The topic of the French wealth tax has sparked significant debate, especially after statements from Bernard Arnault, the owner of LVMH and Europe’s wealthiest man. Arnault warns that the proposed 2% levy on fortunes exceeding €100 million could have a catastrophic effect on the French economy, predicting a potential loss of over €1 billion for himself. This proposed wealth tax, heavily endorsed by economist Gabriel Zucman, aims to address France’s budget constraints but is viewed by many critics as counterproductive. As discussions continue about the wealth tax impact on high-net-worth individuals, it raises essential questions about the future of wealth management in France. Given Arnault’s significant contributions as a taxpayer, his perspective sheds light on the broader implications for affluent citizens within the French economy.

Rising concerns over a potential tax on personal wealth have captured the attention of both politicians and the public in France. Dubbed a levy on substantial fortunes, this proposed taxation is seen by some as a necessary mechanism to promote economic equity, while others argue it poses a threat to the nation’s fiscal health. With notable figures such as Bernard Arnault at the forefront of this discussion, the luxury goods sector is especially attentive to these developments. As the French government grapples with budgetary issues, alternative taxation approaches could either strengthen or weaken the economy, depending on their execution. The conversation surrounding this wealth tax has reignited debates about fiscal responsibility and the role of ultra-wealthy individuals in shaping France’s financial future.

The Potential Impact of French Wealth Tax on Economy

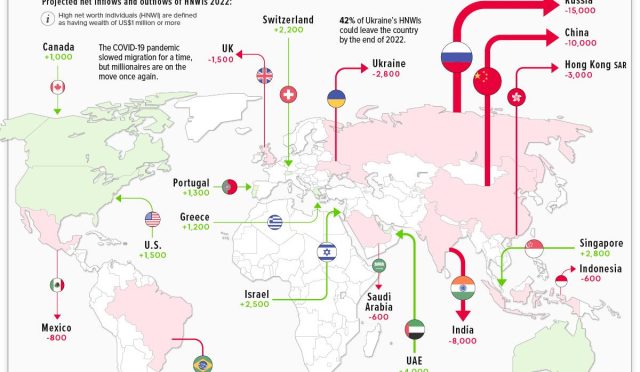

The introduction of a wealth tax in France, particularly one that imposes a 2% levy on fortunes exceeding €100 million, raises significant concerns about its long-term impact on the French economy. Figures like Bernard Arnault, CEO of LVMH, have voiced strong opposition to such a measure, arguing that it could result in a considerable financial burden, potentially costing him over €1 billion. This sentiment echoes among wealth creators across the nation who worry that such taxes could lead to an exodus of the wealthy, stifling economic growth and innovation. An attack on wealth through taxation may inadvertently discourage investment in businesses, which fuel job creation and economic stability in France.

Economists, including Gabriel Zucman, who propose the tax claim it could aid in addressing budget constraints. However, critics highlight that the potential for capital flight could drastically undermine the estimated revenue gains, effectively nullifying the intended fiscal benefits. The challenge lies in balancing fiscal responsibility with nurturing a robust economic environment where both wealth accumulation and equitable taxation can coexist.

Furthermore, the political climate surrounding the wealth tax proposal adds a layer of complexity to this discussion. With ongoing calls for austerity measures in France, social inequality remains a pressing concern. The wealth tax, while framed as a solution to budgetary issues, may also be perceived as a populist measure that could polarize public opinion and stifle economic confidence. Supporters argue it is an essential step to ensure the ultra-wealthy contribute their fair share, especially during times of crisis. Conversely, prominent figures like Arnault insist that it represents an attempt to dismantle the liberal economy that supports social mobility and opportunity for all.

Ultimately, the discourse surrounding the wealth tax necessitates careful examination of its implications, not only for the rich but also for the broader French economy and society at large.

