The proposed billionaire tax in California has ignited a significant debate about wealth distribution and social justice in the state. With U.S. Representative Ro Khanna at the forefront, this tax initiative aims to levy a one-time 5% tax on individuals with net worths exceeding $1 billion to recover $90 billion in Medicaid funds lost due to recent legislative changes. As wealthy Silicon Valley figures threaten to relocate to avoid these financial obligations, the proposal has sparked concern over its potential economic impact, including claims of billionaires leaving California. However, polling indicates a strong preference among Americans for higher taxation of the ultra-wealthy, framing this wealth tax California as a necessary step toward equity and sustainability. Khanna’s stance not only reflects a progressive vision but also challenges the conventional wisdom of how wealthy individuals contribute to society, suggesting that a wealth tax proposal could foster greater innovation and economic well-being.

The topic of taxing extreme wealth has emerged prominently in contemporary discussions surrounding fiscal policy and social equity. The wealth tax proposal, championed by figures like Ro Khanna, seeks to address significant funding gaps in public services, particularly Medicaid, by targeting billionaires who amass staggering fortunes. This legislative measure has drawn ire from some of California’s most affluent residents, who view it as a direct threat to their financial freedom. As affluent individuals contemplate newfound options for relocation, the narrative suggests a growing divide between the wealthy elite and the ordinary citizenry, who largely support measures aimed at redistributing wealth. Consequently, the conversation has shifted towards the broader implications of wealth concentration on economic dynamism and social cohesion.

Understanding the California Billionaire Tax Proposal

The California billionaire tax proposal is gaining significant attention as U.S. Representative Ro Khanna pushes for a measure aimed at the ultra-wealthy. This proposed tax mandates a one-time 5% levy on individuals whose net worth exceeds $1 billion, particularly to recoup lost Medicaid funding of approximately $90 billion due to recent budget cuts. Advocates for this wealth tax in California believe that taxing such immense fortunes can help fund essential public services and ensure that the wealthiest residents contribute a fair share to the state’s economic stability.

