Global Wealth Report 2024: Insights on Millionaire Growth

The Global Wealth Report 2024, released by UBS, paints a vivid picture of current wealth trends and the dynamics shaping the millionaire landscape worldwide. This year’s findings reveal a remarkable increase in US millionaires, with nearly 380,000 individuals joining the ranks of seven-figure earners—a surge that eclipses growth in countries like China and Japan. In particular, the report highlights that although the increase in US millionaires represents a modest 1.5%, the scale of this population makes it significant, translating to over a thousand new millionaires per day. Moreover, UBS’s comprehensive household wealth analysis underscores the growing economic landscape in the United States amidst fluctuating global markets. As these millionaire statistics unfold, it becomes clear that the economic climate—including easing inflation and rising stock markets—has fostered an environment ripe for wealth creation, setting the stage for future trends in the wealth sector for 2024 and beyond.

The 2024 Global Wealth Report offers a detailed exploration of the shifting financial landscape, showcasing the surge in affluent individuals and the changing dynamics of personal fortune. As discussed in the UBS overview, the emergence of new wealth patterns aligns with a broader analysis of household financial status worldwide, particularly highlighting the significant rise in millionaires across the US. This comprehensive report not only outlines the numerical growth of high-net-worth individuals but also reflects on the socio-economic contexts that catalyze such wealth accumulation. Notably, the contrasting millionaire trends in different nations suggest a complex interplay of local economic conditions and global market influences. Through this lens of millionaire demographics and financial trends, the report provides valuable insights into the current and future state of global wealth.

Global Wealth Report 2024 Highlights

The UBS Global Wealth Report 2024 offers an insightful overview of the current dynamics in global wealth distribution and trends. This year’s findings reveal a significant increase in the number of US millionaires, which has reached an impressive count despite only a minimal percentage growth. Key factors contributing to this change include favorable economic conditions and rising asset prices, particularly in stock markets like the S&P 500. Notably, UBS points out that the United States has consistently outperformed other major economies in creating new millionaires, demonstrating its robust economic resilience.

Moreover, the analysis showcases the comparative performance of the US against other nations, with countries such as China and Japan exhibiting varied growth patterns. Specifically, while China added a considerable number of millionaires, Japan saw a decline in its millionaire population, showcasing the complexities of wealth distribution globally. The report emphasizes that understanding these trends is essential for investors and policymakers, as they navigate an evolving financial landscape.

Wealth Trends 2024: A Comparative Analysis

According to the UBS report, the wealth boom in the United States is distinct when compared to the stagnation or decline seen in other economies, such as Japan. With nearly 380,000 new millionaires surfacing in just one year, the trends signal a vibrant economy bolstered by easing inflation and interest rate cuts. As market conditions improve, household wealth analysis reveals that many American families are benefiting from rising asset values, contributing to the growing number of affluent individuals in the country.

In comparison, countries like Turkey and the United Arab Emirates showcased higher percentage increases in their millionaire populations, but the absolute numbers remain significantly lower than that of the US. For instance, while Turkey reported an 8.4% growth, this translated to only 7,000 new millionaires, highlighting the disparity in wealth creation capabilities among different nations. As we delve deeper into millionaire statistics, it becomes evident that the US remains a leader in wealth accumulation, setting a precedent for emerging economies.

US Millionaires Increase: Growth Patterns

The growth of US millionaires in 2024 marks a significant milestone in wealth distribution, as reported by UBS. With an addition of 379,000 millionaires, the data reflects the increasing wealth concentration within the country. Factors such as the robustness of the stock market, marked by a 25% gain in the S&P 500, have played a crucial role in this expansion. This upward trajectory is indicative of a recovering economy, as households continue to accumulate wealth through investments and real estate.

