The debate over whether to impose a California billionaires tax has ignited intense discussions about wealth inequality and the state’s financial future. Advocates, including powerful labor unions and healthcare proponents, are pushing for voters to approve a one-time, 5% tax on the immense fortunes of nearly 200 billionaires residing in California. This California billionaires tax initiative aims to generate roughly $100 billion in revenue, primarily earmarked to bolster the state’s healthcare system and support education funding amidst looming budget cuts. Proponents argue that taxing the ultra-wealthy is essential for maintaining vital services like healthcare, especially given the drastic cuts anticipated from federal funding changes. As the conversation evolves, California’s leadership must confront the challenge of funding essential programs without further burdening its most vulnerable residents.

The proposal to introduce a wealth tax in California specifically targeting billionaires has emerged as a focal point in discussions about tax reform and social equity. Known informally as the billionaires wealth tax, this initiative seeks to levy a one-time tax on the vast assets of the wealthiest individuals in the state, potentially transforming the landscape of California taxes on billionaires. By diverting substantial revenues to support healthcare funding and educational needs, supporters of the SEIU billionaires tax initiative argue for a fairer distribution of resources during a period marked by economic instability and social service cutbacks. As public discourse continues, the implications of such a tax could set a precedent for future fiscal policies that address wealth disparities and funding for essential services.

The California Billionaires Tax Proposal Explained

The California billionaires tax is a groundbreaking initiative proposed by various labor and health care organizations, aiming to impose a one-time 5% levy on the wealth of approximately 200 billionaires residing in the state. This tax is projected to generate an astounding $100 billion in revenue, which would be strategically allocated predominantly to bolster California’s health care system and provide essential funding for K-12 education. The initiative comes at a crucial time as the state grapples with significant budget deficits and potential cuts to vital social services, exacerbating the urgency for innovative revenue solutions.

By structuring the tax to apply to the net worth of billionaires in 2025, proponents assert that this approach ensures the wealthiest individuals contribute a fair share without impacting the middle class or businesses. This is especially pertinent given California’s history of high personal income tax rates, which already significantly burden the top earners. Advocates believe that implementing such a billionaires wealth tax aligns with principles of equity and justice, asserting that those who have accrued substantial wealth should support the systems from which they benefit.

Impact on California’s Healthcare and Education Funding

The prospective California billionaires tax has the potential to transform the state’s healthcare funding landscape dramatically. With nearly 90% of the tax revenue earmarked for healthcare, this initiative aims to stabilize and strengthen the current healthcare infrastructure, thereby preventing facility closures and job losses in the sector. Proponents highlight that, in light of significant federal cuts to social services, this funding could be a lifesaver for an increasingly strained health care system, ultimately aiming to keep medical services accessible for all Californians.

Furthermore, the allocation of 10% of the generated funds to K-12 education is a calculated effort to address the disparities within the education system. As California faces a growing disparity in educational resources, this funding would help to improve public education outcomes, ensuring that children in disadvantaged regions receive the support necessary for success. Given the intersecting crises in health care and education, the proposed billionaires tax could serve as a crucial means for delivering essential services to communities that are most in need.

Challenges Faced by the Billionaires Tax Initiative

Despite the enthusiasm from supporters, the initiative faces both legal and political hurdles that could impact its success. The current climate in California is complicated; while Democrats largely hold power, internal divisions can stymie progressive legislation. Governor Gavin Newsom has historically opposed any plans to implement a wealth tax, which may hinder momentum for the billionaires tax initiative. This conflict not only highlights the challenges advocates must navigate but also reflects a broader tension within California politics regarding wealth distribution and social equity.

As the initiative demands 874,641 signatures to be placed on the 2026 ballot, proponents are mobilizing to gather public support. However, convincing voters to adopt a billionaires wealth tax can be challenging, especially amid misconceptions that such taxes would eventually burden the middle class. Campaigning for the initiative thus involves educating voters on its specific focus on ultra-wealthy individuals. Ensuring the clear communication of the tax’s intentions is vital to countering fears about unintended consequences and to fostering a supportive environment among the electorate.