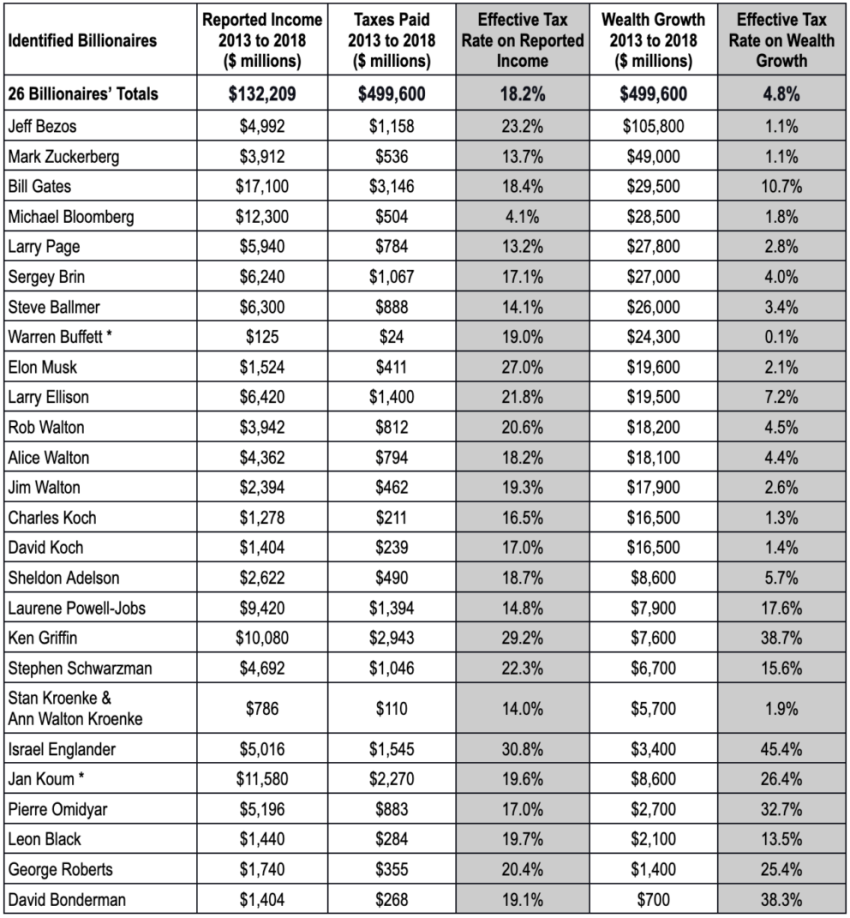

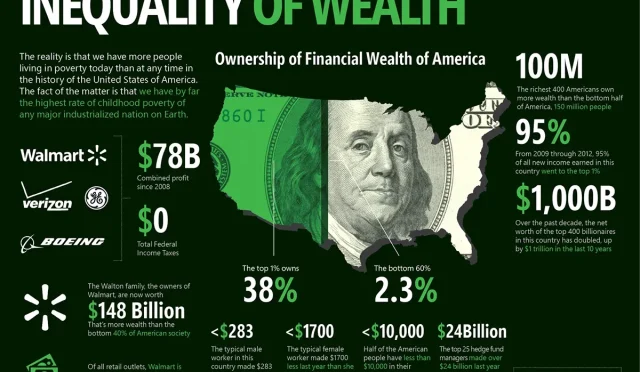

Supporters argue that this California wealth tax is crucial for addressing the increasing wealth inequality throughout the nation. With roughly 200 billionaires affected, the proposal garners widespread public support as studies indicate that a majority of Americans favor higher taxes on the ultra-wealthy. The tax aims not just to alleviate budget shortfalls but also to confront the moral question of wealth accumulation in a nation where many struggle to meet basic needs. Despite pushback from powerful billionaire figures threatening to leave California, data suggests such threats are rarely followed through.

The Political Fallout from the Wealth Tax Proposal

The backlash against Ro Khanna’s billionaires tax proposal highlights the heated political atmosphere in California as prominent venture capitalists and tech moguls express their grievances. Figures like Peter Thiel and Larry Page have indicated their potential departure from California over what they view as punitive tax measures. This situation has stirred discontent among the state’s wealthiest citizens, including Governor Gavin Newsom, who has made his opposition to the proposal clear. Critics argue that such tax initiatives could stifle innovation and drive talent out of the state.

However, Khanna remains steadfast in his belief that taxing extreme wealth is essential for the future of California and America. He contends that acceptance of a wealth tax could lead to greater investment in innovation and support for struggling citizens. By addressing the financial burdens faced by many Americans, Khanna argues that the wealth tax is a means of enhancing public services and ensuring that a thriving democracy supports talent across all demographics.

The Response from Tech Leaders and Potential Challenges

As the California billionaire tax proposal stirs controversy, responses from tech leaders have been swift. Notable entrepreneurs, including those aligned with the Republican Party, liken the tax to an alienation of the very innovators who drive the economy. Critics, such as Garry Tan from Y Combinator, have openly discussed the need for a primary challenge to Khanna, emphasizing a growing divide within the party. Such divisions could pose significant challenges for Khanna as he navigates the potential backlash from influential tech figures.

In light of this opposition, Khanna argues that a modest wealth tax should not deter investment in innovation or entrepreneurship. He maintains that the extraordinary wealth concentration in California does not correlate with the overall economic prosperity experienced by the general public. By defending his wealth tax initiative, Khanna aims to frame it as a crucial step toward fiscal responsibility and equitable economic growth, underscoring the necessity for billionaire contributions to support the societal infrastructure that facilitates innovation.

Impact on California’s Economy and Future

The proposed billionaire tax in California raises critical questions about the future of the state’s economy. If the tax is implemented, it could funnel significant financial resources back into essential services, supporting everything from Medicaid to public education. Khanna believes that nourishing an equitable economic environment will enhance California’s innovation landscape, ensuring that its residents can access opportunities that have long been dominated by the few at the top.

Moreover, the broader implications of a wealth tax extend beyond mere economics; they signal a shift in the societal contract between the wealthy and their communities. The ability of billionaires to support public services can help stabilize California’s economy amidst tumultuous times. Khanna’s vision includes a thriving democracy powered by innovation, whereby economic prosperity is shared rather than concentrated, which he argues is vital for the state’s long-term sustainability.

