Global wealth creation has become a central focus in today’s interconnected economy, transcending traditional powerhouses like the United States. As emerging economies like China and India rise to prominence, they are setting new benchmarks for wealth generation that leverage innovative technological advancements and smart economic strategies. This dynamic shift underscores the potential for sustainable growth that prioritizes environmentally friendly practices alongside profit-making. Moreover, as previously overlooked regions begin to flourish, it is evident that wealth generation is no longer confined to one part of the world. The new landscape of global wealth creation not only challenges existing paradigms but also invites collaboration across borders for a more inclusive economic future.

The concept of wealth formation in a global context is evolving rapidly, reflecting changes in the economic dynamics of various nations. No longer is wealth generation limited to established markets; emerging economies are now demonstrating robust growth led by smart fiscal policies, sustained innovations, and technological breakthroughs. In this new era, sustainable growth models are essential, promoting financial equity and environmental responsibility. As this transformation happens, a deeper understanding of the diverse economic tactics employed internationally becomes imperative for both policymakers and investors. Adapting to these trends ensures a thriving economic landscape where wealth cultivation is shared across borders.

The Shifting Landscape of Global Wealth Creation

The landscape of global wealth creation has undergone a significant transformation in recent years. Countries outside the United States, particularly in emerging economies like China and India, are rising as formidable players in the wealth generation arena. The innovative business practices adopted within these nations are often at the forefront of this shift, demonstrating that wealth creation can thrive outside traditional power blocs. As these economies develop, they are embracing new economic strategies tailored to their unique contexts, notably emphasizing technological advancements and sustainable growth.

This change prompts a re-evaluation of how wealth is generated on a global scale. The emergence of new economic powerhouses illustrates that the dominance once held by the United States is increasingly being shared, if not challenged, by countries adept at leveraging their resources and potentials. As emerging economies harness technology and business acumen, they are poised to significantly impact global wealth creation, shifting long-standing dynamics and necessitating adaptation among established economies.

Technological Advancements Driving Economic Strategies

Technological advancements are pivotal in shaping modern economic strategies, especially within emerging economies. Innovations in digital technologies have provided these nations with tools to enhance productivity, streamline processes, and offer new services, leading to efficient wealth generation. Sectors like e-commerce, fintech, and renewable energy are prime examples where technology is not just a tool for growth but rather a catalyst for a fundamental shift in how economies operate.

Moreover, technology facilitates access to global markets, enabling emerging economies to compete on an international scale. Countries that prioritize technology-driven growth stand to benefit from increased productivity and can attract foreign investments. As a result, nations harnessing these technological advancements are reinforcing their positions in the global economy, collectively contributing to a more diverse and sustainable framework for wealth creation.

The role of technological advancements cannot be overstated, especially as they relate to sustainable growth. Investing in tech-driven industries allows economies to reduce their carbon footprint and promote sustainability while simultaneously fostering economic development. This dual focus on technology and sustainability offers a pathway for countries to enhance their global wealth generation capabilities without compromising future generations.

Emerging Economies and the Future of Wealth Generation

The rise of emerging economies marks a new era in global wealth generation. Nations such as India, Brazil, and various African countries are making significant strides by developing their unique economic strategies. By tapping into their local resources, these countries are not only fostering individual growth but also contributing to a more balanced global economy. The wealth generated in these regions is increasingly important, as it fuels broader economic stability and provides opportunities for innovation and investment.

Additionally, the entrepreneurial spirit within emerging economies is a powerful driver of wealth generation. Local entrepreneurs are often better positioned to identify unique market needs and cater their products to fit cultural contexts. As these economies grow, fostering an environment conducive to entrepreneurship leads to job creation, local investment, and enhanced overall economic vitality, ultimately contributing to global wealth creation.

Sustainable Growth: A New Pillar of Wealth Creation

Sustainable growth has emerged as a crucial component of wealth creation strategies globally. As awareness of environmental issues grows, economies around the world—especially in emerging markets—are beginning to prioritize sustainability in their development plans. By focusing on eco-friendly practices and renewable resources, they can generate wealth while minimizing harm to the planet. This balanced approach allows these nations to attract investors who prioritize corporate social responsibility and sustainability.

