Gen Z Marriage and Wealth: A Strategic Approach to Love

In the world of Gen Z marriage and wealth, traditional notions of romance are undergoing a significant transformation. As this generation navigates their love lives in a complex economic landscape, the focus is shifting towards financial independence and stability rather than just emotional connections. Recent trends show that young couples are strategically assessing their partners’ financial health, turning dating into a pragmatic pursuit akin to corporate mergers. Wealth and dating now intertwine, as Gen Z evaluates the viability of long-term relationships based on shared assets and future financial prospects. In this brave new era of Gen Z relationships, it’s clear that love now comes with a price tag—one that emphasizes wealth alongside affection.

Exploring the landscape of modern relationships for young adults, the concept of marriage among the new generation is notably distinct from previous norms. Present-day love dynamics emphasize financial security as a key factor, with many young couples prioritizing economic stability when choosing their partners. The marriage strategies employed by this cohort are marked by a blend of ambition and practicality, showcasing a departure from romantic ideals to a more financially-aware outlook. As financial independence becomes a hallmark of this generation, their approach to dating reflects a desire for mutual growth and prosperity. Ultimately, the intertwining of finances and personal relationships serves as a critical lens through which Gen Z navigates their love life.

The Strategic Approach to Relationships Among Gen Z

In the age of Gen Z, the approach to romantic relationships has evolved dramatically from the hallmark idealism of love and romance. Young adults today are prioritizing strategic financial planning alongside emotional connections. Instead of simply concentrating on finding love, many Gen Z individuals are viewing relationships through a lens of financial partnership. They are keenly aware that in an economy where stability often hinges on wealth, marrying for financial security rather than solely for love has become a rational choice. Experts suggest that this trend reflects a pragmatic acknowledgment of the challenges faced by young people today in achieving financial independence.

As a result, Gen Z is increasingly discerning about a partner’s financial background, viewing it as integral to their future happiness and stability. From discussing salary expectations on first dates to considering a partner’s family financial dynamics, it’s clear that financial compatibility plays a crucial role in the dating landscape. For many, the fear of financial instability drives them to seek partners who can contribute to a stronger economic foundation, reflecting a shift towards marrying for money — or at least marrying with financial strategy in mind.

Gen Z Marriage Strategies: Wealth Over Romance?

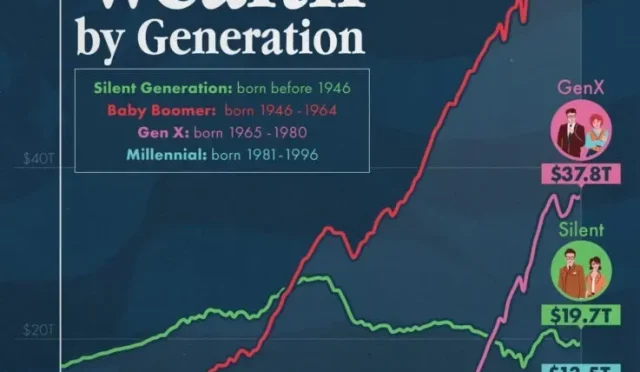

The traditional notions of courtship and marriage are being redefined in the eyes of Gen Z. This generation has witnessed the financial struggles faced by their parents and older siblings, which has shaped their values significantly. Consequently, many Gen Z individuals are crafting marriage strategies that prioritize wealth accumulation and financial stability over fairy-tale romances. This strategic approach posits that love can flourish successfully when rooted in solid financial foundations, as opposed to relying solely on romantic ideals.

Dr. Eliza Filby highlights that the economic realities confronting Gen Z have prompted a shift in how relationships are perceived. Parents’ financial influence — the so-called ‘bank of mom and dad’ — is a critical factor in contemporary partnerships. For Gen Z, falling in love means not only emotional compatibility but also financial synergy. This has led to a generation that is more open about discussing assets, debts, and financial goals early on in relationships, reflecting their keen awareness that wealth and dating are intrinsically linked.

Financial Independence: A Pillar of Gen Z Relationships

Financial independence is a cornerstone of modern relationships for Gen Z, who are determined to carve their paths in a challenging economic landscape. Emerging adults no longer wish to blend romantically with someone who doesn’t share their aspirations for financial stability. Rather, they seek partners who embody similar ambitions around wealth, understanding that such compatibility can lead to successful long-term collaborations. As a result, financial discussions are no longer taboo; they are an expected aspect of the dating dialogue.

