencies.

The advancements made by SpaceX have bolstered Musk’s billionaire ranking, cementing his status as a pivotal figure in the technology and aerospace sectors. As the company continues to push for innovations such as reusable rocket technology, the potential financial implications for Musk are tremendous. In essence, SpaceX contributes not only to Musk’s net worth but also plays a crucial role in redefining the possibilities of space exploration and commercializing it for broader audiences.

Musk’s Entrepreneurial Journey and Key Ventures

Elon Musk’s entrepreneurial journey began in the mid-1990s with the establishment of Zip2, a company that facilitated the digitization of city guides. The sale of Zip2 for $307 million set a strong precedent for Musk’s future ventures. Following this, Musk’s role in the online payment space with PayPal demonstrated his capability to navigate emerging technology trends effectively. His relentless pursuit of innovation led to substantial financial rewards, reinforcing his position among the elite ranks of tech entrepreneurs.

In addition to Zip2 and PayPal, Musk also founded several groundbreaking companies, including Neuralink and The Boring Company, showcasing his diverse interests ranging from brain-computer interfaces to infrastructure improvements. Each venture not only contributed to Musk’s billionaire status but also illustrated his unique ability to foresee technological trends and capitalize on them, creating ecosystems that foster both innovation and wealth.

Comparing Musk’s Wealth to India’s Largest Corporations

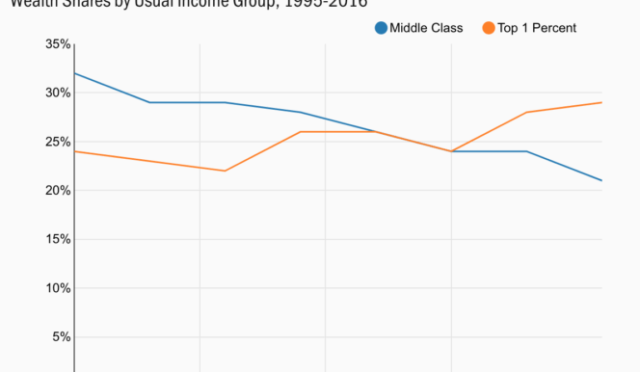

Elon Musk’s wealth eclipsing the combined market capitalization of India’s top four companies highlights a stark contrast in economic power. With Reliance, HDFC Bank, Bharti Airtel, and Tata Consultancy Services collectively valued at approximately $694 billion, Musk’s financial empire stands as a significant reflection of modern capitalism and individual wealth accumulation. This comparison prompts questions about the economic conditions that allow such disparities to exist and what it means for the global business landscape.

The wealth generated by Musk, particularly through companies like Tesla and SpaceX, showcases the transformational potential of technology and innovation to generate wealth far surpassing traditional industries. As countries like India continue to grow economically, the comparison with individuals like Musk emphasizes the ongoing shift towards technology-driven markets and the importance of fostering an environment conducive to innovation and entrepreneurship.

Analyzing Musk’s Impact on Global Market Trends

Elon Musk’s business strategies significantly influence global market trends, particularly in the tech and automotive sectors. His ventures compel traditional companies to reassess their operational models by embracing more sustainable practices, especially in energy consumption and production. Companies around the world watch Musk closely, often adjusting their strategies to align with the disruptive innovations he continually introduces, such as electric vehicles and reusable rocket technology.

The ripple effects of Musk’s business decisions extend beyond financial impacts, inspiring new entrepreneurs and shaping industry standards. As his companies gain further traction, established businesses must adapt to a landscape increasingly defined by rapid technological advancements. This compels industries to innovate and invest in new technologies, demonstrating Musk’s profound influence on market dynamics and corporate strategies on a global scale.

Musk’s Legal Battles and Their Financial Implications

Legal battles have been a significant chapter in Elon Musk’s phenomenal story of wealth accumulation. The recent Delaware Supreme Court ruling reinstating his Tesla compensation package is a prime example of how legal events can drastically impact a billionaire’s net worth. While Musk’s fortune is safely cushioned by his diversified investments, the volatile nature of business law, especially in high-stakes situations like Musk’s, can swing public opinion and investor confidence rather quickly, influencing stock prices and market values.

