House rich millionaires are redefining the boundaries of wealth in today’s economy, illustrating a unique financial paradox. This decade has seen a staggering surge in home equity, with total wealth in the American housing market nearly doubling from $19.5 trillion to almost $36 trillion. For the 24 million millionaire households in the U.S., a significant portion of their net worth is tied up in real estate rather than liquid assets, presenting both opportunities and challenges in terms of wealth creation. Despite their millionaire status, many feel financially constrained due to the illiquid nature of their assets, especially homes and retirement accounts. As the real estate market fluctuates, understanding the dynamics of home equity becomes crucial for these affluent homeowners, allowing them to navigate their financial futures effectively.

Wealthy homeowners, often described as affluent property owners, find themselves in a complex situation in the current economic landscape. The significant appreciation of real estate has resulted in increased home values, creating a wealth of opportunity for many. These individuals, who fall into the category of millionaire households, typically hold their fortunes in less liquid forms like property and retirement savings, which poses unique challenges for accessing cash. While the rise in their net worth is remarkable, it also highlights the difficulties associated with converting these assets into spendable income. Understanding the balance between home equity and liquid assets is essential for these wealthy individuals as they strategize for future financial stability.

The Booming Housing Market and Wealth Creation

The current decade has witnessed an extraordinary boom in the housing market, leading to unparalleled wealth creation among American homeowners. Home equity has surged dramatically, soaring from $19.5 trillion at the end of 2019 to approximately $36 trillion today. This staggering increase of $16 trillion over just six years signifies not only the buoyancy of real estate but also reflects broader economic trends that have made U.S. households significantly richer than ever before. With the dual engines of the housing and stock markets roaring, home ownership has become a crucial pillar of wealth accumulation, propelling many into the millionaire bracket.

Moreover, this wealth transformation has birthed an emerging class of millionaires— there are now over 24 million millionaire households in the United States, representing roughly one in every five households. A noteworthy trend is that one-third of these households achieved millionaire status in the last eight years alone, emphasizing the rapid change in financial landscapes. However, alongside this wealth comes the challenge of liquidity, as much of their wealth remains trapped in illiquid assets, primarily their homes and retirement accounts.

House Rich Millionaires: The Illiquid Wealth Dilemma

While many households have successfully created wealth through home ownership, the phenomenon of being house-rich yet cash-poor presents significant challenges. Current statistics indicate that households identified as ‘barely-millionaires’—those with a net worth between $1 million to $2 million—are often found with about 66% of their wealth tied up in their primary residences and retirement savings. This creates a paradox where individuals may appear affluent on paper yet struggle with liquid assets, affecting their spending capabilities and investment options.

The liquidity crunch is further exacerbated by rising housing prices, making it increasingly difficult to leverage home equity effectively. For instance, while options such as home equity lines of credit and cash-out refinances exist, they require additional borrowing, which may not align with long-term wealth management strategies. As wealth is often illiquid, understanding the financial dynamics of being house-rich is crucial for effective wealth-building, pushing many to reconsider their investment approaches and seek alternatives to diversify their assets.

Navigating the Real Estate Market for Millionaire Households

Navigating the complexities of the real estate market has become imperative for millionaire households, particularly amidst high valuations that can complicate access to liquid assets. As home ownership remains the cornerstone of wealth creation for many Americans, understanding the implications of a rapidly appreciating real estate market is crucial. The upward trajectory of home prices poses both an opportunity and a challenge for homeowners looking to capitalize on their equity while ensuring that they are not overly concentrated in illiquid investments.

Furthermore, a successful navigation involves being aware of market cycles, knowing when to leverage home equity responsibly, and preparing for shifts in economic conditions that might affect property value. Real estate can serve as a powerful wealth-creation tool, but strategic decisions must be made to ensure that homeowners can balance their assets effectively, thereby enhancing both their current living conditions and their long-term financial stability.

The Benefits of Forced Savings through Home Ownership

Among the various advantages of home ownership, one standout feature is its ability to act as a forced savings mechanism. For many middle-class families, their home represents the largest financial asset they’ll ever own, and this positioning is instrumental in encouraging long-term financial discipline. The wealth generated through home equity can significantly impact their overall net worth, providing a savings incentive that mitigates the temptation to liquidate assets prematurely or engage in high-risk investments.

Additionally, the concept of forced savings amplifies the benefits of compounding returns in the housing market. As homeowners make consistent mortgage payments, they gradually build equity in their property, which can amplify their overall wealth over time. This stability is a critical financial foundation that, while it may not deliver immediate liquidity, increasingly pays dividends in the form of enhanced net worth as property values appreciate.

