BlueCard underpayments represent a significant issue within the healthcare billing landscape, particularly affecting patients who utilize insurance from the Blue Cross Blue Shield Association (BCBSA). This loophole allows secretive vendors to exploit discrepancies in pricing among various BCBSA-affiliated insurers, often leading to underpayment recovery schemes that benefit providers at the patient’s expense. Such practices can generate substantial revenues for both vendors and hospitals while squeezing patients with unexpected medical bills. As we dive deeper into the complexities of healthcare billing loopholes, it’s crucial to illuminate the consequences of BlueCard underpayments and how they relate to medical billing discrepancies and the broader healthcare revenue cycle. Understanding these dynamics is key to addressing the financial burdens they impose on insured patients.

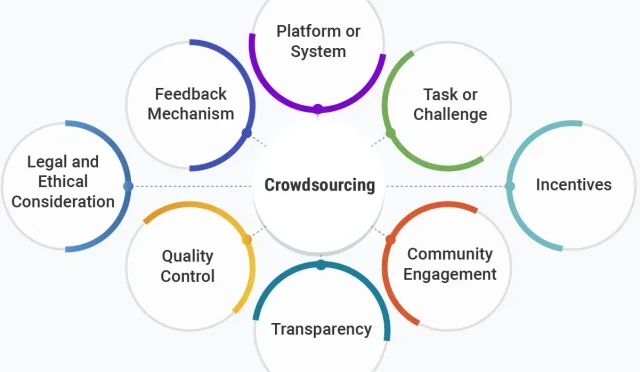

In the realm of healthcare billing, BlueCard underpayments merely scratch the surface of a much more extensive problem involving pricing variances among insurance carriers. Often referred to as insurance underpayment recovery, this issue arises when providers utilize certain vendors to renegotiate claims based on price differences between competing Blue insurers. The deceptive nature of these practices capitalizes on the confusion within the healthcare revenue cycle, leaving patients unaware of the complexities affecting their billing statements. Such billing discrepancies highlight the significant gaps in the current healthcare system, necessitating greater transparency and regulatory scrutiny to protect both providers and patients.

Understanding BlueCard Underpayments in Healthcare

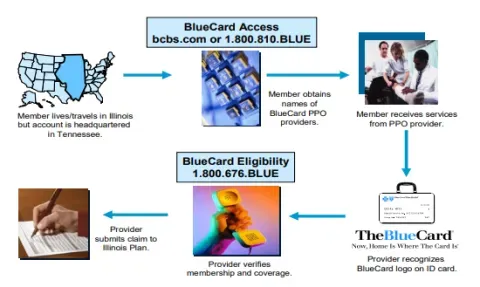

BlueCard underpayments represent a significant challenge within the healthcare billing landscape. These underpayments occur when there are discrepancies in reimbursement rates among multiple Blue Cross Blue Shield (BCBSA) insurance subsidiaries in states with overlapping service areas. A patient receiving care while out-of-state may be subject to a confusing reimbursement structure where the billing process doesn’t reflect the actual service costs. This exploitation of price differences allows vendors to manipulate the system to maximize profits, often leaving patients unaware of the complicated dynamics affecting their bills.

The prevalence of BlueCard underpayments can be traced back to the historical formation of BCBSA and its intricate network structure. States with dual or multiple Blue insurers create fertile ground for billing loopholes, and this has led to a rise in schemes that target these disparities. With healthcare reform and increased administrative burdens in the medical billing cycle, providers may find themselves inadvertently participating in these practices as they seek to recover revenue. This complex interplay raises critical questions about healthcare transparency and the ethical implications tied to these underpayment recovery tactics.

The Role of Vendors in Healthcare Billing

Vendors have emerged as key players in the issue of BlueCard underpayments. They offer services that identify underpayment opportunities to healthcare providers, presenting themselves as essential partners in navigating the convoluted healthcare billing process. By analyzing claims, vendors pinpoint areas where providers can refile claims for higher reimbursement rates, essentially capitalizing on the system’s inherent vulnerabilities. While providers appreciate the potential for increased revenue, this partnership is not without ethical concerns, including the transparency of the billing process to patients.