Implementing sustainable growth strategies not only aids in preserving the environment but also instills a sense of responsibility among businesses and consumers alike. As emerging economies invest in renewable energy, cleaner technologies, and sustainable agriculture, they set an example for how economic development can align with environmental stewardship. This not only enhances wealth generation but also fosters a global economy that values sustainability as an intrinsic part of wealth creation.

Strategic Investments and Their Impact on Wealth Generation

Strategic investments play a vital role in enhancing wealth generation in both established and emerging economies. Countries that prioritize targeted investments in key sectors, such as infrastructure, education, and technology, are better equipped to stimulate economic growth. For instance, nations investing in high-quality education systems ensure a skilled workforce ready to meet the demands of a rapidly evolving global market, directly impacting their capacity for wealth generation.

Moreover, these strategic investments can help diversify economies, reducing reliance on traditional industries and fostering innovation. Countries that recognize the importance of diversifying their economies are better positioned to withstand global economic fluctuations, ensuring sustained wealth creation. By adopting proactive investment strategies that focus on future growth sectors, nations can secure their positions in the global marketplace, paving the way for a more resilient economic landscape.

Education as a Cornerstone of Wealth Generation

Education is often seen as a cornerstone of any successful economic strategy, particularly in the context of wealth generation. Countries that invest heavily in education not only enhance their workforce’s skills but also cultivate an environment conducive to innovation and entrepreneurship. As the global economy increasingly values knowledge and technology, nations prioritizing education are paving the way for sustainable growth, ensuring they remain competitive in a fast-evolving economic landscape.

Furthermore, by improving educational access, emerging economies can reduce inequalities, enabling a larger portion of the population to contribute to wealth generation. Skills development tailored to local contexts can empower individuals, leading to increased productivity and economic prosperity. This emphasizes the essential role of education in shaping economic strategies that align with global wealth creation objectives.

Global Collaboration: Enhancing Wealth Creation Efforts

Global collaboration is becoming increasingly essential in efforts to enhance wealth creation across nations, particularly as emerging economies rise to prominence. Through partnerships and cooperative projects, countries can share knowledge, resources, and best practices, which can lead to improved economic strategies. Collaborative efforts often yield joint investments in infrastructure, technology, and sustainable practices, creating synergies that foster wealth generation beyond domestic limitations.

Additionally, international cooperation can provide emerging economies with access to global markets and networks, allowing them to harness opportunities for growth. By working together on common challenges such as climate change, poverty alleviation, and health crises, countries not only improve their prospects for wealth generation but also contribute to a more stable and equitable global economy. Collaboration thus becomes a catalyst for a more inclusive and resilient approach to wealth creation.

Economic Strategies for Sustainable Wealth Creation

To thrive in the increasingly competitive global market, emerging economies must implement effective economic strategies that emphasize sustainable wealth creation. Countries like India and Brazil are leading the way by adopting comprehensive economic policies that balance growth with environmental stewardship. These strategies often revolve around diversifying economies, empowering local communities, and investing in clean technologies, thereby creating a foundation for long-term wealth generation.

Moreover, as these nations adopt sustainable models of growth, they pave the way for more equitable distributions of wealth. By prioritizing social inclusion within their economic strategies, they can ensure that benefits extend beyond the affluent, ultimately leading to broader economic stability. This approach not only enhances their positions within the global economy but also reinforces the ethical imperative for sustainable practices, showcasing how economic strategies can lead to successful wealth generation.

Building Resilience through Economic Diversification

Economic diversification is a crucial aspect of resilience in wealth generation, especially for emerging markets. By expanding into various sectors, countries can strengthen their economies against global uncertainties. For instance, nations that rely heavily on agriculture can benefit from exploring tourism, technology, and manufacturing sectors. This diversification not only mitigates risks but also opens new avenues for economic growth and wealth creation.