While the 1.5% growth may seem modest, the sheer volume of new millionaires surpasses that of any other nation, cementing the US’s position as a wealth hotspot. The report also shed light on the psychological factors driving millionaire statistics, indicating that increased consumer confidence may further contribute to wealth creation in the coming years. As the Federal Reserve’s monetary policies continue to stimulate economic growth, the patterns observed could lead to unprecedented levels of household wealth in the near future.

Household Wealth Analysis in 2024

The household wealth analysis presented in the UBS report for 2024 reveals significant insights into the financial health of American families. The report highlights that a combination of strong market performance and effective economic policies has led to an increase in wealth among the populace. As inflation wanes and interest rates drop, many American households have seen their financial situations improve, enabling them to invest more in assets such as stocks and real estate.

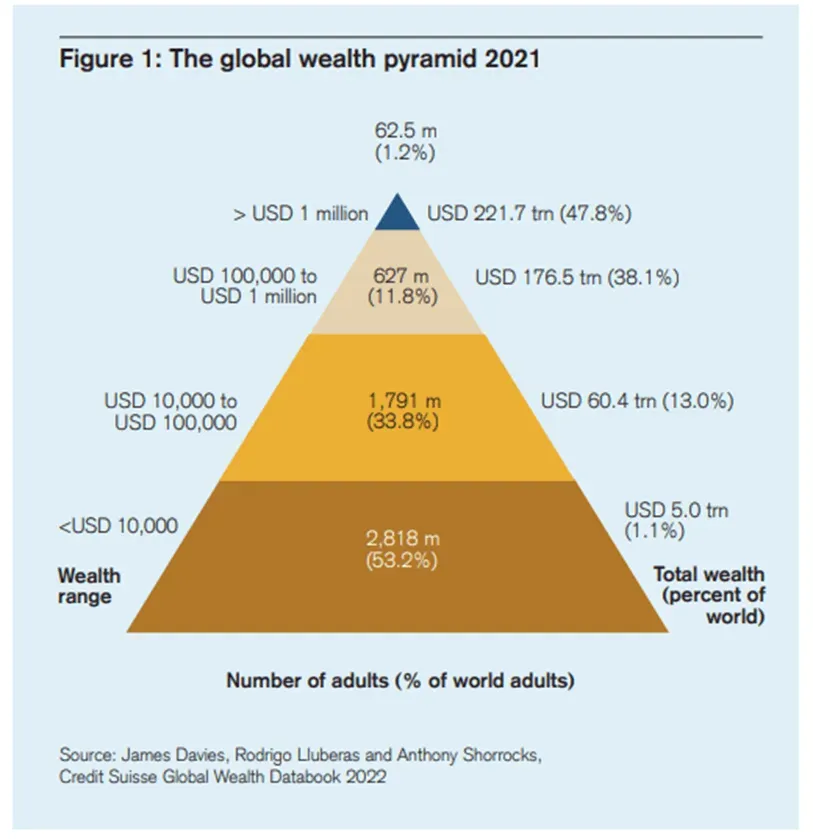

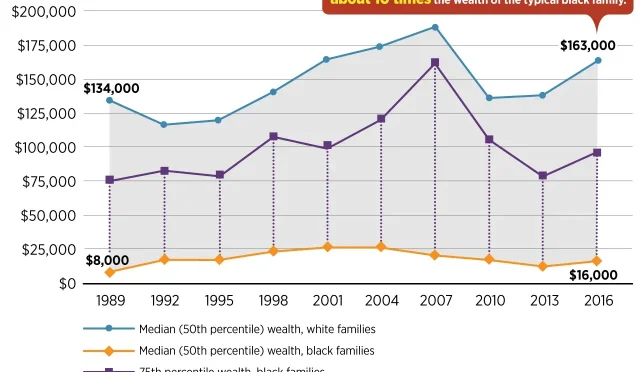

Additionally, this analysis indicates that wealth creation is not uniform across all demographics, as some groups are experiencing a more pronounced increase in wealth than others. The significant uptick in millionaire numbers also points to a widening wealth gap, raising concerns about sustainable economic growth. Understanding these nuances within household wealth is crucial for stakeholders looking to address inequalities and promote inclusive financial practices.