Moreover, these vendors thrive by exploiting medical billing discrepancies, often targeting high-cost claims that yield significant gains through re-billing. The intricate web of insurance agreements and reimbursement standards across different Blues not only complicates the billing landscape but also provides substantial incentives for vendors to continue these practices. As this exploitative model persists, it raises questions about how transparency measures in the healthcare revenue cycle can be enforced to protect patients and foster ethical business practices among healthcare providers.

Navigating the Complications of Healthcare Revenue Cycle

The healthcare revenue cycle is pivotal for medical providers, encompassing the financial processes that includes everything from patient registration to final payment for services rendered. Within this cycle, BlueCard underpayments highlight significant flaws regarding pricing transparency and reimbursement policies. Providers often grapple with understanding the reimbursement rates across different Blue insurers in overlapping states, leading to confusion and potential financial loss if a lower-paying insurer is billed by mistake. As a result, this complexity can create pressure for medical institutions to employ vendors who promise underpayment recovery solutions.

Furthermore, the chaotic nature of the revenue cycle is exacerbated by continuous changes in healthcare regulations and billing practices. Providers are thus driven to search for alternate revenue sources, often resulting in ethical dilemmas as they partner with vendors to identify lucrative billing opportunities that may compromise patient trust. To fortify financial stability, healthcare professionals must adopt strategies aimed at enhancing transparency within their billing operations and proactively educating patients about the intricacies of insurance claims and potential financial implications they might encounter.

Emerging Trends in Insurance Underpayment Recovery

Recent changes in healthcare regulations have led to a growing awareness surrounding insurance underpayment recovery. As providers become increasingly cognizant of the nuances surrounding BlueCard underpayments, many are shifting towards a more proactive approach in monitoring insurance claims. Rather than waiting for the revenue recovery process to unfold retrospectively, some providers are starting to work directly with vendors to optimize their billing processes upfront. This proactive stance not only aims to minimize the risk associated with potential underpayments but also encourages better alignment in terms of patient billing transparency.

As a result, the healthcare industry is witnessing an evolution in how insurance discrepancies are managed. The sustainability of practices related to underpayment recovery is being scrutinized more attentively, aiming to foster an environment where ethical considerations are paramount. This trend indicates a growing recognition among providers of the value that transparent practices bring, not just for revenue generation but also for maintaining healthy patient-provider relationships crucial in today’s complex healthcare system.

The Historical Context of the BCBSA and Its Impact

The intricate history of the Blue Cross Blue Shield Association (BCBSA) has significantly shaped the current state of healthcare billing and the evolution of underpayment schemes. The 1982 merger that formed BCBSA set in motion a complex framework where multiple insurers could coexist in certain states. This organizational structure has unintentionally facilitated opportunities for exploitation, particularly in states with overlapping Blues. The inconsistent rates among these Blues create loopholes that vendors now capitalize on, deriving substantial profits from the systemic inefficiencies in medical billing.

As the healthcare landscape continues to evolve, understanding the BCBSA’s history becomes essential for grasping the complexity that characterizes the revenue cycle today. The blend of remarkable administrative transformations and the subsequent bureaucratic challenges within the system have rendered it vulnerable to exploitation. Moving forward, industry stakeholders must be aware of this historical context to effectively address and rectify the issues surrounding insurance underpayment recovery, thereby safeguarding patient interests and promoting ethical billing practices.

Exploring Healthcare Billing Loopholes

Healthcare billing loopholes have gained notoriety as a pathway for vendors to exploit weaknesses within the BCBSA framework. Predominantly, BlueCard underpayments emerge as a prominent loophole, allowing for strategic maneuvering between insurers operating in the same geographical area. Providers often find themselves ensnared in this complex web of overlapping insurance coverage, leading to the potential for significant financial ramifications. As these loopholes are exposed, the need for reform to tighten billing practices becomes increasingly pressing.

