Great Wealth Transfer: Prepare Your Family for the Future

The Great Wealth Transfer is set to reshape the economic landscape of New Zealand in the coming decades, heralding a monumental passage of over a trillion dollars from the deceased to the living. As families prepare for this unprecedented shift in intergenerational wealth, discussions surrounding inheritance planning have become more critical than ever. Yet, many Kiwi families grapple with the complexities of family estate planning, often neglecting the vital conversations that could ensure a smoother transition. This wealth transfer is not merely about financial assets; it encompasses the emotional and relational aspects tied to money, demanding a greater focus on financial literacy across generations. By addressing these intricate dynamics head-on, families can foster a healthier legacy that transcends monetary value and strengthens familial bonds.

The upcoming transition of significant wealth between generations, commonly referred to as the intergenerational wealth transition, carries profound implications for societies, particularly in nations like New Zealand. This financial shift is not just an exchange of assets; it poses unique challenges and intricacies that families must navigate through effective estate planning. Often sidelined, discussions around inheritance open up broader themes of legacy, responsibility, and empowerment. By prioritizing a forward-thinking approach to family estate management, individuals can better equip themselves and their heirs for the inevitable changes that wealth entails. Emphasizing financial literacy and proactive conversations will lay the groundwork for a more harmonious and responsible handling of inherited assets.

Understanding the Great Wealth Transfer in New Zealand

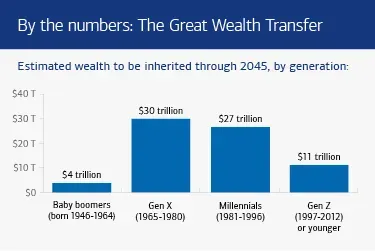

The Great Wealth Transfer represents one of the most significant shifts in wealth dynamics in New Zealand’s history. Over the next 20 years, it is estimated that New Zealanders will inherit over a trillion dollars. This unprecedented transfer of intergenerational wealth is not merely a financial event; it is a societal awakening that necessitates careful planning and proactive dialogue among families. The challenge lies in how we respond to this immense change. Inheritance planning has traditionally been seen as a taboo subject, something families avoid discussing until absolutely necessary, often resulting in confusion and conflict when the time comes.

In this context, understanding inheritance is crucial. Families need to recognize the importance of discussing their estate plans openly. Inheritance is not just about assets; it encapsulates family values, legacies, and relationships. By actively engaging in these conversations, families can create a more harmonious transition during this wealth transfer, ensuring that financial literacy is shared and that all members understand their roles and responsibilities. Just as we prepare for life’s milestones, such as weddings and births, we must prepare for the eventual passage of wealth.

The Importance of Inheritance Planning

Inheritance planning encompasses the strategic organization of assets, ensuring they are passed on according to the wishes of the deceased, while also considering the emotional and relational implications of such transfers. Effective family estate planning can mitigate potential disputes and misunderstandings that often arise during emotional times. By prioritizing transparent communication about inheritance, family members can foster an understanding of each person’s expectations, thus preserving relationships amidst what can be a tumultuous transition of wealth.

Furthermore, integrating financial literacy into inheritance planning creates a foundation of knowledge that can empower beneficiaries to manage their newfound wealth effectively. Educational initiatives that address financial topics can equip family members with the skills needed to handle large sums of money responsibly. This proactive approach not only aids in conflict prevention but also promotes a culture of financial responsibility, encouraging recipients to make informed decisions and view their inheritance as a valuable opportunity rather than a burden.

Navigating Family Dynamics During Wealth Transfer

Family dynamics play a pivotal role in the context of inheritance and wealth transfer. The complexities of blended families, differing financial situations, and the emotional weight of loss can contribute to tension and conflict surrounding estate distribution. It’s not just about dividing assets; it’s about preserving familial bonds and ensuring that the values associated with the inheritance are honored. Open discussions can help clarify individual roles and expectations, thereby reducing the likelihood of disputes regarding asset division.

Moreover, the emotional context of inheritance cannot be understated. The transfer of wealth often coincides with the loss of loved ones, which can exacerbate feelings of grief and resentment if not addressed adequately. Families need to approach these conversations not only with a strategic mindset but also with empathy and sensitivity. By acknowledging the emotional components involved, families can create a more supportive environment that fosters understanding and cooperation, which is essential for a smooth transition.

