Great Wealth Transfer: Gen X Set to Receive $1.4 Trillion

The Great Wealth Transfer is poised to redefine the financial landscape of America, particularly for Generation X, often dubbed the “forgotten generation.” Over the next decade, this group, comprising individuals aged 45 to 60, stands to inherit an astonishing $1.4 trillion annually, a remarkable windfall that could reshape their financial futures. Experts predict that the financial implications of this wealth transfer will reverberate across generations, altering spending habits and investment strategies for years to come. As baby boomer wealth transfer accelerates, Gen X will become the primary beneficiaries of this unprecedented economic shift. This pivotal moment not only promises enhanced financial security for many but also raises important questions about inheritance predictions and the equitable distribution of wealth within society.

As we navigate the impending shift in generational wealth, the concept often referred to as the “great wealth shift” or “intergenerational wealth transfer” comes to the forefront. With significant assets poised to be passed down from the aging population, particularly baby boomers, this transition represents a monumental moment in economic history. Generation X, caught between their own financial aspirations and the looming legacy of their elders, is uniquely positioned to harness this wealth influx. This developing scenario brings crucial financial considerations to light, such as the long-term effects on Generation X’s economic standing and the potential impact on millennial inheritance as well. As wealth disperses to younger generations, understanding these dynamics will be essential for navigating the forthcoming era of fiscal responsibility and legacy planning.

The Financial Implications of Wealth Transfer for Generation X

As Generation X stands on the brink of an astounding financial windfall due to the Great Wealth Transfer, the implications for their economic future are monumental. With estimates suggesting that each member of this generation will inherit over $1.4 trillion collectively in the coming decade, the potential for reshaping their financial realities is significant. This transfer not only represents a substantial increase in wealth but also opens discussions about how Gen X can leverage this inheritance for long-term financial security, especially considering their previous economic hardships during crises that sharply reduced their net worth.

Moreover, the financial implications extend beyond mere wealth accumulation. Gen X must grapple with not just how much they stand to inherit but also how these funds can be wisely managed. Financial literacy plays a crucial role here, as many in this generation have previously experienced financial instability. Understanding investment strategies, tax implications, and prudent spending will be essential for ensuring that the inheritance serves as a foundation for future wealth rather than a temporary boost. The upcoming legacy presents an opportunity for Gen X to redefine their economic narrative.

Generation X Inheritance: Navigating a New Financial Landscape

The inheritance that Generation X is poised to receive arrives at a time when they are balancing numerous financial responsibilities, including caring for both aging parents and children. This unique position complicates how they approach their inheritance. With expectations of $39 trillion flowing to Gen X households over the next 25 years, the challenge lies in distributing this newfound wealth in a profitable manner. They must decide whether to use it to alleviate immediate financial pressures or to invest for future growth while considering the long-term welfare of their family.

Navigating this new financial landscape requires a strategic approach. Gen Xers can consider engaging with financial advisors to create plans that aim at maximizing their wealth over time. Emphasizing financial education will play a vital role in empowering this generation to make informed decisions that consider both current needs and future aspirations, ensuring they don’t fall into the traps of impulsive spending that can often follow a sudden influx of wealth.

