Wealth Distribution in America: Understanding Debt and Assets

Wealth distribution in America has become a pressing topic of discussion as the nation grapples with stark disparities in asset ownership and income levels. Recent net worth statistics reveal that the top 10% of the population controls nearly two-thirds of financial assets, contributing to a growing income inequality that raises eyebrows and ignites debate. The U.S. household debt, which has soared to nearly $20 trillion, further exacerbates the situation as the majority of this burden falls on the lower wealth strata. As we delve deeper into wealth concentration amidst unprecedented economic growth, it becomes clear that the financial landscape is not equally shared. Understanding the nuances of financial assets held across different demographics is crucial to addressing the challenges that face the American economy today.

The conversation around asset allocation in the United States often centers on the division between various socioeconomic groups and their respective financial standings. Phrases like “economic disparity” and “wealth imbalance” capture the essence of a system where financial resources are unevenly distributed among citizens. When examining household financial conditions, it becomes evident that those at the top possess a disproportionate amount of wealth, while the broader demographic grapples with significant liabilities. Exploring these themes, such as the alarming statistics on U.S. household debt and the implications of wealth concentration, sheds light on the potential socioeconomic repercussions this divide may entail. By analyzing income levels and the ownership of financial assets, we can better understand the current economic environment and its effects on everyday Americans.

Understanding U.S. Household Debt and Its Impact

As of 2024, U.S. households are grappling with an overwhelming debt of nearly $20 trillion, dominated predominantly by mortgage obligations which make up about 68% of this figure. The remaining debts include student loans and auto loans, each accounting for around 8%. This immense figure can seem staggering, particularly when compared to the total household assets, which sum up to nearly $180 trillion. The stark contrast between such staggering liabilities and the significant wealth in assets raises questions about financial stability and the economic behaviors of consumers in America.

When we analyze U.S. household debt, it is crucial to consider the net worth statistics that provide context. Despite the $20 trillion debt, the net worth among American families stands at an impressive $160 trillion, illustrating that on balance, many families possess considerable wealth. However, this wealth distribution is far from equitable, leading to nuanced discussions about income inequality and financial asset ownership across different socioeconomic classes.

Wealth Distribution in America: An Overview

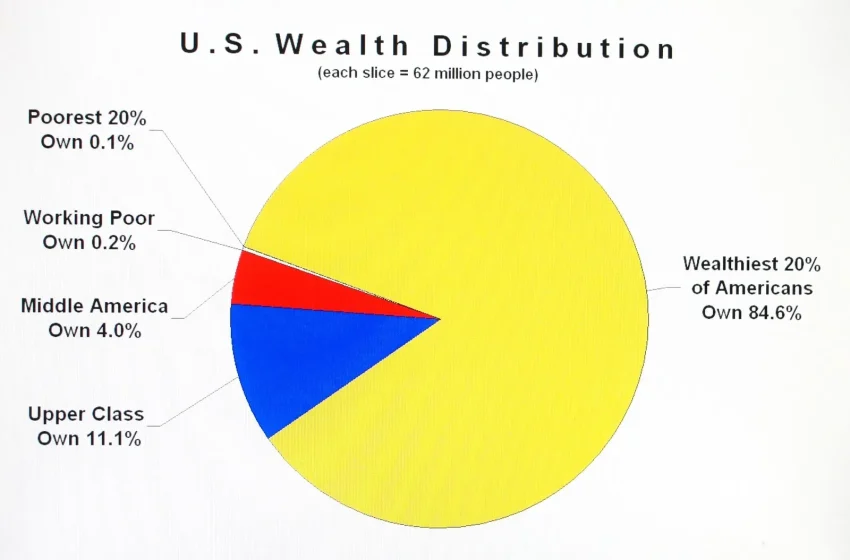

The wealth distribution in America paints a striking image of economic disparity. While the median household net worth has climbed to approximately $140,000, indicating a recovery since the Great Financial Crisis, the concentration of wealth continues to be a pressing issue. Reports show that the top 1% of households own more than half of the nation’s equity; conversely, the bottom 50% holds a mere 1%. This concentration reveals how wealth inequality is integral to understanding America’s economy, exemplified by the notion that wealth begets wealth under capitalism.

Furthermore, the ramifications of wealth concentration are significant. The top 10% of earners control nearly two-thirds of all financial assets yet are responsible for only one-quarter of total household debt. Meanwhile, the majority of Americans, comprised of the bottom 90%, possess just 37% of the nation’s financial assets but carry an astonishing 75% of the debt burden. This stark division forces society to reflect on the implications of economic policies that contribute to this persistent gap in wealth distribution.