The Controversy Surrounding the Billionaires Tax

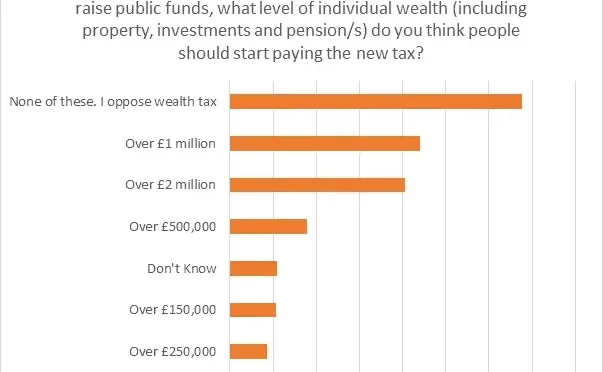

The billionaires tax initiative has ignited controversy across various sectors of society. Critics, including some tax advocacy groups and economic analysts, have voiced concerns that introducing a wealth tax could set a damaging precedent, potentially leading to broader tax increases that reach into the middle class. Notably, opinion pieces have suggested that a wealth tax, while targeting the ultra-wealthy initially, could eventually expand to affect everyday Californians who own property or have accumulated savings.

Furthermore, opponents argue that imposing such a tax could incentivize billionaires to relocate their assets or even leave California entirely, which may result in a significant budget shortfall for the state. This perspective raises critical questions regarding the long-term sustainability of revenue generated through elevated taxes on wealth. Advocates, however, argue that the structure of the proposed billionaires tax is specifically designed to mitigate this risk, claiming that it requires ultra-wealthy individuals to pay taxes based on their 2025 net worth, regardless of where their assets may be relocated.

Billionaires Tax and Federal Funding Cuts

As California faces significant cuts to federal Medicaid funding projected to reach nearly $30 billion annually, the impetus for introducing a billionaires tax becomes starkly apparent. With millions of Californians at risk of losing critical healthcare coverage, the proposed tax seeks to fill the funding gap that results from diminished federal support due to legislation like President Trump’s One Big Beautiful Bill Act. The potential loss of Medicaid funding accentuates the urgency for state-level interventions, such as the billionaires tax, to ensure ongoing healthcare accessibility.

The consequences of not addressing this funding shortfall could be catastrophic, particularly for the most vulnerable populations in California. The billionaires tax is positioned as a viable solution to secure the future of local healthcare and education systems, creating a buffer against the federal cuts that threaten to dismantle essential services. By leveraging the wealth of the ultra-rich, California can strive to preserve and enhance public services critical for ensuring health equity and educational opportunities across the state.

Rallying Support for the Billionaires Tax Initiative

To successfully introduce the billionaires tax initiative, advocacy groups must engage in strategic outreach to mobilize public support. This entails informing voters about the potential benefits of the tax, addressing common misconceptions, and emphasizing the social responsibilities of the ultra-wealthy. As community health organizations and unions band together, they highlight the link between equitable funding sources and improved public services, showcasing data on how enhanced funding can stabilize healthcare and educational resources in the state.

Moreover, gathering endorsements from respected figures and organizations in California can lend credibility to the initiative. Public campaigns that spotlight personal stories from individuals adversely affected by the healthcare funding crisis may resonate more profoundly with voters, emphasizing the real-life implications of funding deficiencies. By centering the conversation around the immediate impacts of the billionaires tax, advocates can galvanize support and create a groundswell of public sentiment favoring the initiative.

Potential Long-term Effects of the Billionaires Tax

If the billionaires tax initiative is successful, it could set a powerful precedent for other states contemplating similar measures. Broadly, this tax could inspire a national dialogue surrounding wealth redistribution and the responsibilities of ultra-high-net-worth individuals. As California often leads in policy innovation, the ramifications of implementing this tax may ripple beyond state borders, influencing other regions to consider similar wealth tax initiatives to address pressing social inequities and fund vital services.

Moreover, the outcomes of the billionaires tax—whether successes or failures—will serve as case studies for future discussions around tax policy reform in the United States. Legislators and policymakers will inevitably analyze the effectiveness of California’s approach in both raising necessary funds and maintaining economic stability. As the conversation around equitable taxation continues to evolve, the implications of the billionaires tax could significantly shape public attitudes towards wealth and taxation in years to come.