Bernard Arnault and His Concerns Over Taxation

Bernard Arnault, recognized as Europe’s richest man with a staggering net worth of approximately $169 billion, has become a vocal critic of the proposed wealth tax in France. His extensive holdings in LVMH, which include prestigious brands such as Louis Vuitton and Dior, underscore his position as a key player in the French economy. Arnault’s worries stem from the belief that the proposed 2% wealth tax is not just a financial burden, but rather a direct assault on the principles of a liberal economy and entrepreneurship that have facilitated economic growth in France. He views the tax as an offensive action that could deter investment and innovation, thereby threatening jobs and economic stability for many.

This perspective is shared by many in the business community, as they fear that high-net-worth individuals may seek more tax-friendly jurisdictions if such taxes were to be enforced. Arnault’s experience during a past episode when he considered relocating to Belgium adds a personal dimension to his objections. With France’s pursuit of a wealth tax amid broader economic discussions, Arnault represents the voice of a significant segment within the economy that emphasizes the necessity of maintaining an attractive business environment while ensuring fiscal responsibility.

Additionally, Arnault asserts his contributions to the French economy through his high level of tax payments. He emphasizes that he is not just a wealthy individual advocating for the preservation of personal wealth; rather, he portrays himself as a responsible taxpayer who has significantly supported the French treasury through both personal and corporate taxes. His assertion raises the question of fairness in the tax system and the broader implications of taxing wealth versus income or consumption. Arnault’s concerns about the wealth tax extend beyond his individual circumstances, touching on fears that blanket approaches to wealth taxation could ultimately harm the entrepreneurial spirit that drives economic progress.

As debates continue, understanding the perspectives of prominent figures like Arnault will be crucial for policymakers trying to navigate the tricky terrain of wealth redistribution while fostering an environment conducive to economic growth.

Gabriel Zucman’s Stand on Wealth Tax Reform

Gabriel Zucman, a prominent economist and advocate for wealth taxation, has brought significant attention to the potential for such tax reforms in shaping a fairer financial landscape in France. With his expertise cultivated at prestigious institutions like the Paris School of Economics, Zucman argues that wealth tax could be a vital tool in addressing the severe economic inequalities that have arisen in recent years. His studies indicate that implementing a wealth tax could generate billions in revenue, potentially up to €20 billion, which could fund essential public services and infrastructure projects in the French economy.

Despite the proposed benefits, Zucman’s approach faces skepticism from those who fear it could drive wealthy individuals out of France, thereby diminishing the anticipated tax revenue. Critics often claim that the potential yield from the tax would be far less than Zucman’s estimates, especially if the wealthy decide to relocate. In advocating for this change, Zucman also emphasizes the importance of addressing societal tensions and the perceived influence of wealth on democracy. His stance lays bare the complex balance between taxing the wealthy effectively and ensuring that France remains an attractive locale for business and investment.

It remains to be seen how Zucman’s proposals will be received by the wider public and government officials in France. With growing economic pressures and a rising cost of living, the discussions around wealth tax are increasingly pertinent, raising fundamental questions about equity, responsibility, and the future direction of the French economy. For Zucman, the task is not just about taxation; it’s about redefining the role of wealth in a socially responsible economy.

The Role of Governance in Implementing Wealth Tax

The role of governance in implementing a wealth tax in France cannot be overstated. With the appointment of new political leaders like Prime Minister Sébastien Lecornu, there is a renewed focus on how the government will navigate the complexities of tax reform amid political tensions and economic uncertainty. The government’s ability to communicate the necessity and impact of a wealth tax will significantly affect public perception and acceptance. As leaders consider the proposed 2% levy on the ultra-wealthy, they must also weigh the political implications of such measures and the potential backlash from affluent citizens who may feel unfairly targeted. The challenge lies in crafting a tax policy that bridges the divide between economic fairness and the essential growth needed to foster a thriving economy.

Moreover, effective governance requires addressing the concerns of both advocates and critics of the wealth tax. Policymakers must be strategic in demonstrating that the tax is not a punitive measure, but rather a necessary step towards a more equitable society. By fostering comprehensive dialogue with economists like Gabriel Zucman, business leaders like Bernard Arnault, and everyday citizens, the French government can build consensus around the goals of the wealth tax. This blend of transparency and inclusivity will be crucial in ensuring that the tax not only contributes to fiscal stability but also reinforces social cohesion and trust in government institutions.