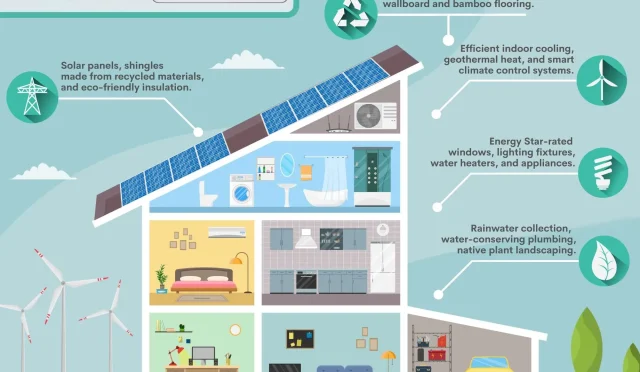

This focus on economic independence among Gen Z is also tied to their broader societal values, which emphasize responsibility and sustainability. Many young adults are inclined to partner with individuals who prioritize financial literacy and responsibility. For them, having aligned financial goals and mutual support in achieving those goals becomes essential. This trajectory suggests that Gen Z relationships are not merely about shared sentiments but about a joint journey toward financial empowerment.

The Intersection of Love and Financial Stability

In today’s dating atmosphere, Gen Z is merging the seemingly disparate realms of romantic love and financial security. The discerning nature of this generation means they often conduct what can be likened to a financial audit of their potential romantic partners. Rather than focusing on superficial attributes, Gen Z is driven by a desire to form bonds that promise mutual economic benefit as well as emotional fulfillment. In a world where economic challenges are omnipresent, the need for partnerships that extend beyond affection to include shared financial goals has emerged.

As wealth becomes an increasingly significant factor in the dynamics of dating, Gen Z is keenly aware of the importance of aligning with partners who possess compatible financial values. The notion of wealth and dating has transformed; it is now common for young couples to discuss investment strategies, savings, and even inheritance plans as part of their relationship narrative. The result is a generation that prioritizes sustainability in their love lives, advocating for partnerships that are not only emotionally satisfying but also economically viable.

Economic Trends Shaping Gen Z Love Life

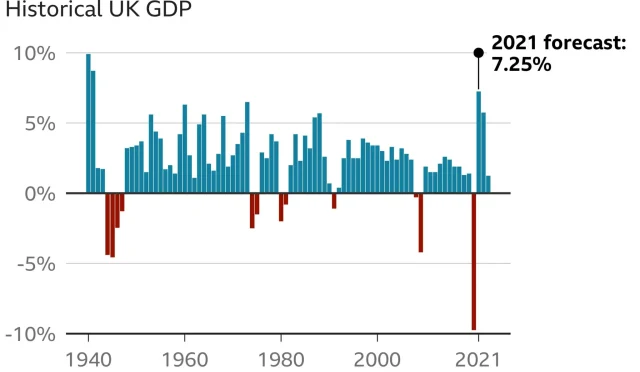

Economic trends have a profound impact on how Gen Z approaches love and relationships. In a world where student debt, rising housing costs, and economic uncertainty loom large, young adults are re-evaluating their priorities in the dating realm. Gone are the days when romantic pursuits were solely focused on emotional bonds; today’s Gen Z daters emphasize financial alignment as an indispensable component of their relationships. This focus stems from their understanding that financial difficulties can strain even the strongest emotional connections.

Moreover, as Gen Z continues to navigate their careers and personal finances, they are increasingly looking for partners who are on similar financial trajectories. The shared goal of achieving financial independence and security plays a crucial role in their relationships, shaping the criteria by which they choose to date. To this generation, a fulfilling love life is one that harmoniously blends romance with the ease that financial compatibility brings, signaling a shift towards practicality in the pursuit of genuine affection.

Wealthy Partners: Navigating Gen Z Romance

The dating landscape for Gen Z features an evolving mindset that heavily weighs the financial status of potential partners. Being strategic about whom they date has led many young people to gravitate toward individuals who exhibit financial stability — often viewed as a pathway to a more secure and fulfilling relationship. This inclination does not stem from a superficial desire for luxury but rather reflects the realities of a generation keenly aware of the economic pressures that can impact personal relationships.

As discussions about financial status become commonplace in Gen Z courtship, the idea of marrying for wealth takes on a new dimension. It is no longer considered gold digging, but rather an informed choice to engage with someone who has a sound economic footing. Those who do not meet these financial expectations may find themselves sidelined in favor of partners who bring both emotional and fiscal support to the table. This nuanced perspective highlights the pragmatic approach taken by Gen Z in navigating love, wealth, and everything in between.

