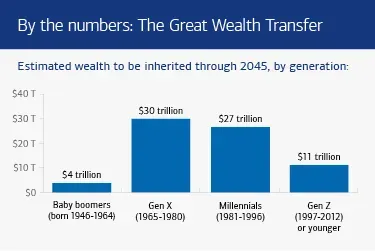

Alternative investments are reshaping the landscape of wealth management, offering a diverse range of opportunities beyond traditional assets. As investors seek enhanced portfolio diversification strategies, trends like private equity, venture capital, and real estate are becoming increasingly accessible to individual clients. With the expansion of alternative investments, understanding their unique characteristics and risk profiles has never been more crucial. Many investors are now exploring these exciting avenues, driven by the desire for higher returns and innovative investment strategies. However, navigating the complexities of these alternatives requires a sharp focus on risk perception and a clear grasp of how these assets can fit into an overall financial plan.

When considering non-conventional asset classes, one encounters a myriad of options often labeled as “alternatives.” These non-traditional investments encompass a wide spectrum beyond equities and bonds, including private credit, venture capital, and infrastructure projects, each with distinct performance drivers and risk parameters. As the sector of private investments evolves, it is essential to understand the nuances between each category, as they significantly differ in their liquidity, return potential, and operational structures. Investors must adapt their strategies to reflect an increasing array of choices while also addressing potential educational gaps regarding these investments. An informed approach to alternative investments can unlock enhanced wealth-building opportunities, emphasizing the need for a thoughtful assessment of different assets and their implications for long-term financial goals.

The Growing Appeal of Alternative Investments

Alternative investments have gained significant traction among today’s investor, particularly due to their potential for higher returns compared to traditional asset classes. As the global economic landscape evolves, more investors are considering avenues like private equity and real estate to enhance their portfolios. This shift is characterized by a noticeable trend towards expanding investment horizons beyond the confines of public equities and conventional fixed income securities. With tools such as evergreen and interval funds, the door to these once exclusive investments has opened, empowering individuals to diversify their wealth management approaches.

However, the rapid proliferation of alternative investment options has introduced a layer of complexity. Investors are now confronted with myriad strategies that span private equity, growth equity, venture capital, and more. This enhanced access is beneficial, but it also raises questions about the appropriate allocation of assets within an individual’s portfolio. Investors need to carefully consider how these alternatives can complement their existing investment strategies, particularly concerning portfolio diversification and overall risk perception.

Frequently Asked Questions

What are alternative investments and how do they differ from traditional investments?

Alternative investments refer to asset classes such as private equity, real estate, private credit, and infrastructure that are not typically available in public markets. Unlike traditional investments, which primarily include stocks and bonds, alternatives often offer unique risk-return profiles, lower correlation to public markets, and the potential for higher returns. Understanding these differences can help investors enhance portfolio diversification.

How can private equity contribute to portfolio diversification?

Private equity can serve as a vital component of portfolio diversification by providing exposure to companies not listed on public exchanges. By investing in private equity, investors can access unique opportunities that often yield higher returns and exhibit lower volatility compared to public markets. This makes private equity an effective strategy for achieving long-term financial goals.

What should investors consider when evaluating alternative investment strategies?

When evaluating alternative investment strategies, investors should consider factors such as the risk-return profile, liquidity, and the expertise of the manager. Understanding how different strategies like private credit or private equity perform can provide insight into their suitability for portfolio diversification. Additionally, investors should assess historical performance, fees, and the manager’s investment process to make informed decisions.

Why is risk perception important in alternative investments?

Risk perception is crucial in alternative investments because many investors still view them as high risk due to unfamiliarity. A clearer understanding of the risks associated with alternatives, such as private equity and real estate, can help investors make better-informed allocation decisions that align with their risk tolerance and financial objectives.

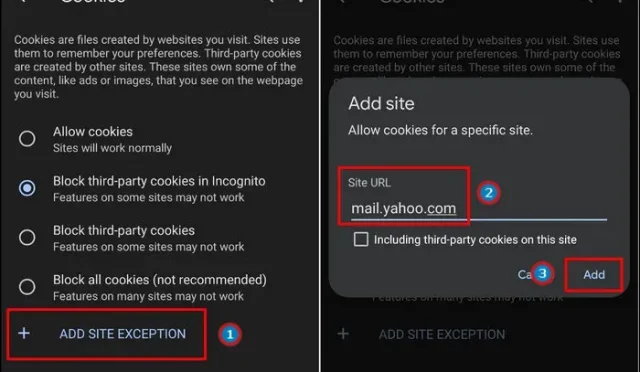

How can wealth management address the education gap around alternative investments?

Wealth management firms can address the education gap by providing comprehensive resources and guidance on alternative investments. This includes workshops, webinars, and detailed reports that explain the mechanics of private equity and other alternatives, helping investors understand their potential role in portfolio diversification and risk management.

What role do liquidity and valuation play in alternative investments?

Liquidity and valuation are critical components in alternative investments, as they can behave differently than public market assets. For example, private equity investments often have longer lock-up periods and may require different valuation methods. Understanding these aspects is vital for investors to evaluate the appropriateness of alternatives within their portfolio.

How do partnerships with high-quality managers affect outcomes in alternative investments?

Partnerships with high-quality managers can greatly enhance outcomes in alternative investments. These managers typically possess extensive origination networks, disciplined risk assessment, and strong valuation practices that yield better returns. By selecting well-managed funds and strategies, investors can capitalize on the benefits of alternatives while minimizing avoidable risks.

| Key Point | Details |

|---|---|

| Role of Kristin Olson | Global head of Alternatives for Wealth at Goldman Sachs, overseeing the alternatives product strategy. |

| Expansion of Access | Individual investors are gaining access to alternative investments like evergreen and interval funds. |

| Complexity of Alternatives | Access comes with complexity; investors face challenges understanding different asset types. |

| Diverse Strategies | Alternatives include private credit, equity, real estate, and infrastructure, each with unique risk and return profiles. |

| Investor Sentiment | Many investors lack clarity on alternatives and their role, with 20% of wealth sitting in cash. |

| Risk Perception | More than half categorize alternatives as high risk; understanding of the category is limited. |

| The Importance of Education | Clear education is needed to help investors understand how alternatives function and what role they play. |

| Manager Selection | Choosing the right managers is crucial as they exhibit different operational and investment disciplines. |

Summary

Alternative investments have become an essential focus for today’s investors, as access expands beyond traditional avenues. While this accessibility provides unique opportunities for portfolio diversification, it also brings substantial complexity and uncertainty. Understanding the nuances of different alternative assets—like private equity, real estate, and infrastructure—is critical for investors. Moreover, the importance of prudent manager selection cannot be overstated; it will largely influence the potential capability of these investments to enhance financial outcomes. Thus, a well-informed approach to alternative investments is paramount for anyone looking to effectively integrate them into their overall strategy.