Great Wealth Transfer: Unequal Inheritance Distribution

The Great Wealth Transfer is poised to reshape the financial landscape as trillions of dollars are set to be inherited across generations. This unprecedented shift in inheritance distribution raises critical questions about wealth inequality and the potential impact on society at large. With Baby Boomers transferring their assets, discussions around financial equity and wealth transfer strategies have become increasingly relevant. The implications of this transfer can significantly address economic disparity, offering opportunities for wealth redistribution and responsible investing. As we delve into the Great Wealth Transfer, it’s essential to explore how individuals can proactively manage their inheritances and advocate for a more balanced approach to wealth management.

As we embark on an exploration of intergenerational wealth migration, commonly referred to as the great inheritance influx, it is crucial to understand the systemic changes it introduces. This phenomenon not only highlights the patterns in asset distribution but also emphasizes the pressing issue of economic disparity that affects so many. The dynamics of financial equity become even more significant during this wealth migration, prompting conversations about responsible wealth transfer strategies. By considering these factors, we can better comprehend how this transition in assets could influence societal structures and contribute to rectifying wealth inequality. Exploring these elements is vital for anyone looking to navigate this evolving financial ecosystem.

Understanding the Great Wealth Transfer

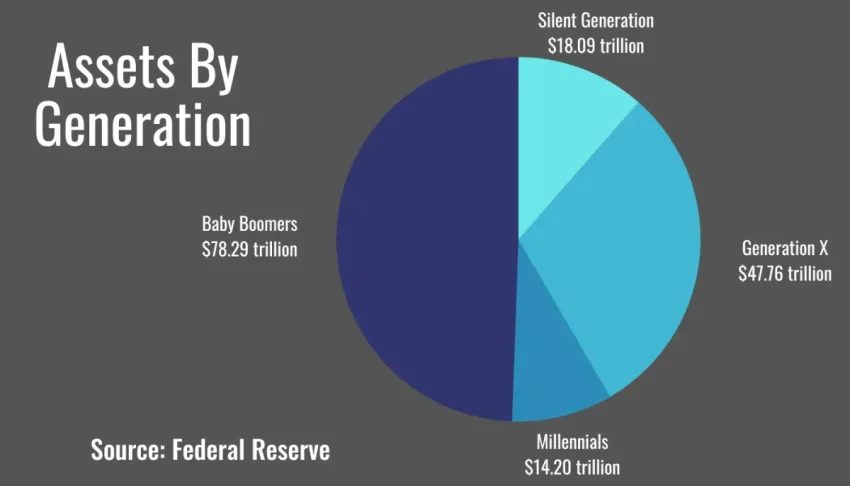

The Great Wealth Transfer refers to the impending transfer of wealth from the aging population of baby boomers to their heirs, which is expected to total trillions of dollars over the next few decades. This phenomenon raises important questions about how inheritance will be distributed among siblings and other beneficiaries. Traditional practices around inheritance distribution often lead to unequal allocations, fueling discussions about equity and fairness in wealth transfer strategies. As millions of families prepare for this transition, understanding the implications of this transfer becomes increasingly crucial, especially in the context of rising economic disparity.

As we observe the Great Wealth Transfer, it’s essential to analyze the role of wealth inequality in society. Historically, wealth has been concentrated in the hands of a few, and the next generation is likely to experience the ramifications of this disparity. Wealth distribution processes and their fairness can significantly influence financial equity among individuals. Implementing effective wealth transfer strategies is vital not only for families but also for ensuring broader economic stability as wealth shifts through generations. This transfer could potentially reshape social landscapes, prompting discussions on how to address wealth inequality moving forward.

Inheritance Distribution and Wealth Inequality

Inheritance distribution is a critical factor in the broader conversation about wealth inequality. Research indicates that those inheriting substantial wealth often experience a significant leap into affluence compared to those with no inheritance. This dynamic perpetuates a cycle of economic disparity, making it difficult for lower-income individuals to achieve financial equity. The methods by which assets are passed down can also reinforce existing economic inequalities, further complicating the social fabric as wealth becomes more concentrated among affluent families.

To bridge the gap created by unequal inheritance distribution, some advocate for more equitable wealth transfer policies. By revisiting inheritance tax laws and promoting financial education among less wealthy heirs, society can begin to address the systemic issues causing wealth inequality. Creative wealth transfer strategies that encourage sharing wealth with charitable organizations or investing in community resources can provide a more balanced approach. This approach not only mitigates the wealth gap but also fosters a sense of responsibility among future generations.