Additionally, by promoting local industries and entrepreneurship, these countries foster an ecosystem that is better equipped to adapt to changing market demands. Encouraging innovation and supporting small-to-medium enterprises (SMEs) leads to job creation and economic vitality, which are essential for sustained wealth generation. Thus, economic diversification is not just a strategy for growth; it is a vital component of a robust framework for global wealth creation.

Frequently Asked Questions

How are emerging economies contributing to global wealth creation?

Emerging economies such as China and India are significantly impacting global wealth creation by adopting innovative business practices and harnessing technological advancements. These countries are implementing economic strategies that focus on sustainable growth, attracting investment, and stimulating local industries, which collectively enhance their global economic footprint.

What role do technological advancements play in sustainable growth and wealth generation?

Technological advancements are central to sustainable growth and wealth generation as they increase productivity, reduce costs, and foster innovation. By enabling emerging economies to leapfrog traditional stages of development, technologies such as artificial intelligence and renewable energy facilitate new opportunities for businesses, driving wealth creation across various sectors.

What are some effective economic strategies for wealth generation in developing countries?

Effective economic strategies for wealth generation in developing countries include investing in education to build a skilled workforce, promoting infrastructure development to enhance connectivity, and fostering innovation through support for startups. Additionally, leveraging global partnerships can help these nations access new markets and technologies essential for sustainable economic growth.

Can global collaboration enhance wealth creation in emerging markets?

Yes, global collaboration can significantly enhance wealth creation in emerging markets by facilitating knowledge transfer, investment, and shared resources. By partnering with established economies, developing nations can adopt proven economic strategies, access advanced technologies, and strengthen their positions in the global market, thus fostering an environment conducive to sustainable growth.

What challenging factors do emerging economies face in global wealth generation?

Emerging economies face multiple challenges in global wealth generation, including political instability, inadequate infrastructure, and limited access to capital. These factors can hinder economic strategies aimed at fostering sustainable growth. However, by addressing these issues through smart policies and international cooperation, these nations can improve their wealth creation capabilities.

How does the reassessment of the global economic hierarchy affect wealth creation strategies?

The reassessment of the global economic hierarchy highlights the rise of emerging economies, prompting traditional powerhouses to rethink their wealth creation strategies. This shift encourages countries to adapt by focusing on innovative approaches, sustainability, and collaborative investments, thereby promoting a more inclusive global economy where wealth creation is distributed more equitably.

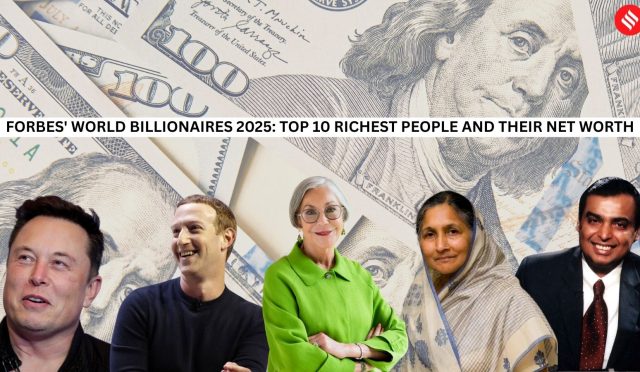

| Key Point | Explanation |

|---|---|

| Global Participation | Countries outside the US are becoming significant players in wealth creation. |

| Emerging Markets | Nations like China, India, and several European countries are growing economic players. |

| Innovative Practices | Technological advancements and innovative business practices are driving growth. |

| Sustainability Focus | Economies are emphasizing sustainability and technology-driven growth. |

| Global Economic Hierarchy | The rise of new players necessitates reevaluating the global economic hierarchy. |

| Importance of Collaboration | Education, policy reforms, and global teamwork are essential for balanced growth. |

Summary

Global wealth creation is evolving with numerous countries now emerging as vital contributors to economic growth. As traditional powerhouses like the US encounter competition from nations such as China and India, it is clear that innovation, technology, and sustainability are key to success. A collaborative approach that emphasizes education and policy reform is crucial for fostering a balanced economic landscape, ensuring that wealth creation is no longer monopolized by a few but is shared globally.