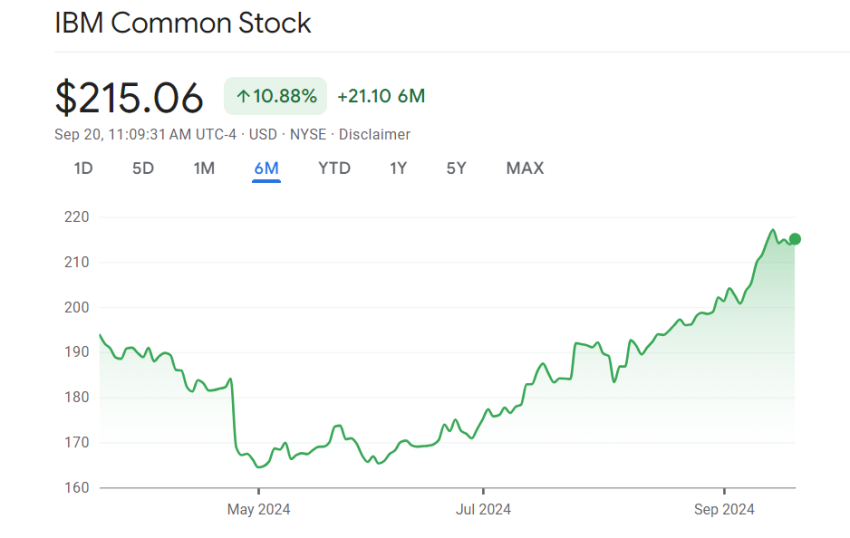

In today’s market, a thorough IBM stock analysis reveals interesting dynamics at play. Recently, IBM shares fell 1.2% to $302.05, reflecting broader trends in the tech sector as investors adjust their strategies amidst a rotation that affects overall stock performance. As we approach the significant IBM earnings announcement set for January 28, traders are keenly watching the impact on the IBM share price and trading volume. The company has impressively rallied by approximately 37% in 2025, but its recent pullback brings concerns about sustainability amid evolving economic conditions influenced by AI tools. Monitoring management’s insights on software demand and client spending will be crucial for investors looking to grasp IBM’s future trajectory as the market fluctuates.

Examining IBM from various perspectives, we see that the performance of its stock is indicative of shifting trends within the technology industry. The focus on IBM’s financial positions sets the stage for an upcoming earnings report that could steer investor sentiment. As trading volumes fluctuate, it’s essential to understand how factors such as technology sector reallocation might be affecting IBM’s profitability and share price movements. In light of the recent sell-off, market participants are particularly interested in how advancements in AI tools may play a role in driving future growth for the company. With a robust analysis of these elements, stakeholders will be better prepared to navigate the investment landscape surrounding IBM.

Current Trends in IBM Stock Price

IBM’s stock price has displayed notable fluctuations recently, closing at $302.05 with a minor decline of 1.2%. This downward movement has been attributed to broader trends within the tech sector, where traders are reacting to various economic signals. In light holiday trading conditions, where liquidity is reduced, such dips can be more pronounced. Analysts note that while the stock has experienced impressive gains throughout 2025, the recent pullback could suggest a critical moment for investors who need to reassess their positions based on upcoming financial disclosures.

Understanding the factors influencing IBM’s share price, especially within the context of trader sentiment and market trends, is essential for navigating the current investment landscape. Additionally, the tech sector rotation has led many holders to reconsider their strategies. If the market maintains this cautious approach, any adverse news following IBM’s earnings announcement could exacerbate the already observed volatility in IBM stock.

Frequently Asked Questions

What does the recent IBM share price decline indicate about IBM stock analysis?

The recent decline in IBM share price, which fell 1.2% to $302.05, reflects a broader tech sector rotation that investors should consider in their IBM stock analysis. As U.S. indexes drift lower during light trading, understanding these market dynamics is crucial for evaluating IBM’s performance.

How will the upcoming IBM earnings announcement affect stock analysis?

The upcoming IBM earnings announcement on January 28 is pivotal for IBM stock analysis. Traders are focusing on management’s insights regarding software demand and consulting contracts, which will influence market sentiment and potentially impact IBM’s share price.

What role does trading volume play in IBM stock analysis?

Trading volume is a key indicator in IBM stock analysis. With approximately 1.88 million shares traded recently, low liquidity during the holiday season can lead to increased volatility in IBM’s stock price, making it important for investors to monitor this metric.

How does the tech sector rotation impact IBM stock?

The current tech sector rotation has a direct impact on IBM stock, as evidenced by the recent decline in share price. This aspect of IBM stock analysis requires traders to assess external market factors and how they influence investor sentiment towards IBM.

What impact do AI tools have on IBM’s market position?

AI tools are expected to significantly influence IBM’s market position, particularly in the context of the company’s upcoming earnings report. An effective IBM stock analysis should take into account how advancements in AI technology align with IBM’s strategic initiatives in hybrid cloud solutions.

What should traders watch for in IBM’s stock near its support level?

Traders should closely monitor IBM’s ability to maintain support around the $302 level during this period of uncertainty. An insightful IBM stock analysis will consider the relationship between current share price movements and the 50-day moving average, currently at approximately $304.

| Key Point | Details |

|---|---|

| IBM Stock Price Movement | IBM shares fell 1.2% to $302.05 amid light holiday trading. |

| Market Influence | Decline linked to a rotation in the tech sector with U.S. indexes drifting lower. |

| Upcoming Earnings | IBM’s earnings announcement is scheduled for January 28. |

| Stock Performance | Stock has risen about 37% in 2025 but has recently pulled back. |

| Trading Volume | Approximately 1.88 million shares traded. |

| Market Conditions | Reduced liquidity may affect intraday price fluctuations as the year closes. |

| Key Metrics to Watch | Traders will monitor management’s commentary on software demand, consulting contracts, and client spending. |

| Support Levels | Traders are watching if IBM can maintain support around $302, with a 50-day moving average at about $304. |

Summary

IBM stock analysis indicates a moderate decline, reflecting a blend of market conditions and investor sentiment leading into the new year. With a noticeable reaction to broader tech sector shifts and anticipation around the upcoming earnings report, IBM’s ability to showcase sustained growth amidst evolving economic demands, particularly in AI and hybrid cloud technologies, will be paramount for attracting investor confidence.