The Baby Boomers wealth myth suggests that this fortunate generation has amassed significant wealth purely through wise financial decisions and diligent saving. However, this perception veils a deeper issue of wealth disparity and the prominent pension misconceptions that burden younger generations. As property investment myths persist, many fail to recognize that the surge in property values often correlates with state-driven improvements in local infrastructure rather than just individual effort. This narrative creates intergenerational inequity, where the financial decisions of boomers are perceived as unfair advantages over today’s struggling younger workforce. It’s essential to unpack these myths and address the real financial landscape that reveals how boomers’ perceived prosperity may actually stem from structural advantages rather than personal merit.

The concept often dubbed the ‘Boomer wealth myth’ could be more accurately described as an illusion, where the wealth accumulated by this generation is mistakenly attributed solely to smart investments and prudent savings practices. This perspective neglects the reality of pension misconceptions and ignores the generational wealth transfer dynamics that disproportionately favor Boomers, leaving younger individuals grappling with significant financial challenges. The belief that wise choices alone led to property gains overlooks the crucial role of governmental policies and infrastructure funding that have driven up property values over the decades. As discussions about intergenerational equity become critical, it is important to recognize how the financial decisions of older generations can impact the economic stability of younger ones. In doing so, we can begin to dismantle the narratives that shield Baby Boomers from accountability for the financial landscape they navigated.

Dispelling the Baby Boomers Wealth Myth

The narrative surrounding Baby Boomers often portrays them as a generation that has built their substantial wealth through hard work and prudent financial decisions. This belief, known as the Baby Boomers wealth myth, glosses over the intricate realities of wealth accumulation and the societal structures that have bolstered this generation’s financial status. While it is true that many Boomers have benefited from rising property values and favorable pension conditions, attributing their wealth solely to individual efforts is misleading. In reality, significant state investments in infrastructure and social services have contributed immensely to the rising values of properties in desirable areas, indicating that much of their wealth has roots in collective societal benefits rather than just personal diligence or savvy investing.

This myth perpetuates wealth disparity, as it both dismisses the struggles of younger generations and leads Boomers to overlook their privilege. While they may feel justified in their claims of hard work, the burden on younger cohorts is growing, especially in terms of housing affordability and job stability. The allure of property investment has also been reinforced by economic policies favoring older homeowners while sidelining first-time buyers and renters. Therefore, understanding the broader context and systemic factors that have influenced wealth accumulation will help dismantle the Baby Boomers wealth myth, fostering a more equitable narrative that acknowledges both privilege and responsibility.

Frequently Asked Questions

What are the common pension misconceptions among Baby Boomers?

Many Baby Boomers believe their pensions represent a substantial reservoir of wealth accumulated over time, which they can draw from in retirement. However, this misconception overlooks the reliance on market conditions and the contributions of current workers. Pensions are often not just savings but investments that depend on a thriving economy and the competitiveness of today’s workforce.

How does wealth disparity affect Baby Boomers compared to younger generations?

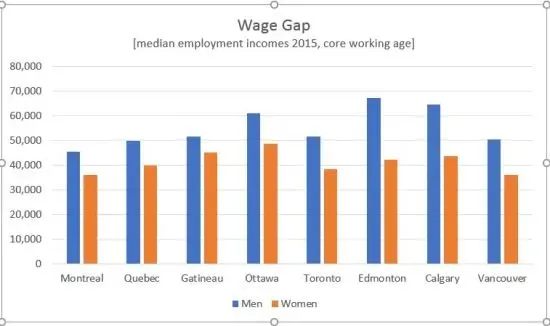

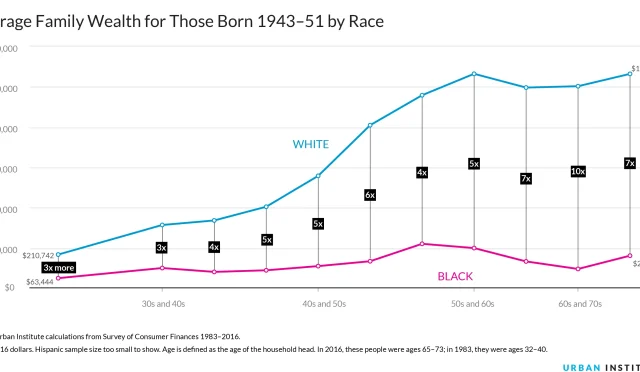

Wealth disparity is a significant issue, with Baby Boomers often holding the bulk of wealth due to rising property values and pension gains. This concentration of wealth creates economic challenges for younger generations, who face higher housing costs and stagnant wages, thus perpetuating a cycle of inequality that can hinder their financial security.