Public Sentiment on Wealth Taxation in France

Public sentiment regarding wealth taxation in France is evidently polarized, reflecting deep divisions in economic perspectives and the notion of fairness. Many citizens, especially those familiar with the struggles of the middle and lower classes, support the notion of taxing the ultra-wealthy as a means of addressing inequality and funding essential public services. This sentiment has been particularly pronounced amid recent economic strains and budget discussions, driving calls for those with substantial means to contribute more equitably to society. Supporters argue that such measures are not merely just economic policy but moral imperatives in the face of rising social challenges.

Conversely, notable figures like Bernard Arnault represent a significant opposition to such reforms, articulating fears that the wealth tax could inflict damage on the very economy it aims to support. These perspectives resonate with many wealthy individuals and business leaders who argue that higher taxation could stifle entrepreneurship, lead to capital flight, and ultimately harm the job market. The clash of these sentiments highlights the delicate balance that must be maintained in the public conversation surrounding wealth taxation, as the government attempts to garner enough support for its proposed reforms. As the discussion evolves, the French populace must navigate the complex terrain of economic equity versus the necessity of fostering a vibrant economy.

Alternatives to Wealth Tax in Fiscal Policy

As the debate around the proposed wealth tax gains momentum in France, it is essential to consider alternative avenues for fiscal policy that could address budget concerns without imposing a flat percentage on the wealthiest citizens. Experts in economics and public finance suggest exploring options such as increasing income taxes on the highest earners or implementing more progressive taxation on capital gains, which could yield significant revenues while avoiding the harsh implications of a wealth tax. Such alternatives may mitigate concerns of driving wealth out of France while still holding the affluent accountable for contributing to public finances.

Moreover, comprehensive reform focused on closing loopholes and ensuring that all income, including unearned income from investments, is subject to taxation could also enhance fiscal stability. Instead of imposing a new tax on wealth, France could enhance its existing tax framework to ensure that high-net-worth individuals pay taxes proportional to their overall income. This approach might garner broader acceptance from various stakeholders as it emphasizes equity without triggering fears of punishing success. As the government contemplates how to best achieve its fiscal objectives, considering a variety of strategies could lead to a smoother implementation of necessary reforms.

Exploring Economic Models: The French Case

The French model of economic governance, particularly in the context of wealth taxation, offers a fascinating case study on the balance between growth and equity. Economists frequently point to France’s blend of social welfare and market-driven practices as a unique framework that could either support or hinder wealth generation. The debate on the wealth tax is a microcosm of broader discussions regarding how countries with robust social safety nets can sustainably manage economic growth while ensuring that wealth disparity does not escalate. As Bernard Arnault articulates the dangers of such a tax, it opens dialogue around the effectiveness of different economic models that prioritize varying degrees of wealth distribution.

Economists like Gabriel Zucman advocate for more interventionist measures, arguing that the wealth tax represents a necessary adjustment to address growing inequalities. Yet, as the discourse around economic models evolves, it becomes clearer that no single approach can be universally applied. Understanding the nuanced ramifications of wealth taxation within the French context will require a comprehensive analysis of past methodologies, current outcomes, and projected trajectories. Balancing the ideals of economic liberalism with the pressing need for equitable wealth distribution remains a complex puzzle that policymakers are tasked with solving.

The Future of Taxation in France: A Balancing Act

Looking towards the future, the discussion surrounding taxation in France is poised to evolve significantly, especially in light of the ongoing debates over wealth taxation. Ensuring a balanced approach to taxation that satisfies both fiscal needs and public sentiment will be vital for maintaining social harmony and economic stability. Policymakers must adeptly navigate these discussions, weighing the philosophical debates of wealth versus social responsibility against practical economic considerations. This balancing act will require innovative thinking and a willingness to experiment with various taxation mechanisms that aim to achieve fairness without limiting economic potential.

