Financial independence is an aspiration for many, representing the freedom to live life on one’s own terms without the constraints of financial worries. As we approach 2026, the conversation around achieving this goal has intensified, fueled by insights from investors who have successfully navigated diverse paths to wealth. They emphasize that employing wealth-building tips such as smart investing strategies, house hacking, and creating multiple income streams can significantly bolster one’s financial stability. These strategies are not just buzzwords; they serve as actionable steps towards the ultimate goal of financial freedom. In a world where economic volatility is prevalent, achieving financial independence has never felt more relevant.

Achieving autonomy over your finances is often referred to as gaining fiscal freedom or economic independence. This concept involves a proactive approach to managing your income and assets, ensuring that you are not solely dependent on a paycheck but have various revenue streams at your disposal. Many believe that the path to wealth creation lies in implementing effective strategies, including real estate investments and innovative money management practices. The insights shared by successful investors underscore the importance of strategies like property hacking and diversified earnings to cultivate a sustainable lifestyle. In this increasingly uncertain economic climate, the pursuit of financial self-sufficiency is crucial for long-term stability.

Tracking Your Financial Progress for Wealth Building

Understanding your financial position is essential for building wealth. This means tracking your income, expenses, savings, and investments diligently. By keeping a close watch on these metrics, you can identify areas for improvement and set realistic targets for your future. The process of monitoring your net worth — the difference between what you own and what you owe — serves as a crucial barometer for your financial health and helps you adjust your strategies as needed.

In 2026, as we embrace economic changes, utilizing financial tracking tools such as apps or spreadsheets can provide real-time insights into your financial standing. Explaining where your money goes and how it grows empowers you to make informed decisions and craft a tailored approach to wealth-building. By establishing a routine of reviewing your financial progress, you can fine-tune your methods, ensuring that each year brings you closer to your financial goals.

House Hacking: A Pathway to Financial Independence

House hacking is an innovative solution for those looking to eliminate their housing costs while simultaneously generating income. By renting out a portion of your living space—whether it be a room or an entire unit in a multi-family property—you not only alleviate the burden of a mortgage but also gain a valuable asset. As shown by the experiences of successful investors, house hacking can play a transformative role in your journey towards financial independence.

Moreover, house hacking allows for the accumulation of wealth through real estate without significant initial outlay. This strategy not only helps in creating multiple income streams but also aids in leveraging real estate appreciation over time. As you build equity in your property, you position yourself to invest further, ultimately paving the way toward financial freedom.

Focus on High-Value Financial Questions

Addressing substantial financial inquiries rather than minute spending concerns is vital for building wealth. Experts like Ramit Sethi advocate for a broader focus, suggesting that contemplating questions such as your future retirement plans, investment habits, and overall savings rates can significantly shape your financial trajectory. This mindset shift towards larger financial decisions can help clarify your goals and direct your efforts more effectively.

In 2026, as economic uncertainty looms, prioritizing these high-stakes questions will serve individuals well. Instead of fixating on daily expenditures, adopting a strategic perspective allows you to allocate resources toward growth-oriented investments that enhance your financial independence over time. Embracing this philosophical approach to wealth management cultivates a mindset aligned with success.

Building Multiple Income Streams for Financial Freedom

Creating multiple income streams is no longer a luxury; it’s a necessity in today’s dynamic economic environment. Rarely does pairing a single job with an investment yield the financial security one hopes for. Instead, by diversifying your income sources—from side businesses to passive investment portfolios—you can insulate yourself from market volatility and enhance your wealth-building potential.

Incorporating various income channels also provides flexibility to navigate life’s uncertainties. As you chip away at debts and build savings, balancing multiple revenue streams aligns with your quest for financial independence. For instance, passive income from investments or automated online businesses can complement your primary income, enabling you to pursue opportunities and investments that could lead to greater long-term wealth.

Investment Strategies for 2026: Navigating Market Volatility

As we head into 2026, developing robust investing strategies is crucial. The market’s drawbacks, influenced by economic uncertainty, force investors to re-evaluate their tactics for building wealth. Techniques such as diversification of assets, index investing, and real estate allocations can create a resilient investment strategy, allowing you to withstand market fluctuations and seize on lucrative opportunities that arise.

