Great Wealth Transfer: Millennials Set to Inherit Trillions

The Great Wealth Transfer, projected to shift an astonishing $124 trillion in assets over the next 25 years, is set to significantly impact millennials and future generations. As older Americans control over 61% of wealth, this unprecedented intergenerational wealth transfer will redefine financial landscapes across the country. Financial planning for millennials has never been more crucial, with many set to inherit substantial fortunes that will influence their spending and saving habits. As traditional asset inheritance patterns emerge, experts are urging younger adults to prepare for this potential windfall. The impact of wealth transfer is poised to reshape not only individual lives but also the broader economy, stirring conversations among families and financial advisors alike about effective asset management.

A seismic shift in financial assets is on the horizon, known as the intergenerational wealth transition. This dynamic change means that a monumental $124 trillion in valuables will flow from older generations to millennials and Gen Z within the next few decades. Many are beginning to discuss the essentials of fiscal strategy tailored for younger demographics, emphasizing the importance of robust financial planning during this wealth redistribution. With a wave of inheritances approaching, these emerging affluent individuals need to navigate their new financial realities responsibly. The significance of this wealth transition cannot be understated, as it not only alters individual financial trajectories but also has profound implications on the economy at large.

Understanding the Great Wealth Transfer

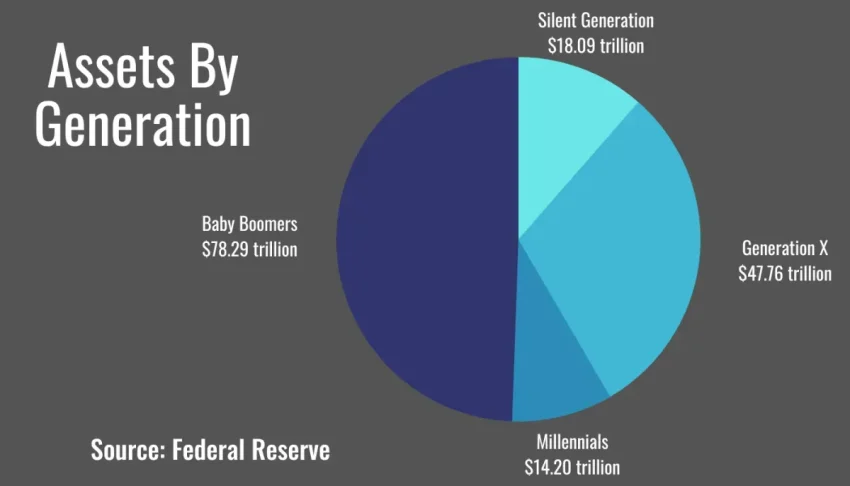

The Great Wealth Transfer, estimated at a staggering $124 trillion, heralds a transformative phase in the financial landscape of America. This generational transfer of wealth is primarily occurring as baby boomers and older generations pass their assets to their heirs, significantly impacting the financial strategies of millennials and Generation X. The scale at which this transfer is taking place not only marks a historic shift in asset distribution but also brings to light the importance of financial planning for millennials who will play a key role in receiving this wealth.

Various factors contribute to the enormity of the Great Wealth Transfer, including inflationary adjustments and the unprecedented rise in asset prices after the pandemic. With older Americans holding 61% of national wealth and their assets poised for intergenerational transfer, millennials are set to inherit a substantial portion. As they prepare to navigate this financial shift, understanding the implications for asset inheritance becomes paramount in empowering them to manage and grow their emerging portfolios.

The Impact of Wealth Transfer on Millennial Financial Planning

The impact of wealth transfer on millennials cannot be overstated, as they are expected to inherit roughly $46 trillion by 2048. This influx of assets reshapes the financial planning landscape for this generation, requiring them to adopt new strategies tailored to their unique needs and preferences. Millennials, often characterized by their tech-savvy approach to wealth management, are likely to favor investment options that align with their values, such as ESG (Environmental, Social, and Governance) and impact investing.

Moreover, the financial behaviors of millennials and Generation Z differ significantly from previous generations. They prioritize self-direction and technological solutions for managing their investments, thereby changing the way wealth is not only inherited but also managed. Financial advisors must consequently adapt their services and offerings, recognizing the importance of catering to the aspirations of millennials who are becoming key players in the financial markets, particularly amid the Great Wealth Transfer.

Intergenerational Wealth Transfer Dynamics

The intergenerational wealth transfer phenomenon is becoming a focal point of discussion among financial advisors, particularly as millennials and Gen Xers prepare to inherit unprecedented amounts of wealth. This transfer occurs through ‘horizontal’ wealth transfers within families and eventually transitions to children and grandchildren. Insights from Cerulli Associates illustrate how millennials, while delayed in traditional life milestones, are set to receive vast sums, positioning them as central figures in this generational transition.