Exploring these loopholes highlights the urgent necessity for a robust mechanism that would limit such exploitative practices. Without comprehensive regulations and enhanced transparency, both providers and patients may continue to encounter challenges within the healthcare billing cycle. Addressing these loopholes not only requires a thorough understanding of existing contractual arrangements but also a willingness from stakeholders to invest in systemic improvements that prioritize the integrity and fairness of healthcare billing operations.

The Implications of Medical Billing Discrepancies

Medical billing discrepancies can pose major challenges for both healthcare providers and patients alike. These discrepancies, often stemming from intricate insurance agreements and the complexities inherent in the BlueCard program, can lead to confusion regarding what patients owe after receiving care. When providers bill mistakenly for the lower reimbursement rates or cannot identify the right payer due to overlapping coverage, patients may find themselves facing unexpectedly high medical bills. This not only creates frustration but can also discourage patients from seeking the necessary care.

Moreover, discrepancies in billing significantly impact providers as well. With pressure to maintain financial viability amid rising operational costs, providers must navigate the complicated landscape of insurance reimbursement while striving to deliver quality care. Addressing these billing discrepancies, especially those related to BlueCard underpayments, is crucial for improving patient trust and ensuring that providers can sustain their financial health. Achieving accuracy and transparency in medical billing will ultimately foster a healthier ecosystem for care delivery.

The Future of Healthcare Transparency

The future of healthcare transparency appears promising, particularly with incremental changes being made to enhance how billing practices are conducted. While issues like BlueCard underpayments persist, evolving regulatory frameworks aim to improve the visibility of healthcare costs for patients. The implementation of the Price Transparency rule has already begun to shed light on hidden costs associated with medical care, and it is anticipated that similar regulations will continue to proliferate. This growing transparency can serve as an antidote to many of the issues stemming from the complexities of billing discrepancies.

Continued efforts to build transparency into the healthcare system will require cooperation among various stakeholders, including payers, providers, and regulators. By focusing on ethical practices and patient-centered approaches to billing, the industry can move towards a more equitable system. As both patients and providers prioritize financial clarity amidst a tangled billing landscape, the broad shift towards transparency is expected to facilitate better understanding and communication surrounding insurance negotiations and medical billing, ultimately benefiting all parties involved.

Raising Awareness About Insurance Underpayment Recovery

Raising awareness about insurance underpayment recovery is crucial in the current healthcare environment, particularly concerning BlueCard underpayments. As patients increasingly encounter unexpected billing scenarios, it becomes imperative that they are knowledgeable about their rights and the intricacies of their insurance plans. Educating patients on how insurance reimbursement works—especially concerning care received from providers out-of-state—can empower them to question discrepancies and navigate potential billing issues effectively.

Furthermore, by informing healthcare providers and vendors about the broader implications of underpayment recovery practices, stakeholders can foster a culture of accountability within the healthcare system. Encouraging dialogue on the ethical dimensions of these practices not only facilitates transparency but also enhances patient trust. As attention continues to be drawn to underpayment phenomena and their ramifications, the healthcare community can work collaboratively to mitigate exploitation and prioritize fair billing for all parties involved.

Frequently Asked Questions

What are BlueCard underpayments and how do they impact healthcare billing?

BlueCard underpayments refer to discrepancies in reimbursement amounts between different Blue Cross Blue Shield (BCBSA) insurers when patients receive medical care in a state that has multiple Blues. These underpayments occur due to vendors exploiting a loophole to bill the higher-paying Blue insurer after initially submitting claims to the lower-paying one. This not only disrupts healthcare billing practices but can also lead to increased costs for patients, affecting their financial obligations.

How do BlueCard underpayments create healthcare billing loopholes?

