As discussions around the California billionaire wealth tax intensify, prominent tech figures like Peter Thiel and Larry Page are reportedly preparing to stage an exodus from the state. This proposed wealth tax, aimed at individuals with fortunes exceeding $1 billion, seeks to generate substantial revenue to bolster California’s healthcare funding. If passed, it could profoundly impact these billionaires’ financial strategies, with many contemplating relocation to tax-friendly states like Florida. The potential instability stemming from this wealth tax has raised alarms among industry leaders, who predict a significant California tax exodus could leave the middle class shouldering an increased tax burden. As the debate unfolds, the fate of California’s economy and its beloved tech ecosystem hangs in the balance, urging a closer examination of the wealth tax impact on the future of innovation within the state.

With the looming prospect of a substantial tax levied on the wealth of California’s richest residents, there is growing unease among the state’s elite. Many entrepreneurs, including influential names from the tech world, are weighing their options amid fears of being financially burdened by the new legislation. Some industry leaders are eyeing alternative locations with more favorable tax environments, much like the decisions made by Elon Musk and others who have already made the switch. The concern is that such a move could signal a larger trend of disinvestment and migration away from California, complicating the landscape for future business ventures. As this conversation continues, the implications for the state’s economy remain critical, particularly concerning how this affects healthcare funding and the entrepreneurial spirit traditionally fueled by Silicon Valley.

The Impending California Billionaire Wealth Tax

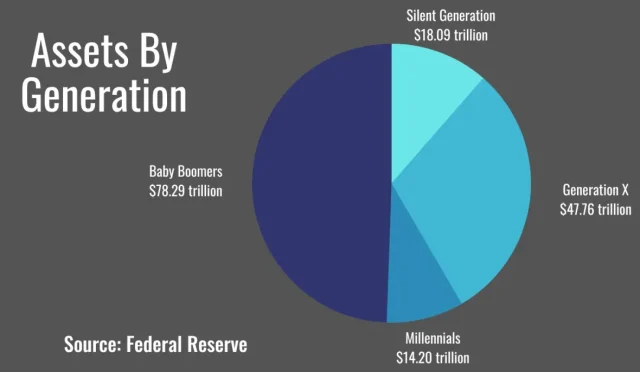

The looming billionaires wealth tax in California has generated significant attention, particularly as influential tech giants like Peter Thiel and Larry Page seem to be contemplating relocation out of the state. This proposed tax, which seeks to impose a one-time 5% levy on Californians with assets exceeding $1 billion, is being positioned as a major source of funding for healthcare improvements. It has fueled a narrative of a potential tax exodus, where affluent residents may choose to leave to protect their fortunes from what they perceive as excessive taxation.

Supporters of the wealth tax argue that it is a necessary measure to ensure accessible healthcare for all Californians, potentially generating around $100 billion in revenue. Yet, critics, including investors and entrepreneurs, warn that such a tax could drive the very individuals who contribute most significantly to innovation and economic growth out of the state. They fear that a significant tax burden, coupled with California’s already high cost of living, could lead to a decline in business activities and push talented individuals to seek more favorable tax environments elsewhere.

California Tax Exodus: The Reaction of Tech Leaders

The potential for a California tax exodus has not only captured media headlines but has also provoked responses from prominent figures in the tech industry. Peter Thiel’s discussions around establishing a presence outside California, alongside Larry Page’s filing of incorporation documents in Florida, exemplify a growing trend among wealthy Californians unsure about the future financial landscape. As tech luminaries express their concerns, the state’s policymakers must consider the broader implications of such a wealth tax.

Recent warnings from investors like Chamath Palihapitiya resonate strongly as he predicts that a wealth tax could catalyze the departure of talented entrepreneurs, stripping California of its innovative edge. With numerous companies already transferring operations to states with more business-friendly environments, the threat of a tax that disproportionately impacts the wealthy could lead to an accelerated outflow of resources and talent. In such a scenario, California’s middle class may end up bearing the full weight of the state’s financial obligations.

Fleeing California: Peter Thiel and Larry Page

Peter Thiel and Larry Page represent just a few of California’s billionaires who are showing signs of wanting to relocate amid the proposed wealth tax. Peter Thiel, noted for his investment strategies and a renowned figure in Silicon Valley, has been observed making preparations to spend more time outside of California, highlighting a shift in sentiment among the state’s upper echelon. Meanwhile, Larry Page’s plans to establish companies in Florida indicate a strategic move away from the high taxes associated with California, emphasizing the real concerns surrounding fiscal responsibility.

