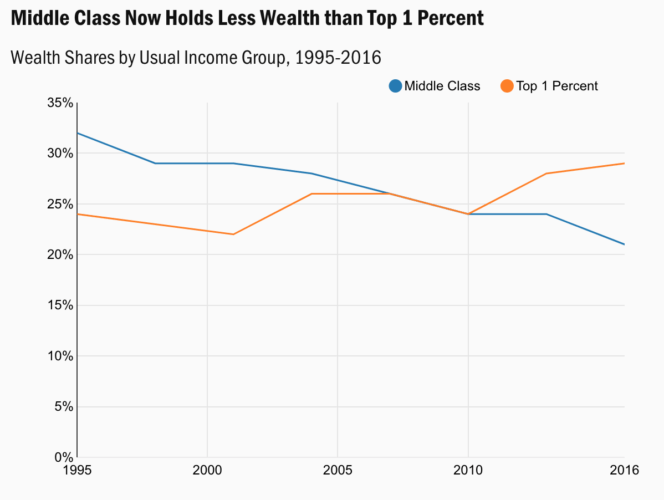

The middle class wealth gap has become a pressing concern, illustrating the ongoing struggle against wealth inequality in today’s society. Recent studies reveal that the average worker may take as long as 52 years to escape the middle class, emphasizing the significant hurdles to economic mobility. Despite a lifetime of diligent saving, many find themselves unable to attain the status once synonymous with the American Dream. This alarming trend highlights the restrictions on middle class savings and underscores how cross-generational wealth perpetuates financial disparities. As the gap widens, it raises critical questions about the feasibility of achieving prosperity in an increasingly uneven economic landscape.

As the divide between socio-economic classes continues to grow, the financial disparities affecting middle-income families have prompted urgent discussions about the state of economic opportunity. The substantial distance between those at the high end of the wealth spectrum and the middle class brings to light issues of financial disparity and limits on upward mobility. The persistent erosion of financial security for average workers casts a shadow over aspirations for a better life, as the definition of a comfortable or ‘rich’ lifestyle becomes increasingly unattainable. With hard-earned wages barely covering daily expenses, aspirations of wealth now seem distant, suggesting a critical examination of how society supports or hinders its own workforce. Notably, the trend of cross-generational wealth retention reinforces the notion that one’s socio-economic starting point heavily dictates eventual outcomes.

Understanding the Middle Class Wealth Gap

The middle class wealth gap has become a pressing concern as recent research reveals that the average worker in the U.S. needs to save for an astonishing 70 years to achieve what is perceived as wealth. This dire statistic underscores the financial challenges that many middle-class families face today. With rising living costs combined with stagnant wages, the dream of ascending from the middle class to wealth seems increasingly unattainable. Such socioeconomic disparities not only highlight the difficulties of saving but also accentuate the limitations on economic mobility—where a family’s financial status often dictates its future opportunities.

These findings resonate with a broader narrative of wealth inequality that has plagued societies worldwide. Many individuals born into the middle or lower class often find themselves trapped in a cycle of financial hardship, making it incredibly challenging to improve their circumstances. The barriers to cross-generational wealth accumulation mean that, even with diligent saving and investment, families struggle to break free from their socioeconomic status. The middle class in particular seems to be bearing the brunt of these systemic issues, as their efforts to build savings are continually undermined by external economic pressures.

The American Dream and Economic Mobility

The American Dream, once a beacon of hope for upward mobility through hard work and perseverance, now appears increasingly elusive for many. In order to retire comfortably and achieve the well-desired middle-class aspiration of owning a home, sending kids to college, and enjoying vacations, Americans need to conjure up savings that far exceed their peers from past generations. Currently, a staggering $4.4 million is needed to fulfill these aspirations, which starkly contrasts the historical norm where home ownership and financial stability were attainable for the average worker.

Economic mobility in the U.S. has stagnated, suggesting that the barriers to achieving the American Dream are entrenched in social and economic structures that favor affluent families. The research indicating that the average worker would need nearly 70 years without expenditures highlights a shift in financial realities where a lifetime’s worth of labor may not suffice to elevate social standing. This growing divide showcases how the path to economic security has narrowed, leaving many to question whether the American Dream is still a viable ambition for future generations.

