Cryptocurrency adoption is on the rise, driven by global wealth trends and an aging population seeking alternative investments. As traditional asset classes become less appealing, many investors are looking towards digital currencies like Bitcoin as a viable option for preserving their wealth. This shift is not just about risk; regulatory clarity is beginning to reshape perceptions and foster a new level of trust in cryptocurrencies. Analysts suggest that as more individuals accumulate wealth, particularly from the baby boomer generation, the demand for diversified asset portfolios that include cryptocurrencies will grow significantly. Thus, the future of investing may see digital currencies becoming as established as gold, reflecting deep-rooted shifts in how society views wealth management and asset demand in an evolving financial landscape.

The burgeoning trend of digital asset integration into investment strategies reflects a broader shift in financial paradigms. As traditional investment avenues face increasing volatility, younger investors and seasoned wealth holders alike are turning towards innovative asset classes, such as Bitcoin and other cryptocurrencies. With demographic changes impacting global economics, the drive for enhanced crypto regulations is becoming crucial for legitimizing these digital currencies as mainstream financial tools. Enhanced regulatory frameworks could create an environment where assets like Bitcoin attract greater confidence from both new and established investors. This transformation marks a pivotal point in financial history, where the dialogue surrounding digital currencies continues to evolve alongside the changing face of global asset demand.

The Impact of Global Wealth Trends on Cryptocurrency Adoption

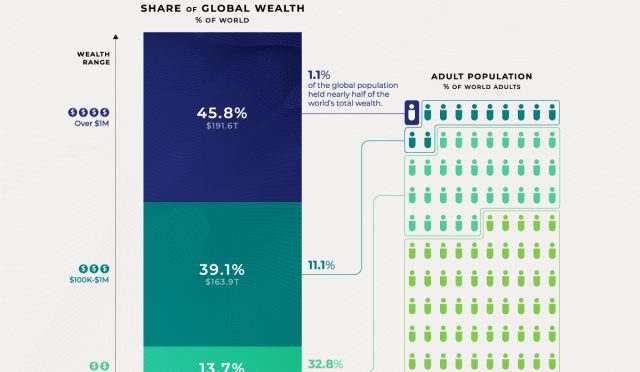

Global wealth trends indicate a significant shift towards higher asset demand as populations age. As the older demographic accumulates capital, their investment preferences are also changing. Specifically, the demand for cryptocurrencies is expected to rise as these traditional investors seek alternative assets, diversifying their portfolios. The analysis points out that as the world becomes increasingly digitized, this shift towards cryptocurrencies, particularly Bitcoin, could be a viable response to the changing economic landscape.

Furthermore, the potential for cryptocurrency adoption aligns with broader global wealth trends. Regulatory frameworks are evolving, providing more clarity and security for investments in digital assets. As the aging population seeks to preserve their wealth, cryptocurrencies may become more appealing due to their decentralized nature and potential as a hedge against inflation. This indicates that as wealth concentration shifts in society, the interest in investing in cryptocurrencies will likely soar.

Navigating the Aging Population and Asset Demand

The aging population is expected to significantly drive global asset demand, as outlined in recent studies. With an increasing number of individuals retiring and looking to sustain their lifestyle, the interest in diversifying investments into cryptocurrencies, such as Bitcoin, is anticipated to grow. The shift in asset preferences stems from a need to maximize returns on investments to accommodate longer life expectancies. Analysts suggest that the inclination towards alternative asset classes will only increase as more individuals seek to leverage their capital in innovative ways.

Moreover, the demographic changes are not just influencing traditional asset chains but are also paving the way for broader acceptance of cryptocurrency. As older investors develop a stronger understanding of digital currencies, the potential for cryptocurrencies to be seen as secure, legitimate forms of investment arises. This growing acceptance may contribute to a future where cryptocurrencies are viewed with the same regard as gold, enhancing their position in the asset market.

Bitcoin Investment: A Safe Haven for the Future

Bitcoin, often referred to as digital gold, may soon become a preferred investment option for the aging population. The notion of Bitcoin as a store of value has gained traction, particularly as traditional markets face volatility. The unique attributes of Bitcoin—limited supply and decentralized nature—offer older investors an opportunity to protect their wealth from inflation and market fluctuations. Its growing acceptance as a legitimate investment asset can encourage the aging population to allocate a portion of their portfolios to Bitcoin.

Furthermore, with the anticipated development of regulatory measures surrounding cryptocurrencies, there is a sense of security that will appeal to risk-averse older investors. As government backing and regulation improve, Bitcoin could become increasingly recognized for its potential to preserve wealth over time, making it an attractive option for those concerned about the long-term viability of their investments.

