The California Billionaire Wealth Tax is set to become a hotly debated topic as it aims to redefine the financial landscape of the Golden State. As part of the proposed “Billionaire Tax Act,” this measure seeks a one-time five percent tax on individuals with a net worth exceeding $1 billion. Proponents argue it will help fund vital services like education and nutrition, especially in light of recent federal cuts to Medicaid. However, critics warn that the wealth tax consequences could have negative ramifications for the California economy, potentially driving wealthy individuals out of the state. Ultimately, this restructuring of California taxes raises important questions about wealth redistribution and its impact on the state’s future prosperity.

As California contemplates a significant fiscal shift, the concept of taxing the ultra-wealthy is coming to the forefront. The impending introduction of the so-called “Billionaire Tax Act” signifies a push to harness revenue from the richest inhabitants to underwrite essential public services. Advocates claim this policy could alleviate some of the burdens placed on programs like Medicaid, aiming to bolster the state’s welfare systems. Yet, concerns surrounding the implications for high-net-worth individuals and their potential exodus from the state remain a stubborn debate. A deeper analysis of this measure reveals a complex interplay between wealth taxation and its role within the larger context of economic stability and social equity.

The Implications of the California Billionaire Wealth Tax

The proposed California Billionaire Wealth Tax could have far-reaching implications for the state’s economy. Economists warn that imposing a one-time 5 percent tax on billionaires may drive wealthy individuals out of California, potentially leading to a significant loss of jobs and investments. This idea stems from the understanding that billionaires often serve as key contributors to local economies, not only through direct employment but also by investing in local businesses, startups, and innovations. A wealth tax could discourage these investments, stifling economic growth and innovation in the state.

Moreover, the consequences of such a wealth tax extend beyond immediate economic impacts. The potential migration of billionaires to tax-friendly states could result in a decrease in California’s tax revenues over time, as those who leave take their wealth—and the associated tax contributions—with them. This situation presents a paradox where, in efforts to encourage wealth redistribution, the state could inadvertently hinder its financial health, leading to budgetary shortfalls and cuts to essential services. The long-term effects of the California Billionaire Wealth Tax pose critical questions on how the state can balance taxation with maintaining a favorable climate for economic growth.

The Potential Effects on California’s Economy

The introduction of a Billionaire Tax Act in California could create a ripple effect across various sectors of the economy. As high-net-worth individuals consider their options in response to the tax, there’s a possibility of a capital flight that could affect housing markets, tech industries, and overall job creation. With billionaires significantly influencing the startup ecosystem, the loss of even a few key individuals could impede innovation, affecting the region’s ability to retain its reputation as a global tech hub.

In addition, the anticipated revenue garnered from the wealth tax, while projected to benefit social programs like education and food assistance, may not materialize as expected. Critics claim that relying on a narrow tax base could lead to unpredictability in state revenues. This aspect is particularly alarming when considering California’s already high taxes. If the wealth tax leads to significant outmigration, the state may end up with larger deficits, thus exacerbating the challenges related to the California economy.

Wealth Redistribution: Pros and Cons

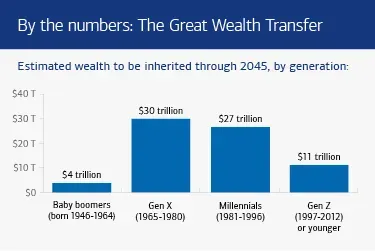

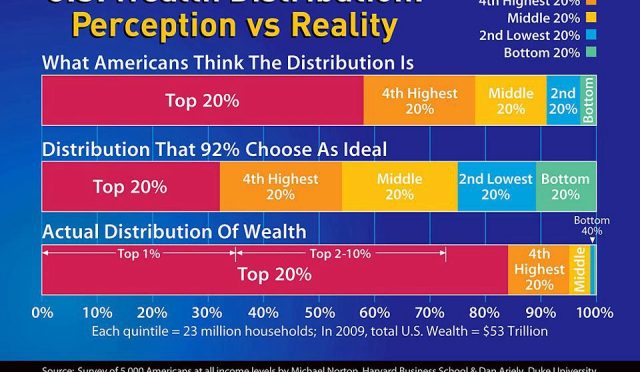

Wealth redistribution through taxes like the proposed California Billionaire Wealth Tax is a contentious topic. Advocates argue that such measures can promote social equity by addressing the stark wealth gap and funding essential public services. They believe that redirecting wealth from billionaires could enable substantial investment in education and health systems, uplifting underprivileged communities and potentially transforming the socioeconomic landscape in California.

