Average Net Worth to be Wealthy: Insights from Recent Surveys

Average Net Worth to be Wealthy, The average net worth required to be considered wealthy has become a focal point in American society, particularly as perceptions shift in response to economic changes. According to the Charles Schwab Modern Wealth Survey, the threshold that Americans believe necessary to achieve wealth now rests at $2.3 million, down from $2.5 million the previous year. This notable decline highlights a growing concern among citizens about the inflation impact on wealth and the financial landscape. Generation Z, in particular, exhibits an optimistic view regarding wealth expectations, even though their benchmark for wealth is significantly lower at $1.7 million. As the nation grapples with these evolving standards, understanding the nuances of what constitutes a financially comfortable net worth has never been more pertinent.

Wealth benchmarks are shifting, and the perception of what it means to be affluent has morphed as financial landscapes adjust. Recent surveys indicate that while many Americans envision a net worth of $2.3 million as the hallmark of wealth, this figure reflects growing apprehensions about economic stability and inflation. Interestingly, Generation Z stands out as the most hopeful cohort regarding achieving financial success, even suggesting a lower threshold for wealth compared to their predecessors. The discourse surrounding the necessary amount for financial comfort has also intensified, revealing disparities among various age groups. As inflation continues to shape financial realities, the dialogue on wealth and security remains crucial for all generations.

Average Net Worth to be Wealthy, Understanding Wealth Perceptions of Generation Z

Generation Z has distinct ideas about what it means to be wealthy, often having lower benchmarks compared to older generations. According to Charles Schwab’s Modern Wealth Survey, this cohort believes that a net worth of $1.7 million is sufficient to classify as wealthy. This figure stands in stark contrast to Baby Boomers, who feel it takes an average of $2.8 million, revealing generational shifts in attitudes towards wealth accumulation and financial success. As the youngest adult generation, they hold optimistic views on wealth creation, with 43% believing they are either ‘wealthy now’ or ‘on track to be wealthy.’

The perception of wealth among Generation Z suggests that they are more focused on immediate financial stability and happiness than long-term wealth accumulation. This attitude may be influenced by various socio-economic factors, including rising living costs and the impact of inflation on financial benchmarks. As inflation affects consumer prices, the financial landscape changes, thereby altering expectations about financial comfort and wealth. For many in this generation, defining financial success also entails elements beyond mere numbers, such as life satisfaction and the ability to live comfortably.

Average Net Worth to be Wealthy, The Impact of Inflation on Wealth Expectations

Inflation has become a crucial determinant of how Americans perceive wealth, particularly in the wake of economic changes over the past few years. In the recent Schwab survey, 73% of respondents indicated that increasing inflation contributes to their belief that it takes more money to be considered wealthy. This correlation highlights the influence of economic conditions on personal finance perceptions and the average net worth deemed necessary for financial security. As prices rise, individuals feel compelled to re-evaluate their financial goals, often leading to increased benchmarks for wealth.

Additionally, respondents are increasingly concerned about the implications of inflation on their paths to wealth. As consumer prices increase—evidenced by a 2.4% rise noted by the Bureau of Labor Statistics—many individuals now feel that a higher net worth is essential for achieving financial comfort. This inflationary trend has made it more challenging for people to save and invest adequately, prompting a reassessment of what it means to be wealthy in today’s economy. The resulting sentiment is shaping a new narrative about wealth that incorporates not just the amount of money one has but also the psychological impacts of financial stress in an inflationary environment.

Adjustment in Wealth Benchmarks Across Generations

Recent trends indicate that wealth benchmarks are not static; they fluctuate as economic conditions change. The Charles Schwab Modern Wealth Survey revealed that the average net worth required to be considered wealthy has decreased to $2.3 million from $2.5 million the previous year. This decline signals a shift in societal perspectives on wealth, potentially reflecting heightened economic anxieties among Americans. People across various generations are responding to these economic realities, with Baby Boomers still asserting higher benchmarks compared to Generation X, Millennials, and Generation Z.

This decrease in the perceived average net worth can be attributed to a variety of factors, including the effects of inflation on disposable income and changing values around financial security. Younger generations are more likely to prioritize being ‘financially comfortable,’ with the current benchmark set at $839,000. For many, achieving financial comfort may take precedence over striving for the traditional perception of wealth, leading to an evolving dialogue about what it means to be financially successful in a rapidly changing economy.

Average Net Worth to be Wealthy, Generation Z’s Unique Financial Comfort Zone

Generation Z’s requirements for financial comfort stand at a notably low $329,000, setting them apart from their older counterparts. This figure illustrates how economic conditions, such as rising living costs and student debt burdens, have shaped their expectations. As the first generation to grow up during a digital revolution and amidst economic uncertainty, they prioritize flexibility and financial security, which often informs their measurement of wealth and success. With a strong focus on the practicality of financial stability, Generation Z is redefining traditional wealth metrics.

