The Dow Jones Industrial Average, a key indicator of stock market performance in the U.S., is experiencing a slight dip as investors navigate thin year-end trading conditions. Today, the DJIA slipped by 0.12%, highlighting the cautious stance of traders as they await the release of the Federal Reserve minutes. As Wall Street grapples with subdued activity, pivotal financial sectors and some technology stocks exert significant pressure on market dynamics. In this climate, stock market news remains focused on the potential implications of the Fed’s decisions, making the forthcoming minutes a critical focal point for market participants. Meanwhile, the S&P 500 and other indexes reflect similar caution, underscoring the interconnectedness of these economic barometers during this pivotal season.

In the world of finance, the Dow represents a cornerstone of market analysis, often referenced as a proxy for the broader economic landscape. Traders and analysts alike watch closely as the blue-chip index reflects trends that may impact various sectors, including financials and technology. With discussions surrounding the Federal Reserve’s policy decisions heating up, particularly those stemming from its recent meetings, the implications for year-end trading strategies become paramount. As discussions emerge about market fluctuations, the S&P 500 index serves as another critical measure of investor sentiment. This interplay between major indices frames a complex narrative of economic expectations as the fiscal year draws to a close.

Dow Jones Performance Amid Year-End Trading

In the last trading sessions of the year, the Dow Jones Industrial Average (DJIA) demonstrates a subtle slip, reflecting broader market hesitations. Falling by 0.12% to 48,404.49, the Dow’s performance has been characterized by subdued trading volumes, typical of year-end dynamics. Investors appear cautious, as many are rebalancing their portfolios, which can significantly influence stock prices despite lower market activity. Financial and technology sectors have faced pressure, resulting in a muted performance for the index on the whole.

Furthermore, as the Dow navigates through these thin trade conditions, it’s vital to recognize the impact of external catalysts. The anticipation surrounding the Federal Reserve minutes is palpable among traders, as insights from these discussions can shape and shift market expectations. Any indications of policy adjustments or changes in interest rate outlooks from the Fed could swiftly alter the trajectory of the DJIA, as seen in previous market reactions to such updates.

The Impact of Federal Reserve Minutes on Market Trends

The upcoming release of the Federal Reserve minutes from its December meeting is set to play a pivotal role in the market outlook. With speculation surrounding interest rates heating up, these minutes could provide crucial insights into the Fed’s decision-making process, especially regarding the recent quarter-point cut. The divergence in opinions among Fed officials, particularly concerning the magnitude of rate adjustments, adds an element of suspense that traders are keenly observing as they strategize for the upcoming year.

Market analysts stress that understanding the Fed’s stance on potential future rate hikes or pauses is essential for making informed investment decisions. Adjustments in the interest rates directly impact equity valuations, as rising yields for bonds may draw investors away from stocks. Thus, the Federal Reserve minutes not only serve as a reflection of past decisions but also provide a roadmap for future economic conditions, influencing key market indices like the DJIA and the S&P 500.

Year-End Trading Dynamics: The Santa Claus Rally

As investors look toward the final days of December, the occurrence of the ‘Santa Claus rally’ comes into focus. This market phenomenon, characterized by a surge in stock prices during the last week of December and the first two trading days of January, has been a recurring theme. However, this year, the anticipated rally may face challenges due to market adjustments and the ongoing reassessment of portfolio allocations by traders.

With many financial desks operating with reduced staff and a cautious approach to trading ahead of the new year, year-end performance may diverge from historical norms. Many investors are recalibrating their expectations, knowing that while seasonal patterns play a role, they are not guaranteed. This leaves room for volatility as traders react to new data or signals from the Federal Reserve minutes and potential shifts in the economic landscape leading into 2026.

Analysing Dow Jones: Stocks in Focus

Within the context of the Dow Jones index, a handful of stocks are particularly noteworthy as they influence trading dynamics. Major companies such as Goldman Sachs, IBM, and Cisco Systems are among those that have shown notable underperformance during this thin trading period. Despite the generally positive outlook for the index in recent months, these specific stocks demonstrate that not all sectors or companies are riding the wave of market gains.