The Gender Dynamic in Inheritance and Wealth Management

When discussing inheritance, the gender dynamics at play often go unnoticed. Women are frequently the primary recipients of estates, as they tend to outlive their partners, leading many to face the monumental task of managing significant sums of money for the first time. Studies indicate that while women may have less confidence in financial management, they often outperform men when they engage in investing. This discrepancy illustrates the need for targeted education that empowers women to navigate the complexities of wealth management effectively.

Additionally, societal expectations of women as caregivers can complicate their roles in estate planning. When women sacrifice careers to provide care for aging parents, it can lead to financial insecurity that impacts their ability to manage inherited wealth. By addressing these gender-specific challenges within estate planning, families can create tailored strategies that ensure all members are equipped to handle the wealth transfer confidently. Prioritizing financial literacy and open dialogues about contributions and expectations can help dismantle the barriers women face during these critical transitions.

Changing the Kiwi Mindset on Inheritance Conversations

The traditional Kiwi mindset around inheritance often centers on silence and avoidance, leading to a lack of preparedness for the wealth transfer. Many families prefer to keep their wills and estate plans hidden away, which creates confusion and disappointment when the time comes to settle an estate. This hands-off approach can create chaos, as family members might be unprepared to handle the realities of shared ownership or significant sums of money. A shift in mindset is required to facilitate open discussions surrounding inheritance and estate planning.

By recognizing that these conversations are not only necessary but beneficial, families can foster healthy communication patterns that strengthen their bonds. Planning for inheritance is like preparing for any other significant life event—it requires conversation, consideration, and collaboration. Encouraging transparency and regular discussions about financial and estate matters ultimately leads to better outcomes for all involved, allowing families to navigate the complexities of the Great Wealth Transfer with grace and clarity.

The Role of Financial Literacy in Inheritance Planning

Financial literacy is a crucial element of effective inheritance and estate planning. As families prepare for the transfer of significant wealth, understanding the nuances of financial management becomes imperative. This goes beyond mere knowledge of personal finance; it encompasses an understanding of investment strategies, tax implications, and asset management. By ensuring that all family members are educated about these aspects, families can cultivate a generation that is both capable and confident in handling inherited wealth, thus enhancing the likelihood of preserving that wealth for future generations.

Implementing educational programs or resources focused on financial literacy can be transformative. These include workshops, courses, or even informal family discussions aimed at demystifying wealth management. When beneficiaries possess a strong foundation in financial concepts, they are better equipped to make informed decisions regarding their inheritance, reducing the likelihood of disputes and financial mismanagement in the long run. This proactive approach to financial education fosters a sense of responsibility and stewardship over the family’s legacy.

The Dangers of Inheritance Expectations

Expectations surrounding inheritance can lead to a host of issues within families. Many children grow up believing that an inheritance will solve their financial problems, which can lead to a false sense of security and inaction in their current financial endeavors. This mindset can create bitterness and disappointment if those expectations are not met, further straining familial relationships. Rather than viewing inheritance as an entitlement, it should be framed as a potential opportunity that complements one’s financial strategy, not a crutch to rely on.

By managing expectations surrounding inheritance, families can encourage their members to take charge of their financial futures actively. Open dialogues about financial goals and the realities of wealth transfer can shift the focus from entitlement to empowerment. This approach not only alleviates pressure on the benefactor but also instills a sense of agency in beneficiaries, fostering a culture of responsibility and prudent financial habits for generations to come.

The Need for Proactive Communication in Estate Planning

Proactive communication is the cornerstone of effective estate and inheritance planning. Families must remain engaged in discussions about financial matters, ensuring everyone understands the intentions behind wills and the distribution of assets. By having these conversations before a crisis emerges, families can avoid the stress and confusion often associated with settling estates. Clear communication allows for a collective understanding of each member’s priorities, thus fostering a collaborative atmosphere that smooths the transition of wealth.

Additionally, regular updates and discussions about estate plans encourage families to reflect on changing circumstances and evolving dynamics. These discussions can help clarify intentions and facilitate understanding among relatives, reducing the likelihood of disputes or misinterpretations down the line. By valuing open communication, families not only respect the wishes of the deceased but also honor the relationships that matter most, ensuring that the legacy left behind is one of unity and support.

