Affordable homeownership is emerging as a foundational pillar in the journey toward financial empowerment for many families. With the rising cost of living, the ability to secure a home at an attainable price is critical in fostering both wealth building and economic mobility. Research from the Atlanta Neighborhood Development Partnership highlights how access to affordable housing and down payment assistance can significantly bolster homebuyer wealth, creating a path toward long-term stability. As housing affordability becomes increasingly scarce, fostering an environment that supports new homebuyers is vital in tackling the complex challenges of wealth generation from homeownership. By investing in programs that enable affordable homeownership, communities can pave the way for future generations to prosper financially and contribute to a more equitable society.

The concept of accessible housing solutions is gaining traction as a vital economic strategy for families striving for wealth and stability. Empowering first-time buyers through financial assistance and educational programs not only promotes individual prosperity but also encourages broader community upliftment. Ensuring that working families can enter the housing market without unbearable financial strain is essential for fostering economic resilience. As housing prices continue to soar, innovative solutions must be implemented to promote residential equity and reduce disparities. Thus, exploring pathways to home ownership with lower barriers is crucial for fostering long-term financial health in communities across the country.

The Importance of Affordable Homeownership for Wealth Building

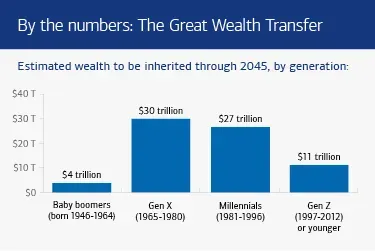

Affordable homeownership is not just about having a roof over your head; it’s a fundamental pathway to building wealth for low and moderate-income families. Research, such as that conducted by the Atlanta Neighborhood Development Partnership (ANDP), underscores the immense wealth-building potential that comes from owning a home. For many families, the equity accumulated in their home represents a significant proportion of their total net worth. This accumulated wealth can be leveraged for further investments or used to provide financial security for future generations, reinforcing the critical role that affordable homeownership plays in economic stability.

Additionally, access to affordable housing can provide families a stepping stone to improved economic mobility. When families can own their own homes, it often leads to increased stability, decreased monthly costs compared to renting, and a greater likelihood of participating in the community. With programs offering down payment assistance and lower purchase prices, even those on lower incomes find it possible to enter the housing market. The sense of ownership instills a level of pride and responsibility, further encouraging individuals to invest in their homes and neighborhoods, subsequently enhancing their economic situation.

Frequently Asked Questions

Why is affordable homeownership important for homebuyer wealth building?

Affordable homeownership is essential for homebuyer wealth building as it allows families, especially those with low to moderate incomes, to accumulate home equity which contributes significantly to their net worth. The Atlanta Neighborhood Development Partnership’s study highlights how access to affordable housing can lead to substantial wealth generation over time, providing a stable foundation for economic mobility.

What role does down payment assistance play in achieving affordable homeownership?

Down payment assistance (DPA) is crucial in facilitating affordable homeownership by reducing the initial financial barriers for homebuyers. The ANDP’s study revealed that 71% of buyers benefited from DPA, averaging $16,400, which significantly aids families in transitioning from renting to owning their homes, making homeownership more attainable.

How does economic mobility through homeownership enhance financial stability for families?

Economic mobility through homeownership enhances financial stability by enabling families to build equity over time, as evidenced in the ANDP study where homeownership generated an average of $191,000 in wealth for long-term homeowners. This financial stability is vital for families, allowing them to weather economic challenges and invest in future opportunities.

What are the current challenges of affordability in housing for potential homebuyers?

The current challenges of affordability in housing include escalating prices, limited availability, and heightened competition for entry-level homes, which make homeownership increasingly unattainable for many working families. High rental costs further complicate the situation, inhibiting the ability to save for down payments and pursue homeownership.

What are the long-term benefits of wealth generation from homeownership?

The long-term benefits of wealth generation from homeownership include substantial equity gains, financial security, and improved quality of life for families. According to the ANDP study, homes appreciated significantly over time, allowing homeowners to build generational wealth that can positively impact their families for years to come.

How does the ANDP study illustrate the impact of affordable homeownership on community wealth?

The ANDP study illustrates the impact of affordable homeownership on community wealth by evaluating the outcomes of 800 homebuyers, showcasing an average wealth creation of $140 million across households. This highlights how targeted interventions in affordable housing can lead to significant economic benefits, not just for individuals, but for entire communities.

What percentage of ANDP homebuyers are first-time buyers and families of color?

In the ANDP study, 93% of homebuyers are first-time buyers, while 78% are families of color. This demographic information underscores the importance of affordable homeownership in promoting equity and opportunity within diverse communities.

How can policymakers support affordable homeownership and economic mobility?

Policymakers can support affordable homeownership and economic mobility by implementing more targeted interventions such as increasing funding for down payment assistance, promoting responsible lending practices, and creating policies that encourage the development of affordable housing. The framework from the ANDP study offers valuable insights for creating equitable housing solutions.

| Topic | Details |

|---|---|

| Importance of Affordable Homeownership | Home equity is a significant part of net worth for low to moderate-income families, vital for wealth building and economic mobility. |

| Challenges to Homeownership | Rising prices, limited availability, and high rental costs complicate access to homeownership for many working families. |

| Key Statistics | 1. Average wealth of $191,000 for homes owned over 5 years. 2. 76% still own homes with an average duration of 7.07 years. 3. 71% received down payment assistance averaging $16,400. 4. Homes purchased at prices 30% below average in Atlanta. 5. Homes appreciated by $163,000 for over 5-year owners. |

| Demographics of ANDP Buyers | 93% are first-time homebuyers, 78% families of color, 58% female-headed households, and 18% veterans or active military. Area median income is 77%, classified as low-income. |

| Key Takeaways | 1. Lower monthly cost burdens due to down payment assistance and affordable prices. 2. Greater long-term stability through predictable housing costs. 3. Higher household wealth due to significant equity gains from affordable homes. |

Summary

Affordable homeownership is a crucial pathway to financial stability, helping families build equity and wealth over time. By addressing the challenges faced by many potential homeowners, including rising costs and limited availability of homes, organizations like the Atlanta Neighborhood Development Partnership are making significant strides. Initiatives such as down payment assistance and responsible lending not only facilitate access to homeownership but also support long-term economic mobility, leading to substantial wealth increases for families. As seen in the recent ANDP study, the positive impacts of affordable homeownership extend beyond individual households, contributing to the overall well-being of communities.