The AI stock market boom has transformed the landscape of wealth accumulation, significantly boosting the fortunes of America’s tech founders. This unprecedented surge in artificial intelligence companies has contributed over half a trillion dollars to the collective wealth of tech billionaires, with the total now soaring to nearly $2.5 trillion. Notable figures such as Elon Musk have reaped massive rewards, as his net worth skyrocketed to $645 billion amidst the AI frenzy. Companies like Nvidia have similarly benefitted, with their stock surge reflecting the rising demand for advanced technologies essential for AI. As the sector continues to attract investment, discussions around wealth concentration and economic balance are becoming increasingly pertinent, making the AI stock market boom a focal point of contemporary economic discourse.

The recent surge in the stock market, driven by advancements in artificial intelligence, represents a significant shift in wealth dynamics within the tech sector. This phenomenon, often referred to as the AI investment explosion, has resulted in staggering riches for many leading technology entrepreneurs. Prominent billionaires, including Musk and Nvidia’s Jensen Huang, have seen their fortunes swell dramatically as investors flock to companies specializing in AI-driven innovations. The excitement surrounding these technologies has ignited investor interest, but it has also raised questions about the sustainability of such rapid growth. As these tech titans amass vast fortunes, the implications for wealth distribution and market stability remain a pivotal topic for economists and policymakers alike.

The Impact of the AI Stock Market Boom on Tech Billionaires

The emergence of the AI stock market boom has significantly transformed the financial landscape for many tech entrepreneurs. With the surge of artificial intelligence companies, such as Microsoft and Nvidia, there has been an impressive increase in valuations that has substantially boosted the wealth of tech founders. According to Bloomberg, the collective net worth of the top ten U.S. tech billionaires soared to nearly $2.5 trillion, highlighting how the integration of AI technology is not just a trend, but a staggering economic force reshaping the foundations of wealth in the tech sector.

Among the most notable beneficiaries of this boom is Elon Musk, whose net worth jumped to $645 billion, illustrating the direct correlation between AI advancements and individual wealth accumulation. As companies like Nvidia continue to push boundaries with their cutting-edge chips designed for AI applications, the associated stock price hikes translate into significant personal gains for tech leaders. This trend reinforces the notion that the wealth of tech founders is increasingly intertwined with the fortunes of their companies, particularly in sectors driven by artificial intelligence.

Elon Musk: A Case Study in AI-Driven Wealth

Elon Musk’s financial ascent amid the AI boom exemplifies the potential for immense wealth creation in the tech industry. With a growth of nearly 50% in his personal fortune, Musk stands out not only as the richest individual globally but as a symbol of the extraordinary value AI technologies are generating. His ventures, particularly xAI, reflect how innovation in artificial intelligence not only captivates public interest but also plays a crucial role in revolutionizing market dynamics and investor confidence.

The projection that Musk could become the world’s first trillionaire highlights the expansive potential for wealth generation within the AI sector. As projects like Tesla’s advancements in self-driving technology align with ongoing investments in AI, it becomes evident that the intersection of technology and financial success is a crucial narrative in today’s economy. Musk’s trajectory is a testament to how AI is not just reshaping tech billionaires’ fortunes but is likely to influence global economic structures and investment strategies.