Transforming the Inheritance Planning Landscape

As New Zealanders face the impending Great Wealth Transfer, an urgent need arises to transform the landscape of inheritance planning. The current reticence surrounding estate discussions can no longer be ignored. Families must embrace a proactive approach—one that prioritizes transparency, financial education, and the open exchange of ideas about wealth transfer. This transformation will help ensure that the staggering wealth set to change hands is managed wisely and retains its value across generations.

To effect this transformation, it is essential to develop programs that promote financial literacy and encourage families to engage in discussions about their estate plans. By integrating these practices into the everyday fabric of family life, future generations will be better equipped to face the challenges of inheriting wealth. The opportunity presented by the Great Wealth Transfer can be one of enrichment rather than conflict, provided families take the initiative to redefine their approach to inheritance planning.

Frequently Asked Questions

What is the Great Wealth Transfer and how does it relate to inheritance planning?

The Great Wealth Transfer refers to the impending transfer of over a trillion dollars between New Zealanders over the next 20 years. It highlights the crucial need for effective inheritance planning, as many families are currently unprepared to manage this significant shift in wealth. Proper inheritance planning can help mitigate conflicts and ensure that the transition of intergenerational wealth is executed smoothly.

How can families effectively prepare for the Great Wealth Transfer?

To prepare for the Great Wealth Transfer, families should engage in open discussions about their financial values and inheritance plans. This includes talking about expectations, updating wills regularly, and emphasizing financial literacy among all family members. By treating inheritance as a supplementary benefit rather than a financial strategy, families can create a more prepared and informed atmosphere for managing future wealth.

Why is financial literacy important in the context of the Great Wealth Transfer?

Financial literacy is essential during the Great Wealth Transfer because it equips beneficiaries with the knowledge needed to manage their inherited wealth wisely. Many individuals, especially women, may feel insecure about managing large sums of money. By fostering financial literacy, families can empower heirs to handle their inheritances effectively, avoiding common pitfalls that lead to mismanagement.

What role does communication play in successful family estate planning related to the Great Wealth Transfer?

Effective communication is key to successful family estate planning, especially in the context of the Great Wealth Transfer. Regular discussions about inheritance intentions, asset distribution, and financial health can help prevent misunderstandings and conflicts among family members. Families that prioritize communication are more likely to navigate the emotional complexities of estate planning and financial transitions successfully.

What are the consequences of neglecting estate planning during the Great Wealth Transfer?

Neglecting estate planning amidst the Great Wealth Transfer can lead to significant emotional and financial turmoil for families. Without clear plans and open conversations, conflicts over inheritances may arise, potentially damaging relationships. Additionally, families may find themselves unprepared for managing unexpected wealth, leading to poor financial decisions and wasted opportunities.

| Key Point | Explanation |

|---|---|

| Inheritance in New Zealand | New Zealanders will inherit over a trillion dollars in the next 20 years, representing the largest intergenerational wealth transfer in history. |

| Lack of Planning | Most families do not prepare for inheritance discussions and treat it passively, leading to potential conflicts. |

| Emotional Aspects of Inheritance | Inheritance involves emotions such as fairness and responsibility, often leading to family disputes if intentions are unclear. |

| Gender Dynamics | Women often outlive partners and manage estates but lack confidence in financial decision-making, exacerbating inequality. |

| Ineffective Kiwi Approach | The silence around inheritance planning creates confusion and mismanagement within families when estates are settled. |

| Communication is Key | Families should discuss values and financial matters openly to avoid conflict and ensure proper handling of inheritances. |

| Opportunity and Responsiveness | Without proactive planning and communication, the Great Wealth Transfer risks being a chaotic process rather than a constructive transition. |

Summary

The Great Wealth Transfer is poised to reshape the financial landscape of New Zealand as over a trillion dollars is passed down through generations. However, to truly benefit from this unprecedented transfer of wealth, families must prioritize open dialogue and strategic planning. By addressing the emotional and financial complexities of inheritance, they can facilitate smoother transitions that honor intentions and preserve relationships. Preparation not only mitigates potential disputes but also empowers recipients to manage their newfound wealth wisely. The time to act is now, as the Great Wealth Transfer unfolds before our eyes.

#GlobalFinance #GreatWealthTransfer #FinancialPlanning #FamilyLegacy #WealthManagement