Gen Z investing trends are reshaping the financial landscape as young investors turn to the stock market in response to the challenges of entering the housing market. For many in this generation, the dream of homeownership seems increasingly out of reach, which explains their shift towards retail investing as a viable means of wealth building. In fact, statistics reveal that the number of 25-year-olds funding investment accounts has surged sixfold since 2015, reflecting a newfound commitment to financial literacy and asset accumulation. By prioritizing investments over property, these young individuals are redefining traditional approaches to financial success, proving their adaptability in a tough economic climate. As this trend continues to evolve, it highlights the significant role Gen Z is expected to play in the future of retail investing and economic growth.

As younger generations grapple with evolving financial landscapes, the investing habits of the digital-native cohort, often referred to as Generation Z, are attracting attention. This group, made up of young investors, is increasingly engaging in equity markets, partly due to their exclusion from an overheated housing market. Rather than focusing on traditional paths to wealth accumulation like home purchases, many Gen Z individuals are embracing retail investment as a way to secure their financial futures. The rising prevalence of financial literacy initiatives has further empowered these young adults, equipping them with the knowledge needed to navigate complex investment opportunities. Ultimately, this shift not only reflects changing attitudes towards wealth but also emphasizes the innovative strategies that define the new era of financial engagement.

The Rise of Retail Investing Among Young Americans

Over the past decade, there has been a notable surge in retail investing among young Americans, particularly those in the Gen Z demographic. This rise can be attributed to a number of factors, including increased accessibility to online trading platforms and a growing interest in personal finance. As traditional avenues for wealth accumulation, such as homeownership, become increasingly out of reach, young individuals are turning to stocks and other financial assets. In fact, a recent report from JPMorgan revealed that the share of 25-year-olds actively funding their investment accounts has grown sixfold since 2015, highlighting a substantial shift in their investment strategies.

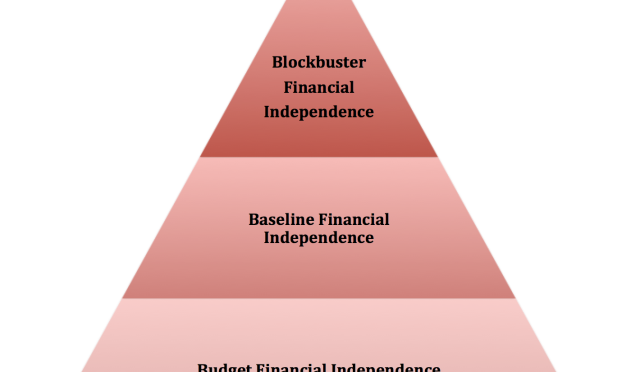

This trend in retail investing among young people is significant not just for individual investors but also for the broader economy. With many in Gen Z opting to forgo buying a home due to skyrocketing prices and high mortgage rates, they are instead channeling their savings into the stock market. This behavior reflects a fundamental change in how younger generations perceive wealth-building opportunities. By investing earlier in life, young Americans are potentially setting the stage for long-term financial stability and independence, thereby redefining wealth accumulation in the modern age.

Gen Z Investing Trends: A Shift in Financial Mindset

Gen Z is characterized by its distinctive approach to investing. Unlike previous generations, who prioritized home ownership as a primary means of building wealth, this generation has adopted a more dynamic view on financial assets. The tough state of the housing market, coupled with rising prices, has led many young individuals to embrace stock investments as a viable alternative. The 2024 survey findings highlight that a significant portion of Gen Zers feel disheartened about their chances of ever affording a home, which in turn has encouraged them to explore other avenues like retail investing and building self-directed portfolios.

The increasing financial literacy among young investors is also playing a crucial role in this shift. With access to educational resources online, Gen Z is becoming more knowledgeable about investment strategies, risks, and the importance of diversifying their portfolios. This new wave of financial awareness encourages them to take charge of their financial futures. By engaging with the stock market at an early age and leveraging technology, Gen Z investors are not only building wealth but are also contributing to a more robust retail-investing landscape.

Financial Literacy: Empowering Young Investors

Financial literacy has emerged as a fundamental tool for Gen Z as they navigate their wealth-building journeys. Understanding the intricacies of the stock market, the significance of compounding interest, and the risks involved in trading has empowered many young individuals to make informed investment decisions. As the data shows, more 25-year-olds are actively managing their investment portfolios than ever before, indicating a shift towards proactive financial behavior. Institutions and educational platforms are recognizing this trend and are increasingly providing tailored resources to help young investors enhance their financial acumen.

Moreover, the rise of social media and investment communities online has further amplified financial literacy among Gen Z. Platforms like TikTok and Twitter have become hotspots for sharing investment tips and strategies, allowing young people to learn from peers and financial experts alike. This peer-to-peer knowledge sharing not only demystifies investing but also fosters a sense of community among young investors. As a result, the growing focus on financial education can significantly impact how Generation Z approaches wealth accumulation and investment opportunities in the future.