Understanding the Great Wealth Transfer: A Historical Perspective

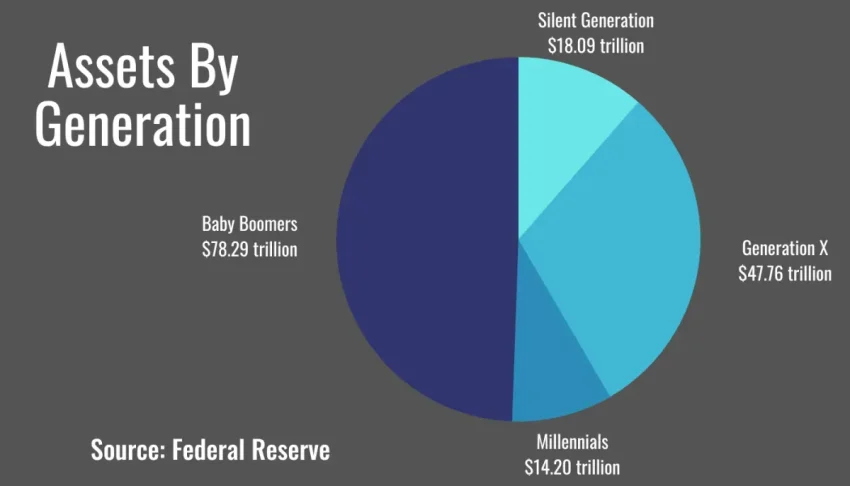

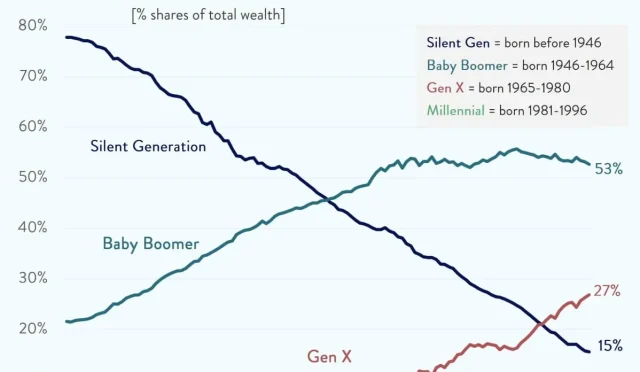

The term ‘Great Wealth Transfer’ encapsulates a critical economic phenomenon that is set to redefine intergenerational wealth dynamics. Historically, baby boomers have amassed the largest pool of wealth in the United States, and their impending retirement means that trillions of dollars in assets will soon be transferred to heirs, primarily Gen X and millennials. As financial advisors have anticipated this shift for decades, it’s essential to understand the historical context and the structural changes in wealth distribution that will come into play.

Projected estimates suggest a staggering $83 trillion will change hands, with more than $29 trillion specifically earmarked for U.S. beneficiaries. This vast transfer of wealth marks not just a financial event, but a cultural shift, altering how wealth is perceived and utilized across generations. For Gen X, recognizing their role as key beneficiaries allows them to foster a mindset that embraces both responsibility and opportunity as they prepare to inherit their share of this monumental wealth.

Demographic Dynamics: Gen X at the Center of Wealth Distribution

As the primary demographic targeted for wealth transfer, Generation X finds itself uniquely positioned within the structural dynamics of wealth distribution. Typically aged between 45 and 60, these individuals are often listed as primary beneficiaries in their parents’ wills. Unlike their millennial siblings, who will see larger cumulative inheritances over time, Gen X is projected to receive more immediate financial benefits from the impending wave of wealth, highlighting the importance of this moment in their economic narrative.

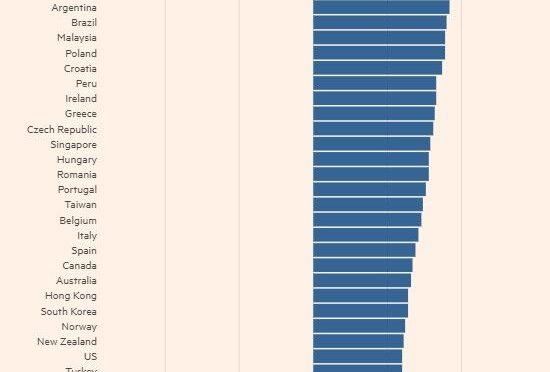

This demographic advantage presents a chance for Gen X to influence market trends profoundly. As they prepare to inherit substantial sums, their collective purchasing power is expected to soar from $15.2 trillion to $23 trillion by 2035. Brands and businesses will need to adapt their strategies to cater to the evolving demands and values of this generation, ensuring that marketing efforts resonate with their newfound financial capacity and lifestyle aspirations.

The Role of Financial Literacy in Managing Inheritance

As Generation X prepares to inherit unprecedented wealth, the importance of financial literacy cannot be overstated. Many members of this generation have experienced financial hardships, making them acutely aware of the volatility inherent in personal finance. Therefore, understanding principles of wealth management, investment strategies, and retirement planning will be crucial in maximizing the benefits of their inheritance from the Great Wealth Transfer.