The Debate Over Wealth Inequality and the American Dream

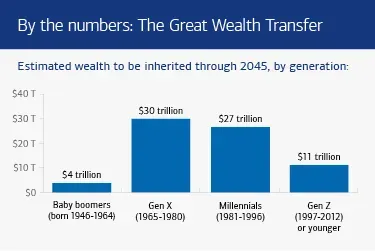

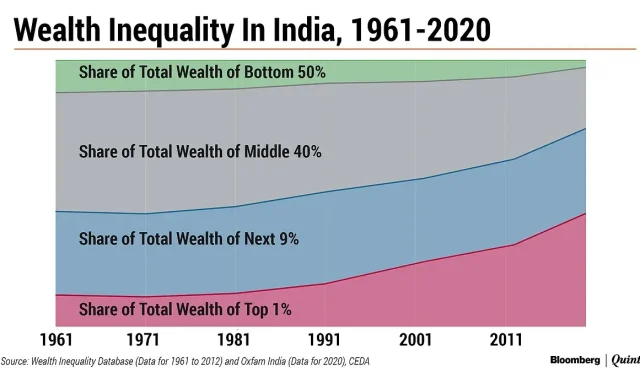

At the heart of the California billionaire tax debate lies the issue of wealth inequality, which has reached unprecedented levels in the U.S. Many advocates echo the sentiment of the American dream being out of reach for the average citizen, arguing that extreme wealth concentration hampers social mobility and economic progress. Khanna’s stance is that a modest wealth tax represents a necessary step to recalibrate this imbalance, ensuring more individuals can participate in the American dream.

The proposal emphasizes the importance of inclusive economic growth, positing that when billionaires contribute to resolving systemic issues, the entire society benefits. Khanna’s assertion is that allowing such wealth to lay largely untapped is counterproductive to the innovation that has historically been a hallmark of American ingenuity. By investing directly into communities, the wealth tax aims to revitalize sectors of the economy that have been left behind.

The Role of Ro Khanna in Progressive Taxation

Ro Khanna’s advocacy for a billionaire tax places him at the forefront of a growing movement for progressive taxation in the United States. As a prominent voice in the Democratic party, Khanna is challenging traditional norms that often favor wealth retention among the richest Americans. He articulates a vision for economic policy that aims to create a fair playing field, insisting that the wealthiest should shoulder more responsibility in funding public goods, particularly when income disparities are so pronounced.

His long-standing support for a wealth tax highlights a shift in how Democrats are approaching issues of economic policy, especially in historically affluent areas like Silicon Valley. Despite opposition from local elites, Khanna believes that such progressive taxation is essential for promoting economic democracy. The long-term impact of his stance could very well redefine the narrative around taxation and wealth distribution in modern America.

The Controversy Surrounding Billionaire Tax Threats

The threats made by billionaires to leave California in response to the proposed tax have sparked intense debate about their legitimacy. Historically, such threats are often viewed with skepticism, as data shows that few of the ultra-wealthy actually follow through on relocating over tax disputes. Khanna’s response encapsulates a broader discussion about the social responsibility of the super-rich, suggesting that escaping taxation can be seen as an abdication of civic duty.

Furthermore, this controversy shines a light on the broader implications of wealth concentration in the political landscape. With billionaires exerting considerable influence, their pushback against the California wealth tax raises essential questions regarding the representation of ordinary citizens. Khanna’s comments aim to challenge this status quo, realigning the dialogue towards collective benefits derived from shared prosperity and taxation.

Future Prospects for Wealth Tax Legislation

Looking ahead, the future of the wealth tax in California largely hinges on public sentiment and the outcomes of upcoming elections. With advocates actively seeking signatures to place the proposal on the ballot for future voting, the measure represents a significant test of how far progressive taxation can go in a state known for its affluence. If successful, the initiative may pave the way for similar movements across the nation, stimulating discussions about equity, taxation, and where responsibility lies.

As the debate progresses, the impact of Ro Khanna’s leadership will be critical in shaping the narrative around wealth and taxation. The struggle against powerful interests will undoubtedly continue but could also inspire a reevaluation of how wealth is perceived in society. Innovators and policymakers alike may need to collaborate on crafting a system that better supports the common good while propelling forward economic growth and innovation.

Analyzing the Broader Implications of Wealth Tax Discussions

Discussions around the California billionaire tax find themselves entwined with larger conversations about national economic policy and equity. The polarized views on taxation often reflect contrasting philosophies regarding wealth distribution and social responsibility. As calls for wealth taxes gain traction, they highlight the urgent need to address the grievances of everyday Americans who feel disenfranchised by an economic system that favors the extraordinarily wealthy.

In this context, wealth taxes could serve as a pivotal tool not only for generating revenue but also for realigning public priorities towards inclusivity and accessibility. Such policies invite citizens to reconsider their expectations of both wealth and governance, fostering a collective vision that aligns individual success with community strength. Ultimately, the ongoing dialogue about a billionaire tax encapsulates broader issues of equity and public welfare that need to be navigated thoughtfully.

Frequently Asked Questions

What is the California billionaire tax proposed by Ro Khanna?