Inflation and Its Effect on Savings

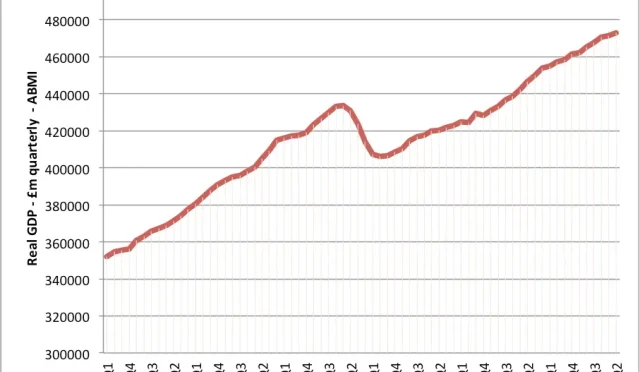

Inflation plays a pivotal role in exacerbating the challenges faced by middle-class families aiming to save for a secure financial future. As the cost of living continues to rise, many find that their purchasing power diminishes, placing further strain on their ability to set aside money for the long term. The alarming statistic that it would take 36 years of full-time work for the average American to feel wealthy with $2.3 million saved indicates that inflation is consistently outpacing salary growth, making it extraordinarily difficult for individuals to alter their financial status.

Moreover, inflation coupled with job security concerns fosters an environment where financial planning becomes increasingly complex. The prospect of automation replacing jobs adds another layer of uncertainty, making it even harder for workers to feel confident in their ability to save effectively. Therefore, without significant changes in wages or economic policies that support sustainable growth for the middle class, inflation may continue to widen the wealth gap, leaving many to grapple with the harsh realities of financial instability.

Passive Income and Wealth Disparities

The concept of passive income has become a focal point in discussions surrounding wealth inequality. Those who have the privilege to invest in assets like real estate or stocks have witnessed significant financial growth thanks to compound interest and market appreciation. In contrast, average workers, who rely solely on their wages, find it nearly impossible to accumulate wealth at a similar rate. This growing divide raises critical concerns about the sustainability of economic mobility, as individuals who cannot invest are left behind in the race for wealth.

Moreover, the wealth accumulated through passive income not only enhances individual financial status but also contributes to cross-generational wealth, creating a cycle where the affluent pass on their advantages, while lower-income families continue to struggle. As passive gains become a principal factor in the widening wealth gap, the disparities between classes become more pronounced. Without innovative solutions that address these systemic inequalities, the divide will likely persist, making it more challenging for those in the middle class to achieve financial independence.

Challenges Faced by the Middle Class

The middle class confronts a multitude of challenges that impede their financial growth and security. Rising costs of education, healthcare, and housing contribute to a precarious financial situation, making it difficult for families to save effectively. The burden of student loans and increasing housing prices further complicate the middle-class struggle for stability, often pushing them further away from the dream of wealth accumulation.

Additionally, middle-class families find themselves vulnerable to economic shifts, such as recessions and job market contractions. These economic uncertainties can exacerbate existing vulnerabilities, resulting in insufficient savings for retirement or emergencies. The intersection of these challenges creates a landscape where the middle class feels increasingly trapped, with limited options for improving their financial circumstances without a significant change in economic policies or societal structures.

The Role of Policy in Financial Inequality

Government policies play a critical role in shaping the financial landscape for the middle class, which in turn affects income inequality. Without strong policies aimed at augmenting wages, reducing healthcare costs, and making education more accessible, the middle class may continue to see their economic opportunities dwindle. Tax reforms, social safety nets, and support for small businesses can significantly affect wealth distribution and the prospects for upward mobility in society.

Furthermore, initiatives designed to mitigate economic disparities, such as increasing the minimum wage or enhancing access to quality education, could empower the middle class to build wealth more effectively. As wealth continues to concentrate in the hands of the few, it is vital that policymakers implement strategies that promote equitable growth and reduce barriers to financial stability for middle-class workers. Doing so could pave the way for a healthier economy where future generations have a fair shot at achieving the American Dream.

The Impact of Job Security on Wealth Accumulation

Job security plays a significant role in determining a worker’s ability to accumulate wealth and achieve financial independence. For many middle-class families, a steady income stream is essential, allowing them to save and invest for the future. However, with rising automation and shifting job markets, workers face increasing uncertainty regarding their employment prospects, which can directly hinder their capacity to build wealth.

The stress of job insecurity can lead individuals to prioritize immediate financial needs over long-term savings goals. As a result, many middle-class workers may find themselves unable to invest in opportunities that could enhance their wealth and contribute to cross-generational financial stability. Without significant advancements in job security and employment policies, this cycle of insecurity will likely perpetuate the disparities in wealth accumulation and make it increasingly challenging for the middle class to thrive.

Financial Literacy and Its Importance

Financial literacy is fundamental to addressing the wealth inequality faced by many in the middle class. Understanding concepts such as savings, investments, and budgeting can empower individuals to make informed decisions about their financial future. Unfortunately, many people lack access to financial education, leading to a cycle of poor financial choices that hinder their ability to save and invest effectively.

As the wealth gap widens, it is essential for educational institutions and community programs to prioritize financial literacy initiatives. By equipping individuals with the knowledge they need to navigate their financial landscapes, we can help bridge the divide between wealth and poverty. Furthermore, enhancing financial literacy can contribute to greater economic mobility by ensuring that individuals are better prepared to seize opportunities that come their way, ultimately working toward a more equitable financial environment for all.