Navigating the Housing Market: Challenges for Gen Z

The current housing market presents a formidable challenge for young Americans, particularly those in the Gen Z cohort. With median home prices soaring and mortgage rates continuing to rise, many young individuals find homeownership unattainable. Data from the US Census Bureau indicates that median sales prices for homes have increased significantly in recent years, which discourages first-time buyers. As the barriers to home buying continue to grow, many Gen Zers have opted to invest their funds into the stock market rather than waiting and saving for a home that seems perpetually out of reach.

This scenario has prompted a reevaluation of traditional financial goals among young investors. Instead of adhering to the conventional path of homeownership as a hallmark of financial success, many Gen Z individuals are aligning their investment strategies to fit the realities of today’s economy. By focusing on building wealth through regular investments in equities and other financial instruments, they are redefining what it means to achieve financial stability in a challenging economic climate.

Impact of Economic Conditions on Gen Z Investment Patterns

Economic conditions play a pivotal role in shaping investment trends among Gen Z. The interplay between rising housing costs and fluctuating financial markets has created a unique environment where young investors prioritize stock market investments over traditional assets. As observed by JPMorgan, the current economic landscape, characterized by high inflation and increasing interest rates, has altered the motivations of young Americans. With the challenges of entering the housing market, many are seizing the opportunity to grow their wealth through diversified investment strategies.

Furthermore, the economic uncertainties accompanying the pandemic have instilled a sense of caution among Gen Z investors, urging them to seek alternative means of financial security. This has led to a culture of actively managing investments, where individuals keep a close watch on market trends and performance. By adapting their financial strategies to these challenging economic conditions, young investors can not only safeguard their investments but also capitalize on emerging opportunities in the stock market.

Building a New Financial Future for Gen Z

As Gen Z continues to navigate the complexities of their financial futures, it is increasingly clear that their approach to wealth accumulation signals a new era of investing. With a forward-thinking mindset and a willingness to embrace modern investment practices, this generation is not just reacting to the economic challenges they face, but actively shaping their paths towards success. By prioritizing investments over traditional wealth-building methods like homeownership, they are creating a robust financial foundation built on strategic asset allocation.

In essence, Gen Z is redefining wealth-building by pioneering new trends that reflect their unique circumstances. This generation’s proactive stance on investment, coupled with enhanced financial literacy, will likely produce long-term benefits, setting them up for healthier financial trajectories. As they learn and grow within this evolving investment landscape, it’s crucial for other generations to consider how these trends will influence the future economic environment and personal finance strategies.

Exploring Investment Strategies for Young Investors

Young investors in the Gen Z demographic are increasingly exploring various investment strategies to maximize their wealth-building potential. Given the constraints of the current real estate market, more individuals are looking at stocks, ETFs, and cryptocurrencies as viable avenues for investment. By diversifying their portfolios, young investors can mitigate risks while also taking advantage of market fluctuations. Online platforms and investment apps have made it easier than ever for Gen Zers to experiment with different investment strategies tailored to their specific financial goals.

Also, the emergence of impact investing and socially responsible investing (SRI) has resonated strongly with the values of Gen Z. Many young investors today are not only interested in generating returns but also in investing in companies that align with their ethical principles. By focusing on sustainability and social impact, they are reshaping the investment landscape, paving the way for a more conscientious approach to wealth building that reflects their priorities and values.

Leveraging Technology for Enhanced Investment Opportunities

Technology is playing a transformative role in the investment strategies employed by young investors. The rise of user-friendly apps and online trading platforms has democratized access to the financial markets, empowering Gen Z to take charge of their investment journeys. With features that allow for real-time trading, portfolio tracking, and educational resources, these platforms are tailored to meet the needs of a generation that values convenience and accessibility. The integration of technology in investing not only facilitates the financial decision-making process but also encourages more people to engage with the markets.

Moreover, advancements in technology, such as AI-driven investment tools, are providing young investors with sophisticated analyses and insights that were once available only to seasoned professionals. By leveraging these technological innovations, Gen Z can enhance their investment strategies, stay informed about market trends, and make data-driven decisions. As they continue to integrate technology into their financial practices, young investors are redefining the art of investing and setting new standards for financial engagement.

The Significance of Community in Gen Z Investing

Community has become an integral aspect of investing for Gen Z. With the advent of social media, young investors are increasingly turning to online platforms to share insights, strategies, and experiences related to their investment journeys. Communities on platforms like Reddit, Twitter, and Discord allow Gen Zers to collaborate, learn from one another, and build a collective knowledge base that enhances their investing prowess. This sense of community creates a supportive environment where individuals can feel empowered to take risks and share in the successes and failures of their peers.