Crypto Regulations: Shaping the Future of Investment

The evolution of cryptocurrency regulations is a critical factor that stands to influence future investment trends. As clearer guidelines and protections emerge, investors, particularly in the aging demographic, are likely to feel more secure investing in cryptocurrencies like Bitcoin. Regulatory clarity can bolster consumer confidence, leading to increased adoption rates among older populations who may have previously viewed cryptocurrencies as high-risk.

Moreover, this regulatory maturation could play a pivotal role in bridging the gap between traditional and digital assets. With governments endorsing cryptocurrencies, it becomes easier for the aging population to transition into this new realm of investing. The assurance of legitimacy could encourage a shift towards these assets, ultimately changing the investment landscape significantly over the next few decades.

Emerging Asset Classes: The Rise of Crypto

The rise of cryptocurrencies as a viable asset class speaks to the broader changes in how investments are evolving in response to global wealth trends. As more individuals become financially literate and connected through technology, the appetite for alternative investments is likely to grow. Younger, tech-savvy investors are driving this trend, advocating for diversification into cryptocurrencies that may yield higher returns compared to traditional assets.

With aging investors also beginning to embrace cryptocurrencies, the market potential is vast. As wealth continues to rise globally, the demand for newer asset classes will grow. Analysts predict a significant surge in Bitcoin investments, especially among those with a better understanding of technology and investment risks, creating a rich opportunity for diversification in the investment landscape.

Risk and Diversification in the Cryptocurrency Market

The evolving investment landscape shows a pronounced shift towards viewing cryptocurrencies as a key part of diversified portfolios. While traditionally seen as high-risk assets, cryptocurrencies are gradually being re-evaluated by investors willing to incorporate them alongside conventional investments. The appetite for diversification into emerging asset classes is particularly relevant for the aging population, who are finding the need to balance risk with the potential for growth.

In this context, Bitcoin’s role as a mature investment option cannot be overstated. Analysts suggest that as global wealth increases, so too will the appetite for riskier assets. The changing perspectives on crypto regulations and the support from various governing bodies can stabilize this new asset class, appealing to a broader base of investors. Consequently, older investors may begin to see Bitcoin and other cryptocurrencies as legitimate avenues for asset growth.

The Role of Technology in Cryptocurrency Adoption

Technological advancements are fundamentally transforming how investments are approached. The integration of technology in financial markets not only enhances accessibility but also informs investors regarding the potential of cryptocurrencies. As the aging population increasingly embraces digital resources, there is an opportunity for education and engagement around Bitcoin and other cryptos. This shift presents a unique avenue for improving financial literacy among older demographics.

Furthermore, the introduction of sophisticated trading platforms and mobile applications makes investing in cryptocurrency more user-friendly. These technological innovations lower the barriers to entry for older investors who may have previously found digital currencies intimidating. As awareness increases, it is likely that technological solutions will play a crucial role in propelling cryptocurrency adoption forward.

Understanding the Long-Term Outlook for Cryptocurrencies

The long-term outlook for cryptocurrencies suggests a promising trajectory for their integration into mainstream finance. Given the current shifts in global demographics and wealth distribution, the demand for digital currencies is poised to grow significantly. Analysts forecast that as more people recognize the benefits of holding cryptocurrencies like Bitcoin, there will be a corresponding increase in asset allocation towards these emerging financial instruments.

In parallel, the proliferation of positive sentiment surrounding digital currencies will likely contribute to their robustness as a long-term investment choice. The integration of cryptocurrencies into retirement portfolios is a trend that could see substantial growth as investment behaviors evolve. In summary, the long-term viability of cryptocurrency rests not only on market dynamics but also on the acceptance and understanding of diverse demographics.

Conclusion: Embracing Change in the World of Investment

In conclusion, the future of investment is and will continue to be shaped by significant demographic shifts and evolving wealth trends. As the global population ages, the resulting changes in asset demand will create opportunities for greater inclusion of cryptocurrencies in investment portfolios. In particular, Bitcoin stands out as a compelling investment option that presents both opportunities and challenges for traditional investors.

Embracing change will be key for both aging investors and younger, tech-savvy individuals seeking to diversify their holdings into various asset classes, including cryptocurrencies. The ongoing development of supportive regulatory frameworks will also play a pivotal role in facilitating this transition, ultimately leading to greater levels of adoption and trust in the cryptocurrency market for years to come.