The outcomes of the wealth tax discourse could also set a precedent for other countries grappling with similar economic dilemmas. As global economic challenges rise, the lessons learned from France’s approach to wealth taxation may inform broader strategies for achieving equitable societies without deterring growth. The interplay between public opinion, economic viability, and governance will ultimately shape the trajectory of taxation in France. It remains to be seen how the government will balance these complex factors, but the stakes are high for both the future of the French economy and the well-being of its citizens.

Frequently Asked Questions

What is the French wealth tax proposed by Gabriel Zucman?

The French wealth tax, often referred to as the ‘Zucman tax’, is a proposed two percent levy on fortunes exceeding €100 million. It aims to address budgetary constraints in the French economy by taxing the ultra-wealthy, potentially generating up to €20 billion annually.

How would Bernard Arnault’s wealth be affected by the French wealth tax?

Bernard Arnault, the owner of LVMH, has stated that the proposed French wealth tax could cost him over €1 billion. He argues that this tax would be detrimental to the French economy, suggesting it may drive wealthy individuals away from France.

What are the potential economic impacts of the French wealth tax according to critics?

Critics of the French wealth tax, including Bernard Arnault, claim that it could undermine the liberal economy of France. They argue it could lead to capital flight, with wealthy individuals relocating to avoid the tax, ultimately harming the French economy.

What does Gabriel Zucman believe about wealth concentration and the French wealth tax?

Gabriel Zucman believes that unprecedented wealth concentration in France has distorted democracy and increased societal tensions. He argues that the French wealth tax is necessary to redistribute this wealth and restore fairness in the economy.

Why is Bernard Arnault opposed to the wealth tax in France?

Bernard Arnault opposes the French wealth tax because he believes it is an ‘offensive action’ that threatens the economic stability and growth of France. He asserts that such a tax would not only impact wealthy individuals but also have broader negative consequences for the entire economy.

Could the French wealth tax generate significant revenue for the government?

According to Gabriel Zucman, the French wealth tax could generate approximately €20 billion. However, if wealthy individuals choose to leave France to avoid the tax, the revenue could drop significantly, potentially to as low as €5 billion.

How has the discussion around the French wealth tax influenced political debates in France?

The discussion around the French wealth tax has intensified political debates in France, particularly in light of recent austerity measures. The controversy highlights varying opinions on economic policy and taxation among political factions, with figures like Bernard Arnault asserting that it could harm the French economy.

What is the relationship between Bernard Arnault and the French economy?

Bernard Arnault is a significant figure in the French economy, primarily due to his ownership of LVMH. His statements on the French wealth tax reflect broader concerns among business leaders about taxation policies and their potential impact on economic growth and investment in France.

How might the French wealth tax affect the lifestyle of ultra-wealthy individuals like Bernard Arnault?

The French wealth tax could significantly alter the lifestyle of ultra-wealthy individuals like Bernard Arnault by imposing higher taxes on their assets. This financial pressure might influence their spending, investment decisions, and even their residency in France.

| Key Point | Details |

|---|---|

| Response to Wealth Tax | Bernard Arnault warns the wealth tax could cost him over €1bn and harm the French economy. |

| Proposed Tax Details | A proposed 2% wealth tax would apply to fortunes exceeding €100m. |

| Government Context | The proposal coincides with a political crisis and unpopular budget cuts in France. |

| Gabriel Zucman’s Argument | Economics professor Gabriel Zucman argues the tax could help manage budget constraints. |

| Arnault’s Taxpayer Status | Arnault claims he is one of the largest individual taxpayers in France. |

| Economics Impact Debate | While Zucman estimates €20bn revenue, others predict it could be just €5bn. |

| Political Implications | Arnault suggests the tax is intended to destroy the French economy. |

Summary

The French wealth tax proposed by Gabriel Zucman has sparked significant debate in France, particularly following concerns raised by Bernard Arnault, Europe’s richest man, regarding its potential detrimental impact on the French economy. The planned 2% tax aimed at those with wealth exceeding €100 million is seen by Arnault as an assault on the liberal economic framework essential for France’s prosperity. This controversy highlights the tension between budget management and the need to maintain an attractive economic environment for the wealthy, illustrating the complexities facing the French government in its fiscal policies.