Understanding the dynamics of intergenerational wealth transfer is vital for all stakeholders involved, from families to financial advisors. As the wealth hierarchy shifts, the focus will increasingly be on how best to manage the assets and cultivate financial literacy among younger generations. The inclusion of strategies aimed at preparing millennials for their newfound wealth will not only promote responsible financial management but also encourage a culture of giving back through philanthropic endeavors.

The Role of Women in the Wealth Transfer

Recent studies indicate that women will play a crucial role in the forthcoming Great Wealth Transfer, with widows from the baby boomer generation set to inherit approximately $40 trillion. This ‘horizontal’ wealth transfer highlights the shift toward female-led financial decision-making as women become the chief asset managers in their families. Moreover, younger women are anticipated to inherit an additional $47 trillion over the next two decades, solidifying their significant influence in shaping wealth management trends.

The empowerment of women in financial decision-making not only transforms family dynamics but also shifts the narrative within wealth advisory contexts. Financial planners must account for this growing demographic of female clients, adjusting their practices to better serve women’s unique financial needs and investment goals. The conversation around wealth transfer is increasingly centering on gender inclusivity, reinforcing the necessity for tailored strategies that acknowledge women’s crucial place within the family wealth structure.

Preparing for Financial Planning Amidst Wealth Transfers

As millennials and Generation X prepare to inherit trillions of dollars through the Great Wealth Transfer, the urgency for robust financial planning has never been greater. The shift in wealth necessitates a reevaluation of current financial strategies, encouraging younger generations to proactively engage in smart investment practices. Developing a comprehensive financial plan that incorporates estate planning, risk management, and charitable giving will position millennials to make informed decisions about their newfound wealth.

Financial education is paramount in this transition period, as many millennials may find themselves inheriting assets without the experience in managing large portfolios. By seeking guidance from financial advisors who understand the challenges and opportunities in wealth management, these generations can gain insight into creating sustainable wealth. Empowering millennials through education and tailored financial plans will ultimately influence the long-term impact of the wealth transfer.

The Future of Financial Advisory in Light of Wealth Transfers

With the Great Wealth Transfer on the horizon, financial advisory firms are undergoing a significant transformation to align with the evolving needs of millennial and Gen Z clients. The influx of younger clients, which has increased dramatically from 8% in 2021 to 25% in 2024, underscores the necessity for advisors to adapt their services. These adaptations will include incorporating technology and innovative investment strategies that resonate with the values of younger investors.

In this rapidly changing environment, advisors must also focus on enhancing relationships with clients by emphasizing transparent communication and personalized service. As millennials inherit wealth and begin to navigate their financial futures, understanding their distinct preferences will be crucial for advisors. The industry must innovate to ensure that financial guidance remains relevant, empowering clients to make informed decisions that align with their long-term financial objectives.

Understanding Millennials’ Investment Preferences

Millennials are reshaping investment landscapes with their distinct preferences, particularly as they prepare to receive wealth through intergenerational transfers. With increased access to technology, this generation tends to focus on investments aligned with social responsibility and sustainability. Millennials are increasingly gravitating toward companies that prioritize environmental, social, and governance (ESG) criteria, revealing a broader perspective on profit that extends beyond financial gains.

This shift in investment priorities emphasizes the importance of financial advisors keeping pace with millennial values and preferences. By introducing platforms that facilitate impact investing and socially responsible ventures, wealth management firms can cater to the evolving mindset of younger investors. Acknowledging and integrating these preferences into financial strategies will not only enhance client relationships but will also capitalize on the anticipated increase in wealth distribution.

The Importance of Preparing for Economic Volatility

As millennials and Generation X inherit wealth through the Great Wealth Transfer, the looming threat of economic volatility remains a significant concern. Navigating financial waters filled with unexpected economic downturns, such as those experienced during the Great Recession, necessitates a practical and resilient approach to wealth management. With their unique understanding of volatility, millennials are positioned to make decisions that prioritize stability and growth in their portfolios.

Therefore, risk management becomes pivotal in the financial planning of these younger generations. Financial advisors must guide clients in developing strategies that mitigate risks associated with market fluctuations, ensuring their wealth remains secure in times of uncertainty. As we anticipate this historic transfer of wealth, establishing sound financial strategies that withstand economic challenges will be essential for preserving and growing the assets passed down.

Impact of Wealth Transfer on Philanthropic Initiatives

The impending Great Wealth Transfer stands to have a profound effect on philanthropic initiatives across the country. Millennials, who are expected to inherit a staggering $46 trillion, are known for their commitment to social causes and giving back to communities. With a stronger emphasis on charitable giving, this wealth transition may reshape the landscape of philanthropy, encouraging younger generations to support nonprofits and initiatives aligned with their values.