Financial Equity in the Age of Economic Disparity

Financial equity is becoming a vital concern as economic disparities widen across the globe. The realization that not all individuals have equal access to resources, opportunities, and wealth creation is sparking conversations about how to level the playing field. The Great Wealth Transfer presents both a challenge and an opportunity in this regard; it demands accountability in how wealth is inherited and subsequently utilized. Families and policymakers must address the implications of transferring larges sums of money while considering broader social equity.

Achieving financial equity requires innovative strategies that prioritize inclusivity. Organizations and individuals alike must consider how wealth can be managed post-inheritance. This involves not only careful planning around wealth transfer strategies but also fostering an environment that supports economic empowerment. Programs that educate heirs about responsible financial stewardship can help dismantle the barriers erected by wealth inequality, creating a more equitable society where everyone can thrive.

Strategies for Effective Wealth Transfer

Wealth transfer strategies are essential in ensuring the effective distribution of assets from one generation to the next. This involves not merely the act of passing on property or funds but also entails thoughtful planning and communication between generations. Utilizing trusts, gift strategies, or charitable donations can minimize taxes and enhance the overall impact of the inheritance received, thus confronting issues related to wealth inequality. It is critical for families to engage in these practices to preserve and grow their assets while promoting financial equity.

Moreover, families should initiate discussions about their values and intentions surrounding inheritance early on. These conversations can demystify the process of wealth transfer and ensure that all family members understand the rationale behind decisions made. Effective wealth transfer strategies not only safeguard assets but also align them with the family’s values, promoting unity and minimizing the potential for conflict. This approach ultimately elevates the conversation around economic disparity, driving home the importance of shared knowledge and collaborative decision-making.

The Impact of the Great Wealth Transfer on Future Generations

The Great Wealth Transfer is poised to significantly impact future generations in various ways. As access to inherited wealth increases, so does the responsibility that comes with it. Future heirs must be educated not only about managing their assets but also about the socio-economic implications of their inheritance. Understanding the legacy of wealth not only shapes individual outlooks but can instill a sense of purpose geared toward addressing wealth inequality.

Future generations will also face the evolving landscape of economic disparity, prompting them to adapt their strategies for wealth management. With a mindset leaning towards philanthropy and social responsibility, they may seek to use their inherited wealth to drive societal change. This potential shift could redefine traditional views of wealth inheritance, paving a path toward a more equitable distribution of resources and actively participating in dismantling systemic economic disparities.

Challenging Wealth Transfer Norms

As the Great Wealth Transfer progresses, there is a growing need to challenge existing norms around how wealth is transferred and distributed. Conventional views often prioritize bloodlines and static wealth preservation, which can exacerbate economic disparity. By adopting a more inclusive approach that considers broader societal implications, families can position themselves to contribute positively to financial equity. Challenging long-standing practices will require awareness and a willingness to reevaluate inheritance methods to foster more equitable outcomes.

This shift can take many forms, including increased dialogue about wealth distribution among family members, collaborative estate planning, and inclusive decision-making processes. Encouraging a culture of transparency can demystify the inheritance process and pave the way for more equitable strategies that resonate with collective values. In doing so, families can become agents of change, ensuring that the wealth transferred encourages financial equity rather than sustaining cycles of inequality.

Addressing Economic Disparity Through Inheritance Policies

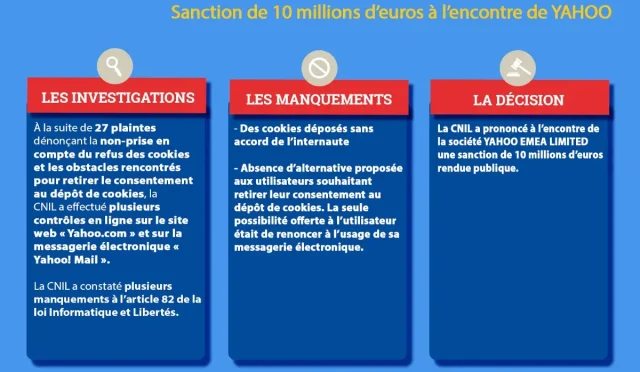

Inheritance policies play a pivotal role in addressing economic disparity in society. By implementing fair and equitable tax systems, governments can mitigate the effects of concentrated wealth and promote diverse asset distribution. Policies that support equal inheritance distribution help prevent wealth from being held by a small segment of the population, which is crucial in the fight against systemic economic inequality. An equitable inheritance policy establishes a framework that not only addresses wealth transfer but also contributes to societal well-being.

Furthermore, integrating financially inclusive policies within inheritance laws can bridge gaps in access to wealth. This entails creating pathways for those who have historically been marginalized to receive equitable support during wealth transfer processes. By fostering a more balanced economic environment through thoughtful policies around inheritance and wealth distribution, societies can combat economic disparities and encourage a more just wealth landscape.

