Cash management is a crucial component of maintaining financial security and optimizing personal finance for individuals and businesses alike. In today’s fast-paced economic climate, effective cash management ensures that funds are readily available, providing the flexibility needed for strategic investment opportunities. By mastering cash flow, individuals can enhance their wealth management strategies, allowing them to allocate resources efficiently and maximize returns. Moreover, strong cash management practices play a vital role in risk management, mitigating uncertainties associated with economic fluctuations. Therefore, understanding the intricacies of cash management not only safeguards financial assets but also paves the way for substantial growth in a well-rounded investment strategy.

Effective liquidity control and cash flow optimization are essential for achieving financial stability and growth in any economic environment. These concepts serve as the backbone for sound wealth accumulation strategies, allowing both individuals and organizations to prepare for unforeseen expenses while seeking out lucrative investment avenues. Mastering your budgeting and funds allocation processes can significantly enhance your overall financial health and contribute to a more robust personal finance framework. Additionally, implementing diligent cash oversight can bolster risk management efforts, ensuring that capital is preserved even during turbulent financial times. Ultimately, embracing comprehensive cash oversight can lead to sustained economic success and greater long-term wealth accumulation.

Understanding Cash Management in Wealth Building

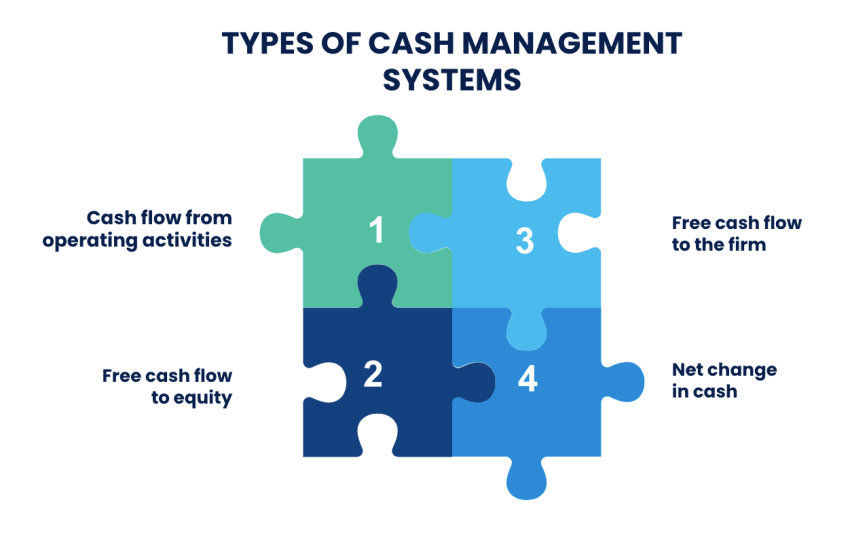

Cash management is a critical component of any solid wealth management strategy. It involves effectively managing your cash flow, understanding your liquidity needs, and ensuring that you have adequate reserves for emergency situations. While holding cash can provide a sense of security, it’s essential to recognize that merely holding onto cash does not contribute to wealth growth. Instead, investors should explore ways to utilize their cash reserves to develop investment strategies that align with their long-term financial goals.

Incorporating smart cash management into your personal finance plan can help optimize your wealth portfolio. This can include creating a balance between cash reserves and investments. A well-thought-out cash management approach allows you to take calculated risks while ensuring that you have enough liquidity to navigate unexpected financial challenges. By analyzing your cashflow alongside your investment strategies, you can ensure your assets are working for you, aiding in risk management and enhancing financial security.

The Role of Investment Strategies in Personal Finance

To enhance your personal finance and build a sizeable wealth portfolio, it’s essential to adopt effective investment strategies. These strategies should align with your financial goals, risk tolerance, and time horizon. Whether you’re focusing on stocks, bonds, mutual funds, or real estate, having a diversified portfolio can help mitigate risk while optimizing returns. As you explore various opportunities, understanding the market trends and economic indicators can empower you to make informed decisions.