UBS Report Insights on Global Wealth

The UBS report provides critical insights into global wealth trends, emphasizing the persistent strength of the US economy in comparison with its counterparts. As wealth creation dynamics unfold, the report illustrates that while emerging markets see growth in millionaire numbers, the United States consistently outpaces them in sheer volume. The report also suggests that geopolitical factors and economic policies will significantly influence wealth distribution in the years to come.

Moreover, the UBS analysis draws attention to varied responses in millionaire growth across different regions, reinforcing the interconnected nature of global economies. As the affluent classes in the US continue to grow, it also presents opportunities for international investors to explore new markets. The comprehensive view offered by UBS helps stakeholders understand where wealth is accumulating and the implications of these trends on future economic policies.

Millionaire Statistics: Global Perspectives

When examining millionaire statistics globally, the UBS report highlights the divergent trajectories of wealth accumulation across nations. While the US remains a powerhouse in terms of the absolute number of millionaires, other countries are also making strides in this area. For instance, the report reveals that developing nations, despite smaller absolute numbers, are witnessing rapid increases in their millionaire populations, which can alter global economic landscapes over time.

This emphasis on comparative millionaire statistics allows for a deeper understanding of how different economies are growing and evolving. While the US adds hundreds of thousands to its millionaire ranks annually, nations such as China are also emerging as formidable players in wealth creation. The implications of these statistics are far-reaching, providing insights into consumer behavior, investment patterns, and potential areas for economic growth.

Future Projections in Wealth Trends

Looking forward, the UBS report outlines several projections regarding wealth trends over the next five years. It anticipates continued growth for both the US and China, which are the primary drivers of global wealth creation. With favorable economic policies and market conditions, the ability for households to generate wealth is expected to improve significantly, leading to a larger influx of millionaires in both regions.

Moreover, emerging markets are expected to see a rise in wealth accumulation, potentially reshaping traditional economic power balances. Understanding these future projections is crucial for investors and policymakers, as they adapt to the changing landscape of global wealth. The insights provided by the UBS report underscore the necessity for strategic planning in anticipation of these shifts.

Economic Factors Influencing Wealth

The UBS report elaborates on various economic factors that influence wealth distribution, particularly in the context of the US economy. Key components such as interest rates, inflation, and market performance play significant roles in the ability of households to build wealth. With the Federal Reserve’s adjustments and a gradually improving economic climate, these factors have synthesized to create an environment conducive to wealth growth.

Furthermore, global economic conditions, such as trade agreements and international policies, affect domestic wealth creation. The report suggests that understanding these economic factors is essential for stakeholders aiming to navigate the complexities of wealth accumulation moving forward. By analyzing these influences, investors and policymakers can make informed decisions to foster sustainable economic growth.

The Impact of Inflation on Wealth Growth

Inflation has a direct impact on household wealth, as highlighted in the UBS report. As inflation levels decrease, purchasing power increases, allowing households to invest more effectively in wealth-building opportunities. The easing of inflationary pressures in the US has created favorable conditions for wealth creation, enabling families to allocate resources for investments in stocks and real estate.

Conversely, high inflation can erode wealth, making it more challenging for households to save and invest. The UBS report emphasizes that managing inflation is crucial for sustaining increases in millionaire populations in the coming years. As the global economy strives to balance growth with inflation control, the insights from the UBS report serve as a guide for navigating these complex economic waters.

Frequently Asked Questions

What are the key findings of the Global Wealth Report 2024 by UBS?

The Global Wealth Report 2024 by UBS reveals significant insights into wealth trends for the year. It highlights an increase of nearly 380,000 US millionaires, surpassing other nations like China, which saw an addition of 141,000 millionaires. The report emphasizes the robust wealth growth in the US, with favorable conditions such as easing inflation and rising stock markets contributing to the millionaire surge.

