Canadian and U.S. Large Caps: Top Investment Picks Revealed

In the dynamic landscape of investment strategies, Canadian and U.S. large caps stand out as formidable contenders for savvy investors looking to build substantial wealth. Large cap stocks, typically characterized by their market capitalization exceeding $10 billion, offer stability and growth potential within the ever-evolving stock market outlook. These blue-chip companies not only deliver reliable earnings prospects but also play a pivotal role in wealth management portfolios, acting as a hedge against market volatility. With the ongoing resurgence of major indices, astute investors are keen to identify top stock picks among Canadian and U.S. large caps, setting themselves up for potentially lucrative returns. As the market evolves, understanding these giants can provide invaluable insights for both seasoned and novice investors alike.

In the realm of financial investments, oversized equities from Canada and the United States emerge as prime opportunities for those aiming to amplify their financial portfolios. Esteemed for their robust presence in the stock exchange, these prominent firms, often referred to as heavyweight stocks, exhibit a blend of growth prospects and market stability. Investors frequently regard these titans as essential components in their investment playbooks, especially during uncertain economic climates. With a keen eye on stock performance and evolving market trends, strategies focused on these heavyweight equities can yield significant benefits. Recognizing the potential of these key players can illuminate paths to strategic wealth accumulation.

Exploring the Landscape of Large Cap Stocks

The current investment climate for large cap stocks in both Canadian and U.S. markets offers notable opportunities for growth and stability. With major indices like the S&P 500 and TSX tracking strong performances, investors are increasingly recognizing the potential of large capitalization companies. These organizations have demonstrated resilience against market volatility, benefiting from substantial cash reserves and established market positions. As wealth management professionals guide investors through uncertain times, large caps serve as a fundamental strategy for balancing risk and reward in portfolios.

Investing in large cap stocks can serve as an effective hedge against inflation, offering stability in uncertain economic landscapes. Additionally, many of these companies pay dividends, providing shareholders with a consistent income stream. Furthermore, as the market trends towards digital integration and sustainability, large caps are well-poised to leverage these trends, making them attractive long-term holdings. Overall, navigating the landscape of large cap stocks involves understanding market dynamics and selecting companies with strong fundamentals.

Unpacking the Stock Market Outlook for 2025

The stock market outlook for 2025 appears cautiously optimistic, fueled by robust earnings reports, particularly from key sectors including technology and healthcare. As reported by Brianne Gardner at Velocity Investment Partners, the recent highs of the S&P 500 highlight this positive trajectory, driven by consumer spending and innovation in sectors that prioritize AI and technology integration. Investors are encouraged to monitor these developments closely, as they influence the overall market sentiment and create a favorable environment for strategic investment.

However, it is crucial to remain vigilant about potential headwinds that could affect this outlook, such as rising Treasury yields and concerns over inflated valuations in technology stocks. A balanced investing strategy, emphasizing diversification across large cap stocks and sectors, can help mitigate risks associated with these market fluctuations. Wealth management professionals must guide their clients through this landscape, selecting top stock picks that align with growth trends while offering defensive characteristics.

Top Stock Picks for Resilient Investment Strategies

In today’s ever-evolving market, identifying top stock picks requires a strategic approach and an understanding of sector performance. As highlighted in the recent market call, Abbott Labs stands out due to its strong presence in the healthcare sector and consistent growth in medical devices. With a well-diversified portfolio and a focus on innovation, Abbott exemplifies a top pick that aligns with investors’ needs for stability and growth—especially in an environment marked by economic uncertainty.

Similarly, Chipotle Mexican Grill showcases how brands can successfully merge premium offerings with fast-casual convenience, appealing to young consumer values. Their robust expansion plans and operational advancements position them favorably for continued success. As high-quality growth stocks, both Abbott and Chipotle represent compelling options for investors looking to reinforce their portfolios with companies that demonstrate resilience, adaptiveness, and the potential for significant returns.

The Role of Wealth Management in Stock Selection

Wealth management plays a pivotal role in guiding investors through the intricacies of stock selection, especially in today’s volatile markets. Experienced wealth managers like Brianne Gardner emphasize the importance of understanding individual client goals, risk tolerance, and the current market landscape. This tailored approach ensures that investment strategies, particularly those involving large cap stocks, align with broader financial objectives while capitalizing on market opportunities.

Moreover, wealth management professionals provide essential insights into market trends and stock performance metrics, helping clients make informed decisions. As the landscape continues to evolve, the ability to navigate through different sectors and capital allocation becomes even more critical. In this context, strong partnerships with wealth management experts can lead to more effective investment strategies that prioritize both growth and risk mitigation.

Market Trends Driving Growth in the Tech Sector

The technology sector continues to be a major driver of growth within the stock market, significantly impacting both Canadian and U.S. large caps. Innovations in artificial intelligence, machine learning, and cloud technologies harness a great deal of investor interest, leading to robust stock performance for companies within this sector. As tech firms unveil advancements that enhance efficiency and productivity, they create a ripple effect, benefiting related industries and attracting further investment.