Additionally, online investment communities often challenge traditional financial advice, encouraging members to question conventional wisdom and explore alternative investment strategies. This collective brainstorming fosters innovation within the investing landscape, leading to the emergence of novel approaches that resonate with Gen Z’s unique circumstances. As they continue to embrace the power of community in their investment efforts, young investors are not only building wealth but also forging connections that enhance their financial literacy.

Frequently Asked Questions

What are the current Gen Z investing trends affecting retail investing?

Gen Z investing trends are significantly shaped by the challenges in the housing market, leading young investors to increasingly turn to retail investing. A surge in accounts among 25-year-olds reflects a sixfold increase since 2015, as this generation seeks to build wealth through stocks instead of homeownership. Financial literacy is becoming essential for these young investors as they navigate this shift.

How has the housing market influenced Gen Z’s approach to wealth building?

The tough housing market has made homeownership less accessible for many Gen Zers. As mortgage rates rise and home prices climb, young investors are opting for retail investing as a more viable path to wealth building. The findings from JPMorgan indicate that 37% of 25-year-olds added funds to investment accounts last year, illustrating this vital trend.

Why are young investors turning to the stock market instead of buying homes?

Young investors, particularly Gen Z, are increasingly turning to the stock market due to the affordability crisis in the housing market. Record-high prices and interest rates have made it difficult for Gen Z to purchase homes, prompting them to focus on retail investing as an alternative means of wealth accumulation. This shift is evident as participation in investing has soared among 25-year-olds.

What role does financial literacy play in Gen Z investing trends?

Financial literacy is crucial for Gen Z investing trends, as young investors seek to understand and manage their investments effectively. With many locked out of the housing market, increasing their knowledge about stocks and other financial vehicles is key to building wealth. Educating themselves allows Gen Z to make informed decisions in retail investing, enhancing their financial future.

How is the retail investing boom related to Gen Z’s financial goals?

The retail investing boom among Gen Z aligns with their financial goals as they adapt to a challenging economic landscape. With rising housing costs making homeownership less realistic, young investors are utilizing digital platforms to invest in stocks as a way to grow their wealth. This trend reflects a proactive approach to securing their financial futures.

What demographic changes are influencing Gen Z investing trends?

Demographic changes, such as the median age of first-time homebuyers reaching 38, are influencing Gen Z investing trends. Many Gen Zers feel excluded from the housing market and are instead looking to build their wealth through retail investing. This generational shift underscores the importance of adapting to new financial realities.

In what ways can Gen Z improve their investment strategies?

Gen Z can improve their investment strategies by enhancing their financial literacy and staying informed about market trends. Engaging with investment education resources, utilizing digital apps for trading, and regularly reviewing investment portfolios can help young investors make more informed decisions in today’s fluctuating market.

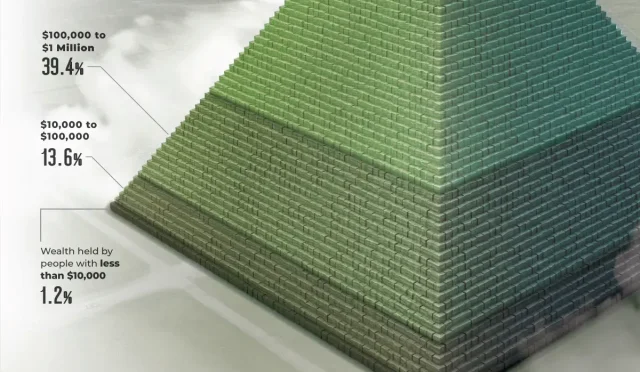

| Point | Details |

|---|---|

| Retail-Investing Boom | Young Americans are increasingly turning to retail investment accounts due to housing market challenges. |

| Increase Among 25-Year-Olds | The share of 25-year-olds funding investment accounts has increased sixfold since 2015, from 6% to 37%. |

| Shift in Wealth Accumulation | Gen Z is skipping homeownership and investing in stocks for wealth accumulation instead. |

| Housing Market Challenges | High home prices and borrowing costs are discouraging young people from buying homes, with the median sales price at $410,800. |

| Future Wealth Potential | If managed well, younger generations’ early investment trend could enhance their long-term wealth-building opportunities. |

Summary

Gen Z investing trends are reshaping how this younger generation approaches wealth accumulation. With many locked out of the housing market, Gen Z is increasingly engaging in retail investing, marking a significant departure from traditional pathways to wealth such as homeownership. This shift is not only a response to escalating housing prices and borrowing costs, but also reflects a broader change in financial habits. If these young investors continue to manage their investment actions wisely, they could pave the way for improved financial futures.