Furthermore, the financial outlook of Generation Z emphasizes experiences and holistic well-being over material wealth. Many in this cohort find happiness in financial management rather than solely in accumulating assets. This shift allows for a broader understanding of financial success—where happiness and a sense of security trump numerical thresholds. As a result, Generation Z’s perspective serves as a valuable insight, guiding how future benchmarks for wealth may be established and how they will influence broader economic dialogues.

Average Net Worth to be Wealthy, The Role of Financial Planning in Wealth Accumulation

Financial planning plays a crucial role in how individuals perceive their wealth status, as indicated by the findings from the Charles Schwab survey. Those who actively engage in saving, investing, and systematic financial planning express a more optimistic attitude towards their potential for wealth. This proactive approach towards financial management empowers individuals to take control of their financial futures, irrespective of shifting economic landscapes or changing perceptions of what constitutes wealth.

Moreover, the survey highlights a strong link between well-structured financial plans and the belief in personal wealth attainment. With approximately 35% of Americans feeling they are either ‘wealthy’ or ‘on track to be wealthy,’ financial literacy and strategic planning emerge as pivotal components. Increasing awareness of investment opportunities and the importance of budgeting can help individuals ensure they meet their financial goals, ultimately enhancing their sense of financial comfort and, by extension, their definition of wealth.

Average Net Worth to be Wealthy, Assessing Happiness in Relation to Financial Resources

According to recent surveys, happiness and financial resources are intricately linked in the American understanding of wealth. Specifically, nearly 45% of respondents identified happiness as a key indicator of wealth, reflecting a societal shift from purely financial metrics towards a more balanced definition including emotional well-being. This evolving view underscores the importance of factors like job satisfaction, quality of life, and personal fulfillment in today’s economic context.

Additionally, financial stability is increasingly recognized as a pathway to happiness, reinforcing the idea that wealth encompasses not only monetary gain but also the absence of financial stress. As Americans navigate their financial journeys, they often identify happiness as a crucial aspect of wealth, demonstrating that personal contentment and financial success are mutually reinforcing. This holistic understanding of wealth aligns well with the priorities of Generation Z, who advocate for balance between financial security and overall well-being.

Average Net Worth to be Wealthy, Comparing Financial Comfort Levels Among Generations

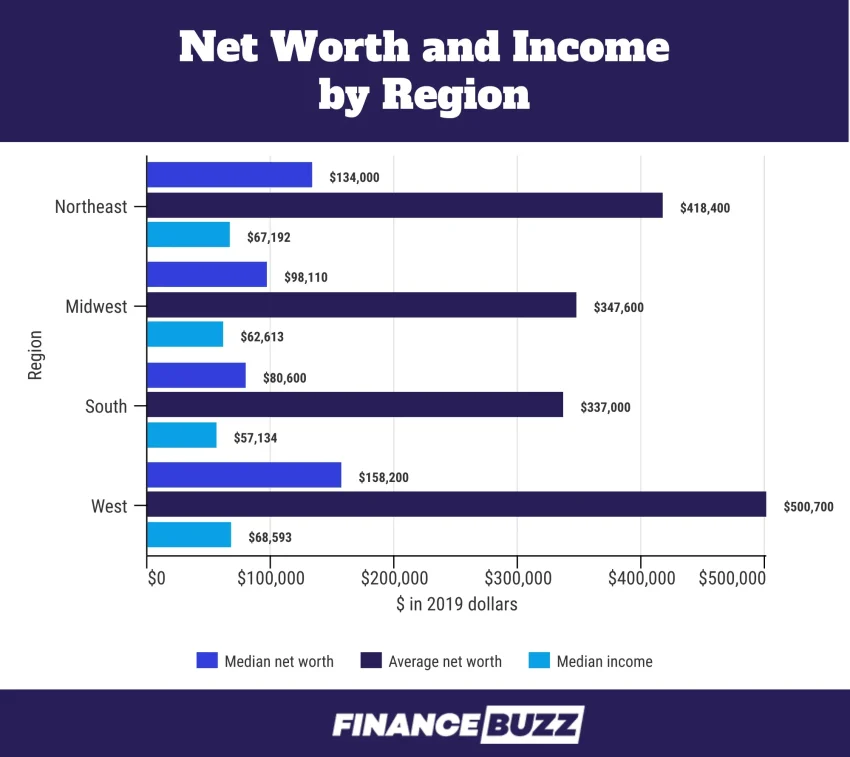

The disparities in perceived financial comfort levels among generations reveal significant insights into societal attitudes towards wealth. The Charles Schwab survey indicates that Baby Boomers regard $943,000 as necessary for financial comfort, whereas Millennials and Generation X estimate $847,000 and $783,000, respectively. Generational differences suggest that older Americans may have different expectations about retirement and savings, creating a gap in understanding what constitutes adequate financial preparation.

On the other hand, Generation Z’s much lower financial comfort benchmark of $329,000 portrays a generation that, faced with uncertainties and changing economic dynamics, is more adaptable and pragmatic in their approach. As younger generations place greater emphasis on financial literacy and adaptability, they seek to reshape established notions of wealth, leading to a broader dialogue about financial viability in an ever-evolving economic landscape.