The price-weighted nature of the Dow complicates matters further, as fluctuations in high-priced stocks have disproportionate impacts on the index itself. This characteristic emphasizes the need for investors to pay close attention to sector performances and individual company health as they strategize around the upcoming trading calendar and potential market influences.

The Role of S&P 500 in Market Sentiment

While the Dow Jones remains a focal point, the S&P 500 also plays a significant role in shaping market sentiment. As a broader representation of the market, the S&P 500’s recent gains, including reaching new highs, invigorate investor confidence. However, the index’s performance closely correlates with key announcements from the Federal Reserve and macroeconomic indicators, framing the expectations around year-end trading.

Moreover, as traders dig into specifics, the stabilization or potential retreat of the S&P 500 could influence movements across major indices. Investors will be keen to see whether the latest Federal Reserve minutes suggest a tighter or more relaxed monetary policy, as such indications can ripple through the market, affecting sentiment and leading to shifts in trading strategies.

Evaluating Stock Market News: Trends and Predictions

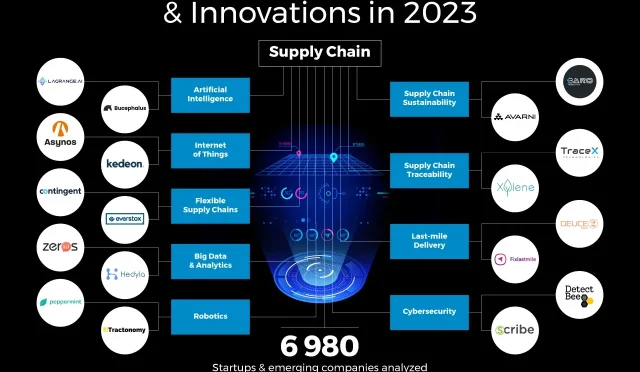

In light of the current trading environment, staying updated with stock market news is essential for investors. As the year winds down, reports surrounding market performance and analyst predictions become increasingly important. Stakeholders are particularly interested in how various sectors, including technology and financials, are adjusting in anticipation of shifts prompted by the Federal Reserve’s decisions.

Moreover, insights into investor behavior during year-end trading often highlight the balance between caution and opportunity. As the thesis around the Santa Claus rally unfolds, it’s critical to analyze emerging trends and market patterns that could shape investor sentiment heading into the new year, helping them prepare for potential price movements and focus on profitable investment opportunities.

The Influence of Treasury Yields on Market Valuations

Currently, the performance of benchmark Treasury yields, particularly the 10-year yield fluctuating around 4.13%, plays a critical role in market valuations. Rising yields can alter the risk-reward dynamic for investors, making bonds a more attractive option compared to equities. This shift in preference can lead to downward pressure on stock prices, impacting indices such as the Dow and S&P 500.

Understanding the relationship between Treasury yields and stock market valuations is essential, especially given the current landscape characterized by lingering economic uncertainties. Investors must closely monitor yield trends as any significant shifts could influence their strategies, prompting reallocation toward lower-risk assets and thereby affecting the overall trading volume and momentum in stock markets.

Key Economic Indicators to Watch in Early January

As the curtain rises on January 2026, a series of significant economic indicators will soon be available for market evaluation. Key reports, including weekly jobless claims, construction spending, and the ISM manufacturing survey, will provide essential insights into the economic health of the country. Investors are particularly eager to see how these indicators align with broader economic expectations and the Federal Reserve’s policy framework.

The upcoming ADP employment report and U.S. payroll figures will also capture attention, as strong labor market performance could reinforce investor confidence, while weaker-than-expected results may raise concerns about growth. As participants digest these economic signals, they remain vigilant, ready for potential market movements that could stem from both favorable and adverse data releases.

Trading Strategies in a Volatile Market Environment

Navigating the intricacies of a volatile market environment, especially as year-end trading unfolds, requires sophisticated strategies. Investors are advised to remain adaptive, especially as portfolio rebalancing and economic data releases create potential market fluctuations. By focusing not just on price movements but also on the underlying economic indicators and insights from Federal Reserve minutes, traders can better position themselves for the expected volatility ahead.