Nvidia’s Stock Surge: Fueling Billionaire Fortunes

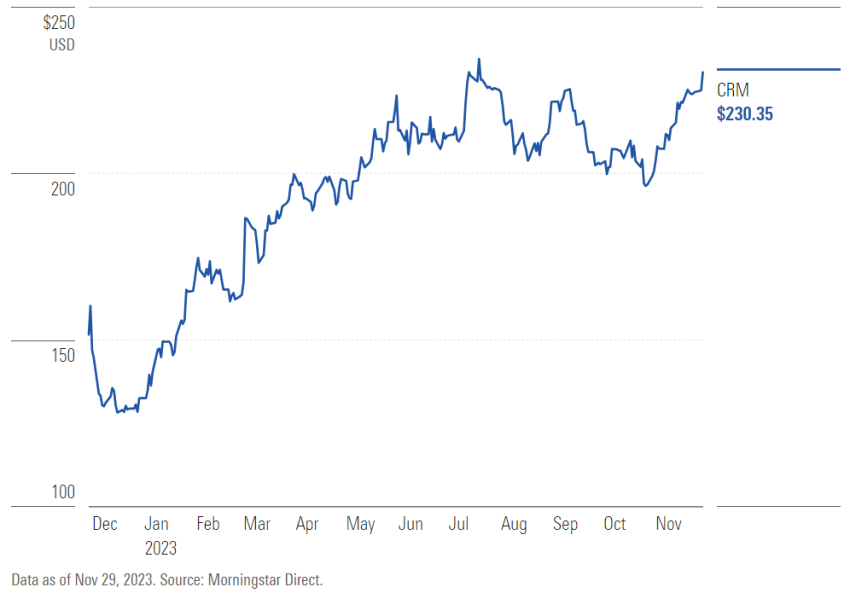

Nvidia’s remarkable stock surge is a cornerstone of the current AI stock market boom and has had profound implications for the wealth of its co-founder, Jensen Huang. With Huang’s personal fortune climbing to $159 billion, his success underscores how pivotal advancements in graphics processing units (GPUs) are for the growth of artificial intelligence technologies. As Nvidia’s chips become increasingly essential for machine learning and high-performance computing, they drive demand not only for Nvidia’s product lineup but also propel Huang’s standing among the world’s wealthiest individuals.

The financial impact of Nvidia’s innovations is significant, highlighting the broader trend among tech companies that are seeing their market capitalizations soar due to AI-related advancements. As analysts forecast the company’s potential to exceed former benchmarks, it’s clear that investment in Nvidia and similar tech firms is viewed as a sure bet amid the booming AI landscape. This aggregate increase in tech billionaires’ wealth illustrates how critical the role of technology—especially artificial intelligence—has become in shaping the new economic order.

The Surge in Wealth Among Tech Founders

The substantial rise in the wealth of tech founders highlights a defining moment in the economic landscape influenced by technological innovations. Significant figures like Larry Page and Sergey Brin have witnessed their fortunes grow astronomically, with Page’s wealth increasing by approximately $102 billion thanks to investor confidence centered on AI advancements. This trend is not just a reflection of individual success but also signals a larger movement within the tech industry that is investing heavily in artificial intelligence capabilities to secure future growth.

In addition to the dramatic increases in stock prices, the wealth accumulation of these billionaires prompts a critical discussion on income inequality and the distribution of wealth within the tech sector. As the fortunes of these individuals balloon, many economists advocate for structural changes to balance the economic scales that increasingly favor a select group. The dynamics of wealth in technology reveal that, while AI continues to create unparalleled opportunities for profit, it also sparks necessary debates around how wealth is generated and shared in society.

Investors Bet Big on AI Companies

The wave of investment in artificial intelligence companies has reached unprecedented levels as investors increasingly recognize the transformative potential of AI technologies. Companies like Nvidia and Alphabet are at the forefront of this investment boom, which is reshaping not just their market valuations but also the overall tech industry landscape. As leading banks and investment firms pour capital into AI lineage stocks, the expectation is that sustained growth will be realized, further cementing the tech titan’s hold on global markets.

However, this optimism brings with it a period of heightened vulnerability. The Bank of England has warned of a potential market correction, should investor enthusiasm wane. Yet, the immediate gains witnessed in the tech sector appear to outweigh concerns, as assets tied to AI innovations continue to surge. As tech billionaires’ net worth climbs concurrently, it becomes evident that the relationship between investor behavior and wealth accumulation among tech leaders is becoming increasingly interconnected.

Market Responses to AI Innovations

The market responses to advancements in artificial intelligence have shaped a new investing economy where mere enthusiasm translates into tangible financial growth. As companies like Tesla and Nvidia innovate and evolve their product offerings, investors are responding with unprecedented levels of enthusiasm, leading to record high valuations. This surge indicates a profound confidence in the long-term viability of AI technologies and their capacity to generate revenue, thereby creating a dynamic environment for both seasoned investors and tech founders.

Given the fluctuations in the market, some analysts caution against overvaluations tied to the hype surrounding AI. They suggest a careful examination of equity market valuations, particularly regarding firms heavily focused on artificial intelligence and their projected growth paths. This cautionary stance emphasizes the need for a balanced approach to investing where excitement is tempered by a realistic outlook on the sustainability of growth generated by tech innovations.

The Role of Wealth Taxes in Addressing Economic Disparities

As wealth among tech billionaires rises, the conversation surrounding wealth taxes has gained renewed urgency. Proponents argue that taxing the immense fortunes of individuals like Elon Musk and Jensen Huang can contribute to addressing growing economic disparities. By ensuring that the ultra-wealthy contribute a fair share, it is proposed that funds could be used to support social programs and investments in education or healthcare, which are critical in fostering wider economic equality.