What myths surround Baby Boomers and property investment?

A common myth is that Baby Boomers have achieved their real estate wealth solely through smart investment decisions. In reality, many of the gains in property values are influenced by public investments in infrastructure and amenities, rather than individual home improvements. This highlights the transfer of wealth from younger renters to older homeowners.

How does intergenerational equity relate to Baby Boomers’ financial decisions?

Intergenerational equity concerns the fairness of financial burdens and benefits between different age groups. Baby Boomers’ financial decisions, particularly regarding pensions and property investments, often prioritize their own wealth accumulation at the expense of younger generations, leading to questions about the fairness and sustainability of this wealth distribution.

What role do Baby Boomers play in financial decisions impacting the economy?

Baby Boomers significantly influence financial decisions in the economy, from voting on policies that affect taxation to shaping the demand for retirement-friendly financial products. Their collective wealth and financial decisions also impact government strategies regarding economic support for younger generations struggling with housing and job security. This can lead to a reluctance to acknowledge the broader implications of their financial success.

How have Baby Boomers’ views on wealth impacted societal perceptions?

Baby Boomers often believe their wealth is a result of hard work and prudent financial decisions, which can create societal tensions as other generations face economic hardships. This perception leads to a reluctance to share their wealth or support systemic changes, perpetuating the myth that their financial success is solely due to personal effort rather than broader economic conditions.

Why is it important to dispel the myth of Baby Boomers’ wealth coming from hard work?

Dispelling the myth that Baby Boomers’ wealth stems solely from hard work is crucial to understanding the complexities of wealth accumulation and its impact on social equity. Acknowledging the role of systemic factors, such as government policies and economic trends, helps create a more accurate narrative that can inform policy discussions, encourage intergenerational dialogue, and lead to a fairer distribution of resources.

| Key Point | Explanation |

|---|---|

| Myth of Wealth from Wise Choices | Many baby boomers believe their wealth is solely due to their hard work and wise investments, but this overlooks the benefits they received from systemic advantages. |

| Misconceptions About Pensions | The idea of a ‘pension pot’ creates a misleading image of a vast reservoir of funds, ignoring that pension investments depend on market conditions and workforce viability. |

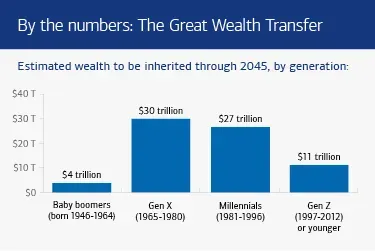

| Wealth Transfer to Younger Generations | Baby boomers’ wealth, particularly from real estate, often comes at the expense of younger generations who struggle with housing affordability. |

| Government Subsidies and Pensions | Pension savers, particularly boomers, receive significant taxpayer subsidies, putting additional financial burdens on younger taxpayers. |

| Rise In Property Value | Many boomers attribute their property gains to personal decision-making, while much of the value increase results from public investments and local improvements rather than individual efforts. |

| Need for Systemic Change | The appeal for fairness in taxation has been largely ignored, and baby boomers can contribute to bridging the funding gap instead of clinging to their wealth. |

Summary

The Baby Boomers wealth myth is misleading as it promotes the belief that their financial success comes strictly from hard work and wise choices. This perspective fails to recognize that their prosperity often relied on structural advantages and systemic policies that disproportionately benefitted their generation. Thus, education and dialogue around this topic are essential to understand the true dynamics of wealth distribution and to address the financial challenges faced by subsequent generations.