Nonetheless, the landscape is not without challenges. As valuations increase, discussions regarding market corrections and inflation become more prevalent. Wealth management strategies must adapt to these changing dynamics by evaluating company fundamentals and long-term growth potential. Investors are advised to maintain a balanced portfolio that leverages the growth opportunities presented by the tech sector while being mindful of potential headwinds that might arise.

Importance of Diversification in Investment Strategies

Diversification is a critical component of effective investment strategies, especially when navigating the complexities of large cap stocks. By spreading investments across various sectors and industries, investors can mitigate risks associated with market volatility. This is particularly pertinent in times of economic uncertainty, where specific sectors may underperform while others thrive. A diversified approach enables investors to capitalize on the strengths of individual companies, such as those highlighted in the recent market call, while safeguarding their portfolios against unexpected declines.

Furthermore, a well-diversified portfolio also includes a mix of asset classes alongside large cap equities, such as bonds and international stocks. This variety not only helps buffer against downturns but also positions investors to capitalize on various market dynamics. As part of wealth management, regular reviews and rebalancing of portfolio allocations ensure alignment with changing market conditions and personal financial goals, ultimately supporting long-term investment success.

Evaluating Economic Indicators Impacting Stocks

Economic indicators play a significant role in shaping stock market performance, particularly for large caps. Metrics such as unemployment rates, inflation trends, and consumer spending directly influence investor sentiment and market trends. As evidenced in the current market outlook, a rise in unemployment or persistent inflation could temper the overall stock performance, thereby affecting strategic investment decisions. Therefore, staying updated on economic releases is essential for wealth management practitioners.

Additionally, understanding how these indicators influence specific sectors is crucial for effective stock selection. For instance, if interest rates are anticipated to decrease, sectors like real estate and consumer goods often benefit, while technology and healthcare might face pressure. By analyzing these economic indicators, investors can make more informed decisions regarding their portfolios, align their strategies with current economic climates, and potentially tap into profitable investment opportunities.

Long-Term Investment Benefits of Large Caps

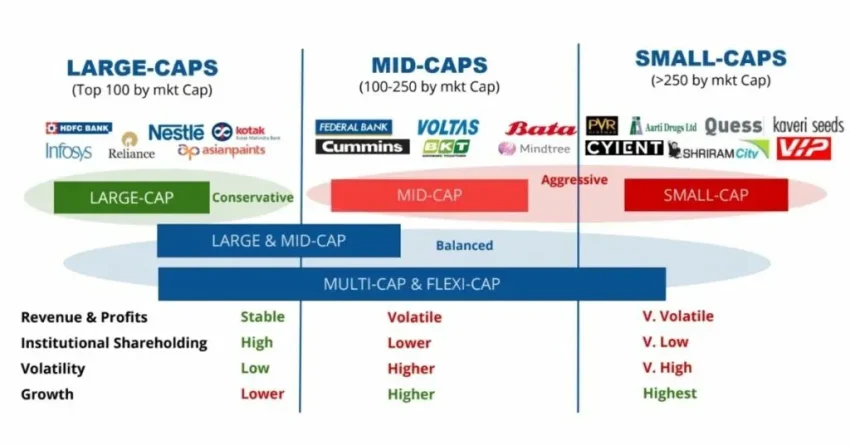

Investing in large cap stocks provides numerous long-term benefits, particularly for investors seeking stability and growth. These companies typically boast strong balance sheets, higher liquidity, and lower volatility compared to small and mid-cap counterparts. Therefore, as part of a wealth management strategy, large caps can stabilize portfolios during market downturns while still offering potential for capital appreciation—a key reason for their appeal among risk-averse investors.

Moreover, large cap companies often have established market positions that allow them to weather economic fluctuations more effectively. This resilience is primarily attributed to their competitive advantages, diverse revenue streams, and the ability to generate positive cash flows. As such, including large caps in investment strategies can help ensure that portfolios remain robust, providing income through dividends while also benefiting from long-term growth opportunities.

The Future of Healthcare Investments in the Stock Market

Investment in the healthcare sector remains a crucial focus for many investors, particularly in light of the recent market trends showcasing significant growth in this area. Companies like Abbott Labs exemplify the potential for innovation and expansion, especially within the medical devices division. By capitalizing on advancements in healthcare technology and fulfilling the need for essential medical services, investments in this sector can yield substantial returns, particularly as the global healthcare landscape evolves.

Additionally, the ongoing influence of demographic shifts, such as aging populations and rising health consciousness among younger consumers, further strengthens the case for healthcare investments. As a wealth management strategy, focusing on these emerging trends can help investors capitalize on the solid growth prospects this sector offers. Identifying key players and innovative companies in the healthcare market can lead to profitable long-term investments as they reshape the future of medical care.

Frequently Asked Questions

What are Canadian and U.S. large caps and why are they important for investment strategies?

