The Allianz Global Wealth Report 2025 unveils significant insights into the dynamics of global financial assets, highlighting a remarkable +8.7% growth in 2024 alone. As total private household financial assets soar to a staggering EUR 269 trillion, the report also addresses the pressing realities of wealth distribution across the globe, where North America retains a disproportionate share. This wealth report summary sheds light on the robust US financial growth, revealing that more than half of the increase in global financial assets originated from North America. The economic trends of 2025 suggest a complex interplay of factors influencing this uneven distribution of wealth, particularly as emerging markets struggle to keep pace. With a closer look at these shifts, the Allianz Global Wealth Report 2025 offers a comprehensive overview of wealth accumulation and its implications for the future.

The 2025 edition of the Allianz Global Wealth Report offers a deep dive into the patterns of financial assets worldwide, reflecting on both their growth and distribution. This evaluation of global wealth highlights the concentration of financial resources, especially in affluent regions like North America, while examining the broader implications for economic equality and opportunity. As we explore this wealth management panorama, alternative metrics also emerge, such as the surge in US financial resources that dominate the narrative of wealth creation. Understanding these economic indicators provides valuable context for anyone interested in the evolution of wealth landscapes, thus enriching our perspective on the pressing issues at play in 2025.

Overview of Financial Growth in 2024

The Allianz Global Wealth Report 2025 presents a compelling narrative of financial growth observed in 2024. The global economy saw a commendable increase in financial assets, with a remarkable rise of 8.7% compared to the previous year’s 8.0%. By the end of 2024, total private financial assets surged to a historic high of EUR 269 trillion. This growth, however, reveals an interesting paradox when viewed against economic activity; relative to economic performance, financial assets remain at the same level as they were in 2017 due to the inflation-induced ‘artificial’ inflation of the GDP denominator.

As financial assets continued to expand, understanding the underlying trends is critical. The upward trajectory can be attributed to several factors, including increased investment in securities, particularly in American markets. The report indicates that positive performance in stock markets has significantly contributed to the acceleration of asset growth, highlighting an ongoing shift in investment preferences among savers across different regions.

Frequently Asked Questions

What are the key findings of the Allianz Global Wealth Report 2025?

The Allianz Global Wealth Report 2025 highlights an 8.7% growth in global financial assets, reaching EUR 269 trillion. It indicates that wealth distribution is heavily skewed, with North America holding about half of all private financial assets. The report also notes that US financial growth significantly outpaced other regions, especially in securities.

How does the economic growth in the US compare to other regions according to the Allianz Global Wealth Report 2025?

According to the Allianz Global Wealth Report 2025, the US economy remains dominant, contributing 53.6% of global financial asset growth in 2024. This is substantially higher than Western Europe and Japan, which lagged behind the global average, highlighting the robust nature of US financial growth.

What trends in wealth distribution does the Allianz Global Wealth Report 2025 reveal?

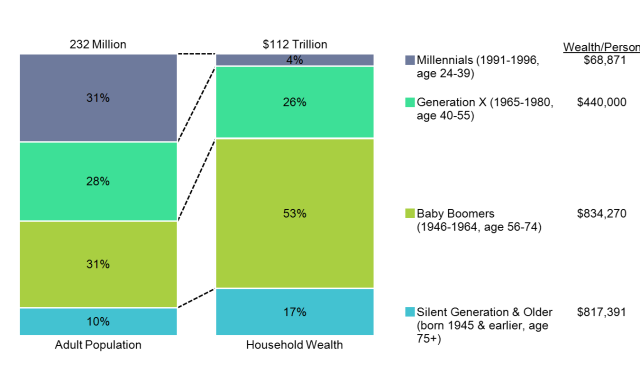

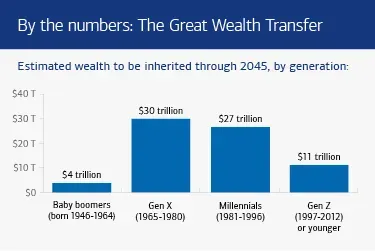

The Allianz Global Wealth Report 2025 reveals a widening gap in wealth distribution, with the richest 10% of individuals owning 60.4% of national wealth, a figure that has remained stable over the past two decades. Notably, the report indicates little progress in reducing inequality, despite significant political focus on the issue.

What are the implications of debt growth as reported in the Allianz Global Wealth Report 2025?

The Allianz Global Wealth Report 2025 shows a slowdown in global private debt growth to 3.1% in 2024, with a total household debt of EUR 59.6 trillion. This indicates shifting financial behavior, as emerging markets experience rising debt ratios while advanced economies like North America practice deleveraging.

How did the performance of real estate assets in 2024 differ according to the Allianz Global Wealth Report 2025?

According to the Allianz Global Wealth Report 2025, real estate assets grew by 3.6% in 2024, more than double the previous year’s rate. However, this growth is still considered weak historically, especially in Western Europe where real estate values saw minimal movement or even decline.

What does the Allianz Global Wealth Report 2025 say about the future of wealth concentration in China?

The Allianz Global Wealth Report 2025 indicates that wealth concentration in China remains high, with the richest 10% now holding 67.9% of total wealth. However, the report suggests that China’s rapid wealth growth phase may be over, with no change in wealth distribution concentration over the last five years.

What strategies for savings and investments are highlighted in the Allianz Global Wealth Report 2025?

The Allianz Global Wealth Report 2025 emphasizes the importance of securities for asset growth, showing North Americans invest 67% of new savings in stocks, outperforming the 26% in Western Europe. This highlights the strategic focus on investment vehicles with high potential for appreciation.

How does the Allianz Global Wealth Report 2025 assess the global financial landscape?

The Allianz Global Wealth Report 2025 assesses the global financial landscape as thriving, with net financial assets reaching EUR 210 trillion, representing strong growth. However, it cautions about increasing inequalities and the contrasting growth rates between developed and emerging economies.

| Key Point | Details |

|---|---|

| Global Growth in Financial Assets | Private household financial assets grew by +8.7%, reaching an all-time high of EUR 269 trillion in 2024. |

| Distribution of Wealth | 50% of financial assets are in North America, with the US holding a steady share while China’s share increased to 15%. |

| Growth of American Households | American households outpaced global growth in financial assets with +6.2% annual growth over the past decade. |

| Preference for Securities | North American savers invest 59.2% of their portfolios in securities, compared to 34.9% in Western Europe. |

| Decrease in Global Debt Growth | Global household debt grew by only +3.1% in 2024, with a significant slowdown in private debt growth. |

| Net Financial Assets Growth | Net financial assets increased by +10.3% to EUR 210 trillion, doubling over the past decade. |

| Real Estate Value Trends | Real estate assets grew by +3.6% in 2024, with varied price trends across regions. |

| Wealth Concentration Stagnation | The wealth gap between richer and poorer countries has not narrowed significantly in the past decade. |

| China’s Wealth Dynamics | Wealth concentration in China surged, with the share of the top 10% in total wealth at 67.9%, but has stabilized. |

Summary

The Allianz Global Wealth Report 2025 highlights the significant growth in global financial assets as well as the continuing disparities in wealth distribution, particularly emphasizing the enduring dominance of North America, especially the U.S. market. Despite global economic growth, real estate remains stagnant in value, and the wealth gap between advanced and emerging markets persists, with little sign of convergence. With China’s wealth concentration showing signs of stability, the report calls attention to the changing financial landscape and the critical need for ongoing observation of economic equality and household financial health.