Frequently Asked Questions

How will global wealth trends influence cryptocurrency adoption in the coming decades?

Global wealth trends are expected to significantly boost cryptocurrency adoption as the aging population, particularly those with substantial capital, seeks alternative investments. This demographic shift, complemented by rising asset demand, indicates that cryptocurrencies like Bitcoin may become more appealing compared to traditional assets.

What role does the aging population play in increasing the demand for assets like cryptocurrencies?

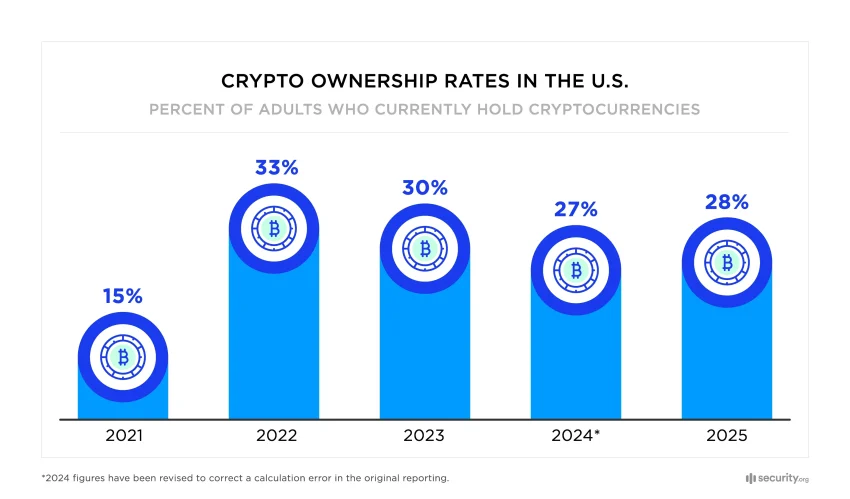

The aging population is projected to enhance asset demand, including cryptocurrencies, as older individuals typically have more capital to invest. This trend could lead to a 200% increase in asset demand relative to GDP by 2100, thereby fostering greater cryptocurrency adoption.

How are Bitcoin investments affected by the maturation of crypto regulations?

The maturation of crypto regulations is expected to positively influence Bitcoin investments, making cryptocurrencies more appealing to a more risk-averse aging population. As regulatory clarity improves, Bitcoin may gain recognition and value similar to gold, further driving its adoption.

Why are cryptocurrencies seen as a necessary alternative investment?

Cryptocurrencies, including Bitcoin, are increasingly viewed as a necessary alternative investment due to declining real interest rates linked to demographic changes. The emerging regulations and government backing further solidify their role as a store of value, enhancing their appeal amid shifting global asset demand.

How does rising asset demand correlate with cryptocurrency adoption among diverse investors?

Rising asset demand is creating more opportunities for cryptocurrency adoption among a diverse range of investors. As wealth levels increase, particularly among the aging population, individuals are more likely to diversify their portfolios to include cryptocurrencies, thereby driving up demand.

What is the expected trend in Bitcoin investments among younger and tech-savvy investors?

Younger, tech-savvy investors are projected to favor Bitcoin investments, as they tend to have higher risk tolerance and a better understanding of technology. Their inclination for emerging asset classes, including altcoins, suggests that the cryptocurrency market will see varied investment strategies, further enhancing overall cryptocurrency adoption.

| Key Point | Details |

|---|---|

| Global Demographics | An aging population will drive asset demand, including cryptocurrencies, driven by increased capital available for investment. |

| Projected Demand | Asset demand is expected to increase by an additional 200% of GDP from 2024 to 2100. |

| Interest Rates Impact | Aging demographics may lead to a decline in real interest rates, fostering interest in alternative investments like Bitcoin. |

| Regulatory Clarity | Increasing regulatory clarity could position Bitcoin as a comparable store of value to gold, particularly for older investors. |

| Wealth Effects | Rising global wealth is likely to increase risk appetite and diversity into cryptocurrencies, especially among younger investors. |

Summary

Cryptocurrency adoption is set to experience significant growth fueled by global demographic shifts and rising wealth. As the population ages, there will be a higher demand for assets, including cryptocurrencies, as older individuals seek to invest their increasing capital. Furthermore, enhanced regulatory clarity is expected to make Bitcoin and other cryptocurrencies more appealing, potentially likening their value storage capabilities to gold. With younger, tech-savvy investors leading the charge into alternative asset classes, cryptocurrency adoption will play a pivotal role in shaping the financial landscape over the next century.