Canadian and U.S. large caps refer to companies with a large market capitalization operating in these countries. They are considered important for investment strategies due to their stability, potential for steady returns, and ability to weather market volatility compared to smaller stocks. Large cap stocks typically belong to well-established firms that dominate their industries, making them a key focus for wealth management and investment portfolios.

How can investors identify top stock picks among Canadian and U.S. large caps?

To identify top stock picks among Canadian and U.S. large caps, investors should analyze market trends, evaluate company fundamentals, and look for growth drivers such as innovation, earnings reports, and strategic expansions. Utilizing resources like market outlook reports can provide insights into the performance of specific sectors, such as technology or healthcare, which can aid in selecting the best large cap stocks for investment.

What is the current stock market outlook for Canadian and U.S. large caps?

The current stock market outlook for Canadian and U.S. large caps is positive, with the S&P 500 reaching new highs driven by strong retail buying and corporate earnings, particularly in the tech sector. Meanwhile, the TSX has seen impressive performance aided by commodity strength and lower interest rate expectations. Investors should remain selective as they navigate these markets, monitoring upcoming earnings reports.

What investment strategies should be considered for Canadian and U.S. large cap stocks?

Investment strategies for Canadian and U.S. large cap stocks may include diversified asset allocation, focusing on sectors with growth potential, and considering long-term holds to capitalize on stable earnings and dividends. Investors might also look at funds that specialize in large cap equity exposure to enhance their portfolios while managing risk.

Why are Canadian and U.S. large caps suitable for wealth management?

Canadian and U.S. large caps are suitable for wealth management due to their typically lower volatility compared to smaller caps, their ability to provide consistent dividends, and their potential for capital appreciation. Wealth managers often recommend these investments as they tend to offer a balance of risk and reward, making them foundational components of a diverse portfolio.

What role do earnings reports play in assessing Canadian and U.S. large cap stocks?

Earnings reports play a critical role in assessing Canadian and U.S. large cap stocks as they provide insights into a company’s financial health, growth prospects, and ability to meet market expectations. Investors often use these reports to evaluate whether the current stock prices are justified and to make informed decisions about buying or selling large cap stocks.

How do inflation and interest rates impact Canadian and U.S. large cap investments?

Inflation and interest rates significantly impact Canadian and U.S. large cap investments. Rising interest rates may lead to increased borrowing costs for companies, potentially affecting profit margins. Conversely, inflation can erode purchasing power but may also allow companies to pass costs onto consumers. Investors need to assess how these economic factors may influence the performance of large cap stocks in their portfolios.

What emerging trends should investors watch for in Canadian and U.S. large cap stocks?

Investors should watch for emerging trends such as advancements in technology, shifts in consumer behavior toward sustainability, and changes in regulatory environments. Additionally, sectors like healthcare, renewable energy, and digital transformation are gaining traction among Canadian and U.S. large cap companies, providing potential growth opportunities.

How does diversification benefit an investment portfolio focusing on Canadian and U.S. large caps?

Diversification benefits an investment portfolio focused on Canadian and U.S. large caps by reducing risk exposure. By investing in various sectors and regions within large caps, investors can cushion themselves against market volatility, as downturns in one area may be offset by stability or growth in another, leading to more consistent long-term returns.

What are the potential risks associated with investing in Canadian and U.S. large cap stocks?

The potential risks associated with investing in Canadian and U.S. large cap stocks include market volatility, sector-specific downturns, and geopolitical uncertainties. While large cap stocks are generally more stable, they are not immune to macroeconomic shifts and investor sentiment, which can significantly impact stock performance.

| Key Points | Details |

|---|---|

| Focus | Canadian and U.S. large caps |

| Top Picks | Abbott Labs, Chipotle Mexican Grill, Motorola Solutions |

| Market Outlook | S&P 500 near 6,300. Resilience driven by retail activity, strong earnings, and AI optimism. TSX approaching 27,000, outperforming S&P 500, driven by energy and financials. |

| Abbott Labs (ABT NYSE) | Strong performance in medical devices despite challenges in diagnostics. Opportunity for long-term investors as the stock has recently pulled back. |

| Chipotle Mexican Grill (CMG NYSE) | Excellent brand strength, projected sales growth, and expansion with new locations. Investing in automation to enhance efficiency. |

| Motorola Solutions (MSI NYSE) | Leader in public safety tech with strong recurring revenue through software and cloud services. Consistent earnings growth and strategic acquisitions drive future potential. |

Summary

Canadian and U.S. large caps are demonstrating remarkable resilience in the face of economic uncertainties. Both markets are performing well but for different reasons: the S&P 500 thrives on tech-led enthusiasm while the TSX benefits from strong commodity performances and a supportive interest rate environment. As investors prepare for upcoming earnings reports and potential central bank moves, it’s prudent to remain selective, keeping an eye on stocks like Abbott Labs, Chipotle Mexican Grill, and Motorola Solutions that offer solid fundamentals and promising growth potential.