Conversely, critics assert that the implementation of a wealth tax can have unintended consequences. They contend that rather than redistributing wealth effectively, it may result in disincentivizing wealth creation altogether. When billionaires are penalized for their success, the argument goes, innovation could decline as individuals reconsider their ambitions and ventures. This intricate balance between promoting equity and encouraging prosperity remains a key debate surrounding the proposed taxation policies in California.

Billionaire Tax Act: A Path to Improved Public Services?

Proponents of the Billionaire Tax Act suggest that it could pave the way for enhanced funding for critical public services. By taxing the wealthiest Californians, the state could theoretically raise substantial revenue aimed at improving programs in education, healthcare, and social services. This funding could serve as a much-needed investment in the infrastructure required to support a burgeoning population and address pressing social issues that have been exacerbated by economic inequality.

However, the expectation that a one-time tax will lead to sustained funding for public services raises questions about its long-term viability. Critics of the measure caution that relying on the wealthy elite to balance the state’s budget can create a tenuous financial foundation. Stable funding for education and social services typically requires consistent revenue streams, and an influx of one-time taxes may not present a reliable solution to California’s ongoing financial challenges.

Taxation Policies and Their Impact on Business

Taxation policies, especially those targeting high-net-worth individuals, can lead to significant shifts in the business climate. The introduction of the California Billionaire Wealth Tax may cause some entrepreneurs and investors to reconsider their business operations in the state. With many billionaires financially involved in diverse industries, their potential exit could lead to a chilling effect on business growth and entrepreneurial endeavors. With California’s vibrant tech scene heavily reliant on its billionaires, any policy that might chase them away could alter the fabric of the state’s economic success.

Moreover, the perception of California as an unfavorable tax jurisdiction could also deter new investments. Potential startups and businesses may choose to establish themselves in states with more favorable tax structures, shifting the competitive landscape. The intricate link between taxation policies and business climate cannot be overstated, as these taxes can play a pivotal role in attracting or repelling investment flows, thereby impacting the overall vitality of the California economy.

Wealth Tax Consequences for Innovation and Growth

The ramifications of implementing a wealth tax in California extend significantly into the realms of innovation and economic growth. Wealthy investors play a crucial role in fueling startup ecosystems by providing essential capital for initial investments. Should the wealth tax discourage these investors from operating within California, the state’s ability to foster groundbreaking ideas and technologies could diminish. Innovation thrives in environments where there is a motivated pool of investors willing to take risks on new ventures.

Furthermore, the interplay of taxation and motivation is a complex one. If billionaires feel that their wealth is constantly under scrutiny and subject to high taxation, their inclination to invest in new, potentially risky innovations may wane. As a result, California could experience a stagnation in growth and the entrepreneurial spirit that has made it a global leader in innovation. This highlights the delicate balance policymakers must strike when considering how to structure wealth taxes while maintaining an environment conducive to sustained growth.

Public Sentiment Surrounding the Billionaire Wealth Tax

Public opinion plays a crucial role in the viability of the proposed Billionaire Tax Act. While many Californians may support the notion of taxing the ultra-wealthy to foster social welfare, others harbor concerns about the practical implications. The potential for negative impacts on the economy leads some to question whether this tax would truly benefit the majority or simply serve as a political statement. Engaging the public in informed discussions about the pros and cons of such a significant tax measure will be essential.

In addition, understanding the sentiments of the middle and lower income groups who may be led to believe that such measures will directly improve their circumstances is crucial. The perceived fairness of taxing billionaires may clash with the unintended outcomes that could come from a wealth tax, such as job losses and diminished economic opportunities. Therefore, framing the tax in a way that emphasizes collective benefit without alienating any demographic will be a vital consideration for advocates of the Billionaire Wealth Tax.

How Other States Approach Wealth Taxes

The conversation around wealth taxes is not unique to California, as other states have approached this topic with varying strategies and outcomes. For instance, states like New Jersey and Washington have attempted to implement their own forms of wealth taxation, analyzing both the potential benefits and drawbacks of such measures. California’s proposed Billionaire Tax Act could lean on the experiences of these states to navigate the implications associated with wealth taxation—both positive and negative.

Understanding the implications of wealth taxes in other states can help Californian lawmakers calibrate their approach. Lessons learned about taxpayer behavior and revenue stability are crucial in formulating a plan that minimizes adverse effects on both the economy and residents. Collaborative discussions among state legislators can spark innovative ideas for creating a balanced taxation framework that considers the needs of both the wealthy and the general public.

The Future of Wealth Taxes in California

As California moves forward with discussions on the proposed Billionaire Wealth Tax, the future of wealth taxation in the state remains uncertain. Will the tax find its way to the ballot and receive voter support, or will concerns over economic consequences derail it? The developments over the coming months will be pivotal, and how the state addresses the competing interests of economic growth versus wealth redistribution will shape California’s financial landscape moving forward.