The rationale for a fair tax system becomes more pressing as the wealth concentration increases. With market dynamics heavily favoring tech leaders, such measures could help redistribute wealth and invigorate economic growth at the grassroots level. The ongoing discussions around taxation are not merely theoretical; they represent a pragmatic approach to manage the burgeoning wealth of tech barons and create a more balanced economic environment.

Global Implications of AI Wealth Concentration

The rise of tech billionaires, fueled by AI advancements, has global implications that reach beyond national borders. With companies like Nvidia establishing themselves as giants in the stock market, the ripple effects of their success can influence global economies and investment strategies. As these firms gain dominance, they not only compete for market share but also set industry standards that impact tech ecosystems worldwide, forcing other nations to adapt and innovate.

Moreover, this concentration of wealth in the tech sector raises significant questions about the future of economic power and how it may shift as AI technologies evolve. As the investments in AI culminate in further advancements, the wealth of companies and their founders could outpace traditional industries, leading to a redefinition of global economic hierarchies. This evolution speaks to the need for policymakers to recognize the trends and make informed decisions that consider not just the local impact of tech wealth but also its global ramifications.

Strategies for Investment in AI Trends

For investors looking to tap into the lucrative AI stock market landscape, understanding the underlying trends and potential growth areas is crucial. As tech companies aggressively pursue artificial intelligence innovations, savvy investors are seeking the long-term winners in this rapidly evolving sector. Companies that exhibit strong fundamentals and strategic alignment with AI-driven growth are attracting significant attention, both from individual and institutional investors alike.

Moreover, diversification within AI-focused investments has become a common strategy to mitigate risks associated with market volatility. Investors are advised to consider a balanced portfolio that encompasses various stakes in companies innovating within artificial intelligence, thus equipping them to capitalize on distinctive technology trends while also buffering against unpredictable market shifts. This strategic approach ensures a well-rounded exposure to the dynamic evolution of the AI economy.

Frequently Asked Questions

How has the AI stock market boom affected the wealth of tech founders?

The AI stock market boom has significantly increased the wealth of tech founders, contributing to a rise of over $500 billion in the past year alone. America’s wealthiest tech leaders, including notable figures like Elon Musk and Jensen Huang, have seen their fortunes soar as investments in artificial intelligence companies surge.

What factors contributed to Elon Musk’s increased net worth during the AI stock market boom?

Elon Musk’s net worth surged by nearly 50% to $645 billion due to the robust performance of AI-related ventures and the stock market’s overall response to the AI boom. As the leader of Tesla and xAI, Musk capitalized on this trend, positioning himself as one of the primary benefactors of the growing interest in artificial intelligence technologies.

Which artificial intelligence companies have seen stock surges during the current market boom?

Companies like Nvidia have experienced remarkable stock surges during the AI stock market boom. Nvidia, essential for producing advanced computer chips critical for AI operations, became the world’s first $5 trillion company, demonstrating the significant investor interest in artificial intelligence sectors.

What impact has the AI stock market boom had on tech billionaires like Larry Page and Jeff Bezos?

The AI stock market boom has positively impacted tech billionaires, with Larry Page seeing his wealth increase by about $102 billion and Jeff Bezos by $255 billion as investors drive up expectations surrounding the advancements in artificial intelligence companies and their technologies.

Are there any potential risks associated with the AI stock market boom?

Yes, the Bank of England has warned of potential risks linked to the AI stock market boom, suggesting that equity market valuations appear overstretched. A sudden correction could occur if investor confidence diminishes regarding the long-term impact of artificial intelligence on the economy.

| Key Point | Details |

|---|---|

| Stock Market Growth | AI companies added over $500 billion to the wealth of U.S. tech billionaires in the past year. |

| Wealth of Tech Leaders | Top 10 tech leaders saw their combined wealth rise from $1.9 trillion to nearly $2.5 trillion. |

| Elon Musk’s Wealth | Musk’s net worth rose to $645 billion, potentially making him the first trillionaire. |

| Nvidia’s Success | Jensen Huang’s wealth increased by $41.8 billion; Nvidia became the first $5 trillion company. |

| Other Billionaires | Larry Page and Sergey Brin’s wealth surged by $102 billion and $92 billion, respectively. |

| Market Concerns | Bank of England warns of potential market correction due to high valuations of AI tech companies. |

Summary

The AI stock market boom has significantly transformed the financial landscape, enriching tech giants and raising alarms about economic disparities. The surge in artificial intelligence investments has led to impressive gains for leaders like Elon Musk and Jensen Huang while prompting concerns among experts regarding market sustainability and the potential for correction. As we embrace advancements in AI, it is crucial to navigate the economic implications to ensure a balanced approach to wealth and investment.