How many US millionaires were added according to the Global Wealth Report 2024?

According to the Global Wealth Report 2024, the US added approximately 380,000 millionaires, indicating a 1.5% increase in the millionaire population. This growth underscores the ongoing wealth creation trends in the United States, which continues to outpace other major economies.

What do the millionaire statistics from the Global Wealth Report 2024 indicate about global wealth distribution?

The millionaire statistics from the Global Wealth Report 2024 indicate a stark disparity in global wealth distribution. While the US saw nearly 380,000 new millionaires, other regions reported significantly lower numbers. For instance, Turkey and the UAE added 7,000 and 13,000 millionaires respectively, showcasing a concentrated growth in the US compared to these emerging markets.

How does the Global Wealth Report 2024 compare US millionaires to those in China?

The Global Wealth Report 2024 highlights that the US significantly outperformed China in millionaire growth, adding nearly 380,000 new millionaires compared to China’s 141,000. Despite China’s rapid creation of millionaires, the total remains lower than the US, illustrating the latter’s dominant position in millionaire statistics this year.

What impact did the 2024 wealth trends have on household wealth analysis according to UBS?

The 2024 wealth trends outlined in the Global Wealth Report by UBS indicate a robust increase in household wealth, particularly in the US. With factors like easing inflation and strong market performance, the report showcases how these elements fostered an environment conducive to new millionaire births, marking a significant year for wealth accumulation.

What is the outlook for global wealth according to the UBS Global Wealth Report 2024?

The UBS Global Wealth Report 2024 presents an optimistic outlook for global wealth, forecasting that the US and China will continue to drive majority wealth growth in the coming five years. The analysis suggests that as economic conditions improve, both regions are likely to experience further increases in their respective millionaire populations.

What regions are noted for high percentages of new millionaires in the Global Wealth Report 2024?

While the Global Wealth Report 2024 shows the US leading in total millionaire count, regions like Turkey and the UAE boast high percentages of new millionaires, with increases of 8.4% and 5.4% respectively. However, it’s important to note that these percentages translate to much smaller absolute numbers compared to the significant gains observed in the US.

What economic factors contributed to the increase in US millionaires as reported in the Global Wealth Report 2024?

The increase in US millionaires, as reported in the Global Wealth Report 2024, can be attributed to various economic factors including a gradual decline in inflation and multiple interest rate cuts by the Federal Reserve. Furthermore, a strong performance of the stock market, particularly the S&P 500’s growth of 25%, has also facilitated wealth creation.

| Key Point | Details |

|---|---|

| Increase in US Millionaires | USA added nearly 380,000 millionaires in 2024, a growth rate of 1.5%. |

| Comparison with Other Countries | China added 141,000 millionaires, while Turkey and UAE reported percentages of new millionaires at 8.4% and 5.4%, respectively. |

| Economic Conditions | Easing inflation and Federal Reserve rate cuts in the US create favorable conditions for wealth creation. |

| US Wealth Growth | The S&P 500 increased by 25% last year after a 26% rise in 2023. |

| Wealth Density | Switzerland and Luxembourg hold the highest density of millionaires per capita. |

| Japan’s Millionaire Rate | Japan saw a decline of 1.2% in millionaires, translating to 33,000 fewer millionaires. |

| Future Trends | US and China expected to remain key drivers of global wealth over the next five years. |

Summary

The global wealth report 2024 by UBS highlights significant trends in wealth accumulation and distribution. The report reveals that the United States continues to lead in the creation of new millionaires, emphasizing the country’s favorable economic conditions and growth in capital markets. With ongoing shifts in global wealth dynamics and the expected influence of major economies like the US and China, the report serves as a crucial reference for understanding wealth trends in the coming years.

#GlobalWealth2024 #MillionaireInsights #WealthReport #EconomicTrends #FinancialGrowth