Moreover, understanding different asset classes and their behaviors during economic shifts prepares you to make informed decisions. Whether it’s stocks, bonds, or alternative investments, aligning your strategy with your financial objectives can achieve growth while safeguarding your wealth. Staying educated on financial trends and investment principles will empower you as you seek financial freedom in the new economic landscape.

The Importance of Setting Specific Financial Goals

Setting specific financial goals creates a roadmap for your wealth-building journey. Objectives should be clear, measurable, and time-bound, which allows you to strategize accordingly. Goals could range from saving a specific amount for retirement, paying off debt, or achieving financial independence by a set age. By establishing these targets, you create a sense of purpose and urgency that drives your financial decisions.

Moreover, regularly revisiting and adjusting your financial goals ensures that they remain relevant as your circumstances change. This practice not only keeps you motivated but also allows for flexibility in your wealth-building journey as life presents unexpected opportunities or challenges. Clear goals can ultimately lead to better financial outcomes and a stronger foundation for future wealth.

Maximizing Returns Through Effective Budgeting Techniques

Effective budgeting is a cornerstone of successful wealth building. The ability to manage your income and expenses efficiently allows you to allocate funds towards savings and investments strategically. By creating a budget that reflects your financial goals and priorities, you can maximize returns and ensure that you are making the most of your resources.

Additionally, budgeting serves as a guide for evaluating your financial decisions. Monitoring spending habits and categorizing expenditures enables you to identify areas where you can cut costs and redirect funds towards higher-yield investments. As we progress through 2026, adopting disciplined budgeting techniques becomes increasingly crucial to achieving greater financial independence.

Leveraging Technology for Financial Growth

In 2026, technology plays an indispensable role in wealth building. Financial apps, investment platforms, and online resources have transformed the way individuals can manage their finances, fostering a culture of informed decision-making. Utilizing these technological tools allows for streamlined budgeting, investment tracking, and even automated fund allocation—all essential for efficient wealth accumulation.

Moreover, understanding how to leverage technology enhances your ability to forecast and strategize your financial goals. Investing in friends’ advice from experienced individuals and learning about new financial technologies can provide insights that lead to maximizing returns. Embracing this technological shift will empower you to adapt and thrive in the pursuit of financial freedom.