Another consideration for traders is to diversify across sectors while keeping a keen eye on market trends. By doing so, they can mitigate risks associated with sudden market shifts. This strategy, combined with proactive monitoring of Fed decisions and other economic indicators, will allow investors to act swiftly and effectively in response to market changes as they anticipate potential rewards amid uncertainty.

Frequently Asked Questions

What does the Dow Jones Industrial Average (DJIA) represent in the stock market?

The Dow Jones Industrial Average (DJIA) is a price-weighted index that tracks 30 large, publicly traded companies in the United States. It serves as a key indicator of overall market performance and investor sentiment within the stock market.

How do Federal Reserve minutes impact the Dow Jones index?

Federal Reserve minutes provide insights into the central bank’s monetary policy decisions, which can significantly influence investor behavior. When these minutes reveal potential changes in interest rates, as seen with the Fed’s recent discussions regarding target ranges, they can cause fluctuations in the Dow Jones, as investors adjust their expectations for economic conditions.

What factors are currently affecting the Dow Jones and stock market news?

Recently, the Dow Jones has been influenced by ongoing developments in the financial sector and technology stocks. Additionally, Fed minutes and their implications for future interest rates have been focal points for investors, causing shifts in stock prices based on economic forecasts.

What is the significance of year-end trade for the Dow Jones?

Year-end trade can distort stock pricing due to lighter staffing and portfolio rebalancing, which can exaggerate market movements. This period is crucial for the Dow Jones, as it often reflects year-end adjustments that investors make to position themselves for the upcoming year.

What is the relationship between the Dow Jones and the S&P 500?

Both the Dow Jones and the S&P 500 serve as key benchmarks for U.S. equities, but they differ in composition. The Dow is price-weighted and includes 30 large companies, while the S&P 500 is market-cap weighted and comprises 500 companies. Market trends often influence both indices, but their reactions to economic events may vary.

How does the stock market react to announcements related to the Federal Reserve?

Announcements from the Federal Reserve regarding interest rates can lead to immediate reactions in the stock market, including the Dow Jones. If the Fed hints at changes in monetary policy, such as rate cuts or hikes, traders adjust their positions based on expectations of economic growth, impacting stock valuations.

What should investors watch for in upcoming Federal Reserve meetings that could affect the Dow Jones?

Investors should monitor the tone of the Federal Reserve’s statements and minutes for signs of potential rate changes. Insights into economic conditions and inflation projections can significantly influence the Dow Jones and overall market sentiment.

What does a slip in the Dow Jones during year-end trading indicate about market sentiment?

A slip in the Dow Jones during year-end trading can indicate cautious sentiment among investors. This could reflect uncertainty regarding future economic conditions or reactions to news such as upcoming Federal Reserve minutes, leading to a more conservative approach in portfolio management.

How do rising Treasury yields impact the Dow Jones?

Rising Treasury yields can put pressure on the Dow Jones as they increase the returns available from bonds, making equities less attractive. This can lead investors to reassess their holdings in the stock market, potentially lowering stock prices, including those in the Dow.

| Key Points | Details |

|---|---|

| Market Overview | The Dow Jones Industrial Average (DJIA) is down 0.12% in subdued year-end trading. |

| Investor Caution | Investors are cautious ahead of Federal Reserve minutes, reflecting uncertainty in trading. |

| Performance of DJIA | DJIA fell 57.44 points to 48,404.49 during trading, showing minimal changes in major indexes. |

| Influential Factors | Financial and tech stocks are primarily weighing down the market, while communication services are boosted by Meta’s acquisition of an AI company. |

| Fed Minutes Anticipation | Upcoming release of the Fed’s minutes from December 9-10 meeting could reveal split opinions among officials. |

| Market Conditions | Thin trading conditions due to year-end fluctuations might lead to rapid price changes. |

| Recent Trends | The DJIA and S&P 500 are on track for their longest winning streak since 2017. |

Summary

The Dow Jones is experiencing a slight dip as investors remain cautious ahead of the Federal Reserve’s minutes release. This situation highlights the delicate balance between investor sentiment and economic data, particularly in a thin trading environment typical of year-end. As market participants prepare for potential shifts in monetary policy discussions, the Dow continues to navigate a path marked by both challenges and opportunities, underscoring its significance in the broader financial landscape.