BlueCard underpayments create loopholes in healthcare billing by allowing providers to target discrepancies in reimbursement rates between Blues in states with multiple insurers. Vendors capitalize on these billing inconsistencies, often leading to claims being rebilled to higher-paying insurers, which may result in unexpected expenses for patients, thereby highlighting an inefficiency in the healthcare revenue cycle.

What role do vendors play in identifying BlueCard underpayments?

Vendors play a crucial role in identifying BlueCard underpayments by analyzing recent claims submitted by healthcare providers. They use specialized knowledge to pinpoint instances where a claim initially billed to a lower-reimbursing Blue can be rebilled to a higher-paying Blue insurer, creating additional revenue for both themselves and the provider, yet potentially increasing costs for the patient.

What measures can healthcare providers take to address BlueCard underpayments?

Healthcare providers can address BlueCard underpayments by utilizing vendor services that specialize in identifying these discrepancies, negotiating contracts that discourage rebilling practices, and actively monitoring billing processes. Additionally, improving understanding of contractual agreements with various Blues can help providers navigate the complexities of healthcare billing and minimize underpayment risks.

Why are BlueCard underpayments more common in states with multiple Beatles?

BlueCard underpayments are more common in states with multiple Blues because the variation in reimbursement rates between different Blues creates opportunities for vendors to exploit these billing inconsistencies. Patients traveling for care in these states may simultaneously be covered by multiple Blues, leading to confusion and potential underpayments if claims are billed incorrectly.

How can patients protect themselves from the effects of BlueCard underpayments?

Patients can protect themselves from the effects of BlueCard underpayments by being aware of their insurance coverage, specifically when traveling for medical care. They should inquire about billing practices and reimbursement policies with their providers to understand cost-sharing implications, ensuring they are informed about potential discrepancies that could lead to elevated costs on their medical bills.

What recent actions have been taken to address BlueCard underpayments in the healthcare system?

Recent actions taken to address BlueCard underpayments include a $2.8 billion antitrust settlement involving BCBSA that mandates reforms aimed at enhancing transparency and reducing administrative costs. These reforms are expected to mitigate the loopholes that allow for underpayment exploitation, indicating a shift toward better practices within the healthcare revenue cycle.

How are BlueCard underpayments affecting healthcare premiums?

BlueCard underpayments can lead to increased healthcare premiums for patients as higher reimbursement claims can translate into elevated overall costs for insurers. When vendors exploit billing discrepancies, the additional costs often get passed down to patients in the form of higher premiums and out-of-pocket expenses, affecting their financial stability.

What are the potential outcomes if the issues surrounding BlueCard underpayments remain unaddressed?

If the issues surrounding BlueCard underpayments remain unaddressed, patients could continue facing unexpected medical bills, resulting in financial strain. Moreover, the healthcare system may experience ongoing complexities and inefficiencies that undermine trust in insurance providers, hinder patient access to care, and perpetuate a cycle of confusion and exploitation in healthcare billing.

| Key Points |

|---|

| BlueCard underpayments exploit pricing discrepancies between Blue Cross Blue Shield (BCBS) insurers across states, leading to significant annual profits for vendors. |

| These practices primarily affect patients, resulting in unexpected higher bills. |

| The loophole exists primarily in states with multiple BCBS insurers, complicating the billing process and generating opportunities for manipulation. |

| Providers often contract with vendors to identify underpayments, increasing their revenue, albeit at the risk of ethical concerns. |

| Recent reforms and transparency initiatives aim to reduce these exploitations, but the healthcare system’s complexity still presents challenges. |

Summary

BlueCard underpayments represent a troubling issue in the healthcare system where vendors exploit loopholes within the Blue Cross Blue Shield Association network. This manipulation not only generates substantial profits for vendors but also increases financial burdens on unsuspecting patients. While recent reforms promise greater transparency and accountability, understanding the intricacies of BlueCard underpayments and their implications remains crucial for patients and providers alike.