As the new stewards of wealth, millennials will likely seek to incorporate philanthropy into their financial planning, leading to greater innovation in charitable giving. This could involve the creation of donor-advised funds, impact investing, or direct support of causes they are passionate about. By leveraging their resources in ways that reflect their values, millennials can effectively influence the future of charitable endeavors, creating a ripple effect of positive change in society.

Frequently Asked Questions

What is the Great Wealth Transfer and how does it affect millennials?

The Great Wealth Transfer refers to the estimated $124 trillion in assets that will be transferred from older generations, mainly baby boomers, to their heirs, including millennials, over the next 25 years. This transfer presents millennials with significant financial opportunities as they are expected to receive the largest share, approximately $45.6 trillion.

How do wealth transfer trends impact financial planning for millennials?

As millennials stand to inherit a significant amount of wealth through the Great Wealth Transfer, it greatly influences their financial planning strategies. With access to various investment options and a strong focus on responsible investing, millennials are adapting their financial plans to align with their values and maximize their inherited assets.

What are the expected inheritance amounts for millennials due to the Great Wealth Transfer?

Millennials are projected to inherit around $45.6 trillion by 2048, which is more than any other generation. This inheritance will primarily come from the intergenerational wealth transfer of assets from older generations.

What factors contribute to the scale of the Great Wealth Transfer?

Key factors contributing to the Great Wealth Transfer include inflation adjustments, rising asset prices post-pandemic, and an increasing percentage of national wealth controlled by older households. These dynamics enable a substantial amount of wealth to be passed down to millennials and other younger generations.

What role do women play in the upcoming Great Wealth Transfer?

Women are anticipated to play a significant role in the Great Wealth Transfer, with an estimated $40 trillion expected to be inherited by widows. This shift is leading to a greater emphasis on female financial decision-making and estate management as they become key holders of wealth.

How will the Great Wealth Transfer impact the financial advisory industry?

The Great Wealth Transfer is significantly changing the financial advisory industry as millennials and Gen Z become an increasingly large portion of clients. Wealth managers are adapting their services to meet the unique needs of younger generations who prioritize technology, self-direction, and value-driven investing.

What are the implications of the Great Wealth Transfer for intergenerational wealth transfer?

The implications of the Great Wealth Transfer for intergenerational wealth transfer are profound, as trillions will be passed down not only to children and grandchildren but also to charitable organizations. This shift is changing the landscape of wealth ownership and management across generations.

How can millennials prepare for the impacts of the Great Wealth Transfer?

Millennials can prepare for the impacts of the Great Wealth Transfer by seeking financial education, establishing comprehensive financial and investment plans, and staying informed about inherited assets and potential tax implications.

Why is the Great Wealth Transfer considered a significant financial event?

The Great Wealth Transfer is considered a significant financial event because it represents the largest generational transfer of wealth in U.S. history, fundamentally altering the financial landscape and presenting substantial economic opportunities for younger generations.

What challenges might millennials face during the Great Wealth Transfer?

Millennials may face challenges during the Great Wealth Transfer, such as navigating the complexities of estate planning, understanding tax implications of inherited wealth, and managing expectations while aligning their own financial goals with the influx of assets.

| Key Point | Details |

|---|---|

| Total Wealth Transfer | $124 trillion will be transferred over 25 years, primarily from baby boomers to heirs and charities. |

| Current Wealth Holders | Older Americans control 61% of the national wealth, a significant increase from previous years. |

| Demographic Shifts | Women are expected to inherit a large portion of the wealth, changing family wealth management dynamics. |

| Generational Benefits | Millennials are projected to receive the largest share of inheritances, totaling $46 trillion by 2048. |

| Impact on Financial Sector | Advisors are adapting to a growing number of millennial and Gen Z clients, marking a transition in wealth management. |

| Effects of Inflation and Asset Growth | Inflation and rising asset prices have significantly increased the projected amount of wealth transfer compared to earlier estimates. |

Summary

The Great Wealth Transfer represents a remarkable shift in how wealth will be distributed in the coming decades. With an anticipated $124 trillion set to be passed down from older generations to heirs, especially millennials, the financial landscape will undergo profound changes. This generational transfer reflects not only the increasing wealth of older Americans but also the diversification of who holds wealth, including a significant rise in wealth among women. As millennials and Gen Z navigate this transformational period, their preferences for self-directed investment and technology-driven tools for financial management will reshape the advisory landscape, ensuring that the Great Wealth Transfer has lasting impacts on both individuals and the financial industry as a whole.