The Role of Family Wealth in Gen Z Relationships

Family wealth plays a critical role in shaping Gen Z’s views on marriage and relationships. Many in this generation recognize the economic leverage that parental resources can provide, influencing their dating decisions heavily. For a significant cohort, understanding a partner’s financial background, especially in relation to family support, is paramount as it can dictate not only immediate lifestyle but also future stability. This awareness leads to an increased emphasis on discussing family finances early on in relationships.

The impact of family wealth on Gen Z relationships foreshadows a broader cultural shift towards valuing economic compatibility as much as emotional connection. As romantic partnerships increasingly mirror corporate strategies in their quest for mutually beneficial arrangements, Gen Z finds itself negotiating the balance between love and financial considerations. This evolving paradigm acknowledges that, in a world shaped by economic realities, love can indeed coexist with financial strategies.

The Changing Face of Commitment in Gen Z

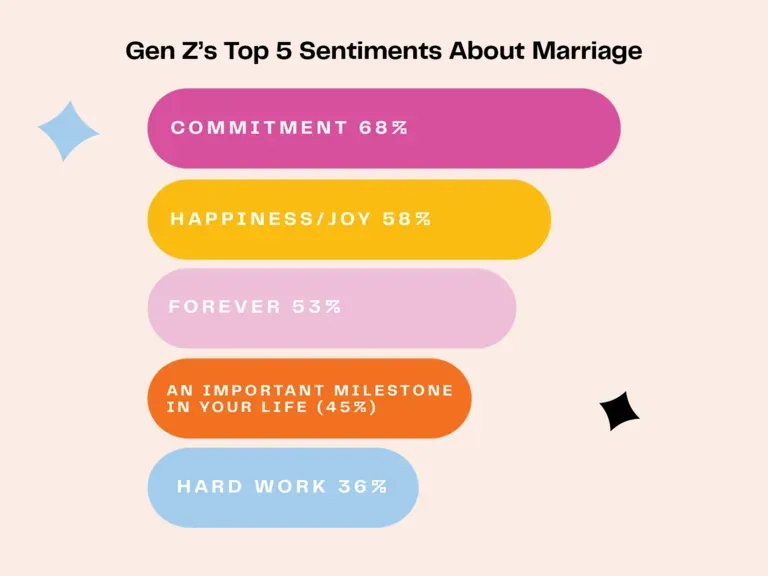

In an era where commitment is often questioned, Gen Z is redefining what it means to be committed in a relationship. While traditional views may frame commitment as an emotional bond solidified through marriage, many in this generation are adopting a more pragmatic approach that considers the financial implications of such a partnership. Young adults feeling the weight of economic uncertainty are increasingly asking themselves: does this relationship contribute to my financial security?

This shift has led to changes in how Gen Z expresses commitment, opting for arrangements that provide not only emotional fulfillment but also financial synergy. This includes assessing a partner’s earning potential and their financial habits as significant factors in determining whether to invest in a long-term relationship. Such a practical outlook reflects a broader understanding of the interconnectedness of love, commitment, and financial health in today’s culture.

Creating a New Marital Blueprint: Insights for Gen Z

As Gen Z continues to navigate their way through the intricacies of relationships, they are also crafting a new blueprint for marriage that embodies both emotional depth and financial strategy. With the recognition that financial stability can enhance relationship satisfaction, this generation is setting the stage for partnerships that thrive on collaboration, transparency, and shared goals. The consciousness surrounding wealth and dating has fostered a mindset where partners work together not only to nurture their love life but also to advance their financial aspirations.

Moreover, discussions around finance are no longer reserved for serious conversations but are integrated into the dating process from the outset. Gen Z’s unique perspective on marriage encourages an openness about financial expectations and goals, allowing couples to align their futures more effectively. Through this innovative approach, the definition of marital success evolves to encompass both emotional connection and the strategic management of shared resources, signaling a new era in the landscape of love and marriage.

Frequently Asked Questions

How does Gen Z’s approach to marriage reflect their focus on financial independence and wealth?

Gen Z’s approach to marriage increasingly emphasizes financial independence and wealth, as they view relationships as strategic partnerships. With rising living costs and economic challenges, many Gen Z individuals prioritize a partner’s financial stability, often seeking to merge assets and enhance their own economic prospects. This trend reflects a shift away from traditional notions of romance, focusing instead on long-term financial security.