Future Implications for the Middle Class

The future of the middle class rests on multiple factors that determine economic stability and mobility. As automation and AI continue to evolve, the job landscape will shift, potentially displacing many middle-class workers while creating new opportunities for wealth generation. It will be vital for individuals to adapt to these changes and pursue lifelong learning to remain competitive in an evolving job market.

Additionally, addressing systemic issues surrounding wealth inequality will be paramount in shaping a brighter future for the middle class. Advocacy for policies that promote economic equity, such as increased minimum wages and affordable housing resources, may unfold in response to the growing consciousness around wealth disparities. By fostering a collective effort to build a more inclusive economy, society can work toward ensuring that all individuals, regardless of their starting point, can pursue a fulfilled life as envisioned in the American Dream.

Frequently Asked Questions

What is the middle class wealth gap and how does it affect economic mobility?

The middle class wealth gap refers to the growing disparity in wealth between the average middle-class worker and the wealthiest individuals. This gap significantly impacts economic mobility, making it increasingly difficult for those in the middle class to ascend the wealth ladder. Research shows that individuals born into lower-income families often remain in similar economic situations due to limited opportunities and resources, creating a cycle of wealth inequality.

How do passive gains contribute to middle class savings and the wealth gap?

Passive gains, such as increases in property and asset values, play a crucial role in exacerbating the middle class wealth gap. Those who invest wisely benefit from exponential growth in wealth, while middle-class workers relying solely on savings struggle to keep pace with rising costs. This disparity highlights the importance of making informed financial decisions to enhance middle class savings and bridge the wealth gap.

What does the American Dream look like in the context of the middle class wealth gap?

The American Dream traditionally encompasses home ownership, stable employment, and a comfortable lifestyle. However, the middle class wealth gap has made achieving this dream increasingly elusive for many. Recent studies suggest that U.S. workers now need over $4.4 million to secure this ideal, indicating that the path to economic mobility is narrowing for many in the middle class.

Why do workers need to save for decades to escape the middle class wealth gap?

Research indicates that it could take the average worker 52 years of saving their entire income to reach the wealth levels of the top 10%. This staggering timeframe reflects systemic issues within the economy, including rising living costs and stagnant wages, which are inflating the threshold necessary for financial security and advancement beyond the middle class wealth gap.

What role does cross-generational wealth play in exacerbating the middle class wealth gap?

Cross-generational wealth refers to the assets and advantages passed down within families. This accumulation of wealth creates significant advantages for those who inherit resources, perpetuating the middle class wealth gap. Families with wealth can invest, accumulate more wealth, and provide opportunities for their children, thereby limiting economic mobility for families without similar resources.

How is inflation impacting the middle class and the wealth gap?

Inflation plays a critical role in widening the middle class wealth gap. As living costs rise, the purchasing power of average middle-class salaries diminishes, making it harder to save and invest. Consequently, middle-class workers may find themselves further from achieving the financial status typically associated with wealth, thereby entrenching existing economic inequalities.

What strategies can the middle class employ to mitigate the wealth gap?

To combat the middle class wealth gap, individuals can focus on enhancing financial literacy, engaging in investment education, and exploring diverse income streams. Additionally, creating smart savings plans and leveraging assets can help middle-class workers build wealth over time, facilitating economic mobility and a stronger financial future.

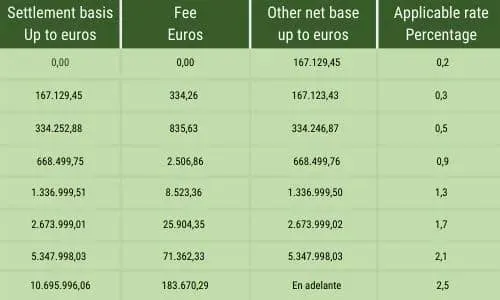

| Key Findings | Details |

|---|---|

| Time Required to Reach Wealth Status | Average worker needs to save for 52 years to be considered wealthy in the UK. |

| Total Savings Needed | £1.3 million ($1.7 million) is needed, assuming no expenses during saving. |

| Wealth Mobility Stats | Wealth gaps are widening; those born poor likely to stay poor. |

| Comparison with the US | US workers need at least $2.3 million to feel wealthy, and $4.4 million for the American Dream. |

| Realities of Savings vs. Income | Median earnings vs. savings requirements show a significant gap, making wealth unachievable. |

Summary

The middle class wealth gap has become a significant issue, revealing that average workers face nearly insurmountable challenges to achieving financial security. Research indicates that individuals would need to save for decades—52 years in the UK and over 70 years in the US—just to meet basic wealth thresholds. This troubling trend highlights the daunting realities of modern economic structures, particularly for those aspiring to break out of generational poverty. Addressing these disparities is crucial for fostering socioeconomic mobility and ensuring that wealth is accessible to all.