Additionally, the outcome of other proposed tax measures in California may create a precedent for future wealth taxes. The public’s reaction to the Billionaire Tax Act will set the tone for how policymakers approach similar tax initiatives in the future. As the state grapples with chronic budget shortfalls and rising inequality, the discussions around wealth taxes will likely continue to evolve, reflecting broader national debates on income distribution and fiscal responsibility.

Frequently Asked Questions

What is the California Billionaire Wealth Tax and how does it work?

The California Billionaire Wealth Tax is a proposed tax, specifically the Billionaire Tax Act, aiming to impose a one-time 5% wealth tax on individuals with a net worth of at least $1 billion. This wealth tax is designed to generate substantial revenue for social programs in California, addressing issues such as education funding and food assistance.

What are the potential consequences of the California Billionaire Wealth Tax?

The wealth tax consequences of the California Billionaire Wealth Tax could have far-reaching effects on the state’s economy. Critics argue that it may lead to wealthy individuals leaving California, potentially reducing investment and economic activity, while advocates believe it could enhance funding for vital state services.

How would the California Billionaire Wealth Tax impact wealth redistribution?

The California Billionaire Wealth Tax is intended to facilitate wealth redistribution by taxing billionaires to finance public programs that benefit lower-income residents. This form of wealth tax aims to address the growing wealth gap in California and promote social equity through increased funding for education and assistance programs.

What are the arguments for and against the Billionaire Tax Act in California?

Supporters of the Billionaire Tax Act argue it is a necessary measure for California to generate funds for essential services, especially amidst federal funding cuts. On the other hand, opponents warn that the tax may drive away key investors and entrepreneurs, adversely affecting the California economy and innovation landscape.

When is the vote on the California Billionaire Wealth Tax expected to take place?

The vote on the California Billionaire Wealth Tax, under the proposed Billionaire Tax Act, is anticipated to occur in November 2026. This referendum will allow California voters to decide whether to implement this wealth tax and its associated implications.

How might the California economy change if the Billionaire Tax Act is implemented?

If the Billionaire Tax Act is implemented, the California economy could see a shift in investment patterns. While the proposed tax aims to fund essential services, there is concern that it may lead to an outflow of wealthy residents, negatively impacting innovation, job creation, and economic growth in the state.

What social programs could benefit from the revenue generated by the California Billionaire Wealth Tax?

Revenue generated from the California Billionaire Wealth Tax could significantly benefit various social programs, particularly in education and food assistance. Proponents argue that the funding is vital for improving educational resources and supporting low-income families, thereby enhancing the overall quality of life in California.

What has been the public response to the proposed California Billionaire Wealth Tax?

Public response to the proposed California Billionaire Wealth Tax has been mixed. Some residents support the initiative, seeing it as a necessary step towards equity and improved public funding. Others oppose it, fearing its potential negative impacts on the state’s wealth distribution and economic vitality.

Are there similar wealth taxes implemented in other states or countries?

Yes, several countries in Europe have implemented wealth taxes, although their effectiveness and impact on the economy are debated. In the U.S., there are currently no states with a wealth tax as extensive as the proposed California Billionaire Wealth Tax, making California a potential pioneer in pursuing this type of taxation.

What are the estimated revenue projections from the California Billionaire Wealth Tax?

While exact revenue projections vary, estimates suggest that the California Billionaire Wealth Tax could generate billions of dollars in funds, which would be allocated to critical areas such as education and public welfare programs, potentially transforming the state’s financial landscape.

| Key Point | Details |

|---|---|

| Introduction of the Billionaire Tax Act | A proposed referendum for a one-time 5% tax on individuals with a net worth of at least $1 billion. |

| Support for the tax | Advocates, including Representative Ro Khanna, claim it will fund essential programs such as education and food assistance due to federal cuts to Medicaid. |

| Potential economic impact | Critics argue that the tax could drive billionaires out of California and negatively impact the state’s economy and innovation. |

| Historical context | California’s approach may hinder its ability to produce tech giants, contrasting with Europe’s history of taxation that stunted similar growth. |

Summary

The California Billionaire Wealth Tax is poised to become a momentous and potentially destructive initiative if passed. This significant tax, targeted at the ultra-wealthy, raises concerns about the implications for California’s economic landscape and its capacity to foster innovation. While proponents argue it can provide crucial funding for welfare programs, critics warn it may ultimately lead to a talented workforce and capital migration out of the state. As voters approach the November 2026 ballot, understanding the complexities surrounding the California Billionaire Wealth Tax will be essential for all stakeholders involved.