The California billionaire tax proposed by U.S. Representative Ro Khanna aims to impose a one-time 5% tax on individuals with a net worth exceeding $1 billion. This initiative is intended to recover approximately $90 billion in Medicaid funds lost due to recent budget cuts. Advocates are currently gathering signatures to place this proposal on the ballot in 2026.

How will the wealth tax California impact billionaires?

The wealth tax in California, specifically targeting billionaires, will require approximately 200 individuals with a net worth above $1 billion to pay a one-time 5% tax. The affected billionaires will be given a five-year period to settle this tax, which is designed to help fund crucial public services like Medicaid.

Are billionaires really leaving California because of the billionaire tax proposal?

While some billionaires, including notable figures like Peter Thiel and Larry Page, have threatened to leave California in response to the billionaire tax proposal, historical data suggests that such threats rarely materialize into actual relocations. Critics of the tax argue that it could drive affluent residents away, but evidence shows that many remain despite higher taxes.

What are the arguments in favor of the wealth tax proposal in California?

Proponents of the wealth tax proposal in California argue that it is necessary to address extreme wealth inequality and ensure funding for essential social services, such as Medicaid. Ro Khanna asserts that a modest billionaire tax can generate significant revenue to support crucial public needs while promoting a fairer economic landscape.

What are the main criticisms of Ro Khanna’s billionaire tax initiative?

Critics of Ro Khanna’s billionaire tax initiative argue that it could alienate influential business leaders and potentially lead to an exodus of billionaires from California. Furthermore, some opponents feel that the measure is out of touch with moderate voters and could harm the state’s entrepreneurial environment.

How does the billionaire tax relate to the American economy and innovation?

Ro Khanna argues that implementing a billionaire tax is crucial for fostering innovation and maintaining a thriving economy. By taxing extreme wealth, he believes that it can help address systemic inequalities while facilitating public investment in areas like healthcare, education, and housing, which are essential for long-term economic stability and growth.

What implications does the California wealth tax have for the future of billionaires in the state?

The California wealth tax could set a precedent for how states address extreme wealth among billionaires. If successful, it may encourage similar proposals in other states, impacting the financial decisions of billionaires and shaping the overall economic climate as public sentiment about wealth distribution continues to evolve.

Will the California billionaire tax affect all wealthy individuals?

No, the California billionaire tax specifically targets individuals with a net worth exceeding $1 billion. It does not affect lower-income or middle-class residents, focusing instead on a small group of extremely wealthy individuals.

How does Ro Khanna’s stance on the billionaire tax reflect broader political trends in California?

Ro Khanna’s support for the billionaire tax reflects a growing progressive stance within California politics that emphasizes wealth redistribution and social equity. This trend is increasingly resonating with voters who feel that addressing wealth concentration is essential for the prosperity and fairness of the state’s economy.

What are the next steps for the California billionaire tax proposal?

The next steps for the California billionaire tax proposal involve gathering sufficient signatures to qualify the measure for the ballot in 2026. Advocates are actively mobilizing support to ensure that this initiative is presented to voters, potentially leading to a significant change in the state’s taxation policy.

| Key Point | Details |

|---|---|

| Billionaire Tax Proposal | A proposed one-time 5% tax on individuals with a net worth exceeding $1 billion to recover $90 billion in lost Medicaid funds. |

| Support and Opposition | Although higher taxes on the ultra-wealthy are popular among Americans, prominent figures in Silicon Valley, including Governor Gavin Newsom, oppose the measure. |

| Responses from Tech Elites | Peter Thiel and Larry Page threatened to reduce their ties to California if the tax is enacted, sparking discussion about the impact of elite opposition to taxation. |

| Khanna’s Defense | Representative Ro Khanna argues in favor of the billionaire tax, citing the need for equity and the benefits for American innovation and democracy. |

| Billionaire Tax vs. American Dream | Khanna emphasizes the tension between extreme wealth concentration and the belief that the American dream is dead for many, advocating for policies that ensure a thriving democracy. |

Summary

The billionaire tax aimed at ultra-wealthy individuals in California represents a significant step towards addressing wealth inequality and recovering funds for essential services like Medicaid. As discussions unfold, the reactions from Silicon Valley elites underscore a contentious dialogue over taxation and its implications for innovation and economic health. Representative Ro Khanna’s stance reinforces the idea that equitable taxation can foster a more robust democracy and ensure that all Americans have access to opportunities. Ultimately, the billionaire tax could mark a critical moment in reshaping fiscal policies to reflect the realities faced by a growing majority.