Average Net Worth to be Wealthy, Wealth Trends and Their Economic Implications

Average Net Worth to be Wealthy, Wealth trends not only reflect individual attitudes about money but also resonate with broader economic implications. As reported by Charles Schwab, the decline in perceived wealth benchmarks highlights a possible reflection of economic recession and its impact on consumer confidence. As more Americans reassess what it means to be wealthy in the context of rising prices and economic strife, we see a trend towards increasing caution in financial behaviors, which could yield significant consequences for spending and investing patterns.

Moreover, understanding shifting wealth trends is critical for financial institutions and policymakers as they strive to accommodate the changing landscape. The emerging trends point towards a need for more comprehensive financial education and resources tailored to various generational needs. Acknowledging evolving definitions of wealth will be essential in shaping future economic strategies and helping individuals achieve their financial goals—especially in the face of challenges like inflation and economic unpredictability.

Average Net Worth to be Wealthy, Redistributing Wealth: The Generational Divide

Average Net Worth to be Wealthy, The notion of wealth redistribution among different generations is gaining visibility, with contemporary discussions highlighting the economic realities faced by younger cohorts. With Baby Boomers holding the majority of wealth in the United States, Millennials and Generation Z express concerns about equitable access to financial resources. The generational divide is underscored by disparities in wealth accumulation, spending habits, and attitudes towards saving, potentially leading to significant socio-economic ramifications.

As highlighted in various studies, including the Schwab survey, younger generations often feel disenfranchised regarding their financial prospects, which may trigger calls for reforms aimed at making wealth accumulation more accessible. Addressing the wealth divide through policy changes could foster a sense of accountability among affluent generations and promote initiatives geared towards inclusive financial growth, thus paving the way for future stability in the economy.

Frequently Asked Questions

What is the average net worth considered to be wealthy in 2023 according to the Schwab Modern Wealth Survey?

In 2023, the Schwab Modern Wealth Survey indicates that Americans believe an average net worth of $2.3 million is necessary to be considered wealthy. This marks a decrease of $200,000 from the previous year, when the figure was $2.5 million.

How does the average net worth for Generation Z compare to other generations in terms of wealth expectations?

Average Net Worth to be Wealthy, Generation Z considers a much lower average net worth of $1.7 million to be necessary for wealth status, in comparison to Baby Boomers who believe it is $2.8 million, and Generation X and Millennials who both see $2.1 million as the benchmark.

What amount of net worth is required for Americans to feel financially comfortable, according to recent surveys?

The Schwab Modern Wealth Survey reveals that an average net worth of $839,000 is perceived as necessary for being ‘financially comfortable,’ a noticeable increase from $778,000 the previous year.

What impact does inflation have on the perceived average net worth needed to be wealthy?

Inflation significantly impacts wealth perceptions, with 73% of Americans citing it as a reason for believing that more money is necessary to be considered wealthy today compared to last year, according to the Schwab survey.

What are the financial comfort levels across different generations according to the Schwab survey?

Based on the Schwab Modern Wealth Survey, Baby Boomers feel a financial comfort level is achieved at an average net worth of $943,000, while Millennials and Generation X require $847,000 and $783,000, respectively. Generation Z only needs $329,000 for the same assurance.

How does the current economic climate influence the average net worth benchmarks for wealth?

The average net worth benchmarks for wealth continue to be influenced by the economic climate, with 63% of respondents from the Schwab survey expressing that it feels like it takes more money to be wealthy today, heavily attributing this to the state of the economy and rising inflation.

What factors do Americans associate with defining wealth according to the latest findings?

According to the survey, 45% of Americans associate happiness with wealth, while 44% link it to having robust financial resources, significantly influencing the average net worth needed to be perceived as wealthy.

What percentage of Americans feel wealthy or on track to be wealthy?

Approximately 35% of Americans feel they are ‘wealthy now’ or ‘on track to be wealthy,’ with 43% of Generation Z and 42% of Millennials expressing positive sentiments towards their wealth status, as highlighted in the Schwab survey.

| Generation | Average Net Worth to be Considered Wealthy | Average Net Worth for Financial Comfort |

|---|---|---|

| Baby Boomers | $2.8 million | $943,000 |

| Generation X | $2.1 million | $783,000 |

| Millennials | $2.1 million | $847,000 |

| Generation Z | $1.7 million | $329,000 |

Summary

The average net worth to be wealthy has recently been identified as $2.3 million, according to the Charles Schwab “Modern Wealth Survey.” This figure has decreased from last year’s benchmark of $2.5 million, reflecting a shifting perception among Americans concerning wealth amid a challenging economic climate. The financial expectations vary significantly across generations, with Baby Boomers generally expecting the highest amounts required to be considered wealthy, while Generation Z sets a notably lower threshold. Overall, the survey indicates that many respondents feel that achieving wealth now requires more financial resources, primarily due to inflation and economic conditions.

#NetWorth #FinancialFreedom #WealthyLifestyle #PersonalFinanceTips #WealthSurvey