The actions of these influential tech entrepreneurs will undoubtedly serve as a litmus test for the effects of the proposed wealth tax. If high-profile leaders like Thiel and Page successfully transition their operations to other states, California risks losing not only tax revenues but also the entrepreneurial spirit that has historically driven innovation in the region. The fear of taxation is prompting practical reactions that could alter the economic landscape of California entirely, leading to regulatory changes and new considerations for the state’s wealthy elite.

Billionaire Tax Resistance: The Stances of Industry Leaders

Chamath Palihapitiya’s resistance to California’s proposed wealth tax underscores a growing sentiment among billionaires regarding fiscal policies. He articulates a glaring concern that the taxation might disproportionately impact innovation, whereby the most capable entrepreneurs would gravitate toward states with lower tax burdens, potentially dooming California’s grand ambitions of economic growth and technological leadership. Many in the tech industry support the notion that such taxation is not just a financial burden but a deterrent to progressive change.

Industry leaders are increasingly vocal about the implications of the wealth tax on their operational decisions, warning that it could lead to unintended consequences for California’s economy. They argue that states implementing friendly fiscal policies attract talent and resources, emphasizing that a wealth tax might only be an initial step toward a broader dislocation of business infrastructures. The discourse within Silicon Valley ultimately revolves around whether taxation can work harmoniously with innovation, or if it will stifle it altogether.

Healthcare Funding and the Wealth Tax Debate

The argument for a billionaire wealth tax often hinges on its potential to fund California’s healthcare system, which advocates claim is underfunded. Proponents, including the Service Employees International Union-United Healthcare Workers West, argue that the tax could lead to substantial revenue that would alleviate federal cutbacks on health services. This perspective positions the wealth tax as not merely a fiscal policy but as a necessary step toward ensuring that all Californians have access to essential healthcare services.

However, critics question the effectiveness of relying on billionaire contributions to resolve systemic healthcare issues. They argue that crafting a sustainable healthcare funding model requires a comprehensive approach that doesn’t solely depend on taxing the wealthy. Instead, they suggest that a multi-faceted strategy focusing on efficiency and accountability in state funding could serve California better, depending on a cohesive plan for reform rather than on the unpredictable nature of wealth taxes.

The Future of Taxation in California

As California considers its future taxation policies, the implications of a proposed billionaire wealth tax cannot be overlooked. This tax would fundamentally redefine the state’s fiscal landscape, especially among the wealthiest residents who play a critical role in the state’s economy. The ongoing discussions surrounding the wealth tax are not just about revenue generation but also about shaping the future of innovation and entrepreneurship in California.

Conversations about tax policy in California raise important questions about how the state can balance social responsibility with the need to maintain a thriving economy. If billionaires feel encumbered by punitive taxes, the risk is that they may choose to relocate, draining California of innovative talent and revenue streams. As states like Florida and Texas become increasingly attractive relocation destinations for influential Californians, it is crucial for state policymakers to reconsider the long-term effects of their taxation strategies.

Innovation vs. Taxation: The California Conundrum

The tension between fostering innovation and imposing taxation in California is exemplified by the potential wealth tax. While the initiative aims to bolster funding for essential services, it simultaneously poses a threat to the dynamic tech ecosystem that has flourished in the state. Venture capitalists and tech leaders worry that stringent tax measures could drive away the entrepreneurial spirit that has made California a leader in global innovation.

For California to maintain its status as a hub for technological advancement, it may need to reassess its approach to taxation. Instituting a wealth tax could mean a diminishing pool of talent and reduced investment in local businesses, as top innovators turn their attention to states with less oppressive fiscal burdens. The challenge lies in establishing a tax system that meets funding needs without stifling the creativity and ambition that characterizes Silicon Valley.

Public Sentiment on the Wealth Tax Proposal

Public sentiment regarding the proposed billionaire wealth tax appears divided. While many see it as a fair approach to taxing the wealthy to support public programs like healthcare, others view it as a punitive measure that could drive economic growth out of California. This divide reflects broader national debates about wealth disparity and the role of government in addressing social issues through taxation.

Surveys indicate that a significant portion of Californians support increased taxes on billionaires, viewing them as responsible for contributing to state challenges. However, skepticism remains regarding whether such taxes will be effectively utilized or merely lead to inefficiencies and waste within government programs. Understanding these public sentiments is crucial for lawmakers as they navigate complex taxation reforms while attempting to balance diverse opinions.