Strategic investment plays a significant role in achieving financial security. By regularly reviewing and adjusting your investment strategies, you place yourself in a better position to respond to changing market conditions. Utilizing tools like asset allocation and diversification can not only enhance your wealth but also prevent potential losses that could arise from market volatility. In personal finance, it is crucial to assess your risk appetite and tailor your investment portfolio accordingly.

Risk Management: Safeguarding Your Financial Future

Risk management is a fundamental component of sound financial planning. It involves identifying potential financial risks and implementing strategies to mitigate their impact on your wealth portfolio. Effective risk management ensures that while you aim for growth through investments, you are also taking precautions to secure your financial future. This can include purchasing insurance, creating an emergency fund, and avoiding over-leverage in investments.

Incorporating risk management into your wealth management practices is essential for long-term financial stability. By understanding the types of risks you’re facing, whether they are market fluctuations, interest rate changes, or unforeseen personal expenses, you can develop a robust financial plan that remains resilient amidst uncertainty. This proactive approach not only protects your assets but also enhances your confidence as you make financial decisions.

Diversification: A Key Element of Wealth Management

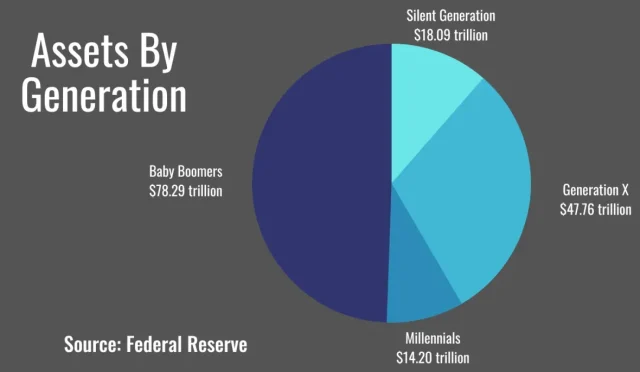

Diversification is often touted as one of the most effective strategies for wealth management. By spreading investments across a variety of asset classes, such as equities, bonds, real estate, and commodities, you can reduce the overall risk of your wealth portfolio. Diversification helps in mitigating losses from underperforming assets while allowing you to capitalize on growth opportunities in other areas.

To successfully implement diversification in your personal finance strategy, it’s vital to analyze your current asset allocation and make informed decisions based on market performance and economic conditions. Regularly reviewing your portfolio will enable you to adjust your investments and maintain an equilibrium that reflects your financial objectives. This balanced approach not only enhances your potential for wealth growth but also fortifies your position against market uncertainties.

Financial Security Through Proactive Wealth Management

Achieving financial security requires a proactive approach to wealth management. This involves setting clear financial goals, creating a budget, and regularly monitoring your progress towards these goals. By understanding the dynamics of your income, expenses, and investments, you can make informed decisions that promote both short-term stability and long-term wealth growth.

Financial security is not just about accumulating wealth; it’s also about ensuring that your financial foundation is strong. This means having adequate insurance coverage, maintaining an emergency fund, and making informed investment choices that align with your risk tolerance. Through disciplined wealth management practices, you can create a resilient financial future for yourself and your family.

Strategic Financial Planning for Future Wealth Growth

Strategic financial planning is vital for anyone looking to grow their wealth over time. This involves crafting a comprehensive plan that encompasses budgeting, saving, investing, and protecting your assets. By setting specific financial goals and identifying the steps needed to achieve them, you can lay a foundation for future wealth creation. The planning process also requires periodic reviews and adjustments to keep pace with life’s changes.

A well-structured financial plan helps you identify the necessary investment strategies that align with your wealth-building objectives. Furthermore, involving financial advisors or using personal finance tools can enhance your decision-making process, ensuring that your plans are backed by thorough analysis and foresight. This careful approach to financial planning can effectively lead to increased financial security and sustained wealth growth.

The Importance of Emergency Funds in Financial Planning

Emergency funds are a crucial aspect of financial planning, providing a financial cushion to cover unexpected expenses or emergencies. Having an adequate emergency fund can help you avoid debt during crises, ensuring that your wealth portfolio remains intact. Financial experts recommend having three to six months’ worth of living expenses saved in a readily accessible account.