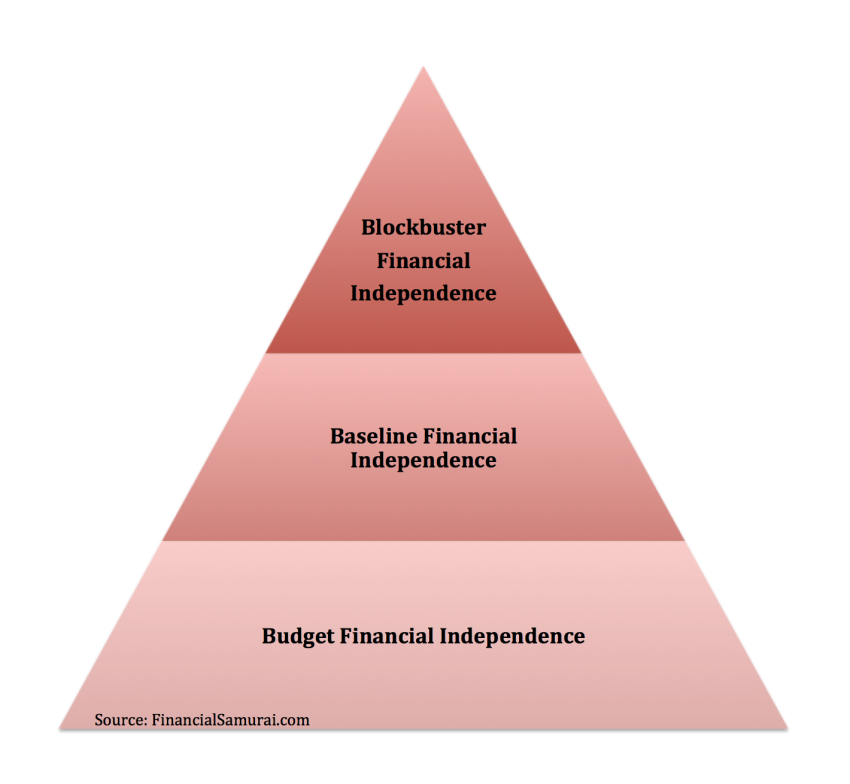

Financial Independence: Achieving Your Wealth Goals

Achieving financial independence is a common aspiration for many, and it involves disciplined planning and execution of effective strategies. This entails growing your savings through various methods like house hacking, tracking investments, and establishing multiple income streams. The goal is to create a self-sustaining financial ecosystem that no longer relies solely on your day job.

To secure financial independence, nurturing a wealth-building mindset through education and experience plays a vital role. As individuals manifest this goal in 2026, the power of financial literacy and proactive wealth management will be paramount. By embracing the principles of wealth building shared by successful investors, you can shape a future where financial independence is not just a dream, but a tangible reality.

Frequently Asked Questions

What are the best wealth building tips for achieving financial independence?

To achieve financial independence, focus on key wealth-building tips such as setting clear financial goals, tracking your net worth, and investing in diverse assets. Consider strategies like house hacking to minimize housing costs and build equity, and create multiple income streams through side businesses or investments. These steps will guide you towards financial freedom and security.

How can investing strategies help in building financial independence?

Effective investing strategies are fundamental for achieving financial independence. Start by diversifying your investment portfolio across stocks, bonds, and real estate. Utilize index funds for long-term gains, and consider house hacking to generate rental income. Regularly review and adjust your investment approach to align with your financial goals and market conditions, ensuring steady wealth accumulation.

What is house hacking and how does it contribute to financial independence?

House hacking is a strategy where you live in one part of a property while renting out the other parts, significantly lowering or eliminating your housing expenses. This practice not only offsets your mortgage payments but also allows you to build equity and generate income, which are crucial steps toward achieving financial independence. This strategy accelerates your path to wealth and financial freedom.

Why are multiple income streams important for financial independence?

Having multiple income streams is vital for financial independence as it diversifies your income sources, reducing reliance on a single salary. This can include income from investments, side hustles, rental properties, and other ventures. By creating these additional streams, you enhance your financial stability, allowing more flexibility and security in your financial planning.

How do you track net worth effectively towards financial independence?

Tracking your net worth is essential for financial independence. Start by listing all your assets, including savings, investments, and property, and then subtract your liabilities, such as debts and loans. Regularly updating this figure will give you insight into your financial progress and help you set realistic goals for wealth building and achieving financial freedom.

What are some practical steps to achieve financial independence by 2026?

To achieve financial independence by 2026, begin by crunching your numbers—understand your debt, savings, and investments. Set specific financial goals, like increasing your net worth or creating multiple income streams. Implement strategies such as house hacking and develop a solid investment plan. Focus on high-impact financial questions to guide your decisions towards building long-term wealth.

How can I utilize online tools for financial independence planning?

Online tools, such as retirement calculators and budget planners, can be invaluable for planning your path to financial independence. For instance, tools like WalletBurst allow you to determine your retirement number based on your current situation and goals. By using these resources to track your spending and investments, you can make informed decisions that align with your financial freedom objectives.

| Key Strategy | Description |

|---|---|

| Crunch Your Numbers | Understand your financial starting point and set specific goals for net worth or retirement. |

| $30,000 Questions | Focus on significant financial decisions like your savings rate and retirement plans rather than trivial daily expenses. |

| House Hacking | Eliminate your mortgage payments by renting out parts of your home or moving into properties you can convert to investments. |

| One-to-Infinity Leverage | Create income streams that require minimal ongoing effort, such as apps or subscriptions. |

Summary

Achieving financial independence is a goal for many, especially as they navigate the financial landscape of the coming years. The insights shared by successful investors emphasize the importance of setting clear financial goals, focusing on substantial financial questions, and leveraging strategies like house hacking to eliminate costs. Additionally, maximizing income from multiple streams can enhance your financial strategy significantly. By adopting these tips, individuals can substantially improve their chances of attaining financial independence.