Understanding Illiquidity and Its Impact on Millionaire Households

For many current millionaire households, illiquidity is a primary concern. Having a net worth concentrated in fixed assets such as homes or retirement accounts can create anxiety around cash flow, particularly when unexpected expenses arise or investment opportunities present themselves. Millionaires often find that their wealth, while substantial, does not translate into immediate purchasing power, leading to the perception of being cash-strapped despite their wealth on paper.

This understanding of illiquidity is essential for financial planning. Households need to develop strategies that account for their asset allocation, ensuring they have access to liquid investments when needed, while still participating in the long-term growth benefits offered by real estate and other illiquid assets. Balancing these dynamics can empower wealthy households to navigate their finances more effectively and avoid the pitfalls associated with being overly house-rich.

Investment Strategies for House-Rich Millionaires

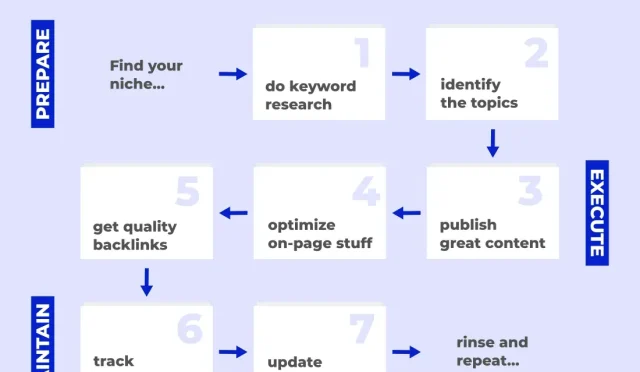

Investment strategies for house-rich millionaires must focus on liquidity management and diversification to mitigate risks associated with being over-reliant on real estate. With finance experts pointing out that a healthy portfolio should encompass multiple asset types, millionaires need to consider moving beyond real estate as their sole wealth generator. By allocating a portion of their net worth to liquid assets like stocks, bonds, or other investment vehicles, millionaire households can better position themselves for economic variability.

Additionally, strategic leveraging of home equity may provide an avenue for investment without having to liquidate the appreciating asset. Utilizing cash-out refinancing or home equity lines of credit can help tap into this wealth, allowing the funds to be redirected into higher-yielding investments. This approach fosters a stronger financial standing that emphasizes growth while addressing the constraints posed by the inherent illiquidity of primary residences.

The Role of Retirement Accounts in Wealth Management

Retirement accounts play a pivotal role in the wealth management strategies of millionaire households. These accounts not only provide tax advantages that facilitate long-term growth but also serve as a repository for a significant portion of their net worth. As many millionaires find that their wealth is heavily nested within retirement plans, it becomes vital to have a clear strategy on how to access and manage these funds effectively.

Moreover, leveraging retirement accounts can provide liquidity at crucial moments, helping to bridge gaps when other funds may be tied up. However, it’s important to navigate the penalties and implications of early withdrawal carefully, balancing immediate needs with the long-term benefits of keeping these accounts intact for future financial stability. Understanding the role and management of retirement accounts is therefore essential for sustaining and growing wealth.

Home Equity: A Double-Edged Sword for Wealth Creation

Home equity is often touted as a cornerstone of wealth creation for many American households, but it can also be a double-edged sword when considering financial flexibility. On the one hand, the equity built in a home over time can provide significant financial security, acting as a form of collateral for loans or a source of cash through refinancing options. On the other hand, depending too much on home equity without having a diversified portfolio can lead to challenges, especially in volatile market conditions.

Additionally, understanding how to effectively access and use home equity is crucial. Potential homeowners and millionaires must evaluate their scenarios critically, seeking a balance between leveraging their home for investment and managing risks associated with market downturns or liquidity constraints. Educating themselves on the complexities of home equity also empowers millionaires to make informed decisions that enhance their overall wealth strategy.

Building Wealth While Managing Illiquidity

For many millionaires and affluent households, building wealth while managing illiquidity underscores the essence of effective financial planning. With increased home equity often transforming into a substantial percentage of their net worth, it is critical for individuals to adopt strategies that factor in both their long-term wealth goals and their immediate financial needs. This juxtaposition of asset management requires a mindset attuned toward patience and strategic thinking.

Engaging in methods such as starting a side business, investing in stocks, or seeking passive income opportunities can help diversify assets and create liquidity without relinquishing their long-term holdings. By fostering a holistic approach toward wealth management, households can effectively navigate challenges posed by being house-rich, ultimately ensuring that their financial futures remain robust and secure.

Frequently Asked Questions

What does it mean to be a ‘house rich millionaire’?

A ‘house rich millionaire’ refers to individuals whose net worth primarily consists of home equity rather than liquid assets. While they may have significant wealth tied up in their property, this type of wealth can feel less accessible for spending, especially when most of it is in illiquid forms like real estate and retirement accounts.

How has the real estate market contributed to the rise of millionaire households?