Understanding the legal landscape is essential for entrepreneurs and investors alike, as Musk’s experiences underline the importance of navigating complex legal frameworks. This ruling, which corrected the perception of Musk’s compensation plan, offers important insights into the potential legal challenges that high-profile business figures may encounter and underscores the need for comprehensive legal strategies in securing long-term financial stability.

The Future of Musk’s Ventures

Looking ahead, the future of Elon Musk’s ventures appears promising yet fraught with challenges. With innovative projects on the horizon, including advanced AI initiatives and interplanetary travel, Musk continues to push the boundaries of technology and entrepreneurship. His vision for a sustainable future via Tesla’s electric vehicles and SpaceX’s ambitious Mars colonization plans represents a dual drive towards environmental sustainability and exploration. This unique blend of ambition has significant implications for his wealth in the coming years.

Moreover, investors and market analysts are keenly monitoring Musk’s next moves. There’s a palpable excitement surrounding the potential public listing of SpaceX and how it could affect Musk’s billionaire ranking. With his capacity to inspire disruptive change, the trajectory of Musk’s initiatives will not only shape his fortune but also influence global technological advancements and corporate strategies in various sectors.

Frequently Asked Questions

What factors contributed to Elon Musk’s net worth reaching $749 billion?

Elon Musk’s wealth has surged due to several factors, including the reinstatement of his Tesla compensation package valued at $139 billion, which was part of a landmark pay deal from 2018. A recent legal victory reinstated this stock option package, boosting Musk’s net worth, which now exceeds that of India’s top companies combined.

How does Elon Musk’s wealth compare to the value of India’s largest companies?

Elon Musk’s net worth of $749 billion is greater than the combined market capitalization of India’s four largest companies: Reliance, HDFC Bank, Bharti Airtel, and Tata Consultancy Services, which together amount to approximately $694 billion.

What is the Tesla compensation package that influenced Musk’s billionaire ranking?

Musk’s Tesla compensation package is a controversial deal set in 2018, originally valued at $56 billion. After legal battles, it was reinstated and now includes stock options worth $139 billion, which significantly contributed to his current billionaire ranking and skyrocketing wealth.

How did SpaceX valuation impact Elon Musk’s wealth?

As an entrepreneur with significant stakes in SpaceX, the company’s increasing valuation has directly impacted Elon Musk’s net worth. Speculations around a potential public listing for SpaceX have further amplified his wealth, highlighting Musk’s influential role in groundbreaking aerospace innovation.

What is Elon Musk’s position in the billionaire ranking as of December 2025?

As of December 2025, Elon Musk sits at the top of the billionaire ranking, holding a net worth of $749 billion. His wealth surpasses that of the second-richest person, Larry Page, by nearly $500 billion, according to Forbes’ Real-Time Billionaires List.

| Key Point | Details |

|---|---|

| Musk’s Net Worth | $749 billion, surpassing the combined market cap of India’s top four companies. |

| Market Cap Comparison | Reliance ($236B), HDFC Bank ($184B), Bharti Airtel ($142B), Tata Consultancy Services ($132B). |

| Legal Win | Delaware Supreme Court reinstated Tesla stock options worth $139 billion, previously deemed improper by a lower court. |

| Compensation Package | Part of Musk’s 2018 pay package, initially valued at $56 billion; massive $1 trillion plan approved by Tesla shareholders. |

| Historical Achievements | First person to exceed a net worth of $600 billion; founder of several major companies including SpaceX and Tesla. |

| Early Career | Co-founded Zip2 in 1995; sold for $307 million. Founded X.com and merged it into PayPal, sold to eBay for $1.5 billion. |

| Future Prospects | Speculations about SpaceX going public and ongoing developments in AI and robotics through Tesla. |

Summary

Elon Musk’s wealth has reached an astonishing $749 billion, a figure that greatly exceeds the combined market capitalization of India’s top four companies. This surge can be attributed to various factors including a significant legal victory and the reinstatement of a hefty compensation package for Musk by the Delaware Supreme Court. His business ventures, particularly with Tesla and SpaceX, have propelled him to secure a place among the wealthiest individuals globally. Musk’s remarkable journey from an early entrepreneur to the world’s richest person showcases not only his innovative spirit but also the immense potential in sectors like electric vehicles and aerospace.