Wealth Transfer and Educational Opportunities

The Great Wealth Transfer also intersects with the realm of educational opportunities. When families pass down wealth, it can be strategically aimed toward access to quality education that promotes upward mobility. Although the inherited wealth can provide immediate financial benefits, investing in educational initiatives offers a sustainable solution to generational challenges associated with wealth inequality. By prioritizing education as part of wealth transfer strategies, families can facilitate long-term success for their heirs.

This focus on educational advancements can also benefit communities at large. When beneficiaries invest wealth into educational institutions or scholarships, they contribute to reducing economic disparity and improving financial equity. Accordingly, promoting educational opportunities through thoughtful wealth transfer strategies not only empowers individuals but also nurtures a society that values knowledge, skills development, and collective growth.

Preparing for Inheritance: A Family Approach

Preparing for inheritance is a complex yet crucial process that families should approach collaboratively. Open discussions about family assets, values, and intentions can create a shared understanding, reducing the likelihood of misunderstandings or conflict. This family-centered approach allows for strategic planning around wealth transfer, ensuring that each member is aware of their roles and responsibilities. Such preparedness fosters financial equity, as all family members are engaged in the process of managing inherited wealth.

By involving every family member in discussions about inheritance, a culture of transparency and accountability can be cultivated. This not only facilitates smoother transitions of wealth but also empowers heirs to make informed decisions about their financial futures. Addressing the complexities of inheritance in a united, family-oriented manner promotes awareness and understanding of wealth distribution dynamics, which is essential in combatting economic disparity in the years to come.

Frequently Asked Questions

What is the Great Wealth Transfer and how does it impact inheritance distribution?

The Great Wealth Transfer refers to the predicted shift of assets from one generation to the next, primarily from the Baby Boomer generation to their heirs. This transition of wealth is significant as it will influence inheritance distribution, potentially increasing wealth inequality if not managed properly. Strategies like planned estate distribution can mitigate the risks of economic disparity.

How does the Great Wealth Transfer affect wealth inequality in society?

The Great Wealth Transfer is poised to exacerbate wealth inequality as large inheritances may not be evenly distributed among beneficiaries. If wealth transfer strategies are not inclusive, the result could be a widening gap between those with inherited wealth and those without, compounding existing economic disparities.

What are some effective wealth transfer strategies to promote financial equity during the Great Wealth Transfer?

Effective wealth transfer strategies that can promote financial equity during the Great Wealth Transfer include establishing trusts, equitable gift giving, and comprehensive estate planning. By considering the needs of all beneficiaries, these strategies can create a more balanced approach to inheritance distribution, reducing the effects of wealth inequality and promoting financial equity.

What role does inheritance distribution play in the dynamics of the Great Wealth Transfer?

Inheritance distribution plays a critical role in the dynamics of the Great Wealth Transfer. How assets are allocated among heirs can shape the future of wealth inequality. If distributions favor certain individuals disproportionately, it will contribute to economic disparity within communities, while equitable inheritance processes can help foster greater financial equity.

What are the potential consequences of unplanned wealth transfers in light of the Great Wealth Transfer?

Unplanned wealth transfers in the context of the Great Wealth Transfer can lead to significant problems, such as increased wealth inequality and economic disparity. Without effective planning, large amounts of inherited wealth may create generations of individuals with vastly different financial resources, hindering the goal of achieving financial equity within society.

How can families prepare for the Great Wealth Transfer to ensure equitable inheritance distribution?

Families can prepare for the Great Wealth Transfer by engaging in open discussions about financial planning, establishing wills, trusts, and utilizing wealth transfer strategies that prioritize equitable inheritance distribution. This proactive approach can safeguard against wealth inequality and promote financial equity among heirs.

| Key Point | Description |

|---|---|

| Inheritance Disparity | The distribution of wealth through inheritance is often unequal, leading to significant disparities in wealth accumulation. |

| Impact on Society | This wealth transfer can exacerbate social inequalities and create barriers for lower-income populations. |

| Generational Wealth | Families with substantial inheritances tend to perpetuate cycles of wealth across generations, impacting socio-economic mobility. |

| Policy Considerations | Governments and policymakers may need to address inheritance tax policies to mitigate wealth concentration. |

Summary

The Great Wealth Transfer refers to the significant shift of wealth from one generation to the next, highlighting the disparities in inheritance distribution. As assets move through inheritance, many individuals face unequal opportunities due to the concentration of wealth within certain families. This transition not only impacts socio-economic mobility but also raises important questions regarding the fairness of such transfers. Addressing these issues is essential for promoting a more equitable society.

#GreatWealthTransfer #InheritanceInequality #WealthDistribution #GenerationalWealth #EconomicJustice