The real estate market has played a crucial role in the wealth creation of millionaire households, particularly in the past decade. Home equity for homeowners in the U.S. has nearly doubled, contributing to a total of almost $36 trillion in wealth, thus minting a significant number of new millionaires.

Why is home equity a significant aspect of wealth for house rich millionaires?

Home equity is important for house rich millionaires because, for many, it represents the majority of their wealth. This form of wealth is a significant asset but is often illiquid, meaning it can’t be readily accessed for spending without selling the property or borrowing against it.

What challenges do house rich millionaires face regarding their wealth?

House rich millionaires often face challenges related to liquidity. While their net worth may appear substantial, much of it is tied up in real estate or retirement accounts, making it difficult to access for immediate needs or desires. Additionally, selling a home involves transaction costs and complexities.

Is being house rich a good way to build wealth?

Yes, being house rich can be a solid strategy for building wealth over time. Although the wealth is illiquid, it serves as a form of forced savings and allows for long-term financial growth through real estate appreciation and compounding, which can significantly increase net worth over time.

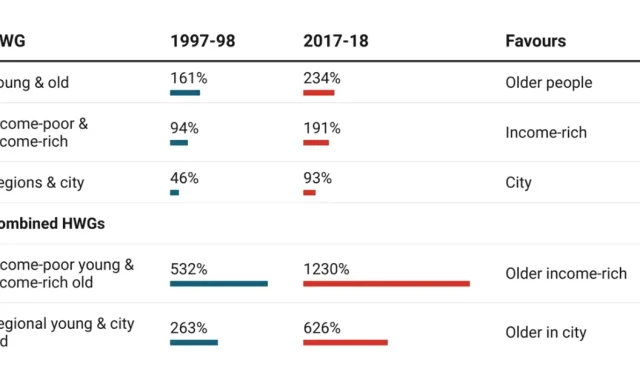

How does the liquidity profile differ among millionaire households?

Among millionaire households, the liquidity profile varies significantly. Households with a net worth closer to $1 million typically have a greater percentage of their wealth tied up in illiquid assets like homes and retirement accounts, while those with $5 million or more have a larger portion accessible in liquid forms, like cash or investments.

What strategies can house rich millionaires use to access their home equity?

House rich millionaires can consider several strategies to access their home equity, including opening a home equity line of credit, cash-out refinancing, or using their equity as a down payment on a new property. However, each option comes with its own costs and considerations that must be evaluated.

How can house rich millionaires feel wealthier, despite their wealth being tied up in assets?

House rich millionaires can feel wealthier by understanding that their investments in real estate and retirement accounts are designed for long-term growth. By recognizing the value of compounding and the benefits of holding onto illiquid assets, they can appreciate their future financial security.

Why is it important for millionaires to be patient with their wealth tied in real estate?

Patience is crucial for millionaires with wealth tied up in real estate, as long-term ownership allows for asset appreciation and compounding. This approach can ultimately lead to greater financial security and higher net worth, despite the frustrations of not having immediate access to liquid assets.

What are some potential downsides of being house rich?

Some potential downsides of being house rich include feeling cash-strapped due to a lack of liquid assets, the complexity of accessing home equity, and the costs associated with selling or managing real estate. Additionally, reliance on illiquid assets can create challenges during economic downturns.

| Key Points |

|---|

| Wealth Created in Housing Market |

| Home equity nearly doubled from $19.5 trillion in 2019 to $36 trillion today. |

| $16 trillion gain in home equity in the past 6 years, surpassing total home equity in 2017. |

| There are more than 24 million millionaire households in America, approximately 1 in 5 households. |

| One-third of millionaires became wealthy in the past 8 years; most wealth is illiquid, tied up in homes and retirement accounts. |

| Households with $1-2 million typically have 66% of their wealth tied in homes and retirement; liquid assets are limited. |

| Households with $5 million or more have more accessible funds (24% in liquid savings) compared to those closer to $1 million (17%). |

| Being house-rich often doesn’t equate to feeling wealthy due to illiquidity of assets and costs involved in accessing them. |

| Real estate is a complicated investment with associated frictions and fees when buying or selling. |

| Forced savings through homeownership often results in long-term wealth accumulation and reduced transaction costs. |

Summary

House rich millionaires currently face the challenge of managing a wealth portfolio that is primarily illiquid, with most of their assets tied up in real estate and retirement accounts. Despite the increase in home equity and the rising number of millionaire households, accessing this wealth often involves complex financial strategies and potential additional costs. This could mean that even being a millionaire does not provide the material freedom one might expect, as liquidity remains a significant issue. However, the long-term benefits of real estate investment should not be underestimated; it often leads to greater financial stability and wealth accumulation. Understanding these dynamics is crucial for house rich millionaires aiming to maximize their financial potential.