Increased education around financial topics will enable Gen X to avoid potential pitfalls associated with sudden wealth. Engaging with financial planners, participating in workshops, or utilizing online resources can empower them to make informed decisions that not only honor their parents’ legacy but also ensure their long-term financial security. The intersection of inheritance and education could pave the way for a more prosperous future, one where generational wealth is maintained and built upon.

Potential Economic Fallout from the Great Wealth Transfer

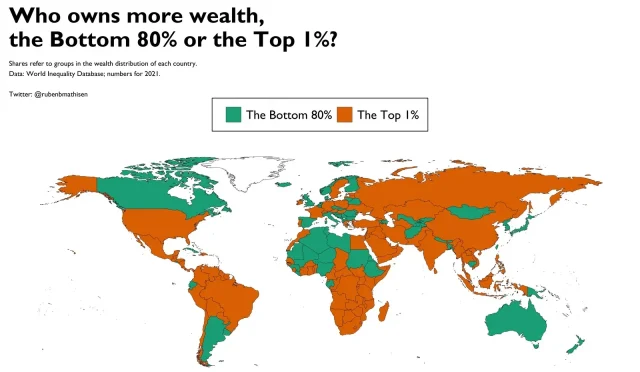

While the optimistic narrative surrounding the Great Wealth Transfer highlights financial opportunities, the potential economic fallout also warrants consideration. The massive influx of wealth to Generation X could exacerbate economic inequality if not managed correctly. Some reports suggest that uneven asset distribution and soaring healthcare costs may reduce the benefits that some inheritors receive, particularly for those who fare less well financially.

As these dynamics play out, the focus on equitable wealth distribution practices will become increasingly important. Policymakers and financial advisors would do well to ensure that the benefits of the Great Wealth Transfer reach as many individuals as possible, crafting frameworks that encourage inclusive growth. Addressing these inequalities early on will be essential to preventing a scenario where wealth exacerbates existing divides.

Generation X: Preparing for Their Financial Future

As Generation X steps into a new financial future characterized by an unprecedented wealth influx, the strategies they adopt will shape their economic legacy. The distribution of wealth projected to flow into their hands will offer them a unique opportunity to profoundly alter their financial circumstances. Emphasis on preparedness, for both the recipients of wealth and the planning necessary to navigate this change, is critical.

The potential for Gen X to reestablish their financial footing is immense, provided they approach the inheritance with foresight. Creating family trusts, investing wisely, and committing to ongoing financial education can ensure that this new wealth is not just fleeting but transforms into sustainable long-term prosperity. Being proactive in financial planning will enable this generation to leverage the Great Wealth Transfer to secure their families’ futures.

Long-term Inheritance Predictions for Gen X and Millennials

The wealth transfer debate does not end with Gen X receiving an immediate influx of cash. Experts predict that while this generation will reap significant short-term rewards from the Great Wealth Transfer, millennials are positioned to inherit even larger cumulative amounts over time. This shifting dynamic underscores how wealth will continue to circulate and evolve within familial and societal contexts, raising essential questions about how both generations will manage and grow their respective legacies.

In analyzing long-term inheritance predictions, understanding the economic landscape is vital. As Generation X utilizes their inherited wealth in an increasingly interconnected and complex economic environment, their choices will significantly influence not just their economic future but also that of millennials. Proactive financial planning and generational engagement will determine whether this wealth shift represents a sound investment for the future or leads to further financial stratification.

Addressing Potential Inequalities in the Wealth Transfer Process

While Gen X stands to inherit substantial wealth from the baby boomer generation, the process is not without its inequities. Wealth concentration among the ultra-rich is a critical concern; some Gen Xers may face dire financial challenges that diminish the inheritance’s intended benefits. Understanding these discrepancies is essential in formulating strategies to address potential inequalities in the wealth transfer process.