In the context of wealth management, an emergency fund not only protects your short-term financial health but also contributes to your long-term strategy. By maintaining liquidity while investing the remainder of your assets, you strike a balance that fosters both security and growth. This careful approach enables you to tackle financial challenges without significantly disrupting your investment plans.

Leveraging Financial Technology for Wealth Management

In today’s digital age, leveraging financial technology can significantly enhance your wealth management strategies. Financial apps and tools enable you to track spending, set savings goals, and monitor your investments in real time. These technologies streamline the financial planning process and provide valuable insights, allowing you to make informed decisions that align with your personal finance goals.

Utilizing financial technology not only simplifies money management but also facilitates better budgeting and cash management practices. By integrating your investments with financial management tools, you can have a holistic view of your financial situation. This comprehensive perspective is essential for effective risk management, optimizing your wealth portfolio, and ensuring ongoing financial security.

The Benefits of Professional Wealth Management Services

Engaging with professional wealth management services can offer numerous advantages for individuals seeking to grow their financial assets. Wealth managers provide tailored investment strategies and financial planning advice based on their expertise and understanding of market dynamics. By leveraging their knowledge, you can gain access to sophisticated financial tools and resources that may be difficult to navigate on your own.

Moreover, professional wealth management ensures that your financial decisions are made in accordance with your long-term goals and risk tolerance. This partnership can help you streamline your investment process, making it easier to maintain a diversified portfolio while adaptively responding to changing market conditions. Ultimately, this strategic collaboration supports your aspirations for financial security and helps to maximize your wealth potential.

Frequently Asked Questions

What is cash management in personal finance?

Cash management in personal finance refers to the process of budgeting, saving, and investing cash to maintain financial security. It involves managing the flow of cash in and out of an individual’s accounts to meet immediate needs while ensuring long-term wealth growth.

How does effective cash management contribute to wealth management?

Effective cash management is essential for wealth management as it ensures that individuals have sufficient liquidity for daily expenses and emergencies while optimizing surplus cash for investments that can grow their wealth. This balance is crucial for achieving financial goals.

What strategies can improve cash management for better investment outcomes?

Improving cash management for investment outcomes involves creating a cash reserve for emergencies, utilizing high-interest savings accounts, and automating transfers to investment accounts. Additionally, evaluating cash flow regularly can help in identifying investment opportunities aligned with personal finance goals.

How does cash management relate to risk management?

Cash management plays a key role in risk management by ensuring that individuals have enough liquid assets to cover unforeseen expenses. A robust cash management strategy allows for better preparedness against financial risks, thereby enhancing overall financial security.

Why is cash management important for financial security?

Cash management is vital for financial security as it helps individuals maintain control over their finances, ensuring they have enough cash flow for regular expenses while also preventing unnecessary debt. A solid cash management plan provides a foundation for sustainable personal finance and investment strategies.

What role does cash flow play in cash management?

Cash flow is the lifeblood of cash management, representing the total amount of cash being transferred into and out of an individual’s accounts. Effective monitoring and planning of cash flow are crucial for balancing spending, saving, and investing, all of which are integral aspects of personal finance.

Can cash management strategies help with retirement planning?

Yes, cash management strategies can significantly aid in retirement planning by ensuring that individuals have enough liquid assets to transition into retirement smoothly. A well-managed cash flow allows for consistent contributions to retirement accounts while covering living expenses.

What tools can assist with cash management in personal finance?

Various tools can assist with cash management, including budgeting apps, online banking platforms, and personal finance software. These tools help users track income, expenses, and savings goals, facilitating better decision-making around investments and financial security.

| Key Point | Details |

|---|---|

| Access Denied | The user does not have permission to access a specific URL on the CNBC website. |

| Important Reference Number | Reference #18.450d7b5c indicates a specific error code related to access issues. |

| Error Source | The error originated from a CDN (Content Delivery Network) provider, suggested by the URL structure. |

Summary

Cash Management is vital for ensuring financial stability and growth. When accessing financial resources like investment insights or news articles, restricted access can hinder understanding market dynamics. Therefore, addressing access issues is crucial for effective Cash Management strategies that aim to enhance wealth generation.