The Rise of Financial Assets Among the Wealthy

As affluence burgeons among the wealthiest segments of society, we must examine the increasing accumulation of financial assets by this group. A study by Goldman Sachs illustrates that the top 10% of income earners not only have the capacity to weather economic downturns but also strategically leverage their investments in stocks and other assets. This trend raises concerns regarding financial literacy and access; if the majority of the population is accumulating debts while a small fraction holds vast assets, accessing the benefits of capitalism proves challenging for many.

The dynamics surrounding financial assets are a crucial aspect of economic discourse. Wealthy individuals tend to have diversified portfolios, allowing them to navigate inflation and market volatilities more effectively than the average American. Consequently, their economic behavior can steer market trends, further entrenching their position in wealth concentration. Understanding how financial assets operate within these broad societal structures provides insights into the overall economic health of the nation.

Income Inequality: A Continuing Challenge

Income inequality in the U.S. continues to challenge policymakers and affect economic mobility across generations. While certain segments of the population enjoy substantial increases in wealth, driven by rising asset values and investment returns, the working and lower middle classes struggle to attain similar growth in earnings. The disparity becomes evident when considering broader economic conditions such as stagnating wages, high consumer debt, and rising living costs, which disproportionately affect lower-income households.

This escalating income inequality not only contributes to a sense of disenfranchisement among many Americans but also poses risks to the economy’s overall stability. As the wealth gap widens, there are implications for consumer spending, economic growth, and social cohesion. Policymakers must grapple with finding effective solutions that not only address the immediate concerns of income inequality but also foster long-term organizational growth and societal equity.

The Economic Power of the Top 10%

The economic influence wielded by the top 10% of earners in the U.S. is substantial. This group accounts for approximately half of all consumer spending, which underscores their importance to market dynamics and economic growth. Their purchasing power not only drives demand but also shapes production and investment strategies across various industries. However, this concentration of economic power raises questions about sustainability, especially during economic downturns.

Despite potential recessionary signals, this affluent demographic showcases remarkable resilience. Even amidst economic uncertainty, the propensity for this group to continue spending raises eyebrows regarding the broader economic outlook. What remains to be seen is how the behaviors of this segment will adapt in response to economic shifts, and whether this shift will eventually lead to a more balanced economic landscape.

Financial Behavior Among America’s Wealthy

The behavior and spending patterns of wealthy individuals offer critical insights into economic resilience in America. Many affluent households are finding themselves more cautious about their financial decisions, often as a reaction to broader economic conditions and social pressures. As discussed by industry insiders, such as luxury real estate agents, there’s a tendency for high-net-worth individuals to keep a tighter grip on their finances amid indicators of potential economic instability.

Moreover, the luxury market has begun to reflect this aversion to overt displays of wealth. In a culture where conspicuous consumption often faces criticism during hard economic times, many wealthy individuals are becoming increasingly sensitive to societal perceptions. This shift highlights an interesting dynamic where wealth, traditionally seen as a status symbol, may now carry an element of hesitation regarding public consumption and displays of affluence.

Examining U.S. Household Net Worth Trends

The trajectory of U.S. household net worth reveals significant trends that reflect the economic landscape of the nation. With a current net worth nearing $160 trillion, the statistics indicate a recovery from the lows experienced during the Great Financial Crisis. Yet, while this overview seems positive, it masks the reality of wealth concentration that sees a disproportionate amount held by a select few, leaving the majority with less than their fair share.

Furthermore, examining net worth trends within various demographics sheds light on systemic disparities. Factors such as education, age, race, and geographic location play crucial roles in determining net worth outcomes for different individuals. This complexity necessitates nuanced discussions around economic policy that strive to reduce the inequities present in wealth distribution while enhancing opportunities for all.

Economic Resilience Amid Spending Trends

Economic resilience in the face of shifting spending trends is crucial for strategizing future policies that promote sustainable growth. As the affluent continue to dominate consumer spending, their unchecked consumption can lead to patterns that do not reflect the broader economic reality for lower and middle-income households. This disconnect often requires analysis by economists to understand the implications for growth and stability in the U.S. economy.

In analyzing consumer behavior, it’s important to question how the spending habits of the rich can impact overall economic conditions. While this group appears more insulated from economic downturns, their financial decisions can still reverberate throughout the economy, influencing job creation and business cycles. Policymakers must consider such factors when creating frameworks aimed at sustaining economic growth for all demographics.

The Future of Wealth: Predictions and Considerations

Looking ahead, the future of wealth distribution presents both challenges and opportunities. While the current framework shows stark inequality, there are signs that economic forces could evolve, potentially leading to changes in wealth concentration patterns. Innovations in technology, shifts in investment strategies, and changes in consumer behavior could all reshape the landscape of financial assets and income distribution over the coming decades.