What are the main marriage strategies Gen Z employs when considering relationships?

When considering relationships, Gen Z employs several marriage strategies, including evaluating a partner’s financial health, career prospects, and lifestyle choices. They are more upfront about discussing finances, prioritizing compatibility in wealth and economic goals. This strategic approach enables them to align their personal and financial aspirations, ensuring that both partners contribute to a secure economic future.

In what ways does wealth influence Gen Z’s dating culture?

Wealth plays a significant role in Gen Z’s dating culture, with many young people viewing potential partners through a financial lens. Instead of solely focusing on emotional connections, Gen Z individuals assess a partner’s financial situation, such as their savings and career trajectories. This pragmatic approach reshapes the dating landscape, encouraging more discussions about wealth and financial planning at the outset of relationships.

How important is financial security for Gen Z when choosing a life partner?

Financial security is critically important for Gen Z when choosing a life partner. As financial independence becomes increasingly challenging, Gen Z seeks relationships that offer not just emotional support but also economic stability. They often look for partners who can contribute to their financial goals, making financial discussions an essential part of modern dating.

What are Gen Z’s views on combining finances in marriage?

Gen Z views combining finances in marriage as a strategic move rather than a romantic ideal. They often prioritize the merging of resources and assets to secure financial independence and stability. This practical perspective allows Gen Z couples to create a united front against economic pressures, reinforcing the idea that financial compatibility is as crucial as emotional connection.

Why do Gen Z daters prioritize discussing finances early in a relationship?

Gen Z daters prioritize discussing finances early in a relationship to ensure compatibility and set clear expectations for future financial collaboration. They understand that financial issues can lead to significant stress in partnerships, so being upfront about financial situations, goals, and attitudes towards money helps establish a solid foundation for their relationship.

How does family wealth and support impact Gen Z marriage decisions?

Family wealth and support greatly impact Gen Z’s marriage decisions as many young people rely on parental assistance for financial stability. The concept of the ‘bank of mom and dad’ signifies that support from family can shape life choices, including marriage. Consequently, Gen Z may be drawn to partners with similar financial backgrounds, as this enhances their chances of achieving their own financial goals.

Is Gen Z’s focus on wealth in relationships considered transactional?

While some may perceive Gen Z’s focus on wealth in relationships as transactional, many believe it reflects a practical approach to modern dating. Gen Z recognizes the importance of financial stability and is not afraid to prioritize economic factors alongside emotional connections. This perspective aims at creating mutually beneficial partnerships that enhance both individuals’ financial security and life prospects.

What challenges does Gen Z face regarding financial independence and marriage?

Gen Z faces numerous challenges regarding financial independence and marriage, including rising student debt, high living costs, and economic instability. Many young people struggle to establish themselves financially before considering marriage, thereby complicating traditional pathways to adulthood. As a result, they may rely more on family support and be more strategic in their choice of partners to navigate these challenges.

How does the concept of wealth affect the perception of love within Gen Z?

The concept of wealth significantly affects the perception of love within Gen Z, with many believing that financial compatibility enhances romantic relationships. This generation views love not just as an emotional bond but also as a partnership that can provide economic stability. Consequently, they are more likely to consider a partner’s financial prospects as a vital component of love and compatibility.

| Key Point | Explanation |

|---|---|

| Financial Focus in Dating | Gen Z is prioritizing financial stability and wealth in relationships, treating them more like business mergers. |

| Parental Financial Influence | Access to parental wealth is becoming a significant factor in marriage, with many feeling they need family support to achieve adulthood milestones. |

| Wealth as a Romantic Factor | Love for Gen Z is increasingly tied to financial considerations rather than just emotional connections. |

| Strategic Partner Selection | Young people are more upfront about their partner’s financial situation and career, making decisions based on strategic financial compatibility. |

| Changing Views on Merritocracy | The belief that education and hard work lead to success is fading, with wealth being viewed as more crucial in relationship prospects. |

Summary

Gen Z marriage and wealth are intertwined as today’s young adults are increasingly looking for financial stability in their romantic relationships. This generation is treating partnerships not just as emotional unions but as financial agreements, where wealth and assets play a central role in decision-making. As they navigate these dynamics, it’s clear that financial compatibility is becoming just as crucial as personal connection in the modern dating landscape.

#GenZTrends #MarriageAndWealth #LoveStrategy #ModernRelationships #FinancialPlanning