Frequently Asked Questions

What is the California billionaires tax initiative?

The California billionaires tax initiative is a proposed ballot measure that seeks to levy a one-time, 5% tax on the net worth of approximately 200 billionaires residing in California, aimed at generating around $100 billion in revenue to support health care and education funding in the state.

How would the California billionaires tax affect healthcare funding?

The revenue generated from the California billionaires tax would be allocated with 90% reserved for health care spending and 10% for K-12 education. This funding is intended to stabilize California’s health care system and keep health care facilities operational amid cuts to social services.

What are the arguments for and against the California billionaires wealth tax?

Proponents argue that the California billionaires wealth tax will address the state’s health care funding crisis and prevent billionaires from avoiding their tax responsibilities. Opponents worry it could set a precedent for taxing wealth more broadly, possibly affecting middle-class individuals in the future and incentivizing billionaires to leave the state.

How does the California billionaires tax compare to existing tax measures?

Unlike California’s high personal income tax rates that mainly target income, the proposed billionaires tax would specifically focus on the net worth of ultra-wealthy individuals. This reflects a shift towards wealth taxation, which has not been successfully implemented in California before.

What are the potential impacts of the California taxes on billionaires?

The potential impacts of the California taxes on billionaires include increased state revenue for critical programs like healthcare and education. However, there are concerns that such taxes could drive wealthy individuals to relocate, which might negatively affect the state’s economy in the long term.

What steps are needed for the SEIU billionaires tax initiative to appear on the ballot?

To place the SEIU billionaires tax initiative on the 2026 ballot, organizers need to gather 874,641 signatures from California voters to meet the requirement set by the state.

How would the billionaires tax be implemented in California?

The billionaires tax would be implemented by taxing the net worth of billionaires based on their 2025 assets. They would be allowed to pay off the tax obligation over five years, which is designed to ensure substantial funding for state health care and educational initiatives.

Why do proponents believe the California billionaires tax is necessary?

Proponents believe the California billionaires tax is necessary due to the potential collapse of the state’s healthcare system, exacerbated by federal funding cuts and the need for stable revenue to support health care facilities and improve public education for all Californians.

What challenges does the California billionaires tax initiative face?

The California billionaires tax initiative faces challenges such as opposition from lawmakers and the need to convince voters of its necessity in addressing urgent state funding crises while mitigating concerns about economic repercussions and fairness.

Can billionaires avoid the California wealth tax by leaving the state?

The structure of the California wealth tax is designed to prevent billionaires from avoiding it simply by relocating. The tax would be based on wealth established in 2025, meaning any individuals moving into the state after that time would not be subject to the tax.

| Key Point | Details |

|---|---|

| Current Situation | California faces budget deficits and is struggling to maintain health care services. |

| Proposed Tax Initiative | A proposed one-time 5% tax on the net worth of approximately 200 billionaires in California to generate about $100 billion. |

| Tax Use | 90% of revenue allocated for health care and 10% for K-12 education. |

| Governor’s Stance | Governor Gavin Newsom opposes wealth taxes and has rejected prior legislative efforts for similar taxes. |

| Opposition Concerns | Critics warn that a wealth tax could set a precedent for taxing middle-class assets. |

| Impact on Billionaires | The tax aims to prevent billionaires from leaving California to avoid taxation. |

| Ballot Initiative Requirements | The initiative requires 874,641 signatures to be placed on the 2026 ballot. |

| Projected Consequences | Cuts in federal Medicaid funding may result in reduced health services for many Californians. |

Summary

The California billionaires tax represents an essential debate about wealth distribution and fiscal responsibility in the state. As California grapples with increasing budget deficits and potential cuts to social services, the proposed one-time 5% tax on the net worth of billionaires could generate significant revenue for healthcare and education. While there are polarizing views on this tax initiative, its potential impact on the state’s financial health and the future of its social services cannot be overlooked. Advocates believe this measure will protect vital services, while opponents fear unintended economic consequences. Ultimately, this proposed tax could shape California’s approach to wealth distribution for years to come.