However, to drive meaningful change, society must engage with pressing questions about equity and opportunity. Addressing systemic barriers that limit wealth accumulation for large segments of the population will require concerted efforts from stakeholders across the economy. By fostering an environment conducive to growth and equitable distribution of resources, the narrative surrounding wealth in America can shift towards a more inclusive future.

Frequently Asked Questions

What are the current net worth statistics for wealth distribution in America?

As of year-end 2024, the total net worth of U.S. households is approximately $160 trillion, highlighting a significant concentration of wealth. The median household net worth stands at around $140,000, reflecting improvements since the Great Financial Crisis, yet it underscores the uneven distribution of assets, with wealth concentrated heavily at the top.

How does income inequality affect wealth distribution in America?

Income inequality plays a crucial role in wealth distribution in America. The top 1% holds more than 50% of stocks, while the bottom 50% owns only 1%. This disparity illustrates how income inequality translates into unequal wealth accumulation, leading to financial assets being concentrated among the wealthy.

What is the impact of U.S. household debt on wealth distribution?

U.S. household debt is nearing $20 trillion, primarily dominated by mortgages, student loans, and auto loans. This high level of debt contrasts sharply with the total household assets of nearly $180 trillion, emphasizing that while America has substantial wealth, a large portion of it is held by the wealthy, exacerbating wealth concentration and affecting overall economic stability.

Can wealth concentration in America affect economic growth?

Yes, wealth concentration can significantly impact economic growth. The top 10% of U.S. households account for half of all spending, indicating that their financial decisions directly influence economic dynamics. If this group reduces spending during economic downturns, it could lead to broader economic challenges.

How are financial assets distributed among different wealth segments in America?

The distribution of financial assets in America is heavily skewed: the top 10% owns nearly two-thirds of these assets while holding only one-quarter of the debt. In contrast, the bottom 90% possesses only 37% of financial assets but carries 75% of household debt, showcasing the stark wealth disparity.

What are the trends in household wealth in the U.S. over the years?

Trends in household wealth show a rising number of millionaires, with about one in six households classified as wealthy. While the wealthy continue to grow their financial assets, underlying issues like debt and wealth concentration persist, influencing socio-economic stability and economic policy.

How does the concentration of wealth in America influence social dynamics?

The concentration of wealth influences social perceptions and dynamics. Wealthy individuals often navigate economic cycles differently, feeling less impact from events like inflation. This creates a divide where conspicuous consumption may be judged, especially in times of economic hardship for the majority.

What role does household debt play in the financial stability of the average American?

Household debt significantly impacts the financial stability of the average American. With nearly $20 trillion in overall debt, a large portion of this burden falls on lower and middle-income households, limiting their financial freedom and exacerbating challenges related to wealth distribution and economic mobility.

How do net worth statistics reflect the reality of wealth distribution in America?

Net worth statistics reveal the reality of wealth distribution by showing a stark divide: while total household net worth is substantial, the median net worth indicates a concentration of wealth at the top, underscoring systemic issues in income and asset distribution.

What are the implications of wealth distribution trends for future policy making in America?

The trends in wealth distribution have significant implications for future policymaking. As wealth concentration grows, effective policies are needed to address income inequality, household debt, and ensure a more equitable distribution of financial assets, which could foster economic stability and improve opportunities for all Americans.

| Aspect | Statistics | Observations |

|---|---|---|

| Total Household Debt | $20 trillion | Majority from mortgages (68%), with student loans and auto loans both at 8%. |

| Total Household Assets | $180 trillion | Assets overshadow debt leading to a net worth of $160 trillion. |

| Median Household Net Worth | $140,000 | Significant increase, although wealth is concentrated at the higher end. |

| Wealth Distribution by Class | Top 1%: 50% of stocks ; Bottom 50%: 1% of stocks | Top 10% holds nearly 2/3 of financial assets; Bottom 90% holds 37% of assets but 75% of debt. |

| Number of Millionaires | 1 out of 6 households | Higher number of millionaires, creating a sense of normalized wealth. |

| Economic Influence of Wealthy | Top 10% accounts for 50% of U.S. spending | Wealthy appear insulated from inflation and economic cycles, impacting consumer resilience. |

Summary

Wealth distribution in America is characterized by significant inequality, where a small percentage of the population controls a vast majority of the wealth. Despite the overall wealth appearing substantial with household assets reaching $180 trillion, the concentration of wealth among the top 1% allows them to command a disproportionate share of financial resources and spending power. Such disparities raise crucial questions about economic balance and the future of wealth in America, particularly in times of economic uncertainty.

#USNews #WealthDistribution #AmericanEconomy #DebtAndAssets #FinancialInsights