As the Great Wealth Transfer unfolds, awareness and advocacy for financial education resources could help bridge the gap. Encouraging financial literacy initiatives aimed specifically at addressing disparities among beneficiaries will ensure that all members of Generation X can access the wealth they inherit and are equipped to manage it effectively. Without proper planning and education, the potential for a widening wealth gap may become a new reality.

Frequently Asked Questions

What is the Great Wealth Transfer and who benefits from it?

The Great Wealth Transfer refers to the upcoming transfer of wealth estimated at over $83 trillion from aging baby boomers to younger generations, primarily Generation X and millennials. Gen X, often referred to as the ‘forgotten generation,’ is expected to inherit around $1.4 trillion annually, positioning them as significant short-term beneficiaries of this historic wealth shift.

How does Generation X inheritance impact financial stability?

The inheritance expected to be received by Generation X from the Great Wealth Transfer is projected to enhance their financial stability significantly. With an average inheritance of $1.4 trillion per year, many Gen Xers may improve their financial circumstances, aiding in retirement planning and economic influence.

What are the financial implications of wealth transfer for Generation X?

The financial implications of the Great Wealth Transfer for Generation X include a potential rise in their economic power and consumer influence, which is projected to increase from $15.2 trillion to $23 trillion by 2035. However, there is also a risk of heightened inequality if inheritances are not shared equitably within the generation.

How does the Great Wealth Transfer affect baby boomers and their heirs?

The Great Wealth Transfer impacts baby boomers as they prepare to pass on their wealth, estimated at around $29 trillion in the U.S. to their heirs, primarily Generation X and millennials. This transfer creates an opportunity for Gen X to gain financial security while also raising concerns about the uneven distribution of wealth and increasing healthcare costs.

What should Gen Xers know about inheritance predictions regarding the Great Wealth Transfer?

Gen Xers should understand that inheritance predictions indicate a substantial windfall due to the Great Wealth Transfer, with the potential for receiving transformational sums. However, they must also prepare for an uneven distribution of wealth, as some may face financial challenges despite the influx, depending on health-related expenses and family circumstances.

How does Generation X wealth compare to that of other generations during the Great Wealth Transfer?

During the Great Wealth Transfer, Generation X’s wealth is positioned to rise dramatically, benefiting as the immediate inheritors of baby boomer fortunes. While they are expected to inherit less cumulatively than millennials over the long term, the short-term influx of $1.4 trillion annually will significantly enhance Gen X’s financial landscape.

What challenges does Generation X face despite the Great Wealth Transfer?

Despite the Great Wealth Transfer, Generation X faces challenges such as increased healthcare costs and economic inequality. While they are positioned to receive a significant inheritance, the concentration of wealth means that many Gen Xers may experience mixed results, with some benefiting greatly while others may gain little.

| Key Points |

|---|

| Gen X is set to inherit $1.4 trillion annually over the next decade. |

| Generation X was economically overshadowed by Baby Boomers and Millennials. |

| Experiencing significant financial disruptions, Gen X lost 38% of net worth during the Great Financial Crisis. |

| The term ‘Great Wealth Transfer’ refers to the wealth transfer from Baby Boomers to their heirs. |

| By 2024, $83 trillion is expected to be transferred, with Gen X as primary short-term beneficiaries. |

| Potential for increased economic influence, as Gen X’s buying power may rise from $15.2 trillion to $23 trillion by 2035. |

| Inequality concerns persist as wealth distribution may be uneven due to healthcare costs and asset concentration. |

| The outcome of this wealth transfer will depend on Gen X’s financial decisions and planning. |

Summary

The Great Wealth Transfer signifies a monumental shift in wealth from the aging Baby Boomer generation to their heirs, predominantly impacting Generation X. As this forgotten generation prepares to inherit $1.4 trillion each year over the next decade, they stand on the brink of a financial transformation that may redefine their economic prospects. The implications of this wealth shift will not only affect Gen X but could also reshape consumer markets and influence economic trends for generations to come.

#WealthTransfer #GenXInheritance #EconomicTrends #FinancialNews #GenerationalWealth