Comparative Analysis: Wealth Taxes Around the Nation

As California debates its own billionaire wealth tax, it’s valuable to understand how similar taxes have been implemented across the nation. Other states have adopted variations of wealth taxes, each with different results and repercussions. For instance, in some areas where wealth taxes were introduced, large numbers of affluent residents left, resulting in decreased funding for local programs and diminished economic growth.

These case studies serve as cautionary tales for California lawmakers. They must thoroughly analyze the potential long-term impacts that a wealth tax could have on its economy and population retention. By leveraging lessons learned from other jurisdictions, California has an opportunity to design a wealth tax that achieves its aims without precipitating a mass exodus of its wealth creators.

Frequently Asked Questions

What is the California billionaire wealth tax proposal and how does it relate to Peter Thiel’s potential exit from the state?

The California billionaire wealth tax proposal aims to impose a one-time tax of 5% on individuals with a net worth exceeding $1 billion. This tax is intended to fund healthcare initiatives in the state. Notable billionaire Peter Thiel has indicated plans to spend more time outside California as a response to this potential tax, reflecting concerns among wealthy individuals about the implications of such a wealth tax.

How might the California wealth tax impact billionaires like Larry Page and their tax planning strategies?

The California wealth tax could significantly influence tax planning for billionaires like Larry Page. Given the proposed structure, taxes based on total assets rather than just income could prompt Page to consider relocating his financial activities to states with more favorable tax conditions, such as Florida, where he has already filed incorporation documents.

Could the California billionaire wealth tax lead to a mass tax exodus similar to what we’ve seen with tech companies?

Yes, experts warn that the California billionaire wealth tax could trigger a tax exodus, as wealthy individuals may flee to states with lower tax burdens. This pattern is already evident, as numerous tech leaders have relocated their companies to avoid high taxes, raising concerns about the future economic landscape of California.

What are the expected revenues from the California billionaire wealth tax, and what could they fund?

The California billionaire wealth tax is projected to generate approximately $100 billion in revenue, primarily aimed at supporting healthcare funding in the state. The tax proposal is backed by healthcare advocates who believe it could mitigate financial cuts at the federal level.

How does the proposed California wealth tax compare to recent tax trends and legislation in other states?

The proposed California wealth tax contrasts sharply with tax trends in many other states that have lowered or eliminated income taxes, creating a more attractive environment for billionaires. This divergence may accelerate the trend of wealthy individuals relocating to states like Texas and Florida, which offer significantly lower taxes.

What arguments are being made against the California billionaire wealth tax by entrepreneurs like Chamath Palihapitiya?

Entrepreneurs such as Chamath Palihapitiya argue that the California billionaire wealth tax could undermine the state’s economy by driving away talented entrepreneurs and businesses. He suggests that the exodus of wealth could leave lower and middle-income residents to shoulder a greater share of the tax burden, potentially leading to economic instability.

What are some concerns expressed by California officials regarding the billionaire wealth tax and its execution?

California officials, including Democratic Rep. Ro Khanna, acknowledge concerns about transparency and accountability in managing tax revenues if the billionaire wealth tax is enacted. There are calls for improved measures against corruption within state finances to ensure that the revenue generated effectively supports public services like healthcare.

How has public sentiment been shifting towards high-income earners and taxes in California?

Public sentiment in California appears increasingly critical of high-income disparities, with a significant portion of the population believing that the wealth concentration among billionaires is problematic. The proposed billionaire wealth tax is one approach lawmakers are considering to address these disparities and enhance funding for essential services.

| Key Points |

|---|

| Tech billionaires, including Peter Thiel and Larry Page, are considering leaving California due to a proposed billionaire wealth tax. |

| The wealth tax could require individuals worth over $1 billion to pay 5% of their assets. |

| Opponents warn that such taxes may drive away wealthy entrepreneurs and negatively impact the California economy. |

| Supporters claim the tax could generate $100 billion for healthcare, aiding public services. |

| California’s economy shows signs of businesses relocating to states with lower taxes and more favorable regulations. |

Summary

The California billionaire wealth tax aims to impose a tax on the state’s wealthiest individuals to fund healthcare initiatives. However, this proposal has sparked significant debate among tech billionaires and economic analysts, with figures like Peter Thiel and Larry Page contemplating leaving the state in response. Critics argue that such a tax could drive away essential talent and ultimately harm California’s economy, while supporters highlight its potential to generate vital revenue for public services. As the situation unfolds, the implications of the wealth tax on California’s future remain a critical point of discussion.